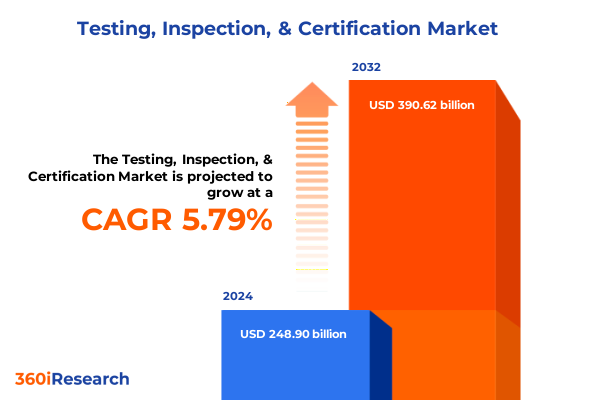

The Testing, Inspection, & Certification Market size was estimated at USD 262.82 billion in 2025 and expected to reach USD 277.69 billion in 2026, at a CAGR of 5.82% to reach USD 390.62 billion by 2032.

Navigating the Evolving Testing, Inspection, and Certification Arena with Strategic Clarity and Insight to Drive Informed Decision-Making

The testing, inspection, and certification landscape plays a pivotal role in safeguarding product quality, ensuring compliance with ever-evolving regulations, and fostering consumer trust across industries. As supply chains grow more complex and regulatory demands continue to tighten, organizations face mounting pressure to validate product safety, demonstrate environmental stewardship, and uphold corporate responsibility at every juncture. It is within this context that a deep understanding of market dynamics, disruptive forces, and strategic imperatives becomes essential for decision-makers seeking to mitigate risk and capitalize on emerging growth opportunities.

This report serves as a strategic compass, illuminating key drivers that define the modern testing, inspection, and certification ecosystem. It synthesizes in-depth analysis of regulatory shifts, technological advancements, and macroeconomic trends to equip industry leaders with a clear line of sight into notable challenges and potential inflection points. Through this executive summary, you will gain a concise yet robust overview of the transformative currents reshaping the industry, complemented by targeted recommendations designed to fortify your competitive positioning. By establishing this foundational perspective, the stage is set for a comprehensive exploration of market segmentation, regional nuances, and actionable strategies that resonate with today’s fast-paced business environment.

Unveiling the Key Drivers Redefining the Testing, Inspection, and Certification Ecosystem and Shaping Tomorrow's Compliance Standards

A confluence of technological innovation, shifting regulatory frameworks, and evolving customer expectations is fundamentally redrawing the contours of the testing, inspection, and certification ecosystem. Organizations are recalibrating their strategies to harness digital solutions such as automated testing platforms, remote inspection capabilities, and advanced analytics. These tools not only accelerate validation cycles but also enable real-time quality monitoring, predictive maintenance, and data-driven risk mitigation. As a result, service providers are investing heavily in digitization to stay ahead of the curve and meet rising demands for transparency and efficiency.

Concurrently, the industry is responding to increasingly stringent environmental, social, and governance criteria that impose new layers of compliance complexity. Regulatory bodies across major economies are rolling out updated standards, compelling enterprises to validate eco-friendly materials, reduce emissions, and demonstrate adherence to circular economy principles. This shift has elevated the imperative for integrated certification pathways that can span product lifecycles and geographic jurisdictions.

Moreover, heightened geopolitical tensions and supply-chain disruptions are prompting stakeholders to rethink sourcing strategies and operational footprints. Businesses are seeking partners who can offer end-to-end security assurances, from origin verification to final delivery. Altogether, these transformative shifts underscore the need for strategic agility, cross-functional collaboration, and a robust foundation of market intelligence to ensure sustainable growth within the modern testing, inspection, and certification landscape.

