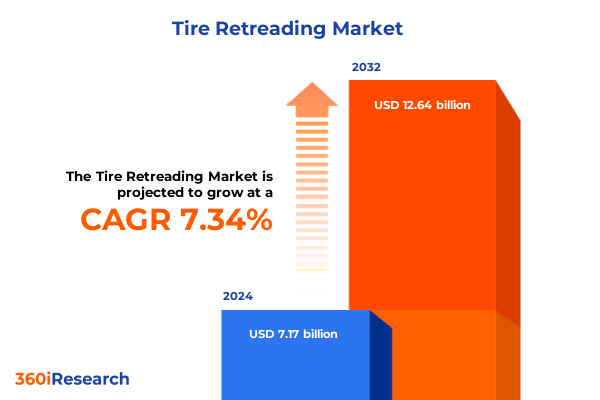

The Tire Retreading Market size was estimated at USD 7.68 billion in 2025 and expected to reach USD 8.24 billion in 2026, at a CAGR of 7.37% to reach USD 12.64 billion by 2032.

Understanding the Crucial Role of Tire Retreading in Driving Sustainability, Cost Efficiency, and Circularity Across the Automotive Industry

Tire retreading has emerged as a foundational strategy for modern fleets seeking to reconcile economic imperatives with environmental stewardship. By extending the service life of tire casings through proven processes, operators can reduce the burden of raw material consumption and mitigate waste generation. Beyond the immediate financial benefits, retreading aligns with circular economy principles by transforming spent tires into high-performing assets, thereby conserving resources and lessening dependency on virgin rubber.

As fuel prices and carbon regulations tighten, retreading provides an effective mechanism to lower total cost of ownership. It not only reduces procurement expenses by as much as 30 percent compared to new tire purchases, but it also offers predictable maintenance intervals that streamline operational planning. In addition, the carbon footprint of a retreaded tire is significantly lower than that of a comparable new tire, reflecting reductions in energy use and greenhouse gas emissions during production. These combined advantages position retreading as a critical lever for sustainability and cost management across commercial and passenger vehicle applications.

Meanwhile, evolving customer expectations and regulatory frameworks are driving broader acceptance of remanufactured vehicle components. Retreading technologies have advanced to deliver performance parity with new tires, offering reliability under a variety of road conditions. Consequently, retreaded tires are gaining traction not only in long-haul trucking and public transportation but also in private passenger fleets, where lifetime value and environmental credentials are increasingly prioritized. This convergence of economic, regulatory, and performance factors underscores the pivotal role of retreading in charting a resilient path forward for the automotive sector.

Navigating the Profound Technological, Regulatory, and Sustainability-Driven Transformations Redefining the Global Tire Retreading Landscape

Contemporary retreading operations are increasingly powered by advanced scanning and automation technologies that elevate quality control and throughput. High-resolution imaging systems can detect casing anomalies with sub-millimeter precision, reducing rejection rates and optimizing material usage. Simultaneously, automated buffing and curing platforms enable consistent tread profiles, shortening cycle times while ensuring uniform adhesion. The integration of predictive analytics further enhances operational efficiency by forecasting casing viability and scheduling maintenance proactively, thereby minimizing unplanned downtime.

At the same time, regulatory landscapes are evolving to emphasize resource conservation and emissions reduction across the tire lifecycle. In North America, the introduction of stringent labeling requirements has incentivized lower rolling resistance in retread formulations, prompting material innovators to refine compound blends. In Europe, extended producer responsibility directives are holding manufacturers accountable for end-of-life tire management, creating new opportunities for certified retreading services. These policy shifts are driving capital investments in compliant facilities and spurring collaboration along the value chain.

Moreover, sustainability commitments from major transportation and logistics firms are catalyzing demand for greener retread solutions. Companies are setting ambitious carbon reduction targets that can only be met through circular strategies, and retreading serves as a linchpin in their decarbonization journeys. This has led to pilot projects exploring reclaimed synthetic rubber and natural rubber derivatives in retread materials, as well as closed-loop initiatives that reclaim cured treads for secondary applications. Such innovations are redefining performance benchmarks while reinforcing the industry’s overarching sustainability mandate.

