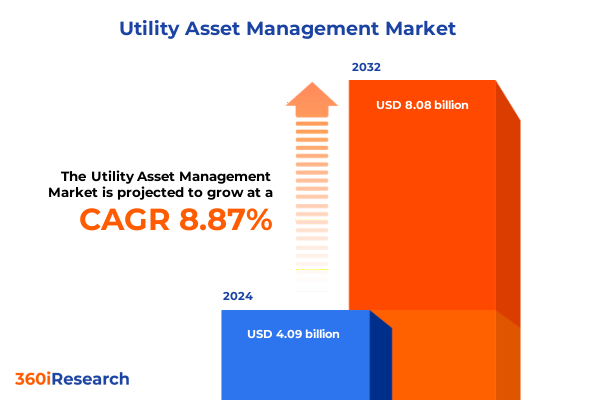

The Utility Asset Management Market size was estimated at USD 4.40 billion in 2025 and expected to reach USD 4.73 billion in 2026, at a CAGR of 9.06% to reach USD 8.08 billion by 2032.

Navigating the Evolving Utility Asset Management Ecosystem with Strategic Insights into Digitalization, Regulatory Pressures, and Operational Excellence

In the rapidly evolving world of utility operations, asset management has emerged as a strategic imperative for organizations seeking to balance reliability, efficiency, and sustainability. Aging infrastructure, combined with intensifying regulatory requirements and growing demand for uninterrupted service, has propelled utilities to reimagine how they monitor, maintain, and optimize critical assets. This executive summary introduces a holistic examination of these challenges and opportunities, laying the groundwork for exploring the multifaceted dimensions of the utility asset management landscape.

Amid digital transformation and the advent of Industrial Internet of Things (IIoT) technologies, utilities are harnessing real-time data to transition from reactive maintenance schedules to predictive models that preempt equipment failures. Concurrently, decarbonization goals and climate resilience imperatives are driving investments in next-generation grid modernization initiatives. This report synthesizes prevailing trends, illuminates how tariff fluctuations are reshaping supply chains, and decodes segmentation and regional nuances that underpin strategic decision-making.

By weaving together expert perspectives, granular segmentation analysis, and forward-looking recommendations, this document equips stakeholders-from C-suite executives to asset reliability engineers-with an authoritative roadmap. It underscores the necessity of embracing digitalization, adapting to policy shifts, and deploying analytical rigor to unlock value in hardware, software, and service investments, ultimately enabling utilities to navigate complexity with confidence and foresight.

Unprecedented Technological and Regulatory Forces Reshaping Utility Asset Management into an AI-Driven, Decarbonized, and Resilient Grid

Utility asset management is undergoing a fundamental metamorphosis driven by converging technological, regulatory, and market forces. Digitalization stands at the forefront of this transformation, with cloud-native platforms enabling seamless integration of distributed sensors, controllers, and communication devices. As a result, utilities can gather granular data from remote assets and apply advanced analytics and machine learning models to forecast equipment health and performance. At the same time, the proliferation of edge computing architectures has reduced latency, enabling real-time diagnostics and automated fault detection that enhance system resilience.

In parallel, regulatory landscapes are shifting toward more aggressive decarbonization targets and stringent reporting standards. Legislative frameworks are mandating utilities to demonstrate progress in reducing greenhouse gas emissions and improving energy efficiency, compelling them to adopt asset management platforms that support geo-referenced visualization and comprehensive audit trails. These requirements, fueled by rising stakeholder demand for transparency, have accelerated adoption of GIS integration and advanced reporting capabilities that align operational excellence with environmental stewardship.

Moreover, renewable energy integration and distributed energy resources pose both challenges and opportunities for asset managers. As intermittent generation sources proliferate, utilities are recalibrating protection relays, switchgear configurations, and substation operations to maintain voltage stability and grid reliability. Consequently, services such as consulting and training for specialized installation, commissioning procedures, and maintenance protocols have gained prominence. Taken together, these transformative shifts underscore the imperative for utilities to overhaul traditional maintenance paradigms and embrace a data-driven, regulatory-compliant, and customer-centric asset management model.

