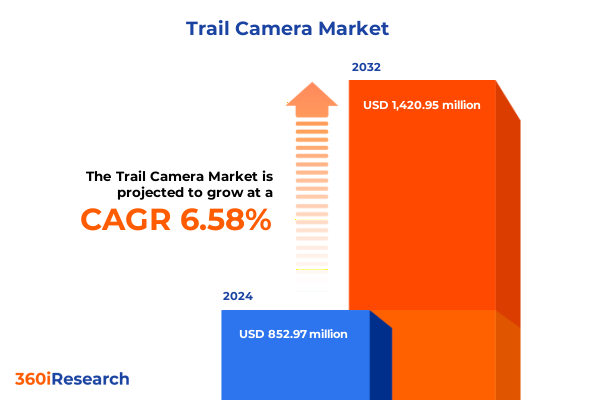

The Trail Camera Market size was estimated at USD 905.94 million in 2025 and expected to reach USD 962.92 million in 2026, at a CAGR of 6.64% to reach USD 1,420.95 million by 2032.

Unlocking the Dynamic Potential of Trail Cameras as Vital Tools for Enhanced Surveillance, Biodiversity Conservation Efforts, and Outdoor Recreation Applications

Trail cameras have emerged as indispensable instruments across wildlife conservation, security surveillance, and outdoor research, capturing critical data in remote environments where human presence is limited. Their ability to record high-quality images and videos autonomously, often over extended periods, has revolutionized how conservationists, hunters, and land managers gather actionable intelligence. By eliminating the need for constant on-site monitoring, these devices have bridged the gap between field observations and strategic decision-making, enabling stakeholders to make timely, evidence-based decisions that enhance both ecological stewardship and property security.

The current generation of trail cameras is defined by rapid technological proliferation, characterized by enhanced image resolution, advanced connectivity, and energy-efficient designs. More than half of cameras deployed in 2023 featured pixel ratings above 12MP, providing ultra-clear visuals even in low-light settings, while the majority of new models incorporated LTE and Wi-Fi modules for real-time data transmission across vast terrains. Complemented by rugged IP66-rated enclosures that withstand extreme environmental conditions and solar-powered options that minimize battery maintenance, these trail cameras deliver operational autonomy and resilience previously unattainable in remote surveillance applications.

Transformative Innovations Driving the Trail Camera Landscape with Artificial Intelligence Connectivity and Energy Efficiency Breakthroughs

The integration of artificial intelligence and machine learning into trail cameras has ushered in a new era of intelligent field monitoring. In 2023, over 1.5 million units featured AI-based recognition systems that automatically distinguish between animals and humans, dramatically reducing false triggers and streamlining data analysis workflows. By harnessing onboard algorithms, these devices now classify species in real time, enabling researchers and land managers to focus resources on high-priority events rather than sifting through hours of irrelevant footage.

Equally transformative is the rapid evolution of wireless connectivity, which has redefined the concept of “remote” in trail camera applications. With approximately 62% of new trail cameras offering Wi-Fi or cellular transmission in 2023, stakeholders can receive instant alerts and images without physically retrieving memory cards from isolated sites. This capability not only enhances operational efficiency but also ensures that responding to theft, boundary breaches, or environmental threats occurs with minimal delay, bolstering both security and conservation outcomes.

Energy autonomy has become a cornerstone of modern trail camera deployment, driven by advancements in solar charging technology. Solar-powered units accounted for nearly one in five shipments in 2023, supplying uninterrupted performance in regions where battery replacement trips are impractical or costly. By integrating high-efficiency photovoltaic panels and smart power management, manufacturers have extended field durations from weeks to months, empowering long-term biodiversity studies and continuous perimeter monitoring in remote landscapes.

Moreover, sensor and chassis enhancements have elevated image fidelity and device durability to unprecedented levels. Over 52% of trail cameras sold globally in 2023 featured pixel sizes above 12MP, with many supporting 4K video recording and full-color night vision, enabling clear identification of subjects under challenging lighting conditions. At the same time, ruggedized, waterproof housings with IP65 and higher ratings have become standard, ensuring reliable operation through heavy rain, dust storms, and temperature extremes. As these transformative shifts converge, trail cameras are evolving into truly autonomous, intelligent sensors that redefine field data collection across applications.

