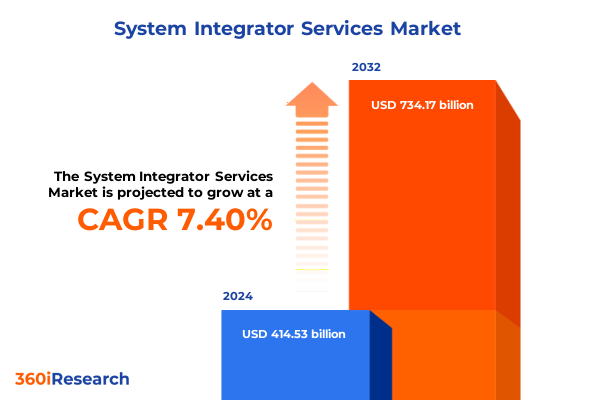

The System Integrator Services Market size was estimated at USD 444.42 billion in 2025 and expected to reach USD 476.77 billion in 2026, at a CAGR of 7.43% to reach USD 734.17 billion by 2032.

Unveiling the Strategic Imperatives and Market Dynamics Fueling Unprecedented Growth and Complexity in the System Integrator Services Ecosystem Today

In the face of accelerating digital complexity, system integrator services have emerged as foundational pillars that enable enterprises to orchestrate diverse technologies into seamless, high-performing solutions. Driven by the imperative to modernize legacy environments and harness cloud, edge, and data analytics capabilities, organizations increasingly rely on integration partners to streamline operations, enhance agility, and unlock value from their technology investments. According to industry research, global spending on digital transformation initiatives is set to reach trillions in the next few years, underscoring the critical role that system integrators play in aligning business objectives with evolving IT architectures. As digital leaders scale generative AI deployments and enterprise automation, integration specialists are called upon to bridge the gap between innovative initiatives and sustainable operational practices.

Moreover, system integrator services are key in navigating the talent landscape and addressing the talent shortage that threatens transformation timelines. Enterprises are seeking partners who can not only deliver technical proficiency but also provide strategic guidance and change management to maximize ROI. With cybersecurity risks intensifying and compliance requirements becoming more stringent, integrators are also tasked with embedding robust security frameworks throughout the integration lifecycle, ensuring that every deployed solution adheres to regulatory standards and mitigates emerging threats.

Exploring the Transformative Waves of Digital Innovation Security Imperatives and Architectural Evolution Remaking Modern System Integrator Practices

The integration landscape is undergoing a profound shift as edge computing, multi-cloud architectures, and AI-powered automation converge to redefine how services are delivered. Enterprises are moving beyond single-vendor solutions toward open, interoperable ecosystems that require integrators to orchestrate a growing maze of APIs, microservices, and data pipelines. This shift is further accelerated by rapid advances in generative AI and machine learning, which demand integration of analytics engines and model management frameworks at scale. Survey data indicates that organizations scaling AI across multiple business units experience measurable gains in efficiency and innovation velocity, yet face critical challenges in ensuring governance and interoperability at enterprise scale.

Simultaneously, hybrid integration models have become the norm as on-premises workloads coexist with cloud and edge deployments. Leading service firms are partnering with hyperscale cloud providers to deliver turnkey integration platforms that span public and private environments, enabling real-time data interchange and elastic compute. For example, a strategic collaboration announced earlier this year extends integration services for agentic AI and mainframe modernization on a leading cloud provider’s platform, empowering clients to accelerate digital core transformation and drive continuous reinvention. At the same time, large providers have moved to consolidate their position by acquiring complementary businesses that enhance AI-driven automation and business process integration capabilities, reflecting the industry’s push toward end-to-end intelligent operations.

Assessing the Far-Reaching Operational and Financial Strains Imposed by Recent United States Trade Measures on Integration Projects

Since the start of this year, enhanced trade measures have imposed higher duties on key technology imports, directly influencing integration project budgets and timelines. In early January, the U.S. Trade Representative implemented increased levies on solar wafer and polysilicon imports from certain regions and raised duties on select tungsten products, elevating costs by half of their import value for some components and by a quarter for others as part of a statutory review under trade policy aimed at protecting critical supply chains. Although some exclusions were extended through the third quarter to mitigate short-term disruptions, the broader uncertainty has already prompted equipment manufacturers to factor these additional charges into capital expenditure plans.

