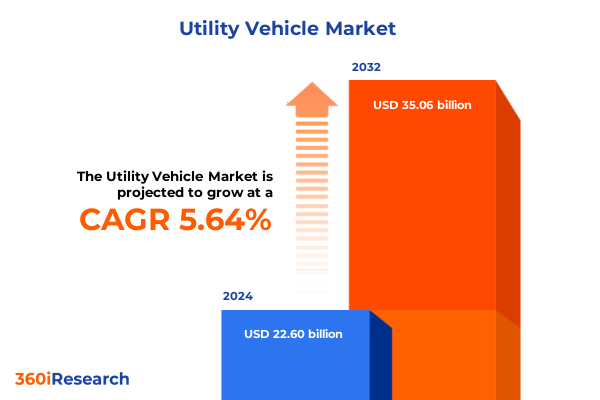

The Utility Vehicle Market size was estimated at USD 23.90 billion in 2025 and expected to reach USD 25.11 billion in 2026, at a CAGR of 5.62% to reach USD 35.06 billion by 2032.

Discovering Emerging Forces in the Utility Vehicle Arena Driving Operational Efficiency, Sustainability Integration, and Dynamic Competitive Advantages

The utility vehicle industry is undergoing a profound transformation driven by technological breakthroughs, shifting customer expectations, and evolving regulatory frameworks. Historically known for its rugged performance and versatility across agriculture, construction, and recreational applications, the sector now stands at the cusp of redefinition as new powertrain solutions, advanced connectivity, and sustainability imperatives reshape core offerings. As these vehicles increasingly blend on-road comfort with off-road capability, stakeholders face both opportunities and complexities in aligning product roadmaps with future needs.

Against this backdrop, our study explores the fundamental forces shaping the utility vehicle arena, highlighting how major original equipment manufacturers, emerging disruptors, and Tier 1 suppliers are strategically repositioning to capitalize on growth pockets. By examining end-user trends, competitive dynamics, and high-impact technologies, readers will gain a clear understanding of how the convergence of digitalization, electrification, and intelligent systems is setting the stage for the next generation of utility vehicles. Throughout this report, emphasis is placed on actionable intelligence-equipping leaders to anticipate market shifts, optimize resource allocation, and unlock the full potential of their product portfolios.

Unveiling Transformative Shifts Redefining Utility Vehicle Development through Electrification, Autonomous Innovation, and Expanding Mobility Ecosystems

Over the past several years, the utility vehicle landscape has experienced a wave of transformative shifts that extend far beyond conventional engineering enhancements. Central to this evolution is the rapid integration of electrified powertrains coupled with advanced battery management systems, which are redefining expectations for vehicle endurance, performance, and environmental footprint. Simultaneously, autonomous control technologies-ranging from basic driver-assist features to fully autonomous navigation modules-are steadily advancing through rigorous field testing, promising to revolutionize applications in precision agriculture, mining operations, and facility maintenance.

Moreover, the proliferation of connected platforms and telematics solutions has ushered in a new era of data-driven maintenance strategies and fleet optimization techniques. Providers are leveraging real-time diagnostics, usage analytics, and predictive upkeep algorithms to minimize downtime and elevate total cost of ownership metrics. Meanwhile, growing consumer and end-user consciousness around eco-friendly operations is prompting stricter emissions and noise regulations, particularly in urban and protected environments, which in turn drives manufacturers to innovate with hybrid systems and low-emission diesel alternatives. Taken together, these convergent trends are not only reshaping product roadmaps but also redefining competitive battlegrounds, compelling market participants to adopt agile development frameworks and forge strategic partnerships to stay ahead.

Evaluating the Cumulative Impact of 2025 Trade Tariffs on the United States Utility Vehicle Landscape and Supply Chain Resilience Strategies

The introduction and escalation of United States trade tariffs in 2025 have exerted a substantial cumulative impact on the utility vehicle supply chain and cost structures. By targeting critical components and core materials, these measures have led to increased procurement expenses, compelling manufacturers to reassess sourcing strategies and negotiate long-term contracts to mitigate volatility. In response, many original equipment manufacturers have accelerated efforts to localize production, forging alliances with regional suppliers to reduce cross-border dependencies and buffer against future policy fluctuations.

These tariff-induced pressures have also influenced pricing strategies, as companies navigate the delicate balance between preserving margin integrity and maintaining competitive end-user price points. Additionally, lead times for imported parts have extended, triggering inventory management challenges that necessitate dynamic safety-stock algorithms and enhanced supplier collaboration. To adapt, industry leaders are increasingly investing in digital supply-chain control towers and blockchain-enabled provenance tracking, ensuring greater transparency and resilience. As a result, the sector is witnessing a shift toward more vertically integrated models, where firms take on expanded roles in component manufacturing to secure supply continuity and reinforce cost optimization measures.

