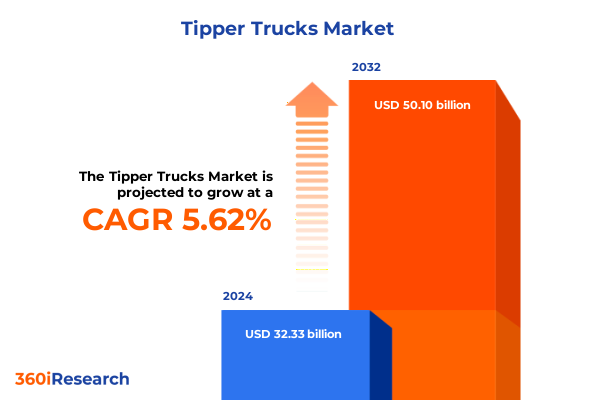

The Tipper Trucks Market size was estimated at USD 34.11 billion in 2025 and expected to reach USD 36.01 billion in 2026, at a CAGR of 5.64% to reach USD 50.10 billion by 2032.

Establishing the Foundational Context for the Tipper Truck Industry by Highlighting Key Drivers Market Dynamics and Emerging Themes Shaping Its Future

Paragraph 1: In an era defined by rapid industrial modernization and escalating demand for robust hauling solutions, the tipper truck market has emerged as a pivotal sector underpinning global infrastructure development. These specialized vehicles designed for efficient bulk material transport serve as the linchpin for sectors such as construction, mining, and agriculture. Amid shifts toward urban expansion, renewable energy installations, and resource extraction in remote geographies, stakeholders from OEMs to fleet operators are re-evaluating strategies to align with evolving performance expectations and regulatory landscapes.

Paragraph 2: As governments and private enterprises embark on ambitious projects ranging from smart city construction to large-scale mineral extraction, the role of tipper trucks in optimizing logistical workflows and reducing operational bottlenecks cannot be overstated. Heightened focus on fuel efficiency, emissions reduction, and advanced telematics integration has transformed these vehicles from basic workhorses into sophisticated mobile assets that deliver real-time data and predictive maintenance insights. Consequently, original equipment manufacturers, component suppliers, and end-users are collaborating more closely to co-develop solutions that balance payload efficiency, durability, and total cost of ownership.

Paragraph 3: This executive summary sets the foundational context by laying out the strategic imperatives, market catalysts, and critical success factors driving the tipper truck industry. It illuminates how technological innovation, regulatory dynamics, and macroeconomic trends intersect to redefine competitive positioning. By undertaking a comprehensive examination of these core themes, decision-makers can chart a clear course toward sustainable growth and long-term value creation.

Unveiling the Paradigm Shift in Tipper Truck Operations Fueled by Electrification Automation and Evolving Regulatory Frameworks Across Global Markets

Paragraph 1: The tipper truck landscape has witnessed a paradigm shift fueled by a confluence of technological breakthroughs and evolving stakeholder expectations. Electrification stands at the forefront of this transformation, with OEMs investing heavily in battery-powered drivetrains that promise zero-emission operation without compromising payload capacity. Coupled with automated driving systems that enhance safety and reduce labor costs, these advances are redefining operational models across construction sites and mining operations alike.

Paragraph 2: Beyond propulsion innovations, the integration of advanced telematics and predictive analytics has unlocked new dimensions of productivity. Real-time data streams from onboard sensors enable fleet managers to monitor vehicle health, optimize routing for fuel economy, and forecast maintenance needs before costly breakdowns occur. This convergence of connectivity and automation is fostering collaborative ecosystems where OEMs, aftermarket service providers, and technology vendors coalesce around digital platforms to deliver integrated solutions.

Paragraph 3: Simultaneously, tightening emissions regulations in key markets have accelerated the adoption of alternative fuels and powertrain diversification. Hybrid systems combining diesel engines with electric drives provide an interim pathway for regions where charging infrastructure remains nascent. As standardization efforts around zero-emission heavy-duty vehicles gain momentum, early movers in the tipper truck segment are gaining a competitive advantage by demonstrating compliance ahead of regulatory deadlines while establishing leadership in sustainable practices.