Assessing the Multifaceted Consequences of 2025 US Tariffs on Raw Materials, Import Flows, and Operational Competitiveness in Tire Retreading

In January 2025, the United States implemented targeted tariffs on select imported rubber compounds and fully retreaded tire casings, marking a significant policy shift designed to protect domestic producers and manage trade imbalances. As a direct consequence, key inputs such as reclaimed synthetic blends experienced immediate cost escalations, prompting many retreading facilities to reassess their supplier agreements. The sudden price surge pressured operational budgets, compelling some service providers to reprice retreading packages or seek alternative materials with softer tariff implications.

Furthermore, the new tariff regime altered traditional import flows, redirecting volumes away from established overseas partners toward tariff-exempt or lower-duty regions. This redistribution strained logistics networks and extended lead times, particularly for facilities reliant on specialized rubber formulations. In response, large fleet operators accelerated nearshoring initiatives, forging partnerships with regional suppliers to stabilize their supply chains and insulate operations from ongoing trade volatility.

Despite these headwinds, the tariffs have stimulated renewed investment in domestic material innovation. Research collaborations between compound manufacturers and retreading enterprises have intensified, leading to the development of proprietary blends that meet performance standards without incurring prohibitive duties. Consequently, while short-term cost pressures have been significant, the mid-term outlook points toward enhanced material resilience and greater self-reliance within the industry.

Uncovering Critical Market Insights Through Diverse Product, Design, Process, Material, Size, Distribution, and Application Segmentation Perspectives

A nuanced understanding of market segmentation reveals how product type, tire design, retreading process, material composition, tire dimensions, distribution methods, and end-use applications shape growth and competitive dynamics. Mold cure and pre-cure offerings drive distinct value propositions, with mold cure retreads commanding premium positions in high-mileage commercial segments due to their tailored tread profiles, while pre-cure solutions maintain appeal for rapid-turn maintenance in mixed fleets. Bias and radial designs define compatibility parameters and influence operational preferences, as bias retreads continue to serve specific off-road or heavy-duty niches, whereas radial retreads have become predominant in on-road trucking due to superior ride quality and fuel efficiency.

The choice between hot and cold retreading processes underscores differences in production throughput and energy consumption. Hot retreading maintains high bond strength at the expense of longer cycle times, whereas cold retreading offers flexibility and lower capital requirements for smaller operators. Material selection further differentiates offerings; natural rubber imparts elasticity and resilience, reclaimed rubber delivers cost advantages, and synthetic compounds enable optimized rolling resistance and thermal stability. Tire size segmentation similarly informs facility design and inventory management, where large-size retreads cater to long-haul fleets, medium-size retreads serve regional haul and bus operators, and small-size retreads address passenger and light commercial vehicle needs.

Finally, distribution channels from traditional workshops to digital platforms affect service delivery models, with online procurement simplifying order placement and offline networks ensuring hands-on inspection and customization. End-use applications split between commercial vehicle fleets-ranging from heavy to light commercial vehicles-and passenger car services, each demanding tailored warranties, performance checks, and sustainability certifications. Through this multilayered segmentation lens, industry stakeholders can pinpoint strategic opportunities and optimize portfolio mixes to meet evolving market requirements.

This comprehensive research report categorizes the Tire Retreading market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Tire Design

- Process

- Material

- Tire Size

- Distribution Channel

- Application

Analyzing Regional Dynamics Shaping Tire Retreading Growth Patterns Across the Americas Europe Middle East & Africa and Asia Pacific Markets

Regional market dynamics exhibit pronounced variations in demand drivers, operational maturity, and regulatory environments across the Americas, Europe Middle East & Africa, and Asia Pacific spheres. In the Americas, robust logistics corridors and mature fleet maintenance infrastructures underpin consistent demand for retreading services, with North American operators emphasizing fuel efficiency and carbon reduction to comply with evolving state-level emissions standards. Meanwhile, Latin American markets exhibit growth potential tied to expanding public transportation networks and government incentives supporting circular economy practices in tire management.

