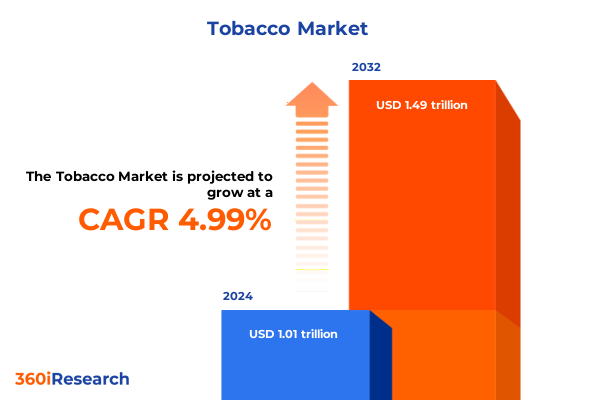

The Tobacco Market size was estimated at USD 1.06 trillion in 2025 and expected to reach USD 1.11 trillion in 2026, at a CAGR of 5.00% to reach USD 1.49 trillion by 2032.

Understanding the Dynamic Evolution of the Tobacco Industry and the Critical Factors Shaping Consumer Behavior and Market Dynamics

The tobacco industry stands at a pivotal moment, characterized by the juxtaposition of enduring traditional products and the rapid ascent of innovative alternatives. In recent years, conventional cigarette consumption has shown signs of maturity in established markets, while smokeless and electronic nicotine delivery systems have gained significant traction among new and existing consumers. This dynamic reflects broader shifts in consumer preferences driven by heightened health awareness, evolving regulatory frameworks, and technological advancements that enable novel product formats.

Moreover, regulatory landscapes across key territories have introduced stringent measures aimed at reducing consumption, particularly among youth, spurring companies to diversify their portfolios and explore harm-reduction strategies. Tax increases, advertising restrictions, and flavor bans have compelled industry players to reassess their go-to-market approaches, invest in research and development, and seek new channels of engagement that align with public health objectives without sacrificing commercial viability.

As consumer behavior continues to evolve, fueled by a desire for lower-risk alternatives and customizable experiences, manufacturers and distributors are embracing digital platforms, subscription services, and direct-to-consumer models. This introduction sets the stage for a deeper examination of the transformative shifts reshaping product innovation, distribution channels, regulatory impacts, and market segmentation-in essence, illuminating the strategic imperatives crucial for stakeholders aiming to thrive amid ongoing disruption.

Exploring the Profound Transformative Shifts Driven by Regulatory Overhauls Technological Advances and Evolving Consumer Preferences in Tobacco

The tobacco sector has undergone profound transformation as emerging regulations, scientific insights, and societal attitudes converge to redefine product development and market engagement. One of the most visible shifts has been the rapid proliferation of electronic nicotine delivery systems, which leverage advanced battery and aerosol technologies to mimic the sensory aspects of smoking without combustion. At the same time, heated tobacco products have introduced a middle ground, offering a smoke-free experience that retains some of the tactile cues familiar to traditional smokers.

In parallel, public health campaigns and tightening regulations targeting youth uptake have driven flavor restrictions and age-verification protocols that challenge established marketing strategies. Brands are recalibrating their innovation pipelines to focus on adult smokers seeking alternatives, redesigning product aesthetics, and refining communication tactics to maintain compliance while preserving brand equity.

Furthermore, the emergence of data-driven personalization tools has enabled manufacturers to tailor offerings based on individual preferences, consumption patterns, and regional regulatory allowances. This shift toward consumer-centric models is accompanied by a growing emphasis on sustainability, as stakeholders prioritize recyclable packaging, reduced waste, and transparent supply-chain practices to meet evolving stakeholder expectations. These converging trends underscore the need for agile adaptation across product design, regulatory navigation, and consumer engagement to remain competitive.