Assessing the Compounding Effects of United States Tariff Measures in 2025 on Tipper Truck Supply Chains Production Costs and Competitive Positioning

Paragraph 1: In 2025, the United States implemented targeted tariff measures affecting critical components and raw materials used in tipper truck manufacturing. Section 301 adjustments on steel and aluminum inputs, coupled with selective duties on electronic control units and battery cells, have reshaped cost structures for both domestic producers and importers. Manufacturers are contending with heightened scrutiny of supply chain resilience and seeking alternative sourcing strategies to mitigate input cost inflation.

Paragraph 2: The cumulative impact of these tariffs has manifested in extended lead times and a strategic pivot toward near-shoring assembly operations. OEMs with global footprints are reevaluating production footprints, shifting high-value assembly tasks back to domestic facilities where tariff exposure is minimized. While this reallocation supports local employment and strengthens supply chain transparency, it also demands capital investments in advanced manufacturing technologies and workforce training to maintain competitive output quality.

Paragraph 3: For end-users, the ripple effect of 2025 tariff adjustments is evident in the total cost of ownership. Fleet acquisition budgets are under pressure as the landed cost of new tipper trucks rises, prompting operators to extend vehicle life cycles through comprehensive remanufacturing and retrofitting programs. The aftermarket segment is capitalizing on this trend by offering certified upgrades and conversion kits that enhance performance without necessitating full fleet replacement, thereby preserving capital expenditure flexibility.

Deep Dive into Critical Segmentation Dimensions Revealing How Payload Capacity Propulsion Type and Application Verticals Drive Market Differentiation

Paragraph 1: When viewing the market through the lens of payload capacity, operators differentiate requirements into heavy-duty platforms designed for maximum cubic volume and load weight, medium-duty variants that balance maneuverability with respectable carrying capabilities, and light-duty units optimized for urban or semi-urban applications where regulatory constraints on vehicle dimensions and emissions are most stringent. This tiered approach influences procurement decisions, as heavy-duty truck buyers prioritize chassis reinforcement and powertrain robustness, while those seeking medium and light assets emphasize versatility and fuel efficiency.

Paragraph 2: Propulsion type represents a second axis of segmentation that draws a clear divide between diesel-powered incumbents, emerging electric alternatives, and hybrid systems that bridge the gap between fossil fuel reliance and full electrification. Diesel remains prevalent in regions with established fueling infrastructure and long-haul applications, whereas electric drivetrains are rapidly gaining traction in urban construction zones and municipalities committed to carbon neutrality. Hybrid configurations offer a transitional pathway in geographies with nascent charging networks, enabling operators to leverage regenerative braking and partial electric drive while retaining diesel range assurance.

Paragraph 3: The third dimension of analysis encompasses application verticals spanning agriculture, construction, and mining. Within agriculture, the market subdivides into crop transport vehicles tailored for bulk grain and seed handling operations, and livestock transport models designed with animal welfare and biosafety features. Construction applications split between earthmoving tipper trucks built to resurface roads and clear excavated material, and material haulage trucks configured for loading and moving aggregates, concrete, and debris. In the mining sector, surface mining tipper trucks are engineered for high-tonnage haul routes in open-pit operations, while underground models focus on compact designs, reinforced cabins, and advanced safety systems to operate effectively in tunnel networks. Each vertical presents unique performance requirements, regulatory frameworks, and service-model opportunities that manufacturers must address through specialized product portfolios.

This comprehensive research report categorizes the Tipper Trucks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payload Capacity

- Propulsion Type

- Application

Analyzing Geographic Variances Across Major Regions Highlighting How Americas Europe Middle East Africa and Asia Pacific Shape Tipper Truck Demand

Paragraph 1: In the Americas, robust construction activity across North and South America drives demand for high-capacity tipper trucks capable of enduring diverse climates and challenging terrains. Infrastructure modernization initiatives, including bridge rehabilitation, highway expansions, and renewable energy farm installations, are fueling procurement of both diesel and hybrid models. Additionally, agricultural tipping trucks for crop transport see heightened uptake in grain-producing regions of the United States and Brazil.