Across Europe, the Middle East, and Africa, regulatory frameworks such as the European Union’s End-of-Life Tires directive have institutionalized retreading as a sustainable practice, fostering high penetration rates in Western Europe. In the Middle East, rapid urbanization and logistics expansion are prompting new facility investments, often in partnership with global material suppliers. African markets, while nascent, present opportunities in municipal and mining sectors, where rugged bias retreads deliver cost-effective durability under challenging conditions.

In the Asia Pacific region, a mix of large-scale commercial players and fragmented service providers coexist. Countries like China and Japan leverage advanced retreading technologies and economies of scale, whereas Southeast Asian markets rely on low-cost cold retreading and reclaimed rubber solutions to serve price-sensitive local fleets. India’s infrastructure modernization programs are driving incremental demand, especially for radial retreads in intercity bus and regional haul segments. These divergent regional profiles underscore the importance of tailored strategies that reflect local regulatory imperatives, supply chain realities, and end-user expectations.

This comprehensive research report examines key regions that drive the evolution of the Tire Retreading market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives Innovation Portfolios and Competitive Positioning of Leading Global Tire Retreading Companies

Leading industry participants have adopted differentiated strategies to secure market leadership and capitalize on emerging growth areas. Some have invested heavily in next-generation curing equipment and proprietary rubber compounds to enhance product performance, trading premium pricing for demonstrable fuel savings and extended tread life. Others have expanded their geographic footprints through strategic mergers and joint ventures, enabling rapid access to underserved regions and diversified customer bases.

Innovation portfolios vary widely, with a subset of companies pioneering end-to-end digital platforms that integrate real-time casing diagnostics, inventory management, and predictive maintenance scheduling. These digital solutions not only streamline operations for large fleet customers but also create data-driven insights that inform material research and service enhancements. Simultaneously, several market leaders have forged alliances with transport and logistics conglomerates, embedding retreading services into total fleet management contracts and leveraging cross-selling opportunities.

Competitive positioning also hinges on sustainability credentials, as firms secure eco-certifications and participate in carbon offset programs to differentiate their offerings. By publicly reporting circularity metrics and emissions reductions, these companies strengthen relationships with environmentally conscious clients and unlock new business in corporate and municipal segments. Collectively, these strategic initiatives illustrate how top performers are aligning technological leadership, distribution scale, and sustainability credentials to chart a path ahead of evolving market expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tire Retreading market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akarmak

- Apollo Tyres Ltd.

- Best-One Tire & Service

- BLACK STAR

- Bob Sumerel Tire

- Bridgestone Corporation

- Continental AG

- Delray Tire & Retreading, INc.

- Elgi Rubber Company Limited

- Fedan Tire Co.

- Hankook & Company Co., Ltd.

- Hawkinson Company

- Insa Turbo Tyres

- Italmatic SRL

- Kal Tire

- Kit Loong Commercial Tyre Group

- KRAIBURG Holding SE & Co. KG

- Marangoni S.p.A.

- McCarthy Tire Service

- Melion Industry Co., Ltd.

- Michelin Group

- MRF Limited

- National Tyre & Wheel Ltd.

- Nokian Heavy Tyres Ltd.

- Parrish Tire Company

- Pirelli & C. S.p.A.

- Polar Rubber Products Inc.

- Pre-Q Galgo Corporation

- Purcell Tire and Service Centers

- Salvadori Srl

- Snider Fleet Solutions

- Southern Tire Mart

- TCi Tire Centers LLC

- The Goodyear Tire & Rubber Company

- TreadWright Tires

- Tyregrip Pvt. Ltd.

- Vaculug Traction Tyres Ltd.

- Vipal Rubbers

- Yokohama Rubber Co., Ltd.

Delivering Actionable Strategic Recommendations to Drive Operational Excellence Sustainability Leadership and Market Expansion in Tire Retreading

Industry leaders should prioritize the integration of advanced nondestructive evaluation systems into their production workflows to preemptively identify casing defects, thereby reducing scrap rates and improving yield consistency. By leveraging machine learning algorithms trained on historical failure data, decision-makers can refine quality control thresholds and align retread acceptance criteria with performance objectives. This approach not only safeguards brand reputation but also drives operational efficiency gains.

