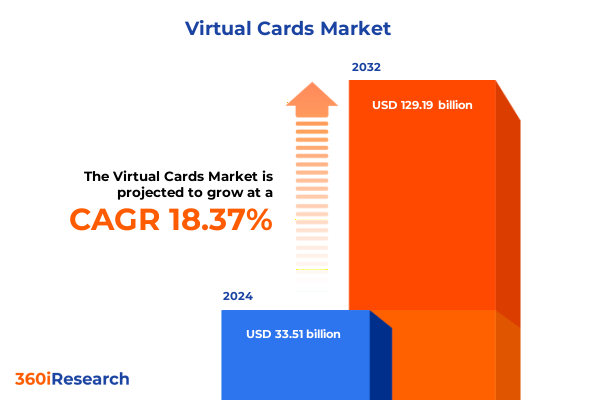

The Virtual Cards Market size was estimated at USD 39.62 billion in 2025 and expected to reach USD 46.85 billion in 2026, at a CAGR of 18.39% to reach USD 129.19 billion by 2032.

Exploring the Emergence and Evolution of Virtual Cards as a Cornerstone of Modern Secure Payment Frameworks Driving Operational Efficiency and Control

Virtual cards, originally introduced in the 1990s by Orbiscom as a security measure for online payments, generate unique payment credentials that can be tailored for single transactions or defined usage limits to prevent unauthorized charges. Unlike traditional plastic cards, these digital instruments issue real-time card numbers, CVVs, and expiration details, minimizing fraud risks while preserving the convenience of conventional payment cycles. This technological model has evolved from basic one-time numeric generation to sophisticated programmable tools that can enforce complex spending policies and integrate with decentralized identity systems.

In recent years, virtual cards have experienced a pronounced resurgence within the corporate sector, driven by the imperative for enhanced control over expense management and the growing automation of payables. Modern platforms such as Stripe and Marqeta issue virtual numbers on demand, enabling finance teams to align spend with budgetary policies, enforce real-time spend caps, and streamline reconciliation processes. According to industry reports, over seventy-eight percent of B2B organizations have adopted virtual card solutions to replace labor-intensive manual processes, signaling a pivotal shift in how enterprises approach digital payments.

This executive summary delves into the technological transformations, regulatory shifts, tariff impacts, segmentation strategies, regional dynamics, leading innovators, and actionable recommendations shaping the virtual card ecosystem today, offering decision-makers robust insights to navigate an evolving payments landscape.

Identifying the Pivotal Technological and Financial Shifts Reshaping Virtual Card Adoption and Embedded Finance Integration in 2025

As embedded finance becomes a cornerstone for software platforms, virtual card offerings are now seamlessly integrated into core workflows to deliver on-demand payment capabilities. Companies are embedding card issuance APIs directly into their applications, empowering users to generate virtual card numbers for claims payouts, supplier invoices, or subscription services with minimal friction. This shift not only streamlines operational processes but also elevates financial control by automating reconciliation and audit trails at the transaction level.

Simultaneously, advances in behavioral biometrics are enhancing the security of virtual card transactions without compromising user experience. By analyzing typing patterns, mouse movements, and other device interactions in real time, financial platforms achieve fraud detection accuracy rates approaching ninety-five percent while reducing false positives by over sixty percent. This invisible authentication layer operates continuously in the background, safeguarding each transaction and reinforcing customer trust.

The convergence of virtual cards with mobile wallets and contactless payment technologies is accelerating adoption across both online and in-store channels. Major mobile wallet providers now support one-tap provisioning of virtual credentials, enabling users to make secure payments at physical terminals and digital checkouts alike. These tokenized transactions leverage enriched metadata-such as device ID and geolocation-to optimize authorization rates and minimize chargebacks, underscoring the role of virtual cards in bridging digital and brick-and-mortar experiences.

Looking ahead, programmable payments powered by Web3 protocols and smart contracts are emerging as a frontier for virtual card innovation. Organizations are experimenting with self-executing rules that govern spending limits, merchant whitelists, and lifecycle controls embedded within each card credential. This evolution positions virtual cards as dynamic instruments capable of enforcing complex business logic in real time, unlocking new possibilities for automation and security.

Assessing the Broad Economic and Operational Consequences of Recent United States Import Tariffs on Virtual Card Services and Fintech Operations

The United States introduced a uniform ten percent tariff on a broad range of imports in early 2025, aiming to strengthen domestic manufacturing but triggering significant repercussions across the financial technology ecosystem. These trade levies have injected uncertainty into cross-border payment corridors, elevating costs for import-dependent fintech platforms and complicating global settlement flows.

Early indications suggest that tariff-driven volatility is already dampening payment volumes. Research indicates that stagnation or slight declines in consumer card spending may persist for months as businesses and individuals recalibrate budgets to absorb higher import expenses. This environment places downward pressure on transaction growth, with portfolio managers closely monitoring earnings reports for signs of persistent volumetric drag.