Industry analysts warn that semiconductor equipment makers may incur upwards of a billion dollars in additional annual costs due to these measures, a burden that often cascades down to integrator projects in the form of escalated procurement expenses and lengthened lead times. As a result, system integrators are rapidly adapting by diversifying their supplier networks, optimizing component sourcing strategies, and redesigning implementation roadmaps to absorb tariff-related fluctuations. In this context, the ability to provide agile project management and flexible contractual terms has become a critical differentiator for integrators seeking to maintain project continuity and protect client budgets against ongoing trade volatility.

Deciphering Core Deployment Service and Industry Archetypes That Define Segmentation Opportunities in Integration Services

A nuanced understanding of deployment modalities reveals distinct integration challenges and growth opportunities. Solutions delivered entirely through cloud architectures demand expertise in public and private cloud orchestration, with multi-cloud environments necessitating seamless data fluidity and unified governance frameworks. Hybrid models further introduce scenarios where cloud bursting and edge integration must coexist with on-premises data solutions, calling for integrators to balance performance, latency, and security. Conversely, purely on-premises engagements hinge on in-house data center integration or hosted private cloud implementations, requiring deep familiarity with legacy systems, virtualization platforms, and co-location services.

Service offerings similarly span a spectrum from strategic design and consulting engagements to robust managed service arrangements. Pre-implementation and process advisory services set the foundation for transformation, while custom development and comprehensive system integration ensure technical cohesion. Post-deployment, proactive managed services cover asset oversight, security operations, and systems monitoring, supplemented by preventive and corrective maintenance to maintain system resilience. Finally, integration demands vary significantly across industries: financial institutions seek stringent compliance and high-availability architectures, healthcare organizations prioritize data privacy and interoperability, while retail and manufacturing companies emphasize supply chain connectivity and real-time analytics to drive operational agility.

This comprehensive research report categorizes the System Integrator Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Integration Model

- Deployment Model

- Organization Size

- End User Industry

Understanding Regional Market Nuances and Growth Differentials Across Americas EMEA and Asia-Pacific Integration Hubs

Regional dynamics in integration services reflect diverse market maturity and investment priorities. In the Americas, established enterprises continue to modernize legacy infrastructure while pursuing cloud-native strategies, leading to sustained demand for large-scale migration and AI orchestration initiatives. Contrastingly, Europe Middle East and Africa see increasing emphasis on data sovereignty and compliance-driven integration, with integrators adapting solutions to meet evolving privacy regulations and regional data localization mandates. In Asia-Pacific, rapid digital adoption is fueled by smart manufacturing and public sector modernization efforts, pushing integrators to deliver scalable edge computing and IoT-enabled platforms to support national digital agendas.

Across all regions, local partnerships and understanding of regulatory frameworks are vital for integration success. Providers that cultivate deep in-market alliances and maintain regional delivery capabilities are best positioned to tailor offerings to each environment’s unique requirements, ensuring that integration projects align with broader economic and policy objectives.

This comprehensive research report examines key regions that drive the evolution of the System Integrator Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning and Competitive Moves of Leading System Integrators in the Global Technology Landscape

Leading integration providers are doubling down on AI and cloud-first strategies to capture emerging demand. A prominent professional services firm recently raised its revenue outlook, attributing the upward revision to growing enterprise investments in AI-powered tools and extensive cloud migration projects. During its latest quarter, the firm highlighted significant new bookings in generative AI and reported stronger-than-expected revenue performance driven by cross-industry digital transformation mandates. In parallel, that same organization deepened its strategic alliance with a major cloud provider to introduce advanced integration capabilities spanning agentic AI, networking modernization, and mainframe enablement, thereby reinforcing its position as a reinvention partner of choice.

Meanwhile, a leading European integrator solidified its AI and process services portfolio by acquiring a global business process specialist for several billion dollars. This strategic acquisition bolsters its capacity to deliver end-to-end intelligent operations, capturing synergies in digital business process management and data analytics that are expected to drive accretive revenue and margin enhancement in the coming years. Collectively, these competitive moves underscore a market where scale, strategic partnerships, and ecosystem integration are critical to maintaining leadership in a landscape defined by rapid technological convergence.