Assessing the Cumulative Impact of the United States’ 2025 Tariffs on Component Sourcing Manufacturing Costs and Supply Chain Resilience

The landscape for trail camera manufacturing and distribution has been fundamentally altered by the layered implementation of U.S. tariffs in 2025. On April 10, reciprocally imposed ad valorem duties on imports from China, Hong Kong, and Macau were raised to 125% in addition to existing Section 301 and Section 232 tariffs, resulting in a cumulative duty burden that significantly increased the cost of essential camera components sourced from these regions. This steep tariff climb has compelled manufacturers to re-evaluate cost structures and consider alternative sourcing strategies to maintain competitive pricing.

Compounding these challenges, the removal of the de minimis exemption on May 2, 2025, eliminated the duty waiver for imports valued at $800 or less from China and Hong Kong, subjecting even low-value shipments to either a 120% ad valorem charge or a flat fee of $100 per package-rising to $200 in June-depending on the carrier’s choice. This policy shift has driven up logistics costs for accessories such as batteries, memory cards, and mounting hardware, historically shipped in small parcels to remote research sites and retail distribution centers.

In mid-April, targeted exemptions issued for certain electronics, including cameras, computer components, and flat panel displays, provided temporary relief by reducing reciprocal duties to 10% for specified items, effective retroactively from April 5, 2025. However, these exemptions excluded Section 301 and fentanyl-related IEEPA tariffs, leaving a residual duty of 20% on many high-volume components and maintaining elevated procurement expenses. Consequently, many OEMs and distributors continue to face pressure on margins as they navigate a complex tariff framework.

Faced with soaring import costs, a significant portion of U.S.-based companies has accelerated relocation and nearshoring initiatives to mitigate exposure to punitive duties. According to a recent survey by the U.S.-China Business Council, 27% of American firms operating in China plan to move operations out of the country in 2025, driven by tariff-induced cost inflation and geopolitical uncertainty. While this shift promises longer-term supply chain resilience, transitional challenges in quality control, workforce training, and logistical integration remain critical hurdles to overcome.

Uncovering Key Segmentation Insights across Product Types Pixel Sizes Connectivity Applications Distribution Channels and End User Profiles

Insight into product type segmentation reveals that professional-grade trail cameras continue to command premium placements with advanced feature sets such as dual-lens imaging and AI-driven analytics, catering to research institutions and high-end security operators. In parallel, specialized cameras-particularly solar-powered units and models with camouflage housing-are gaining traction among users requiring stealthy, long-duration monitoring solutions. Standard entry-level cameras, however, remain pivotal for cost-sensitive consumers, striking a balance between basic motion detection and acceptable image quality for recreational hunting and personal property surveillance.

Examination of pixel size preferences indicates a clear upward shift toward higher-resolution sensors; models in the above-12MP category now dominate new product launches, satisfying demand for detailed imagery in wildlife identification and forensic-level surveillance. Simultaneously, the mid-tier 8–12MP range retains relevance for applications where image clarity is important but balanced against data storage and transmission bandwidth considerations. Cameras with below-8MP sensors are predominantly positioned as budget-friendly alternatives for users prioritizing affordability over ultra-high definition output.

Connectivity-based segmentation underscores the growing role of cellular and Wi-Fi-enabled trail cameras in enabling real-time alerts and remote asset management; these offerings are especially prominent among commercial users and government agencies monitoring critical infrastructure. Bluetooth-equipped models serve localized download and setup scenarios, enhancing convenience where on-site visits are feasible and network coverage is limited. Across applications, agriculture monitoring and hunting rely heavily on cost-effective, offline solutions, whereas security surveillance and extensive wildlife monitoring increasingly depend on always-on network capabilities.

When evaluating channel distribution, online stores have emerged as the primary go-to for individual consumers seeking broad product selection and competitive pricing, while offline retailers and specialty dealers remain critical touchpoints for commercial and institutional buyers who require hands-on consultation and immediate technical support. End-user analysis highlights that commercial operators-spanning agriculture, utilities, and property management-are investing in connectivity and durability; government and research organizations prioritize advanced analytics, data security, and long-term deployment reliability; individual users focus on ease of use, price accessibility, and quick setup.

This comprehensive research report categorizes the Trail Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pixel Size

- Connectivity

- Application

- Distribution Channel

- End-User

Exploring Regional Dynamics in the Trail Camera Market across Americas EMEA and Asia Pacific Driving Diverse Application Growth and Challenges

The Americas region stands at the forefront of trail camera innovation and adoption, driven by a robust hunting culture in the United States and Canada and strong conservation mandates across national parks and private reserves. North America accounted for over 30% of global wildlife camera deployment in early 2025, reflecting a mature market with sophisticated demand for features such as cloud integration, GPS tagging, and AI-powered species classification. Additionally, Latin American countries are increasingly investing in biodiversity studies and anti-poaching surveillance to protect critically threatened species.