Operational expenses for many fintech firms have risen as hardware and infrastructure components become subject to higher import duties. To mitigate these pressures, firms are exploring alternative supplier networks, renegotiating contracts, and considering localized production for critical hardware. While some anticipate long-term efficiencies from onshore sourcing, the near-term impact includes margin compression and tighter capital allocation for strategic investments.

Uncovering Deep Insights Across Diverse Segmentations to Illuminate the Multifaceted Landscape of Virtual Card Deployment and Usage Patterns

Virtual card deployments can be best understood through the lens of card-type segmentation, where corporate cards lead in enterprise spend management, reloadable instruments support repeat-use scenarios, and single-use credentials serve high-security, one-off transactions. The prevalence of single-use virtual cards reflects a market prioritizing granular control and fraud mitigation, with business-to-business deployments accounting for a commanding majority of issuance volume.

From a technology perspective, virtual cards span chip-enabled credentials for in-store acceptance, contactless tokens provisioned to digital wallets for one-tap payments, and legacy magnetic stripe formats for backward compatibility. The rise of tokenization and mobile wallet integration has accelerated contactless adoption, while chip-enabled virtual cards continue to expand acceptance at traditional point-of-sale terminals.

Usage frequency segmentation highlights a dynamic interplay between one-time use cards designed for single transactions, regular purchase plans that support ongoing vendor relationships, and subscription-oriented credentials that automate recurring billing cycles. Each frequency category is underpinned by bespoke policy controls that align with business requirements, from budget tracking to automatic expiry upon renewal.

In terms of end users, virtual card adoption skews heavily toward corporate customers-both large enterprises and small-to-medium businesses-seeking automated reconciliation and policy enforcement. Individual consumer uptake remains nascent but is gaining traction among younger demographics who value privacy and real-time control over their spending.

Application-based segmentation reveals a broad spectrum of use cases, ranging from e-commerce platforms optimizing checkout security to healthcare providers issuing on-demand payment credentials for patient billing, retailers enabling streamlined vendor payouts, telecom operators managing top-up flows, and travel & hospitality companies disbursing digital lodging and expense allowances. Each vertical draws on the programmability and control features of virtual cards to address its unique payment challenges.

Finally, the issuer landscape comprises traditional banks maintaining robust compliance frameworks, fintech companies offering API-first issuance and real-time analytics, and leading retailers embedding virtual cards within loyalty and procurement ecosystems. This diversified issuer mix drives competition across control features, integration capabilities, and pricing models.

This comprehensive research report categorizes the Virtual Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Usage Frequency

- Technology

- End User

- Application

- Card Issuers

Evaluating Regional Dynamics to Reveal Distinct Drivers and Adoption Trends in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, North America spearheads virtual card adoption with a robust infrastructure that marries advanced regulatory guidance and a mature payments ecosystem. Leading financial institutions and fintech innovators have launched comprehensive corporate expense solutions that seamlessly integrate with enterprise resource planning systems. This environment fosters rapid program roll-outs and continuous feature enhancements, cementing the region’s position as a global benchmark for innovation.

Europe, the Middle East, and Africa benefit from a confluence of regulatory initiatives and digital transformation mandates. The advent of the Revised Payment Services Directive and Strong Customer Authentication requirements has elevated security standards, driving issuers to adopt tokenization and real-time controls. Contactless payments have surged across retail and corporate channels, supported by mobile wallet proliferation and open-banking frameworks that enable embedded card issuance with minimal friction.

Asia-Pacific markets are experiencing rapid growth driven by dynamic digital economies and high smartphone penetration. Businesses across the region prioritize fraud prevention features, with over ninety-one percent of enterprises seeking card solutions that deliver strong security controls and seamless expense management. Collaboration among banks, fintechs, and payment networks is unlocking on-demand issuance capabilities, particularly for travel and employee expense programs. These trends underscore APAC’s trajectory as the fastest-accelerating market segment.

This comprehensive research report examines key regions that drive the evolution of the Virtual Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Approaches and Innovations of Leading Virtual Card Issuers and Fintech Firms Driving Market Progress

Stripe and Marqeta have emerged as market frontrunners by pioneering API-driven issuance platforms that enable rapid integration of virtual card services into digital ecosystems. Their developer-centric approaches allow businesses to spin up virtual credentials within minutes, complete with granular spend controls and real-time reconciliation feeds. These capabilities have redefined expense management and procurement automation for enterprises of all sizes.

Traditional payment providers such as PayPal and American Express have responded by expanding their commercial portfolio to include virtual card options. While these incumbents leverage established network acceptance, they face competition in speed and customizability from fintech startups. Partnerships between card networks and banks have facilitated tokenized in-wallet provisioning, enabling broader acceptance and enhanced security for corporate clients.