This comprehensive research report delivers an in-depth overview of the principal market players in the System Integrator Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Accenture plc

- Atos SE

- ATS Corporation

- Avanceon Limited

- Burrow Global, LLC

- Capgemini SE

- CGI Inc.

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Dell Technologies Inc.

- Deloitte Touche Tohmatsu Limited

- DXC Technology

- Fujitsu Limited

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- Honeywell International Inc.

- Infosys Limited

- International Business Machines Corporation

- MAVERICK Technologies Holdings, LLC

- Microsoft Corporation

- NEC Corporation

- NTT DATA Corporation

- Oracle Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- STADLER + SCHAAF Mess-und Regeltechnik GmbH

- Tata Consultancy Services Limited

- Wipro Limited

- Wunderlich-Malec Engineering, Inc.

- Yokogawa Electric Corporation

Formulating Actionable Roadmaps to Navigate Complexity Accelerate Innovation and Capitalize on Emerging Integration Trends

To thrive amid escalating complexity and trade uncertainty, integration leaders must embrace a dual focus on technological innovation and resilient execution frameworks. Providers should prioritize development of cross-functional teams skilled in AI governance, cloud security, and edge computing, ensuring that service delivery models can adapt to evolving client requirements. In parallel, establishing flexible contracting structures-such as outcome-based engagements and tariff-adjustment clauses-can help mitigate risk exposure and align incentives with customer success metrics.

Furthermore, integrators should deepen partnerships across hyperscale cloud platforms and emerging technology vendors to maintain access to cutting-edge solutions and early-stage innovations. By co-creating reference architectures and joint go-to-market initiatives, service firms can accelerate delivery timelines and reduce integration complexity. Finally, continuous investment in thought leadership, training programs, and regional delivery hubs will enable providers to scale effectively, uphold high-quality standards, and reinforce their role as trusted advisors through every phase of integration.

Detailing Rigorous Mixed-Method Research Approaches and Data Triangulation Techniques Underpinning Our Insights

This analysis is grounded in a comprehensive mixed-method research design combining primary interviews with senior executives at leading integrator firms, secondary review of trade publications and regulatory filings, and triangulation of quantitative data from public financial disclosures. Expert consultations provided context on evolving technology stacks and procurement strategies, while case studies of marquee integration projects offered insights into best practices for deployment model selection and governance frameworks.

Data synthesis employed cross-validation techniques to reconcile insights from diverse sources, ensuring that findings reflect both macro-level industry shifts and micro-level implementation nuances. Regional pattern analysis further incorporated geopolitical developments and regulatory changes, allowing for a holistic view of market dynamics and enabling tailored recommendations for both service providers and end-user organizations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our System Integrator Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- System Integrator Services Market, by Service Type

- System Integrator Services Market, by Integration Model

- System Integrator Services Market, by Deployment Model

- System Integrator Services Market, by Organization Size

- System Integrator Services Market, by End User Industry

- System Integrator Services Market, by Region

- System Integrator Services Market, by Group

- System Integrator Services Market, by Country

- United States System Integrator Services Market

- China System Integrator Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward for Integration Leaders

In summary, the system integrator services landscape is being reshaped by the confluence of digital transformation demands, evolving trade policies, and the strategic imperative to integrate advanced AI and edge capabilities. As deployment models grow increasingly hybrid and segmented across service types and industries, providers must align their offerings with regional priorities and regulatory constraints. Leading firms are distinguishing themselves through strategic acquisitions, deep cloud partnerships, and targeted investments in generative AI, underscoring the importance of scale, agility, and ecosystem integration. The insights presented here equip stakeholders to navigate near-term risks, capitalize on emerging opportunities, and chart a course for sustainable growth and competitive advantage in a complex and dynamic market.

Engage With Our Expert and Unlock Comprehensive Market Intelligence for System Integrator Services Excellence

If you require a detailed strategic blueprint and comprehensive data to guide critical decisions in system integration, reach out to our Associate Director of Sales and Marketing to explore tailored licensing options and secure immediate access to the full report.

By partnering with Ketan Rohom, you can ensure your organization harnesses authoritative insights and actionable analysis designed to accelerate your competitive advantage and support transformative outcomes across your most complex integration initiatives.

Contact Ketan Rohom today to discuss customized research packages and drive your integration strategy forward with confidence.

- How big is the System Integrator Services Market?

- What is the System Integrator Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?