Examining the Cumulative Impact of United States Tariffs Introduced in 2025 on Supply Chains Consumer Costs and Manufacturer Strategies

In 2025, the United States implemented a series of tariffs targeting imported tobacco leaf, components, and finished products, intensifying cost pressures across the supply chain. These levies prompted manufacturers to rethink sourcing strategies, with several major players exploring alternative suppliers in Latin America and Southeast Asia to mitigate tariff-induced margin erosion. Consequently, procurement teams have scrambled to negotiate favorable long-term contracts and build strategic reserves to hedge against future duty escalations.

The cumulative effect of these tariffs has also rippled through transportation and warehousing costs, as higher freight expenses and customs clearance delays have become increasingly common. Distributors, facing narrower margins, have passed a portion of these added costs to retailers, who in turn grapple with consumer sensitivity to price increases. This dynamic has accelerated the shift toward premiumization, as value-oriented smokers trade down to cost-effective alternatives while premium brands reinforce their value propositions through loyalty programs and bundled offerings.

Moreover, manufacturers have intensified collaboration with domestic growers, investing in technological enhancements to local cultivation and processing. By shortening supply chains and reducing reliance on cross-border shipments, these initiatives aim to contain operational costs and fortify supply-chain resilience. In essence, the 2025 tariff regime has served as a catalyst for strategic realignment, compelling stakeholders to innovate procurement, optimize logistics, and refine pricing models in anticipation of ongoing policy shifts.

Uncovering Key Segmentation Insights Spanning Product Types Distribution Channels Flavors and Application-Based Consumer Behaviors for Strategic Positioning

A nuanced understanding of market segmentation reveals the intricate layers that govern consumer choices and brand positioning. Product categories extend beyond traditional cigarettes and cigars to encompass electronic cigarettes, which are further differentiated into disposable e-cigarettes, pod systems, and vape pens. Pod systems themselves bifurcate into pre-filled pods designed for convenience and refillable pods that appeal to users seeking customization. Smokeless tobacco also commands attention, spanning chewing tobacco, dissolvable tobacco, snuff, and snus, each offering unique tactile and flavor experiences.

Parallel to these product distinctions, distribution channels play a pivotal role in shaping accessibility and consumer engagement. Offline outlets range from ubiquitous convenience stores and specialty tobacco retailers to large supermarkets, hypermarkets, and dedicated tobacco stores, each presenting distinct merchandising opportunities and customer touchpoints. Meanwhile, online platforms have emerged as critical growth engines, enabling direct-to-consumer subscriptions and digital loyalty programs that bypass traditional retail constraints.

Consumer flavor preferences further stratify the market into fruit, menthol, and classic tobacco expressions, driving product innovation around novel flavor profiles that align with regional regulatory allowances. Applications, including heated tobacco products, oral nicotine pouches, and conventional combustible offerings, continue to evolve, reflecting shifting attitudes toward risk and sensory experience. Finally, nicotine content categories-ranging from nicotine-free and low-nicotine formulations to regular strength-along with demographic segments spanning ages 18 to 24, 25 to 34, 35 to 44, and 45 and above, underscore the importance of targeted communication, packaging, and pricing strategies tailored to varied consumer cohorts.

This comprehensive research report categorizes the Tobacco market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor

- Nicotine Content

- Age Group

- Processing Method

- Distribution Channel

- Application

Highlighting Critical Regional Insights Across the Americas Europe Middle East Africa and Asia Pacific to Understand Diverse Market Dynamics and Drivers

Regional dynamics exert significant influence on product adoption rates, regulatory approaches, and competitive landscapes. In the Americas, shifting public health initiatives and regional trade agreements have facilitated the introduction of alternative nicotine products, with the United States emerging as a focal point for heated tobacco and vaping innovations. Latin American markets, meanwhile, present growing interest in flavored disposable products, though regulatory scrutiny continues to intensify.