Examining How Recent U.S. Tariff Measures Have Reshaped Testing, Inspection, and Certification Operations and Cost Structures

In 2025, a series of U.S. tariff adjustments targeting critical industrial inputs and consumer goods has exerted significant influence on testing, inspection, and certification operations. As the cost of imported raw materials and finished products rose, service providers encountered margin pressures and revised pricing structures to absorb or pass through these added expenses. Companies with extensive cross-border workflows have had to reevaluate supplier relationships, negotiate alternative sourcing channels, and adapt service portfolios to mitigate the ramifications of elevated duties.

These tariff measures have also catalyzed a surge in nearshoring initiatives, with manufacturers seeking to reestablish regional value chains and reduce exposure to import levies. Consequently, demand for localized inspection and certification services has intensified, prompting providers to expand their on-shore footprints and deepen collaborative ties with regional laboratories and accreditation bodies. While this pivot fosters resilience against future trade volatility, it simultaneously elevates competition among domestic service operators.

Furthermore, the recalibration of supply chains has underscored the strategic importance of real-time data visibility and agile testing protocols. Organizations are increasingly integrating continuous monitoring systems to track compliance milestones across tariff-impacted shipments. In doing so, they secure faster customs clearances and minimize risk of non-compliance penalties. Overall, the cumulative impact of U.S. tariffs in 2025 has reshaped cost structures, driven dynamic service delivery models, and accelerated the transition toward more resilient, regionally diversified testing and certification frameworks.

Integrating Diverse Segmentation Perspectives to Surface Strategic Opportunities from Product and Sourcing to Technology, Organization, Application, and End-User

A nuanced segmentation framework reveals that the testing, inspection, and certification domain is far from monolithic, with each dimension offering unique pathways for strategic differentiation. When examining the product dimension, certification services split into personnel, product, and system streams, while inspection workflows encompass factory and product phases. Testing methodologies span from consumer goods validation to in-process, environmental, and laboratory analyses, highlighting the breadth of technical competencies providers must cultivate.

Beyond product scope, the sourcing type dimension illustrates a dynamic interplay between in-house teams and outsourced partnerships. Organizations that maintain robust internal capabilities can ensure tight control over quality protocols, yet they often face challenges scaling rapidly. Conversely, outsourced engagements afford access to specialized expertise and flexible resource allocation, serving as a critical lever for companies that must adapt swiftly to evolving market pressures.

On the technology axis, the shift from conventional TIC approaches toward automated testing platforms, digital certification portals, and remote inspection systems underscores the industry’s digital acceleration. This trend is particularly pronounced among larger enterprises with the capital to invest in advanced digital frameworks, whereas small and medium organizations frequently seek turnkey solutions to bridge capability gaps.

When considering organizational size, applications such as consumer protection, quality assurance, and regulatory compliance emerge as the primary drivers of service consumption, subtly influenced by sector-specific mandates. Meanwhile, end-user verticals ranging from aerospace and automotive through chemicals, consumer goods, energy, food and beverage, healthcare, manufacturing, and telecommunications showcase varying thresholds of technical rigor and regulatory oversight. Integrating these segmentation perspectives empowers stakeholders to craft tailored value propositions that resonate with the precise needs of each cohort.

This comprehensive research report categorizes the Testing, Inspection, & Certification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Sourcing Type

- Technology

- Application

- Organization Size

- End User Industry

Comparative Regional Dynamics Highlighting Growth Drivers, Regulatory Complexities, and Innovation Trends Across Americas, EMEA, and Asia-Pacific

Regional dynamics exert a profound influence on testing, inspection, and certification strategies, each territory characterized by distinct regulatory landscapes, maturity curves, and innovation priorities. In the Americas, stringent federal and state directives governing product safety and environmental standards have elevated demand for comprehensive compliance services. This environment has encouraged service providers to establish end-to-end offerings that combine rapid lab turnaround with robust on-site inspections, responding to a business climate that prizes agility and accountability.

Across Europe, the Middle East, and Africa, a complex tapestry of regulatory regimes and accreditation requirements has given rise to a highly specialized service ecosystem. Companies in this region must navigate harmonization initiatives spearheaded by supranational bodies, as well as localized mandates targeting everything from chemical substances to data privacy. The need for multi-jurisdictional expertise has prompted providers to forge strategic alliances and invest in cross-border digital certification platforms that ensure consistency and traceability across fragmented markets.

