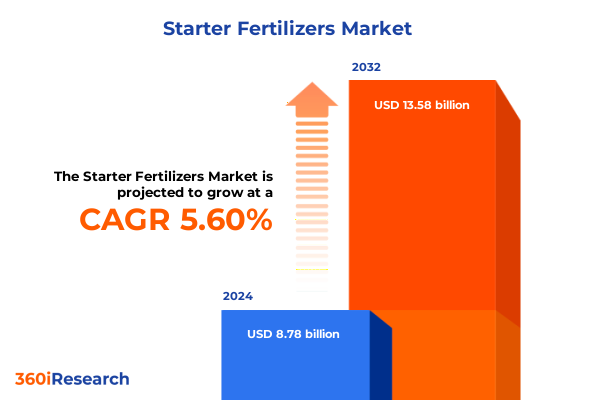

The Starter Fertilizers Market size was estimated at USD 9.20 billion in 2025 and expected to reach USD 9.65 billion in 2026, at a CAGR of 5.71% to reach USD 13.58 billion by 2032.

Unveiling the Critical Dynamics of Starter Fertilizers Shaping Sustainable Crop Nutrition Strategies Across Diverse Agricultural Environments Worldwide

Starter fertilizers represent a critical foundation for successful crop emergence and early vigor, delivering concentrated nutrients directly to the seed furrow where young plants can access them most effectively. By placing essential elements such as nitrogen, phosphorus, and potassium in proximity to emerging roots, these formulations support accelerated root development and minimize nutrient losses during initial growth stages. In diverse agricultural environments, from temperate cereal belts to tropical plantation systems, starter fertilizers play a pivotal role in maximizing yield potential, particularly where soil nutrient availability may be constrained or unevenly distributed. The integration of coated granules, solution concentrates, and other advanced formulation types reflects an industry-wide shift toward precision nutrition strategies that optimize resource use efficiency and sustainable production practices.

As growers and agribusinesses navigate evolving regulatory frameworks and mounting environmental imperatives, the demand for innovative starter fertilizer solutions has intensified. Emerging digital agronomy tools, variable-rate application technologies, and enhanced nutrients have created a dynamic landscape where early investment decisions can drive substantial agronomic and economic benefits. This introduction sets the stage for a comprehensive examination of market transformations, tariff impacts, segmentation dynamics, and regional and corporate strategies in the starter fertilizer sector. By synthesizing the latest trends and expert perspectives, this report provides essential context for stakeholders seeking to enhance productivity, manage risk, and align with the future of sustainable crop nutrition.

Exploring Key Transformations Reshaping Starter Fertilizer Adoption Distribution Networks and Technological Innovations in Agricultural Markets

The starter fertilizer landscape has undergone seismic shifts as growers embrace technological, regulatory, and logistical innovations to meet modern agronomic challenges. Until recently, traditional granular and liquid formulations dominated early growth promotion, but the advent of precision application tools and smart nutrient coatings has catalyzed new pathways for targeted nutrient delivery. Digital agronomy platforms now integrate real-time soil and weather data to enable microdosing at the seed level, optimizing nutrient placement and reducing environmental runoff. Simultaneously, partnerships between formulations specialists and equipment manufacturers have yielded novel application machinery that seamlessly incorporates starter blends into planting operations, transforming how nutrients reach the root zone.

Beyond technology, supply chain restructuring has reshaped market access for domestic and international producers alike. Regional distribution networks are adapting to shifting trade policies and heightened sustainability criteria, prompting stakeholders to diversify sourcing strategies and shorten delivery lead times. Meanwhile, evolving soil health initiatives and carbon credit schemes are encouraging the adoption of bio-enhanced starter fertilizers with microbial inoculants and polymer-based coatings. Taken together, these transformative shifts underscore an industry in rapid evolution, where agility in adopting the latest innovations and aligning with best-practice protocols will determine competitive advantage and long-term viability.

Analyzing the Comprehensive Impact of 2025 United States Tariff Measures on Starter Fertilizer Supply Chains Production Costs and Market Accessibility Dynamics

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on established supply chains for imported phosphate and potassium-based trail blends. As duties on certain fertilizer inputs rose substantially, domestic producers experienced cost implications that reverberated throughout distribution channels and ultimately influenced farm-gate pricing. In response, some stakeholders accelerated local production initiatives, while others sought alternate international partnerships in regions not subject to the new duty structure. These strategic pivots highlighted vulnerabilities in lean supply networks and underscored the importance of diversified procurement strategies.