Across Europe, the Middle East, and Africa (EMEA), diverse use cases shape regional dynamics. European Union biodiversity funding programs saw a 28% budget increase in 2023, supporting large-scale wildlife monitoring initiatives that leverage high-resolution and thermal imaging cameras for ecological research and habitat management. In the Middle East, trail cameras are deployed for perimeter security and border surveillance, while African nations focus heavily on anti-poaching efforts; Kenya’s pioneering use of AI-driven FLIR thermal cameras in reserves like Ol Pejeta and Solio has set benchmarks for technological integration in wildlife protection programs.

Asia-Pacific is the fastest-growing trail camera market, propelled by agricultural applications in Australia and Southeast Asia, where farmers deploy cameras for pest detection and livestock tracking. China and India are emerging manufacturing hubs, with local production driving cost efficiencies and regional exports. Rising environmental awareness and government-backed conservation projects in countries like China, Japan, and South Korea further catalyze demand for advanced monitoring solutions. Meanwhile, security and infrastructure sectors across the Pacific Rim are adopting networked trail cameras to safeguard remote facilities and transportation corridors.

This comprehensive research report examines key regions that drive the evolution of the Trail Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovation Trends among Leading Trail Camera Manufacturers Shaping Future Market Opportunities and Technological Leadership

Leading industry players have channeled significant investments into R&D to stay ahead of the technological curve. Reconyx, recognized for its high-end professional-grade solutions, has focused on dual-lens hybrid cameras that deliver rapid trigger speeds below 0.2 seconds and advanced AI-based classification, catering to both conservation scientists and tactical security teams. Meanwhile, Vista Outdoor’s Bushnell brand has leveraged its heritage in hunting optics to introduce camouflage-design trail cameras with enhanced concealment features and rugged form factors.

Cellular connectivity innovators like SPYPOINT have carved a niche by optimizing data plans and transmission protocols to ensure reliable image delivery under challenging network conditions. Their platform-centric approach, bundling mobile apps with subscription services, exemplifies a shift toward recurring revenue models and user-friendly remote management capabilities. At the same time, Browning Trail Cameras balances performance and price by offering models with integrated night vision and weatherproof enclosures that appeal to both recreational users and small-scale commercial operators.

Emerging entrants such as Campark and Victure are intensifying competition through aggressive online channel strategies and feature-rich sub-$200 models, challenging incumbents on cost and digital marketing prowess. Simultaneously, established analog leaders like Cuddeback and Stealth Cam continue to enhance firmware functionality and accessory ecosystems, underscoring the importance of comprehensive technical support and ecosystem lock-in for long-term customer retention. Across corporate strategies, partnerships with software providers and cross-industry collaborations are increasingly common, reflecting the convergence of hardware, connectivity, and data analytics in defining future competitive landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Trail Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Barn Owl Tech, Inc.

- Basler AG

- Baumer Holding AG

- Black Gate Hunting Products, LLC

- Blackmagic Design Pty. Ltd.

- Boly Media Communications Co., Ltd.

- Bowhunters Superstore

- Browning Trail Cameras

- Bushnell

- Campark Electronics Co. Ltd.

- Canon Inc.

- Carl Zeiss AG

- Cognex Corporation

- Cosina Co., Ltd.

- Cuddeback

- Dahua Technology Co., Ltd.

- DSE S.R.L.

- FeraDyne Outdoors, LLC

- FLIR Systems, Inc.

- Fujifilm Holdings Corporation

- GardePro

- GoPro, Inc.

- Govicture

- Hanwha Techwin Co., Ltd.

- Hikvision Digital Technology Co., Ltd.

- Leica Camera AG

- Ltl Acorn

- MINOX GmbH by Blaser Group GmbH

- Moultrie by PRADCO

- Nikon Corporation

- Olympus Corporation

- Orion Systems Integrators, LLC

- Panasonic Corporation

- RECONYX, INC.

- RED Digital Cinema, Inc.

- Shenzhen Dongfanghongying Technology Co., Ltd.

- Shenzhen Ereagle Technology Co., Ltd.

- SHENZHEN HUNTING TECH CO., LTD.

- Shenzhen Kinghat Technology Co., Ltd.

- Shenzhen Zecre Technology Co., Ltd.