In the Asia-Pacific region, rapid industrialization, expanding manufacturing hubs, and evolving consumer markets have generated outsized growth in testing and inspection demand. Digital TIC adoption is gaining momentum as enterprises seek to automate routine workflows and embed quality gates into high-velocity production lines. Moreover, emerging economies are increasingly embracing international standards, creating fertile ground for service providers to introduce packaged solutions spanning certification, environmental monitoring, and regulatory compliance.

This comprehensive research report examines key regions that drive the evolution of the Testing, Inspection, & Certification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Edge and Differentiation in the Testing, Inspection, and Certification Sector

Leading organizations within the testing, inspection, and certification sphere continue to differentiate themselves through expansive global networks, diversified service portfolios, and targeted investments in digital capabilities. Major players have pursued strategic acquisitions to augment their technical expertise, while forging partnerships with technology firms to accelerate the development of automated testing platforms and remote inspection tools. This dual focus on inorganic expansion and in-house innovation underscores a broader arms race for market leadership.

At the same time, forward-thinking companies are cultivating ecosystems of specialized laboratories, niche verification centers, and collaborative research partnerships to deliver custom solutions tailored to emerging sectors like electric mobility, renewable energy, and advanced therapeutics. Their ability to embed domain specialists within broader service offerings allows for seamless end-to-end support, from initial material validation through post-market surveillance.

Furthermore, an increasing number of service providers are exploring subscription-based models, digital certification portals, and embedded software-as-a-service frameworks to foster recurring revenue streams and strengthen client retention. By transitioning from transactional test transactions toward consultative, outcome-oriented engagements, these firms are cementing long-term strategic relationships that extend beyond traditional compliance mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Testing, Inspection, & Certification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALS Limited

- APi Group, Inc.

- Applus Services SA

- ATIC (Guangzhou) Co., Ltd.

- Bureau Veritas SA

- CESI S.p.A

- Combined Selection Group Ltd.

- CSA Group Testing & Certification Inc.

- DEKRA SE

- DNV AS

- Element Materials Technology Group Limited

- Eurofins Scientific SE

- IFS Aktiebolag

- Intertek Group plc

- IQVIA Holdings Inc.

- Johnson Controls International plc

- Kiwa NV

- LabWare, Inc.

- Medistri SA

- Mistras Group, Inc.

- Riverside Company

- SGS SA

- Spinnsol

- Super.AI Inc.

- TUV Nord AG

- TÜV Rheinland AG

- TÜV SÜD AG

- UL LLC

Strategic Imperatives and Tactical Roadmaps Empowering Industry Leaders to Navigate Disruption, Optimize Processes, and Seize New TIC Opportunities

To remain at the forefront of industry transformation, executives must prioritize several high-impact initiatives. First, accelerating the adoption of digital testing platforms, automated inspection systems, and remote certification tools will be essential to achieving scalable efficiency gains and driving down turnaround times. Investing in end-to-end digital workflows not only streamlines technical processes but also provides actionable analytics for continuous improvement.

Next, organizations should diversify their service portfolios by integrating complementary offerings, such as sustainability audits, cybersecurity validation, and supply-chain risk assessments. Establishing multidisciplinary teams that can span certification, inspection, and testing disciplines will enable holistic value delivery and differentiate companies in competitive markets. Concurrently, a focus on regulatory intelligence and proactive policy tracking will ensure that service roadmaps remain aligned with evolving compliance requirements.

Partnerships with technology innovators, academic institutions, and accreditation bodies can further bolster capabilities, unlocking access to cutting-edge methodologies and specialized expertise. Finally, embedding client-centric approaches-such as subscription-based service agreements, self-service digital portals, and outcome-oriented deliverables-will foster stronger long-term relationships and create stable revenue streams, positioning industry leaders to capture emerging growth opportunities.