Across Europe, the Middle East, and Africa, harmonized regulatory frameworks such as the revised Tobacco Products Directive have established rigorous standards for ingredient transparency, labeling, and cross-border advertising. EU member states exhibit considerable variation in tax structures and flavor bans, prompting companies to adopt multi-tiered product strategies. In the Middle East and Africa, relatively nascent regulatory regimes offer both opportunity and risk, as market liberalization coexists with emerging public health campaigns against youth uptake.

Asia-Pacific stands out for its rapid embrace of electronic nicotine delivery, particularly in East Asia, where technological innovation thrives and consumer profiles skew younger. Flavors that resonate with local palates and premiumization trends have driven product diversification, while traditional markets in South Asia maintain strong demand for smokeless tobacco products. Regional partnerships and domestic manufacturing investments continue to evolve as companies seek to balance global standards with localized market insights.

This comprehensive research report examines key regions that drive the evolution of the Tobacco market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Key Company Strategies Competitive Positioning and Innovation Efforts Shaping the Future of the Tobacco Industry Landscape

Across the competitive landscape, leading tobacco companies have accelerated investments in research and development to advance next-generation products. Multinational conglomerates are leveraging their scale to establish cross-functional centers of excellence, driving innovation in aerosol generation, flavor encapsulation, and nicotine modulation. Strategic partnerships with technology firms have emerged to refine device ergonomics and digital integration, enabling features such as usage tracking and customized nicotine delivery.

Simultaneously, several challenger brands have capitalized on nimble go-to-market tactics, engaging niche consumer segments through direct-to-consumer models and social media channels. These emerging players often highlight artisanal production techniques or wellness-inspired formulations, challenging established reputations and compelling legacy companies to reexamine their brand personas and value propositions.

In addition, downstream stakeholders such as distributors and retailers are forging deeper alliances with manufacturers to co-develop loyalty platforms, share consumer analytics, and optimize inventory management. This collaborative approach enhances shelf visibility, accelerates product trial, and fosters data-driven decision-making. Together, these company-level initiatives underscore a collective pivot toward innovation, agility, and consumer centricity as the hallmarks of success in an evolving tobacco ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tobacco market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altria Group, Inc.

- British American Tobacco p.l.c.

- Cheyenne International LLC

- China Tobacco International Company Limited

- Eastern Company S.A.E.

- Godfrey Phillips India Limited

- Imperial Brands PLC

- ITC Limited

- Japan Tobacco Inc.

- KT&G Corporation

- Mac Baren Tobacco Company A/S

- NTC Industries Ltd.

- Pataka Group

- Philip Morris International Inc.

- PT Djarum

- PT. Gudang Garam Tbk

- Scandinavian Tobacco Group

- Smoore International Holdings Limited

- Swisher International Group

- Taiwan Tobacco and Liquor Corporation

- Tobacco Authority of Thailand

- Turning Point Brands, Inc.

- Universal Corporation

- Vietnam National Tobacco Corporation

- VST Industries Ltd.

Delivering Actionable Strategic Recommendations to Industry Leaders for Navigating Emerging Trends Regulatory Shifts and Competitive Challenges with Confidence

To navigate the confluence of regulatory complexity, shifting consumer preferences, and technological disruption, industry leaders must embrace a proactive, data-informed approach. It is essential to invest in agile innovation pipelines that balance incremental improvements to existing offerings with bold explorations into novel delivery formats and flavor experiences. By fostering cross-disciplinary collaboration between R&D, regulatory affairs, and marketing teams, organizations can expedite product approvals and align launches with consumer demand signals.

Furthermore, building robust scenario-planning capabilities will enable decision-makers to anticipate policy changes and market inflection points. Engaging early with regulatory bodies and participating in industry forums can shape outcomes and secure a first-mover advantage when new frameworks emerge. Parallel to these efforts, developing dynamic pricing and promotional models can help mitigate cost pressures stemming from tariffs, taxation, and supply-chain disruptions.

