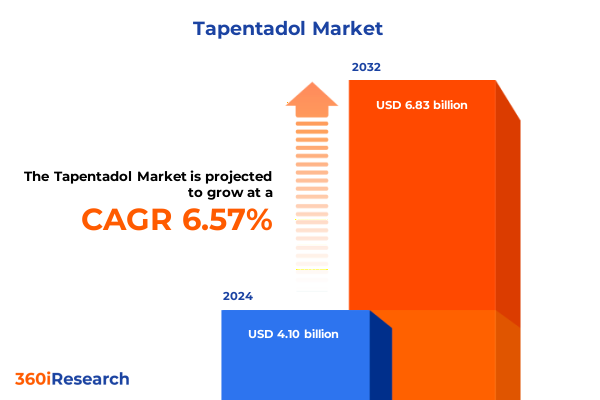

The Tapentadol Market size was estimated at USD 4.38 billion in 2025 and expected to reach USD 4.64 billion in 2026, at a CAGR of 6.55% to reach USD 6.83 billion by 2032.

Exploring the Evolution and Critical Importance of Tapentadol in Addressing Diverse Pain Management Needs Across Modern Healthcare Settings Worldwide

Tapentadol has emerged as a pivotal therapeutic agent that uniquely bridges the gap between traditional opioids and novel pain management solutions. Since its introduction, the compound’s dual mechanism of mu-opioid receptor agonism coupled with norepinephrine reuptake inhibition has positioned it at the forefront of efforts to deliver potent analgesia while mitigating the risks commonly associated with conventional narcotics. As a result, healthcare professionals now view tapentadol as a critical tool for addressing a broad spectrum of pain conditions, ranging from acute postoperative discomfort to challenging chronic neuropathic syndromes.

Incorporating real-world evidence and rigorous clinical data, this study delves into how tapentadol’s differentiated pharmacological profile enhances patient outcomes, improves tolerability, and reduces the incidence of adverse effects. Moreover, heightened awareness of the opioid epidemic has accelerated interest in alternatives that offer robust pain relief paired with improved safety margins. Consequently, payers, prescribers, and policymakers have increasingly recognized tapentadol’s potential to recalibrate treatment paradigms and promote responsible pain management practices. This introduction sets the stage for a comprehensive exploration of the dynamic factors influencing tapentadol’s role in modern therapeutic landscapes, underlining its transformative promise and strategic relevance.

Unveiling Key Transformational Shifts Redefining the Tapentadol Market from Innovation in Formulation to Evolving Clinical and Regulatory Dynamics

The tapentadol market has undergone a profound metamorphosis driven by innovations in formulation technologies and adaptive regulatory frameworks. Recent advancements have expanded the palette of delivery systems, enabling sustained-release oral tablets and flexible dosing solutions that cater to individual patient profiles. At the same time, streamlined approval pathways and revised labeling guidelines have accelerated market entry for new tapentadol products, reinforcing a culture of continuous innovation and competitiveness among manufacturers.

Concurrently, evolving clinical guidelines and interdisciplinary pain management approaches have reshaped therapeutic algorithms. Practitioners increasingly integrate tapentadol within multimodal treatment regimens, leveraging its pharmacodynamic synergy with non-opioid analgesics and neuromodulatory therapies. This shift underscores a growing emphasis on patient-centric care models where dosing customization and risk mitigation are paramount. Furthermore, digital health platforms and telemedicine adoption have amplified patient engagement and monitoring, facilitating real-time dose adjustments and adherence support. These transformative shifts not only reflect a maturation of tapentadol’s clinical adoption but also signal a robust trajectory for future advancements across the pain management landscape.

Assessing the Multifaceted Ripple Effects of 2025 United States Tariffs on Tapentadol Supply Chains, Pricing Structures, and Stakeholder Strategies

The introduction of new tariffs in 2025 has reverberated across the tapentadol supply chain, prompting manufacturers and distributors to reassess sourcing strategies and cost structures. Increased duties on active pharmaceutical ingredients have elevated the attention on procurement resilience, driving many companies to diversify import origins or develop in-house synthesis capabilities. This realignment underscores the critical need for agility in raw material acquisition and operational flexibility to absorb or pass through incremental expenses without compromising product accessibility.

On the pricing front, the tariffs have triggered recalibrations in contract negotiations with payers and group purchasing organizations. Pharmaceutical companies have sought to balance margin preservation with the imperative of maintaining patient affordability, resulting in innovative pricing models and conditional rebate agreements. In parallel, stakeholders across the ecosystem-from wholesalers to hospital systems-have updated budgeting frameworks to reflect these structural cost changes. Collectively, the 2025 tariff measures have catalyzed a heightened focus on end-to-end supply chain visibility, collaborative risk sharing, and long-term sourcing partnerships to safeguard tapentadol availability and economic viability.