Another critical recommendation is to diversify raw material sourcing through regional partnerships and backward integration initiatives. Establishing co-development agreements with eco-focused rubber recyclers and synthetic compound providers will hedge against future tariff volatility and raw material scarcity. Concurrently, creating buffer inventories of low-tariff blends can insulate production from sudden policy shifts and logistical disruptions.

In parallel, organizations should cultivate collaborative relationships with vehicle OEMs and logistics operators to embed retreading services within fleet management contracts. Offering bundled maintenance packages that include performance-based warranty structures can foster long-term customer loyalty while providing stable order volumes. Furthermore, companies must continue to expand digital service offerings, enabling remote casing inspections and predictive maintenance alerts that add value for high-volume customers and differentiate their service portfolios in an increasingly competitive marketplace.

Detailing a Robust Multi-Phased Research Methodology Ensuring Comprehensive Data Validation Expert Insights and Regional Analysis Rigor

The research methodology underpinning this analysis combined rigorous primary and secondary data collection protocols to ensure comprehensive market coverage and analytical accuracy. Industry interviews with fleet managers, retreading facility operators, material innovators, and regulatory officials provided firsthand insights into operational challenges, technology adoption rates, and policy impacts. These qualitative findings were cross-validated with secondary sources, including trade association reports, technical journals, and public regulatory filings, to establish robust trend triangulation.

Quantitative data were obtained from proprietary databases tracking manufacturing capacities, import-export statistics, and energy consumption metrics across key regions. The data collection spanned a 36-month window to capture pre- and post-tariff landscapes, facilitating temporal analysis of supply chain adjustments and cost structures. Advanced econometric models were employed to assess correlations between policy interventions and retreading adoption rates, while scenario analysis tools projected the resilience of various market segments under alternative regulatory regimes.

To address regional heterogeneity, the study incorporated a layered approach, segmenting markets by infrastructure maturity, fleet demographics, and material availability. This permitted granular benchmarking of technology deployment, pricing strategies, and sustainability practices. Expert review panels validated final findings and recommendations, ensuring that the report reflects both current realities and plausible future trajectories in the tire retreading industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tire Retreading market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tire Retreading Market, by Product Type

- Tire Retreading Market, by Tire Design

- Tire Retreading Market, by Process

- Tire Retreading Market, by Material

- Tire Retreading Market, by Tire Size

- Tire Retreading Market, by Distribution Channel

- Tire Retreading Market, by Application

- Tire Retreading Market, by Region

- Tire Retreading Market, by Group

- Tire Retreading Market, by Country

- United States Tire Retreading Market

- China Tire Retreading Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Perspectives on Future-Proofing Tire Retreading Operations Through Sustainability Integration Technological Adoption and Collaboration

As the tire retreading industry navigates an era defined by sustainability imperatives, technological breakthroughs, and shifting trade policies, organizations must adopt agile strategies to remain competitive. The convergence of advanced analytics, digital service platforms, and eco-certified materials offers a pathway to enhance both operational performance and environmental stewardship. Companies that embrace these innovations will be best positioned to capture emerging opportunities and deliver differentiated value to their customers.

Moreover, the ongoing recalibration of supply chains in response to tariff adjustments underscores the need for resilient procurement frameworks. Forward-looking firms will leverage regional partnerships and vertically integrated models to mitigate cost pressures and maintain consistent production flows. At the same time, alignment with global and local regulatory directives will be essential for securing market access and enhancing corporate reputation.

Ultimately, the future of tire retreading hinges on collaborative initiatives that bridge technology providers, material scientists, fleet operators, and policymakers. By fostering knowledge exchange, investing in sustainable material research, and integrating end-to-end digital solutions, the industry can accelerate its transition toward a truly circular ecosystem. This evolution not only benefits commercial and passenger vehicle operators but also advances broader climate and resource conservation goals.

Engage with Associate Director Ketan Rohom to Acquire In-Depth Market Intelligence and Propel Strategic Decision Making in Tire Retreading

To gain unparalleled visibility into market dynamics, competitive positioning, and regional growth opportunities, reach out to Associate Director Ketan Rohom for a customized consultation and to secure your copy of the comprehensive tire retreading market research report

Elevate your strategic planning today by connecting with Ketan Rohom at the earliest convenience

- How big is the Tire Retreading Market?

- What is the Tire Retreading Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?