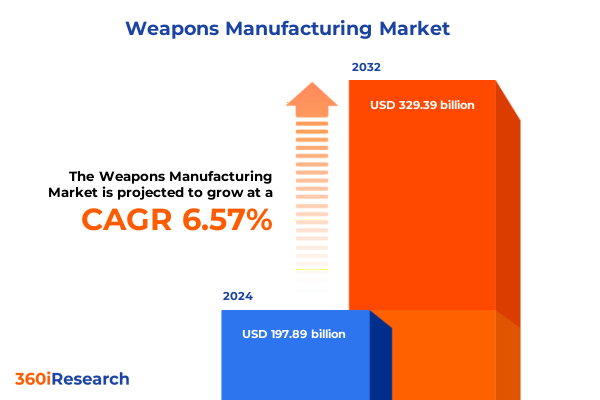

The Weapons Manufacturing Market size was estimated at USD 210.13 billion in 2025 and expected to reach USD 223.12 billion in 2026, at a CAGR of 6.63% to reach USD 329.39 billion by 2032.

Understanding the Evolving Dynamics of Global Weapons Manufacturing Amid Geopolitical Pressures Technological Progress and Supply Chain Resilience

The global landscape of weapons manufacturing today is defined by a convergence of geopolitical volatility, technological breakthroughs, and evolving security paradigms. As defense budgets rise amid strategic competition, manufacturers are racing to modernize legacy platforms while pioneering next-generation systems that address asymmetric and hybrid warfare scenarios. Simultaneously, nations are prioritizing supply chain resilience to mitigate disruptions from trade disputes and pandemic-induced shocks.

Against this backdrop, stakeholders across government, industry, and capital markets must navigate a rapidly shifting environment. Procurement frameworks are adapting to shorter technology cycles, placing a premium on agility and innovation. The integration of digital ecosystems-from additive manufacturing to digital twins-fosters efficiency but also intensifies cyber and operational risks. Consequently, decision-makers require a holistic understanding of the forces shaping production, policy, and procurement in order to position their organizations for sustained growth and security preparedness.

Examining the Transformative Technological Advancements Autonomy and Digital Integration Reshaping Weapons Manufacturing for the Next Generation of Warfare

Recent years have witnessed a profound shift in how defense systems are conceived and produced. Advanced manufacturing technologies such as additive processes and high-precision robotics have transitioned from pilot projects to full-scale implementation. Companies are deploying digital twins to simulate end-to-end production flows, optimizing workflows before physical assets are committed. These innovations not only accelerate time-to-field but also enhance quality control through real-time analytics and AI-driven inspection systems.

In parallel, autonomous platforms-from drones to unmanned underwater vehicles-are redefining force projection across domains. AI-enabled targeting and navigation systems amplify situational awareness and reduce human exposure to risk. The rise of network-centric warfare has further elevated the demand for systems interoperability, driving investments in open architectures and secure data links. Government initiatives in the United States and European nations have eased regulatory barriers for defense startups, fostering a more vibrant innovation ecosystem, as illustrated by Germany’s integration of battlefield AI, strike drones, and unmanned submarines into its procurement strategy.

Moreover, sustainability and life-cycle management have emerged as critical considerations. With budgets under scrutiny, extended-service contracts and predictive maintenance protocols are gaining traction. Defense prime contractors and subsystem suppliers collaborate closely to design platforms that can be upgraded incrementally, mitigating obsolescence and reducing total cost of ownership. As a result, weapons manufacturing is evolving from a capital-intensive, one-off production model to a continuous, digitally enabled ecosystem.

Assessing the Cumulative Economic Operational and Strategic Consequences of United States Tariffs on Weapons Manufacturing and Defense Supply Chains in 2025

The tariff environment in 2025 has exerted multifaceted effects on costs, schedules, and strategic planning within weapons manufacturing. Following significant increases in duties on steel and aluminum-reaching 50 percent in some categories-leading contractors have reported hundreds of millions of dollars in additional expenses. For instance, a major aerospace and defense conglomerate adjusted its profit forecast downward by approximately $500 million after absorbing tariff-related cost inflators tied to metal imports and subcomponents.

These broad-based levies extend beyond raw materials. A 25 percent duty on critical aircraft components sourced from certain Asian markets, accompanied by tariffs ranging from 10 to 15 percent on defense electronics and composite materials, has compelled manufacturers to reevaluate supplier networks. Many programs have introduced redesign efforts to substitute imported parts with domestically produced equivalents, resulting in development slowdowns and elevated R&D outlays.