Assessing the Collective Consequences of Latest United States Tariff Measures on Utility Asset Supply Chains, Innovation Adoption, and Cost Structures

In 2025, the United States maintained a suite of Section 301 tariffs targeting imported electrical and communications equipment, directly influencing the cost structures and procurement strategies of utility asset managers. Components such as communication devices and sensors-often sourced from low-cost manufacturing hubs abroad-have experienced elevated import duties, prompting procurement leads to reassess supplier portfolios and explore alternative manufacturing partnerships. Additionally, the tariffs on advanced controllers have reverberated through the hardware segment, forcing many organizations to absorb higher capital expenditures or pass costs downstream to ratepayers.

These tariff measures have also spurred heightened interest in domestic production and local content requirements. Utilities and original equipment manufacturers have accelerated discussions around nearshoring and joint ventures with regional suppliers to mitigate exposure to import levies. Concurrently, technology integrators have reworked service contracts-encompassing consulting and training, installation and commissioning, and maintenance and repair-to reflect revised component pricing, creating a ripple effect across total cost of ownership considerations.

While software suites for analytics and reporting, asset management platforms, and GIS integration are primarily developed and licensed via global technology firms, they too have felt indirect impacts. Slower hardware deployments caused by supply chain adjustments have delayed software roll-outs, heightening the importance of flexible licensing models and scalable cloud architectures. As a result, asset management leaders are revisiting digital transformation roadmaps to accommodate dynamic tariff landscapes and ensure seamless continuity of both hardware and software initiatives.

Dissecting Component, Asset Type, Application, and End User Perspectives to Uncover Deep Segmentation Trends Driving Utility Asset Management Choices

A comprehensive understanding of the utility asset management market emerges when examined through the lenses of component, asset type, application, and end-user segmentation. The component dimension reveals that hardware investments encompass communication devices for real-time telemetry, controllers that automate system responses, and sensors that capture precise operational metrics. Complementing these are services such as consulting and training programs designed to upskill maintenance personnel, installation and commissioning workflows that ensure safe and compliant deployments, and maintenance and repair engagements that maximize asset uptime. Software, on the other hand, underpins this infrastructure with analytics and reporting tools that translate data into actionable intelligence, asset management platforms that centralize maintenance schedules and work orders, and GIS integration modules that map asset locations against environmental and operational risk factors.

Shifting to asset type, distribution automation equipment-including capacitor banks, fault indicators, and reclosers-has become critical for reducing outage durations and improving power quality. Modern metering infrastructure now spans IoT-enabled meters that provide high-frequency load profiles and smart meters that enable time-of-use billing and demand response programs. Protection relays are evolving with sophisticated fault detection and diagnostics capabilities, while substations, switchgear, and transformers are retrofitted with health-monitoring systems to detect anomalies before they escalate.

When viewed by application, the market prioritizes asset performance management to holistically optimize health and cost metrics, condition monitoring through acoustic, temperature, and vibration sensing to identify early warning signs, and fault detection and diagnostics to swiftly isolate issues. Predictive maintenance strategies leverage both machine learning models and rule-based systems to forecast failures and plan interventions, whereas remote monitoring solutions grant control room operators the visibility needed to address emergent events without dispatching field personnel.

Finally, end users span commercial facilities seeking energy efficiency, industrial plants in manufacturing, mining, and oil and gas sectors that demand continuous operations, residential networks adapting to smart home integrations, and utility companies-both distribution and transmission entities-that require grid-wide asset oversight. This multilayered segmentation underscores how stakeholders with divergent priorities converge on the imperative of securing asset reliability and minimizing lifecycle costs.

This comprehensive research report categorizes the Utility Asset Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Asset Type

- Application

- End User

Exploring Regional Nuances in Utility Asset Management Adoption across Americas, Europe Middle East Africa, and Asia Pacific to Highlight Strategic Opportunities

The utility asset management landscape exhibits pronounced regional divergences that reflect regulatory environments, infrastructure maturity, and investment appetites. In the Americas, the United States and Canada are leading the charge in grid modernization efforts, fueled by government initiatives and private sector commitments under the Infrastructure Investment and Jobs Act. Utilities in this region are quick to adopt predictive maintenance platforms and advanced metering systems, often piloting edge-based analytics and digital twin technologies to improve system reliability and accelerate return on technology investments. Furthermore, collaborative forums and industry consortia are fostering interoperability standards, enabling seamless data exchange across diverse vendor ecosystems.