Paragraph 2: Europe, Middle East & Africa exhibit a multifaceted market landscape where stringent emissions mandates in the European Union accelerate electrification efforts, while Middle Eastern infrastructure mega-projects require heavy-duty diesel platforms adept at operating in extreme heat. In Africa, nascent mining operations create demand for reliable surface and underground tipper trucks, often procured through partnerships that encompass extensive aftermarket support and operator training programs.

Paragraph 3: Asia-Pacific represents the fastest-growing region, driven by robust economic expansion, urbanization, and a booming mining sector in countries like Australia and Indonesia. China’s emphasis on clean energy and green logistics propels the adoption of electric and hybrid tipper trucks in commercial construction, while India’s investments in smart city development and rural road networks drive continued orders for medium-duty and heavy-duty models. Collectively, these regions underscore how regulatory climates, infrastructure priorities, and resource endowments shape regional demand patterns.

This comprehensive research report examines key regions that drive the evolution of the Tipper Trucks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Tipper Truck Manufacturers and Technology Integrators Leading Innovations in Performance Reliability and Sustainability

Paragraph 1: Leading the charge in product innovation, several global manufacturers have introduced next-generation tipper trucks with modular chassis architectures, enabling rapid customization for specific payload and application requirements. These OEMs leverage cross-industry partnerships to integrate advanced suspension systems, lightweight composite bed structures, and telematics-driven fleet management suites that deliver measurable gains in uptime and fuel consumption.

Paragraph 2: Component suppliers specializing in powertrain electrification and autonomy are forging alliances with established truck builders to co-develop battery packs, charging infrastructure, and level-2 to level-4 driving assistance systems. These collaborations are accelerating market readiness for fully electric tipper trucks, particularly in urban and municipal segments where zero-emission mandates are already in effect. At the same time, tier-one OEMs are scaling hybrid offerings that deliver diesel-electric synergies in transitional markets.

Paragraph 3: Aftermarket service providers and technology integrators are also emerging as critical players. They offer predictive maintenance platforms that apply machine-learning algorithms to operational data, preventing unplanned downtime and optimizing inventory for spare parts. Their role in extending vehicle lifespans through certified remanufacturing and upgrade kits is helping operators navigate tariff-driven cost pressures, thereby reshaping the competitive dynamics between new-vehicle sales and aftermarket solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tipper Trucks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Ashok Leyland by Hinduja Group Ltd.

- Belaz Holding

- Bell Trucks America

- BEML Limited

- Caterpillar, Inc.

- China National Heavy Duty Truck Group Co., Ltd.

- Daimler Truck AG

- Deere & Company

- Doosan Corporation

- Faw Jiefang Automotive Co., Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Isuzu Motors Ltd.

- IVECO S.P.A.

- JAC Motors

- Komatsu Limited

- Liebherr-International Deutschland GmbH

- Mack Trucks, Inc.

- Man Truck & Bus AG

- Paccar Inc.

- Saic-iveco Hongyan Commercial Vehicle Co., Ltd.

- Sany Heavy Industry Co., Ltd.

- Scania AB

- Tata Motors Limited

- XCMG Group

- Zhengzhou Dongfeng Mid-south Enterprise Co., Ltd.

Defining Strategic Actions for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Strengthen Competitive Resilience in the Tipper Truck Domain

Paragraph 1: Industry leaders should invest in collaborative research and development initiatives that bridge the gap between legacy powertrains and emerging electric platforms. By establishing pilot programs with component innovators, manufacturers can validate hybrid and battery-electric tipper designs under real-world conditions, accelerating time to market and demonstrating compliance with intensifying emissions regulations.

Paragraph 2: To mitigate supply chain vulnerabilities exposed by tariff fluctuations, companies must diversify sourcing strategies and pursue strategic partnerships with regional assemblers and key steel and aluminum producers. Cultivating a network of qualified local suppliers reduces lead times, insulates against geopolitical disruptions, and fosters stronger community ties through domestic job creation.

Paragraph 3: Operational excellence can be enhanced by deploying integrated telematics ecosystems that centralize vehicle diagnostics, route optimization, and driver performance analytics. Companies that leverage predictive maintenance and data-driven fleet optimization will unlock significant reductions in unplanned downtime and lower total cost of ownership, thereby strengthening their market positioning against competitors reliant on conventional service models.