Furthermore, the blanket 10 percent surcharge on a wide range of trading partners has intensified pricing pressures. Defense procurement offices face the dilemma of whether to absorb these costs, petition for waivers, or adjust procurement volumes. In artillery and ammunition segments, tariffs have driven up raw material prices by as much as 25 percent, directly impacting munitions production costs and contributing to extended lead times as suppliers seek alternative sources.

Collectively, these measures have had a paradoxical effect: while intended to spur onshore manufacturing, they have raised operating expenses across the defense industrial base, complicating budget planning and prompting legislative inquiries into targeted exemptions for critical materials and technologies.

Uncovering Key Segmentation Insights Across Product Types End Users Technology Platforms and Caliber Tiers in the Weapons Manufacturing Market

The product type dimension of the weapons manufacturing market reveals distinct strategic priorities. Large caliber ammunition is in high demand for artillery and naval guns, while precision-guided missile systems rely on specialized warheads. Within the small arms category, handguns such as pistols and revolvers continue to serve law enforcement and civilian segments, whereas machine guns, assault rifles, and sniper rifles fulfill military requirements for varied engagement ranges.

Across end users, the civilian market emphasizes personal safety and sport shooting, driving demand for ergonomic semi-automatic platforms. Law enforcement agencies focus on reliability and modularity to support urban and tactical operations. Military clients prioritize ruggedized systems and integrated munitions solutions. Private security firms occupy the niche between civilian and military spheres, often procuring scalable calibers and adaptable platforms to meet diverse assignment profiles.

Technological segmentation highlights the balance between legacy and modern firing mechanisms. Bolt-action and lever-action designs retain relevance in applications demanding accuracy and simplicity, whereas fully automatic and semi-automatic technologies dominate rapid-response scenarios. Platform segmentation underscores the interplay between air, land, and naval systems; unmanned aerial vehicles require lightweight munitions and guided mini-missiles, land systems leverage howitzers and mortars paired with artillery shells, and naval platforms depend on large-caliber projectiles and anti-ship missile systems.

Lastly, caliber tiers-from small to medium to large-dictate supply chain dynamics. Small caliber ammunition benefits from high-volume manufacturing techniques, while medium and large calibers often involve more intensive metallurgical processes and tighter quality control. Together, these segmentation lenses enable suppliers and end users to pinpoint growth pockets and optimize resource allocation across the diverse landscape of weapons manufacturing.

This comprehensive research report categorizes the Weapons Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Platform

- Caliber

- End User

Illuminating Regional Dynamics and Emerging Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific Defense Manufacturing Sectors

The Americas region continues to lead in defense production and innovation, anchored by the United States’ substantial defense outlays. In 2024, the U.S. accounted for nearly $1 trillion in military spending, reflecting a 5.7 percent growth that underscored prioritization of modernization initiatives across land, sea, and air domains. Mexico’s military budget also surged, driven by investments in domestic law enforcement capabilities and expanding naval assets to secure territorial waters and support counter-narcotics operations.

In the Europe, Middle East & Africa corridor, procurement programs exhibit marked divergence. European NATO members responded to regional security concerns with a 17 percent combined increase in defense spending, channeling funds into unmanned platforms, munitions stockpiles, and integrated air defense systems. Gulf Cooperation Council states continue to diversify their arsenals, augmenting missile and drone capacities to balance power dynamics. African nations, while representing a smaller share of global expenditure, have incrementally boosted allocations to address internal security and border control needs.

Asia-Pacific stakeholders are accelerating military modernization in response to regional tensions. China’s defense budget rose by 7 percent to $314 billion, directing resources toward naval expansion and cyber capabilities. Japan registered a historic 21 percent increase, driven by new procurement of next-generation fighter aircraft and missile defense enhancements. India sustained its position as a top-five global spender, allocating funds to upgrade its missile fleet and naval surface combatants, while Southeast Asian nations pursue multi-origin sourcing strategies to avoid overdependence on a single supplier.

This comprehensive research report examines key regions that drive the evolution of the Weapons Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Industry Participants Strategic Innovations and Competitive Strengths in the Global Weapons Manufacturing Ecosystem

Major defense primes have demonstrated resilience amid cost pressures and shifting policies. Raytheon Technologies, for example, cited tariff-related cost headwinds totalling $125 million in the first half of 2025, yet leveraged strong demand for air defense systems and propulsion units to maintain robust sales growth. Similarly, prime contractors such as Lockheed Martin and General Dynamics continue to diversify their portfolios through strategic acquisitions and partnerships that extend their reach into emerging technologies.

Emerging players and established firms are also intensifying collaboration with venture-backed startups to accelerate innovation. Recent initiatives involve co-development of autonomous systems by consortiums led by Airbus-Kratos and L3Harris, as well as significant VC investments by Booz Allen into high-tech defense ventures. Project archetypes ranging from hybrid aircraft to intelligent munitions underscore a collective move toward multi-domain integration.