Across Europe, the Middle East, and Africa, regulatory mandates on carbon neutrality and renewable integration are pushing asset managers to reconfigure substations and switchgear to accommodate distributed energy resources. The European Union’s stringent reporting requirements have expedited uptake of GIS-powered risk mapping and environmental impact tracking, while Middle Eastern utilities, riding the wave of large-scale solar deployments, emphasize condition monitoring to mitigate harsh climate effects on field equipment. In Africa, nascent smart grid projects are emerging with donor-backed funding, targeting rural electrification and leveraging remote monitoring to manage widely dispersed networks.

Asia-Pacific markets present a spectrum of maturity, from China’s state-led smart grid rollouts emphasizing big data analytics to India’s drive for smart metering as part of grid upgrade programs. Southeast Asian nations are partnering with global technology providers to pilot AI-based asset performance management solutions, aiming to reduce technical losses and enhance power quality. These regional distinctions highlight the need for tailored deployment strategies, acknowledging local regulatory contexts, infrastructure readiness, and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Utility Asset Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global and Regional Suppliers to Illuminate Competitive Dynamics, Partnership Strategies, and Innovation Pipelines in Utility Asset Management

The competitive landscape of utility asset management is shaped by a blend of long-standing industrial conglomerates and agile specialist firms, each bringing distinct strengths to the table. Siemens has expanded its digital grid suite by integrating advanced analytics modules into its EnergyIP platform, while Schneider Electric leverages EcoStruxure middleware to deliver seamless connectivity between edge devices and cloud services. ABB has doubled down on partnerships with academic research centers to refine its predictive algorithms for transformer monitoring, and General Electric’s Grid Solutions division recently unveiled enhancements to its Protection and Control portfolio that streamline relay configuration and firmware management.

Meanwhile, Honeywell’s acquisition of a leading condition-monitoring software provider has bolstered its capacity to deliver end-to-end maintenance workflows, from data capture to actionable insights. Emerson is capitalizing on its field instrumentation heritage by embedding IIoT sensors within switchgear assemblies, enabling asset intelligence where previously manual inspections prevailed. In the software domain, AVEVA (formerly OSIsoft) continues to advance PI System deployments for utilities seeking historian capabilities, and IBM’s Maximo Asset Performance Management has integrated machine learning toolkits to improve anomaly detection.

Regional and niche players also play a critical role. Cloud-native start-ups offering SaaS-based analytics are forging strategic alliances with incumbent EPC firms to bundle digital monitoring services into large-scale grid upgrade contracts. Meanwhile, specialized consulting groups are differentiating through deep domain expertise in regulatory compliance and environmental risk assessment. Collectively, these companies are driving innovation through M&A activity, cross-industry partnerships, and continuous enhancement of technology stacks to meet the evolving demands of utility asset managers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Utility Asset Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Cisco Systems Inc.

- General Electric Company

- Hexagon AB

- IBM Corporation

- Itron, Inc.

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- Trimble Inc.

Recommending Targeted Strategic Actions and Technology Roadmaps for Utility Executives to Accelerate Digital Transformation and Enhance Operational Resilience

To secure a competitive advantage in utility asset management, organizations should prioritize the integration of predictive analytics capabilities that leverage both machine learning and rule-based models to anticipate equipment failures. By aligning capital expenditure plans with data-driven insights, asset managers can schedule maintenance interventions precisely, thereby reducing downtime and avoiding unplanned outages. In conjunction with this, establishing digital twin environments-virtual replicas of critical assets-enables scenario modeling that supports decision-making around load balancing, asset refurbishment, and lifecycle extension.

A second imperative is to diversify the supply chain in light of ongoing tariff uncertainties. Utility procurement teams must develop relationships with domestic and regional suppliers to mitigate import dependencies, while fostering joint development agreements that spur local innovation. This dual approach not only cushions organizations against external shocks but also aligns with government incentives focused on enhancing local manufacturing capabilities.