Uncovering Key Market Segmentation Drivers across Drive Type, Vehicle Configurations, Payload Capacities, Propulsion Technologies, and Application Use Cases

The utility vehicle market reveals nuanced demand dynamics when analyzed across various segmentation dimensions. When considering drive type, operators often prioritize all wheel drive for its balanced traction and maneuverability across mixed-terrain environments, while four wheel drive remains essential for heavy-duty applications requiring maximum torque delivery. Conversely, two wheel drive configurations continue to offer a cost-effective solution for less demanding transport and recreational use scenarios.

Examining vehicle type uncovers further complexity: all terrain vehicles bifurcate into four wheel drive and two wheel drive variants to cater to both professional and leisure riders, whereas utility terrain vehicles diversify offerings through two seater, four seater, and six seater models that address workforce transport and cargo handling needs. Payload capacity segmentation paints an even richer picture, as heavy payload solutions are deployed in mining and large-scale construction sites, medium payload platforms serve municipal services and agriculture contractors, and light payload units excel in last-mile deliveries and small-scale maintenance operations.

Propulsion technology segmentation underscores a clear pivot toward diversified energy sources. Diesel engines maintain dominance in high-torque, long-duration missions, while gasoline alternatives support niche flexibility. Electric drive systems are rapidly gaining ground in noise-sensitive and zero-emission zones, complemented by hybrid technology that bridges performance with environmental compliance. Finally, application segments spanning agriculture, construction, military, mining, oil & gas, and recreation reveal distinct requirements for durability, customization, and serviceability, illustrating the importance of configurable architectures and modular accessory ecosystems for meeting varied operational demands.

This comprehensive research report categorizes the Utility Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drive Type

- Vehicle Type

- Payload Capacity

- Propulsion

- Application

Examining Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific to Illuminate Shifting Utility Vehicle Demand Patterns

Regional analysis highlights significant disparities in utility vehicle adoption and growth catalysts. In the Americas, robust investments in agriculture modernization and natural resource extraction have elevated demand for high-payload, all terrain solutions engineered for durability under rigorous conditions. North American emphasis on workplace safety standards and emissions regulation in urban centers also fuels interest in low-emission hybrid and electric variants, accelerating OEM commitments to alternative powertrain R&D.

Within Europe, Middle East & Africa, varied regulatory landscapes and terrain profiles drive diversified procurement strategies. Stringent European emissions guidelines boost interest in electric-driven utility vehicles for municipal services and sensitive industrial zones, while Middle Eastern markets continue to rely on heavy-duty diesel platforms for oil & gas operations. Across Africa, growth in infrastructure projects and mining ventures stimulates demand for rugged four wheel drive and heavy payload models capable of handling remote, undeveloped terrains.

Across Asia‐Pacific, rapid industrialization, urbanization, and government-led smart city initiatives are propelling adoption of connected utility platforms and autonomous assist features. Infrastructure renewal projects in Southeast Asia and Australia emphasize multi-use vehicles that can transition seamlessly between agriculture, construction, and emergency response roles. Moreover, competitive manufacturing ecosystems in the region support cost-effective production, enabling export opportunities and reinforcing Asia-Pacific’s position as both a consumer and supplier hub.

This comprehensive research report examines key regions that drive the evolution of the Utility Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation and Strategic Collaborations in the Utility Vehicle Sector to Define Competitive Leadership

Industry leadership within the utility vehicle space is characterized by a blend of legacy expertise and forward-leaning innovation strategies. Established original equipment manufacturers consistently leverage decades of off-road vehicle experience to refine chassis durability, drivetrain efficiency, and service network coverage. Simultaneously, several emerging disruptors are carving out niches by introducing digital twins and remote diagnostics capabilities, effectively enhancing maintenance workflows and customer engagement.

Strategic collaborations have become a hallmark of competitive positioning, with joint ventures between propulsion specialists and electronics providers driving breakthroughs in battery management, motor control, and advanced safety systems. Similarly, supplier alliances are focusing on lightweight materials and additive manufacturing to reduce vehicle weight without compromising strength. Tier 1 part producers are also expanding co-development initiatives, offering modular subsystems that accelerate time to market and support rapid customization.

The convergence of aftermarket service providers and OEMs into unified platforms is redefining customer experience paradigms. By integrating digital commerce portals, predictive maintenance scheduling, and extended warranty programs, leading companies enhance brand loyalty and establish recurring revenue streams. In addition, multi-tier distribution networks that blend direct and dealer relationships ensure broader geographic reach, optimizing local support capabilities for end users across diverse sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Utility Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arctic Cat Inc.

- Bad Boy Buggies

- Bintelli Electric Vehicles

- Bombardier Recreational Products Inc.

- Club Car LLC

- CNH Industrial N.V.

- Deere & Company

- Doosan Bobcat Inc.

- Evolution Electric Vehicles LLC

- General Motors Company

- Hisun Motors Corp.

- Honda Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Polaris Inc.

- Textron Inc.

- Toro Company

- Toyota Motor Corporation

- Yamaha Motor Co. Ltd.

- ZHONGXING Automobile Co. Ltd.