- Sigma Corporation

- Sony Corporation

- Sony Corporation

- Spartan Camera

- Spromise

- Spypoint

- Stealth Cam. by Good Sportsman Marketing, LLC

- Tactacam by Deer Management Systems LLC

- Teledyne Technologies Inc.

- Toshiba Teli Corporation

- Trailcampro

- UOVision Technology (Shenzhen) CO., LTD.

- Vosker Corporation

- WiseEye Technologies, LLC

- Wosports

Deploying Actionable Recommendations for Industry Leaders to Optimize Trail Camera Product Portfolios Drive Operational Efficiency and Maximize Market Penetration

Industry leaders must prioritize supply chain diversification to mitigate the financial impact of tariff volatility and geopolitical uncertainty. By establishing dual-source agreements in Southeast Asia and Mexico, organizations can reduce their dependency on any single region, securing component availability and stabilizing unit costs. Furthermore, implementing dynamic procurement platforms that monitor real-time tariff changes will enable proactive adjustments to sourcing strategies and contractual terms.

Investment in advanced R&D capabilities remains critical for sustaining product differentiation. Manufacturers should accelerate the development of AI-driven analytics, multi-sensor fusion, and next-generation power management systems, targeting applications in smart agriculture, infrastructure surveillance, and biodiversity research. Collaborations with technology startups and academic institutions can also inject fresh perspectives and speed time-to-market for breakthrough features such as predictive analytics and terrain-aware detection algorithms.

Finally, a customer-centric go-to-market framework-tailoring solutions by segmentation and region-will drive deeper market penetration. This entails aligning feature sets with end-user priorities, whether emphasizing ease of deployment and cost-effectiveness for individual consumers, or highlighting data security and integration capabilities for government and research entities. Thoughtful channel optimization across e-commerce and specialized distribution partners will further enhance customer reach and service responsiveness.

Defining a Rigorous Research Methodology Combining Primary Industry Interviews Secondary Data Analysis and Comprehensive Market Intelligence Processes

This analysis combines primary research comprising in-depth interviews with trail camera manufacturers, industry experts, and end-users to capture firsthand perspectives on evolving use cases, feature requirements, and procurement realities. Qualitative insights gathered from structured discussions were triangulated with feedback from pilot deployments and beta-testing programs to ensure alignment with real-world operational needs.

Secondary research included a meticulous review of company reports, regulatory filings, and public policy announcements to map the regulatory landscape and emerging tariff implications. Trade association bulletins, technical whitepapers, and patent filings were also analyzed to track innovation trajectories in areas such as AI integration, energy harvesting, and connectivity protocols. Market intelligence was augmented by examining regional case studies across the Americas, EMEA, and Asia-Pacific to contextualize adoption patterns and investment flows.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Trail Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Trail Camera Market, by Product Type

- Trail Camera Market, by Pixel Size

- Trail Camera Market, by Connectivity

- Trail Camera Market, by Application

- Trail Camera Market, by Distribution Channel

- Trail Camera Market, by End-User

- Trail Camera Market, by Region

- Trail Camera Market, by Group

- Trail Camera Market, by Country

- United States Trail Camera Market

- China Trail Camera Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Delivering a Comprehensive Conclusion Highlighting Core Drivers Technological Advancements and Strategic Imperatives for Trail Camera Stakeholders

Trail cameras have undergone a profound transformation, evolving from basic motion-triggered image capture devices into sophisticated, networked sensors that underpin critical conservation, security, and operational workflows. Technological advancements in artificial intelligence, connectivity, and power autonomy have enabled these devices to deliver unparalleled situational awareness across diverse environments, from dense rainforests to open farmland.

Amidst escalating tariff pressures and shifting regional dynamics, companies must adopt agile supply chain strategies and maintain relentless innovation in feature development to sustain competitive advantage. By aligning product roadmaps with segmented end-user needs and regional market drivers, stakeholders can unlock new growth avenues and fortify their positions in an increasingly complex global landscape. As the trail camera ecosystem continues to mature, the fusion of hardware excellence, software intelligence, and strategic partnerships will define the next wave of market leadership.

Take Action Today to Connect with Ketan Rohom for Exclusive Access to In-Depth Trail Camera Market Intelligence and Tailored Research Insights

Are you ready to transform your organization’s strategic approach with rich, actionable insights into the trail camera market? Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive industry analysis report. He will guide you through the report’s depth, highlight key intelligence tailored to your needs, and ensure you leverage this research to gain a competitive advantage. Reach out today to take the next critical step in understanding market dynamics, technological innovations, and regional trends with unparalleled clarity.

- How big is the Trail Camera Market?

- What is the Trail Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?