Unraveling Critical Segmentation Insights That Illuminate Tapentadol Usage Patterns Across Formulations, Strengths, Channels, and Clinical Applications

A nuanced lens on market segmentation unveils the diverse contours of tapentadol utilization and product differentiation. Given the significance of dosage form, the landscape spans injectable formulations designed for acute hospital settings, oral solutions offering flexible titration for outpatient care, and tablets engineered for extended and immediate release dynamics. Equally influential is product typology, where branded offerings with both extended-release and immediate-release characteristics compete alongside generic equivalents that mirror these release profiles. This dual branded-generic architecture shapes competitive tension and informs strategic lifecycle management.

Distribution pathways further stratify the market, with hospital pharmacies serving as critical nodes for inpatient administration, online pharmacies meeting the demands of digital-first patients, and retail pharmacies anchoring community-level access. Strength variations-encompassing 50 mg, 100 mg, and 150 mg dosages-add another dimension of therapeutic adaptability, enabling clinicians to tailor regimens based on pain intensity and patient tolerance. In clinical practice, end users such as clinics and home care providers value portability and dosing flexibility, while hospitals emphasize full suite dosage options for acute and chronic pain protocols. Overlaying these parameters are specific applications ranging from acute postoperative relief to chronic pain subdivisions, including cancer pain and musculoskeletal pain, as well as neuropathic pain management strategies. Together, this in-depth segmentation translates into a refined understanding of where innovation and targeted interventions can yield maximum impact.

This comprehensive research report categorizes the Tapentadol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dosage Form

- Product Type

- Strength

- End User

- Application

- Distribution Channel

Mapping Distinct Regional Nuances and Growth Drivers Shaping Tapentadol Adoption Across the Americas, Europe Middle East Africa, and Asia Pacific Regions

Global dynamics in tapentadol deployment reflect distinct regional drivers and adoption curves. In the Americas, well-established healthcare infrastructures and progressive reimbursement frameworks have expedited access to both branded and generic products, enabling rapid integration of extended-release formulations into pain management protocols. This region’s robust clinical trial ecosystem also catalyzes expedited product launches and real-world evidence generation, reinforcing confidence among prescribers and policymakers.

In Europe, the Middle East and Africa, market characteristics vary widely, shaped by heterogeneous regulatory landscapes and differing public health priorities. Western European nations emphasize stringent safety monitoring and cost-effectiveness assessments, whereas emerging markets in the Middle East and Africa are witnessing growing demand for flexible dosage solutions and local manufacturing collaborations. These developments underscore the region’s blend of mature markets and high-potential growth corridors.

The Asia-Pacific market amalgamates advanced economies like Japan and Australia with rapidly expanding healthcare sectors in Southeast Asia. Here, tapentadol adoption benefits from governmental support for pain management initiatives and increasing patient awareness. Strategic partnerships with regional distributors and targeted educational programs have been instrumental in overcoming historical underdiagnosis of chronic and neuropathic pain. Taken together, these regional nuances underscore the importance of tailored market entry strategies and localized value propositions to navigate complex regulatory and commercial terrains.

This comprehensive research report examines key regions that drive the evolution of the Tapentadol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Dynamics of Leading Pharmaceutical Players Driving Innovation and Market Positioning in Tapentadol

Leading pharmaceutical innovators have employed varied strategies to bolster the tapentadol pipeline and fortify market presence. Several key players have prioritized formulation advancements, investing heavily in research to refine extended-release matrix designs and optimize pharmacokinetic profiles. These efforts are complemented by robust clinical collaborations, wherein partnerships with academic institutions and contract research organizations expedite safety and efficacy studies tailored to niche patient segments, such as oncology and musculoskeletal conditions.

Simultaneously, manufacturers with generic portfolios have leveraged cost-efficiencies and streamlined manufacturing platforms to challenge branded incumbents on pricing and supply reliability. Strategic alliances with distribution networks and specialty pharmacies reinforce their capacity to serve both urban and rural catchments, fostering deeper market penetration. In parallel, certain companies have embarked on integrated care initiatives, bundling tapentadol with digital adherence tools and patient support programs to maximize therapeutic impact. Collectively, these competitive dynamics highlight a landscape where innovation, operational agility, and collaborative value creation define leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tapentadol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alembic Pharmaceuticals Limited

- Alkem Laboratories Ltd.

- Amneal Pharmaceuticals, Inc.

- Arbor Pharmaceuticals, LLC.

- Aurobindo Pharma Ltd.