Across segments, companies are channeling capital into digital transformation, supply chain visibility platforms, and additive manufacturing facilities. This orientation not only addresses the imperative for cost containment amid tariff uncertainties but also supports rapid prototyping of critical parts in conflict zones. Competitive differentiation increasingly hinges on the ability to deliver end-to-end solutions that blend hardware, software, and sustainment services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Weapons Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- General Dynamics Corporation

- Huntington Ingalls Industries, Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Systems Corporation

- O. F. Mossberg & Sons, Inc.

- Raytheon Technologies Corporation

- RemArms LLC

- Savage Arms, Inc.

- Schuele & Somappa Springs Pvt. Ltd.

- Steyr Arms GmbH

- Sturm, Ruger & Co., Inc.

- Thales S.A

- The Boeing Company

Crafting Actionable Strategies to Optimize Production Modernization Supply Chain Resilience and Regulatory Engagement for Weapons Manufacturing Leaders

Industry leaders should prioritize the integration of advanced manufacturing technologies to bolster agility and cost efficiency. By deploying additive production lines and AI-driven quality assurance, organizations can reduce dependency on imported components while maintaining precision tolerances. Strengthening domestic supply networks through strategic partnerships and targeted investments will mitigate the impact of future trade disruptions.

Leaders must also engage proactively with policymakers to secure tailored tariff exemptions for critical defense materials and to support research incentives for strategic minerals processing. Establishing multi-year contracts with government customers can stabilize revenue streams and facilitate capital planning for capacity expansions. Simultaneously, developing modular platform architectures will enable incremental upgrades, alleviating obsolescence risks and enhancing lifecycle value.

Finally, fostering collaboration across the value chain-through joint R&D initiatives, industry consortia, and public–private partnerships-will accelerate the maturation of transformative technologies. By coalescing around interoperability standards and open architectures, stakeholders can ensure seamless integration of legacy systems with next-generation capabilities, thereby strengthening deterrence postures and operational readiness.

Outlining a Rigorous Multi Source Research Methodology Leveraging Primary Insights Secondary Data and Expert Validation in Defense Manufacturing Analysis

This research synthesizes insights from primary interviews with senior executives at defense prime contractors, subsystem suppliers, and government procurement officials. Expert surveys and Delphi panels were conducted to validate strategic themes and to gauge adoption timelines for emerging technologies. Secondary data sources include official defense budget releases, trade association reports, and publicly disclosed contract awards.

Additional quantitative analysis leveraged production volume data, import–export statistics from customs agencies, and patent filings in additive manufacturing and autonomous systems. Cross-referencing of company financial disclosures and third-party intelligence reports ensured triangulation of findings. The methodology also incorporates scenario analysis to stress-test supply chain resilience under varying tariff and geopolitical conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Weapons Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Weapons Manufacturing Market, by Product Type

- Weapons Manufacturing Market, by Technology

- Weapons Manufacturing Market, by Platform

- Weapons Manufacturing Market, by Caliber

- Weapons Manufacturing Market, by End User

- Weapons Manufacturing Market, by Region

- Weapons Manufacturing Market, by Group

- Weapons Manufacturing Market, by Country

- United States Weapons Manufacturing Market

- China Weapons Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Strategic Imperatives Innovation Imperatives and Resilience Pathways Shaping the Future of Weapons Manufacturing

In an era defined by strategic competition and rapid technological change, the weapons manufacturing sector stands at a critical inflection point. Organizations that embrace digital transformation, diversify their supplier base, and align with evolving regulatory frameworks will secure competitive advantage. Conversely, failure to adapt may result in exposure to cost overruns, schedule delays, and capability gaps.

The juxtaposition of advanced manufacturing techniques with traditional defense procurement practices presents both challenges and opportunities. By fostering a culture of continuous innovation and cross-sector collaboration, industry stakeholders can navigate volatility and reinforce readiness. Ultimately, success hinges on the ability to balance cutting-edge development with pragmatic risk management, ensuring that next-generation systems are delivered on time, on budget, and with uncompromised performance.

Engage Directly with Associate Director Ketan Rohom to Secure Access to the Comprehensive Weapons Manufacturing Market Research and Gain Strategic Advantage

To explore in-depth market intelligence and gain a strategic edge through comprehensive analysis of weapons manufacturing dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, you can secure full access to tailored insights on production trends, tariff impacts, and competitive landscapes, empowering your organization to make informed decisions and capitalize on emerging opportunities in 2025 and beyond.

- How big is the Weapons Manufacturing Market?

- What is the Weapons Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?