Robust Hybrid Research Framework Combining Qualitative and Quantitative Techniques to Deliver Rigorous, Transparent, and Actionable Market Insights

This study leverages a hybrid research framework that melds qualitative insights with robust quantitative analyses to deliver a comprehensive, evidence-based assessment. Primary research activities included in-depth interviews with senior executives, technical directors, and regulatory authorities, supplemented by structured surveys that captured firsthand perspectives on service requirements, technology adoption, and strategic priorities.

Secondary research involved the systematic review of public filings, industry publications, standards organization guidelines, and peer-reviewed literature to contextualize evolving regulations and technological trends. Data triangulation techniques were employed to cross-validate findings, while rigorous quality checks ensured consistency and accuracy across diverse information sources. Analytical tools such as scenario modeling, gap analysis, and benchmarking frameworks were applied to distill actionable insights and identify high-potential segments.

By blending stakeholder interviews, structured data collection, and methodical validation protocols, the research delivers a transparent, reproducible, and adaptable methodology. This approach underpins the credibility of the study’s conclusions and equips decision-makers with the robust intelligence needed to navigate the complexities of the modern testing, inspection, and certification industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Testing, Inspection, & Certification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Testing, Inspection, & Certification Market, by Product

- Testing, Inspection, & Certification Market, by Sourcing Type

- Testing, Inspection, & Certification Market, by Technology

- Testing, Inspection, & Certification Market, by Application

- Testing, Inspection, & Certification Market, by Organization Size

- Testing, Inspection, & Certification Market, by End User Industry

- Testing, Inspection, & Certification Market, by Region

- Testing, Inspection, & Certification Market, by Group

- Testing, Inspection, & Certification Market, by Country

- United States Testing, Inspection, & Certification Market

- China Testing, Inspection, & Certification Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings to Illuminate Strategic Pathways and Foster Sustainable Growth Trajectories in the Testing, Inspection, and Certification Domain

The testing, inspection, and certification industry stands at a pivotal juncture, shaped by digital innovation, regulatory evolution, and shifting trade dynamics. The convergence of automated testing, remote inspection, and digital certification is redefining traditional service paradigms, while new tariff regimes and regional diversification strategies are altering cost structures and competitive landscapes. Against this backdrop, a nuanced segmentation lens reveals discrete opportunities in product, sourcing, technology, organizational, application, and end-user dimensions, each demanding tailored value propositions.

Regional insights further highlight contrasting market maturity levels and compliance complexities across the Americas, EMEA, and Asia-Pacific, underscoring the importance of localized expertise and multi-jurisdictional capabilities. Leading companies are responding with integrated service models, strategic partnerships, and digital innovations that elevate customer experiences and unlock recurrent revenue pathways. This report’s actionable recommendations-from advancing digital workflows to expanding multidisciplinary service portfolios-provide a roadmap for industry leaders to not only adapt but thrive.

By synthesizing these core findings, stakeholders can chart strategic pathways that align with emerging trends, regulatory requirements, and technological breakthroughs. The insights presented herein are designed to foster sustainable growth trajectories, drive operational excellence, and secure a competitive edge in an increasingly complex and dynamic testing, inspection, and certification environment.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Testing, Inspection, and Certification Market Intelligence That Drives Strategic Growth

To access the full breadth of market intelligence and strategic insights, we invite you to engage directly with Associate Director Ketan Rohom. He will guide you through the report’s comprehensive findings and help tailor its strategic implications to your organization’s unique challenges and goals. Ketan can provide an in-depth briefing on critical trends such as digital transformation initiatives, tariff-driven operational shifts, and regional regulatory nuances, ensuring you have the context needed to make informed decisions. By partnering with Ketan, you will gain access to exclusive data breakdowns, personalized scenario analyses, and actionable roadmaps that can accelerate time-to-value and enhance competitive differentiation. Reach out today to schedule a consultation, discuss customized deliverables, or secure access to this indispensable market research report that empowers your strategic growth initiatives in the testing, inspection, and certification industry.

- How big is the Testing, Inspection, & Certification Market?

- What is the Testing, Inspection, & Certification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?