Emerging challengers such as Brex, Ramp, and Revolut differentiate through vertical specialization and global footprint. They offer localized card issuance, multi-currency support, and compliance modules tailored to regional regulations across multiple jurisdictions. This ‘glocal’ strategy caters to businesses operating international supply chains, ensuring seamless cross-border capability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adyen N.V.

- Alliance Bank Malaysia Berhad

- American Express Company

- AU Small Finance Bank Limited

- Bank of America Corporation

- Barclays PLC

- BLOCK, INC.

- BNP Paribas S.A.

- Capital One Financial Corporation

- Cardless, Inc.

- Citigroup Inc.

- Deutsche Bank AG

- First Abu Dhabi Bank PJSC

- Global Payments Inc.

- HSBC Holdings PLC

- JCB Co., Ltd.

- JPMorgan Chase & Co.

- Lithic, Inc.

- Marqeta, Inc.

- Mastercard International Incorporated

- N26 Bank AG

- PayPal Holdings, Inc.

- Paysafe Limited

- Revolut Ltd.

- Stripe, Inc.

- Synchrony Bank

- U.S. Bancorp

- UnionPay International Co., Ltd

- Visa Inc.

- Wells Fargo & Company

- WEX Inc.

- Wise PLC

- Zeta Help Inc

Outlining Strategic Actions and Prioritized Initiatives to Empower Industry Leaders in Maximizing Virtual Card Solutions and Competitive Advantage

Adopt a platform-first mindset by embedding virtual card issuance within core financial applications. Prioritize developer-friendly APIs and modular architecture to enable on-demand credential generation, spend rule enforcement, and seamless data integrations. This approach minimizes time-to-market and fosters a culture of continuous innovation.

Invest in advanced authentication frameworks combining behavioral biometrics, multi-factor protocols, and tokenization to safeguard every transaction. Align these security measures with regulatory mandates such as Strong Customer Authentication to establish competitive differentiation based on trust and reliability.

To mitigate tariff-induced cost pressures, diversify your hardware and software supplier base. Explore strategic partnerships for localized infrastructure and consider multi-sourcing agreements to preempt operational disruptions. Regularly review supply-chain contracts to renegotiate terms and secure favorable pricing.

Expand regional footprints through collaborative alliances with local acquirers and banking partners. Customize virtual card programs to address market-specific requirements-whether compliance, currency, or customer preferences-to accelerate adoption and drive stickiness.

Detailing the Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Expert Validation to Ensure Robust Insights

This research combines primary interviews with payment executives, fintech innovators, and corporate treasury professionals to capture firsthand perspectives on virtual card adoption and program management. Secondary data sources include industry publications, regulatory filings, and technology white papers to ensure comprehensive coverage of market developments.

Data triangulation methods were applied to validate insights from diverse channels, while expert panels reviewed preliminary findings to refine thematic narratives and confirm accuracy. Rigorous quality assurance processes, including peer reviews and consistency checks, underpin the robustness of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Cards Market, by Card Type

- Virtual Cards Market, by Usage Frequency

- Virtual Cards Market, by Technology

- Virtual Cards Market, by End User

- Virtual Cards Market, by Application

- Virtual Cards Market, by Card Issuers

- Virtual Cards Market, by Region

- Virtual Cards Market, by Group

- Virtual Cards Market, by Country

- United States Virtual Cards Market

- China Virtual Cards Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Key Discoveries and Strategic Impacts of Virtual Cards on Payment Modernization and Financial Security Across Industries

The analysis underscores virtual cards as a transformative payment instrument that marries security, flexibility, and automation. Key discoveries reveal how programmable credentials and embedded finance integration are redefining expense management, while tokenization and advanced authentication set new industry benchmarks for fraud prevention.

Segmentation insights highlight diverse usage patterns-from single-use cards for one-off transactions to subscription-based models for recurring billing-tailored to meet the needs of corporate and individual end users. Regional findings demonstrate North America’s leadership, EMEA’s regulatory-driven innovation, and APAC’s rapid acceleration fueled by digital adoption and fraud prevention prioritization.

Leading issuers differentiate through API-first platforms, global-local strategies, and strategic partnerships, shaping a competitive landscape that rewards agility and customer-centric features. Actionable recommendations guide industry leaders in strengthening security, optimizing supply-chain resilience, and customizing regional offerings to secure competitive advantage.

In summary, virtual cards stand at the nexus of modern payment innovation, offering a scalable, secure, and programmable framework suited to the evolving needs of businesses and consumers alike.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Strategic Decision Making with the Latest Virtual Cards Report

If your organization is ready to harness the full potential of virtual cards and translate these insights into strategic advantage, we invite you to engage directly with Associate Director, Sales & Marketing Ketan Rohom. His deep expertise in payment innovation and market intelligence ensures you will receive tailored guidance on leveraging virtual card solutions to meet your operational objectives. Contact him to secure your copy of the comprehensive market research report and unlock actionable intelligence that empowers confident decision making.

- How big is the Virtual Cards Market?

- What is the Virtual Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?