Actionable Strategic Recommendations for Industry Leaders to Navigate Market Disruptions, Accelerate Innovation, and Enhance Operational Agility

To capitalize on evolving market conditions, industry leaders must adopt a strategic blend of innovation, agility, and partnership. First, organizations should prioritize the development of versatile electric and hybrid powertrains, aligning with regulatory demands and end-user preferences for low-emission operations, while also pursuing modular platform architectures to facilitate rapid customization for diverse applications. In parallel, investment in advanced connectivity solutions and data analytics platforms will enable predictive maintenance and enhanced fleet management capabilities, reducing downtime and optimizing asset utilization.

Furthermore, strengthening supply chain resilience through dual-sourcing strategies and strategic stockpiling of critical components is essential in mitigating the impacts of tariff fluctuations and global disruptions. Engaging with regional suppliers to localize key production processes not only safeguards against policy shifts but also shortens lead times and lowers logistics costs. Equally important is forging strategic alliances with technology start-ups and software developers to integrate autonomous control modules and artificial intelligence-driven operational intelligence, positioning organizations at the forefront of digital transformation.

Lastly, cultivating talent through targeted workforce development programs and cross-functional training ensures that teams possess the skills required to manage emerging technologies and complex project lifecycles. By fostering a culture of continuous improvement and open innovation, companies can streamline decision-making processes, accelerate product development cycles, and maintain sustained competitive advantage in the dynamic utility vehicle arena.

Detailing Rigorous Research Methodology Integrating Primary Insights, Stakeholder Interviews, and Cross Functional Data Synthesis Techniques

Our research methodology was designed to deliver rigorous, unbiased insights by combining qualitative and quantitative approaches across multiple channels. Initially, in-depth interviews were conducted with senior executives from leading OEMs, Tier 1 suppliers, and major end users to capture firsthand perspectives on technological priorities, procurement challenges, and regulatory impacts. These primary discussions were supplemented by workshops with subject-matter experts in propulsion systems, electrification, and vehicle telematics to validate emerging trends and risk factors.

Secondary research comprised a comprehensive review of academic publications, patent filings, industry association reports, and public regulatory filings, ensuring a broad understanding of historical developments and competitive benchmarks. Data triangulation techniques were applied to cross-verify findings, while statistical analysis tools enabled the identification of correlation patterns between market drivers and adoption rates. Furthermore, a dedicated data validation phase involved peer reviews by independent analysts, who assessed data integrity, consistency, and completeness against internal validation protocols.

To enhance the robustness of the conclusions, scenario-planning exercises were conducted to examine the potential implications of shifting regulations, tariff changes, and breakthrough technologies. This multi-layered approach guarantees that the insights presented are not only reflective of current market realities but also adaptable to future industry developments, equipping stakeholders with actionable intelligence for informed strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Utility Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Utility Vehicle Market, by Drive Type

- Utility Vehicle Market, by Vehicle Type

- Utility Vehicle Market, by Payload Capacity

- Utility Vehicle Market, by Propulsion

- Utility Vehicle Market, by Application

- Utility Vehicle Market, by Region

- Utility Vehicle Market, by Group

- Utility Vehicle Market, by Country

- United States Utility Vehicle Market

- China Utility Vehicle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Strategic Conclusions to Highlight Critical Insights, Market Evolution Trends, and Future Proofing Approaches in the Utility Vehicle Industry

As the utility vehicle sector advances through a period of accelerated innovation and regulatory evolution, several strategic imperatives emerge for stakeholders seeking sustained success. First, the integration of electrification and digital capabilities is no longer optional; it represents a fundamental requirement to meet both environmental standards and customer expectations for connectivity. Additionally, building supply chain resilience through localized partnerships and diversified sourcing strategies will be critical in buffering against geopolitical risks and tariff-related cost pressures.

Moreover, the ability to segment offerings effectively-tailoring drive type, payload capacity, and propulsion choices to specific application needs-will determine market responsiveness and profitability. Regional nuances must inform product development and go-to-market approaches, as adoption drivers vary significantly across the Americas, EMEA, and Asia-Pacific. Leading companies will be those that not only innovate technically but also excel in forging collaborative ecosystems encompassing suppliers, technology partners, and aftermarket service providers.

In conclusion, the path forward for the utility vehicle industry hinges on a balanced fusion of technological prowess, operational agility, and strategic foresight. Stakeholders that embrace data-driven decision frameworks, invest in next-generation powertrains, and cultivate a culture of continuous improvement are best positioned to thrive in an increasingly competitive and dynamic landscape. These insights lay the groundwork for informed decision-making, enabling market participants to seize emerging opportunities and navigate challenges with confidence.

Engage Directly with Our Associate Director of Sales & Marketing to Secure Exclusive Utility Vehicle Market Intelligence and Customized Support

To delve deeper into these strategic insights and equip your organization with the comprehensive data and analysis required to confidently navigate the evolving utility vehicle market, reach out to Ketan Rohom, Associate Director of Sales & Marketing. You can discuss tailored solutions, secure early-bird access to custom briefings, and learn how our detailed report can support your critical decision-making processes and investment planning. Elevate your market intelligence by engaging today and gain the strategic foresight to lead in an increasingly competitive landscape.

- How big is the Utility Vehicle Market?

- What is the Utility Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?