Paragraph 4: Finally, stakeholders should adopt flexible service models that include subscription-based maintenance, performance-based contracts, and value-added digital offerings. These innovative commercial structures can secure recurring revenue streams, drive customer loyalty, and differentiate offerings in a market increasingly defined by service quality and life-cycle cost transparency.

Detailing the Research Framework Methodologies and Analytical Approaches Employed to Ensure Comprehensive Insight and Data Integrity in the Study

Paragraph 1: This research employs a multi-tiered methodology combining primary interviews with industry veterans, OEM executives, and fleet operators, alongside comprehensive secondary research of publicly available regulatory filings, technical white papers, and specialized trade publications. Quantitative data is validated through triangulation across multiple sources, ensuring robust findings that withstand cross-comparison and reconcile discrepancies.

Paragraph 2: Market segmentation is developed by synthesizing operational parameters, such as payload capacity thresholds, propulsion architecture, and application use cases. Each segment undergoes detailed performance profiling, encompassing factors like load cycle frequency, terrain variability, and emissions compliance requirements. Regional analyses integrate local regulatory contexts, infrastructure development plans, and macroeconomic indicators to illustrate demand drivers and growth constraints.

Paragraph 3: Competitive landscape assessment combines company profiling, product benchmarking, and patent analysis to map innovation trajectories. A scenario-based analysis framework evaluates potential impacts of policy shifts, raw material price fluctuations, and technology adoption curves. Finally, sensitivity analyses quantify key cost and performance variables, providing stakeholders with clear insights into strategic levers and risk exposures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tipper Trucks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tipper Trucks Market, by Payload Capacity

- Tipper Trucks Market, by Propulsion Type

- Tipper Trucks Market, by Application

- Tipper Trucks Market, by Region

- Tipper Trucks Market, by Group

- Tipper Trucks Market, by Country

- United States Tipper Trucks Market

- China Tipper Trucks Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Drawing Conclusive Reflections on Market Trajectories and Strategic Imperatives to Map the Path Forward for Stakeholders in the Tipper Truck Eco System

Paragraph 1: Through an exhaustive examination of evolving propulsion technologies, shifting trade policies, and region-specific demand patterns, it becomes clear that the tipper truck industry is at a strategic inflection point. Zero-emission mandates and electrification roadmaps are no longer conceptual goals but immediate priorities in many developed markets, compelling OEMs and operators to adapt swiftly.

Paragraph 2: At the same time, geopolitical dynamics and tariff frameworks continue to exert influence on material sourcing and cost structures, driving organizations to innovate supply chain resiliency measures. The balance between leveraging global manufacturing efficiencies and securing localized production capabilities will define competitive advantages in the medium term.

Paragraph 3: Segment distinctions based on payload, propulsion, and application reveal diverse customer needs that cannot be addressed through one-size-fits-all solutions. Customization, modularity, and service bundling emerge as key differentiators, while data-driven maintenance and fleet management are indispensable for achieving performance targets.

Paragraph 4: In summary, success in the tipper truck market will be underpinned by an integrated approach that marries technological innovation, agile supply chain design, and customer-centric service models. Stakeholders who proactively address these strategic imperatives will not only navigate current disruptions but also capitalize on emerging growth pathways.

Engage with Ketan Rohom Associate Director Sales Marketing to Access In Depth Tipper Truck Market Research Intelligence to Propel Your Strategic Decisions

To gain an authoritative edge in navigating the evolving complexities of the global tipper truck market and secure actionable intelligence, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and in-depth knowledge of market dynamics and distribution channels ensure that your organization receives a tailored research solution aligned with strategic priorities. By collaborating with Ketan, stakeholders can unlock confidential data sets, scenario analyses, and bespoke insights that empower investment, sourcing, and operational decisions. Reach out today to discuss customizable packages, enterprise licensing options, and complimentary briefing sessions designed to accelerate your understanding of competitive drivers and emerging opportunities. Position your business for sustainable growth by partnering with a dedicated research leader who can deliver the clarity needed to outperform peers in a rapidly shifting environment and build resilient strategies that capitalize on tipping points across markets worldwide.

- How big is the Tipper Trucks Market?

- What is the Tipper Trucks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?