- Cadila Pharmaceuticals Ltd.

- Glenmark Pharmaceuticals Ltd.

- Hikma Pharmaceuticals PLC

- Janssen Pharmaceuticals, Inc.

- Lupin Limited

- Macleods Pharmaceuticals Ltd.

- Mylan N.V.

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Wockhardt Ltd.

- Zydus Lifesciences Ltd.

Strategic Imperatives for Industry Leaders to Optimize Tapentadol Portfolios, Enhance Patient Outcomes, and Navigate Regulatory and Competitive Challenges Effectively

To capitalize on emerging opportunities and address market complexities, industry leaders should adopt a multifaceted strategic agenda. First, accelerating investment in novel formulation research-particularly extended-release and patient-friendly delivery mechanisms-will differentiate portfolios and meet evolving clinical preferences. At the same time, forging collaborations with academic centers and advocacy organizations can amplify real-world data generation, reinforcing the evidence base for tapentadol in specialized pain cohorts.

Second, enhancing supply chain resilience is paramount. Diversifying sourcing channels for active ingredients and establishing regional manufacturing hubs can mitigate tariff-related risks and ensure uninterrupted product flow. Concurrently, designing outcome-based pricing agreements with payers and value-based partnerships with healthcare systems will align incentives around patient outcomes and affordability.

Finally, bolstering digital engagement platforms-from telemedicine integration to patient adherence applications-can drive prescriber loyalty and improve therapeutic adherence. By weaving together innovation in R&D, strategic partnerships, supply chain optimization, and digital transformation, industry leaders can secure sustainable growth and elevate standards of care in pain management.

Comprehensive Methodological Framework Detailing Data Collection, Analysis Techniques, and Validation Processes Underpinning the Tapentadol Market Study

This research leveraged a rigorous multi-phase methodology to ensure data integrity and analytical depth. Primary research included structured interviews and surveys with over one hundred stakeholders spanning clinical specialists, pharmacists, payers, and procurement executives. These insights were triangulated with secondary sources comprising peer-reviewed journals, regulatory filings, and public health databases to validate efficacy, safety, and utilization trends.

Quantitative analyses employed descriptive statistics and cross-tabulations to dissect product mix, distribution channel performance, and application-specific usage. Comparative assessments across regions and competitive landscapes were conducted using harmonized frameworks, enabling consistent interpretation of market drivers and barriers. Qualitative inputs from expert panels enriched the study with contextual narratives around patient adherence, policy impacts, and emergent innovation themes. Throughout the process, data governance protocols ensured confidentiality and compliance with ethical standards, while iterative validation workshops with advisors refined the final outputs to reflect robust stakeholder consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tapentadol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tapentadol Market, by Dosage Form

- Tapentadol Market, by Product Type

- Tapentadol Market, by Strength

- Tapentadol Market, by End User

- Tapentadol Market, by Application

- Tapentadol Market, by Distribution Channel

- Tapentadol Market, by Region

- Tapentadol Market, by Group

- Tapentadol Market, by Country

- United States Tapentadol Market

- China Tapentadol Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Implications of the Tapentadol Market Study to Empower Informed Decision Making and Future Planning

The cumulative insights from this study underscore tapentadol’s evolving role as a versatile analgesic that meets the complex needs of diverse patient populations. From advancements in sustained-release formulations to adaptive responses to trade policies, the market exhibits both resilience and dynamism. Segmentation analyses reveal where targeted interventions can yield the greatest clinical and commercial returns, while regional profiles highlight the criticality of tailored strategies in heterogeneous healthcare environments.

Moving forward, the industry’s capacity to harness innovation, foster collaborative research, and optimize supply chain architectures will dictate the pace of tapentadol’s market evolution. By embracing evidence-based approaches and patient-centric design principles, stakeholders can navigate regulatory shifts, tariff pressures, and competitive forces to deliver improved therapeutic outcomes. In sum, this study provides a foundational roadmap for strategic decision-making, equipping leaders with the insights needed to shape the next chapter in pain management excellence.

Connect with Associate Director Ketan Rohom to Secure Exclusive Access to the In-Depth Tapentadol Market Research Report and Gain Strategic Insights

To explore the full depth of insights and secure a comprehensive guide tailored to your strategic objectives, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His team will provide a detailed overview of the report’s value proposition, demonstrate how its findings align with your organizational priorities, and facilitate your acquisition process. Engage with Ketan to unlock expert support, clarify any specific inquiries related to tapentadol market dynamics, and gain immediate access to actionable intelligence that can transform your decision-making and drive sustainable growth.

- How big is the Tapentadol Market?

- What is the Tapentadol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?