Finally, leaders should cultivate end-to-end digital ecosystems that integrate consumer insights from both offline and online channels. Leveraging advanced analytics to segment audiences by age group, flavor preference, nicotine content tolerance, and purchasing behavior will unlock targeted engagement strategies and drive brand loyalty. By combining strategic foresight with operational dexterity, companies can seize emerging opportunities and safeguard competitiveness in a landscape marked by continuous transformation.

Outlining Robust Research Methodology and Analytical Framework Ensuring Data Integrity Validity and Reliability in Tobacco Industry Study Processes

This study employs a comprehensive research methodology combining primary and secondary data sources to ensure the highest levels of validity and reliability. Primary research included in-depth interviews with senior executives from leading tobacco companies, regulatory officials, and key distributors, alongside consumer focus groups across demographic cohorts to capture nuanced preferences and perceptions. Quantitative surveys supplemented these insights, providing statistically robust data on usage patterns, flavor appeal, and price sensitivity.

Secondary research encompassed an extensive review of government publications, regulatory databases, trade association reports, and peer-reviewed journals. Where possible, proprietary data from logistics providers and supply-chain analytics platforms was integrated to assess the impact of the 2025 tariff regime on shipping costs, lead times, and vendor diversification. Rigorous cross-verification of data from multiple sources ensured consistency and minimized bias.

Analytical frameworks applied include Porter’s Five Forces for competitive intensity analysis, PESTEL for macro-environmental assessment, and conjoint analysis to model consumer trade-offs among product features. Geographic information system (GIS) mapping provided regional visualization of retail density and regulatory stringency. Throughout the research process, quality checks, peer reviews, and methodological audits were conducted to uphold the integrity of findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tobacco market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tobacco Market, by Product Type

- Tobacco Market, by Flavor

- Tobacco Market, by Nicotine Content

- Tobacco Market, by Age Group

- Tobacco Market, by Processing Method

- Tobacco Market, by Distribution Channel

- Tobacco Market, by Application

- Tobacco Market, by Region

- Tobacco Market, by Group

- Tobacco Market, by Country

- United States Tobacco Market

- China Tobacco Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Concluding Insights Reinforcing the Importance of Strategic Agility Collaboration and Innovation in Addressing Future Challenges of the Tobacco Sector

In closing, the tobacco industry’s trajectory is defined by its capacity to adapt to regulatory mandates, technological innovations, and evolving consumer sentiments. Companies that leverage data-driven insights to tailor product portfolios, optimize distribution channels, and engage consumers through personalized experiences will be best positioned to capture emerging value pools. The 2025 tariff adjustments underscore the importance of supply-chain resilience and strategic sourcing as cornerstones of operational agility.

Moreover, success will hinge on forging collaborative ecosystems that align stakeholder interests across manufacturers, regulators, distributors, and consumers. By prioritizing transparency, sustainability, and harm-reduction objectives, industry leaders can foster trust and strengthen brand equity in an environment increasingly focused on public health outcomes. As regional dynamics continue to diverge, nuanced localization strategies that respect both global standards and local sensibilities will unlock new growth avenues.

Ultimately, strategic agility, continuous innovation, and a consumer-centric mindset will serve as the guiding principles for navigating the complexities ahead. Those who embrace these imperatives will not only sustain relevance but also shape the future contours of an industry in flux.

Engage Today with Associate Director Ketan Rohom to Unlock Exclusive Tobacco Industry Insights and Empower Strategic Decisions with Our Comprehensive Report

If you’re ready to deepen your understanding of a rapidly evolving tobacco industry and equip your strategic roadmap with unparalleled insights, reach out today to Associate Director Ketan Rohom. By engaging with Ketan, you’ll gain tailored access to an in-depth report that unpacks the latest regulatory developments, consumption trends, and competitive strategies shaping the market’s future. Don’t miss the opportunity to leverage expert analysis, robust methodology, and actionable guidance in one comprehensive package. Connect now with Ketan Rohom to secure your copy of this indispensable resource and drive confident decision-making that positions your organization for success in an increasingly complex competitive environment

- How big is the Tobacco Market?

- What is the Tobacco Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?