Furthermore, bolstering cybersecurity defenses is essential as grids become more interconnected. Utilities must implement rigorous vulnerability assessments across communication devices, controllers, and software platforms, complemented by continuous monitoring programs that detect anomalies in network traffic. Concurrently, workforce upskilling initiatives in consulting and training will ensure that technicians and engineers possess the competencies required to operate within secure, digitally enhanced environments.

Lastly, cultivating a culture of cross-functional collaboration-spanning operations, IT, finance, and regulatory affairs-will expedite digital transformation roadmaps. By embedding agile governance structures, utilities can iterate rapidly on pilot projects, scale successful implementations, and adapt swiftly to emerging regulatory mandates.

Detailing Rigorous Qualitative and Quantitative Research Methods Employed to Ensure Robust Data Integrity and Actionable Insights in Utility Asset Management Study

This study employs a rigorous mixed-methodology approach, integrating both qualitative and quantitative techniques to deliver robust and actionable insights. Secondary research encompassed a comprehensive review of regulatory filings, academic journals, industry white papers, and corporate presentations to map out prevailing trends in hardware, services, and software domains. In tandem, primary research involved in-depth interviews with senior utility executives, technology vendors, and engineering consultants to validate secondary data and uncover nuanced perspectives.

Quantitative analyses utilized structured data from asset performance databases and survey responses to identify adoption rates of key applications such as predictive maintenance, condition monitoring, and remote diagnostics. Data triangulation was achieved by cross-referencing survey results with publicly disclosed pilot project outcomes and third-party case studies. This ensured that insights reflect real-world performance metrics rather than vendor-declared capabilities.

Additionally, expert panels comprising grid modernization specialists and regulatory advisors conducted peer-reviews of preliminary findings, enhancing the credibility of strategic recommendations. Geographic segmentation analyses were underpinned by market intelligence tools that track regional investment flows and infrastructure upgrade plans, enabling nuanced differentiation across the Americas, EMEA, and Asia-Pacific. Together, these methodological pillars underpin an evidence-based framework designed to guide decision-makers in shaping resilient and future-ready utility asset management strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Utility Asset Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Utility Asset Management Market, by Component

- Utility Asset Management Market, by Asset Type

- Utility Asset Management Market, by Application

- Utility Asset Management Market, by End User

- Utility Asset Management Market, by Region

- Utility Asset Management Market, by Group

- Utility Asset Management Market, by Country

- United States Utility Asset Management Market

- China Utility Asset Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Reinforce Strategic Imperatives and Future Pathways for Stakeholders in the Utility Asset Management Landscape

In synthesizing the key themes of this report, it becomes evident that utility asset management sits at the nexus of digital innovation, regulatory evolution, and operational excellence. The convergence of advanced analytics, edge computing, and comprehensive service models offers utilities a pathway to transcend legacy maintenance paradigms. By aligning component, asset type, application, and end-user requirements, organizations can craft tailored strategies that optimize reliability and cost efficiency.

Regional disparities further emphasize the need for context-aware approaches: while the Americas push forward with digital twin pilots and collaborative interoperability frameworks, EMEA stakeholders contend with decarbonization mandates, and Asia-Pacific markets vary widely in technological maturity. Against this backdrop, leading companies are forging strategic alliances and investing in domain expertise to differentiate through value-added services and integrated solutions.

Looking ahead, the ability to adapt to tariff fluctuations, diversify supply chains, and embed cybersecurity safeguards will determine which utilities can harness the full potential of digital transformation. By implementing the recommended actions outlined here-centered on predictive analytics, supply-chain resilience, cross-functional collaboration, and workforce upskilling-industry leaders can secure a competitive edge and ensure grid reliability in an increasingly complex environment.

Engaging Directly with Ketan Rohom to Unlock Comprehensive Utility Asset Management Intelligence and Drive Informed Decision Making through Expert Collaboration

To explore the full breadth of insights and strategic perspectives contained in this comprehensive utility asset management report, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. His in-depth understanding of market dynamics and tailored guidance will help you leverage actionable intelligence for your organization’s growth. Engaging with Ketan will grant you exclusive access to detailed analyses that can drive informed decision-making, streamline procurement strategies, and elevate your operational resilience. Connect today to unlock the decisive edge your team needs in managing critical utility assets.

- How big is the Utility Asset Management Market?

- What is the Utility Asset Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?