Moreover, increased import costs catalyzed a reappraisal of value-added formulation strategies, with formulators investing in nutrient-efficient coatings and enhanced solubility technologies to offset tariff-driven price escalations. Seasonal timing of purchases shifted accordingly, as buyers adjusted procurement schedules to precede tariff implementations and mitigate financial exposure. Concurrently, government rebate programs and targeted subsidies for domestic phosphate mining helped stabilize certain market segments, albeit with increased regulatory oversight. Overall, the 2025 tariff environment reshaped production economics, prompted innovation in formulation design, and reinforced the strategic necessity of adaptable supply-chain frameworks across the starter fertilizer industry.

Revealing Fundamental Segmentation Insights for Starter Fertilizers Across Product Forms Crop Types Nutrient Categories Applications and Distribution Channels

A nuanced understanding of starter fertilizer segmentation offers critical insight into formulation preferences, application modalities, and distribution strategies. In the realm of product form, granular options such as coated and uncoated granules continue to provide robust nutrient delivery where mechanical placement systems are prevalent, whereas liquid formulations-including solution concentrates and suspension concentrates-deliver enhanced solubility and compatibility with precision spraying equipment. This duality in product form aligns closely with crop type considerations, where staple cereals and grains often favor granular blends for banded applications, while fruits and vegetables-including leafy greens, root vegetables, and solanaceous crops-derive advantage from the rapid nutrient uptake facilitated by liquid starters. Turf and ornamental segments, spanning flowering plants to turfgrass, similarly respond to formulation selection based on both aesthetic goals and nutrient release kinetics.

Further differentiation emerges through nutrient type, where balanced NPK blends cater to generalized fertility needs, while targeted formulations rich in nitrogen, phosphorus, or potassium address specific soil deficiencies or crop yield objectives. Application methods also shape product design, as foliar applications demand high solubility and low phytotoxicity, preplant applications emphasize placement uniformity, and side-dress techniques prioritize compatibility with in-field equipment. Finally, distribution channel preferences across dealers, direct sales teams, and digital platforms reveal evolving buyer behaviors, with each channel offering unique service models, technical support capabilities, and inventory management approaches. Observing how these segmentation layers intersect provides a comprehensive lens through which to assess region-specific adoption patterns and emerging growth corridors in the starter fertilizer space.

This comprehensive research report categorizes the Starter Fertilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Nutrient Type

- Product Form

- Crop Type

- Application

- Distribution Channel

Illuminating Regional Dynamics Influencing Starter Fertilizer Adoption Patterns and Growth Drivers Across Americas EMEA and Asia Pacific Environments

Regional dynamics exert profound influence on starter fertilizer adoption, as agronomic, economic, and regulatory factors vary markedly across the Americas, EMEA, and Asia-Pacific territories. In the Americas, robust cereal and grain production systems drive strong demand for granular starter blends, with growers leveraging coated granules to manage phosphorus availability in corn and soybean rotations. Latin American producers, particularly in Brazil and Argentina, have accelerated adoption of suspension concentrates to accommodate intercropping practices and evolving mechanization levels. In North America, supportive government programs and precision agriculture incentives continue to foster innovation, encouraging formulators to invest in advanced nutrient stabilizers.

Europe, the Middle East, and Africa present a mosaic of regulatory landscapes and climatic challenges. Stringent nutrient stewardship regulations in the European Union have spurred a shift toward highly efficient liquid formulations and bio-enhanced starters, whereas Middle Eastern markets prioritize phosphate-rich starters aligned with arid soil constraints. African growers, facing infrastructure limitations, often rely on direct sales and cooperative distribution models to access both granular and liquid starter options. Meanwhile, Asia-Pacific markets reflect a combination of smallholder and commercial farming dynamics. In China and India, rice and wheat systems drive a preference for balanced NPK banded starters, while cotton and canola regions explore side-dress solutions. Australia’s low-rainfall environments have accelerated trials of foliar starter applications to ameliorate moisture stress and enhance early vigor in pulse and oilseed rotations.

This comprehensive research report examines key regions that drive the evolution of the Starter Fertilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Partnerships Strategic Positioning and Competitive Strategies in the Global Starter Fertilizer Landscape

Leading companies in the starter fertilizer domain are distinguishing themselves through strategic collaborations, technological investments, and sustainability commitments. Major integrated nutrient producers are forming alliances with precision agritech providers to co-develop application systems that seamlessly integrate nutrient delivery with planting equipment. Simultaneously, specialty fertilizer innovators are leveraging proprietary polymer coatings and bio-stimulant additives to differentiate offerings and command premium positioning. Such collaborations often extend to academic and government research institutes, where pilot programs and field trials validate crop response benefits under diverse soil and climatic conditions.

In parallel, global firms are expanding capacity in key regions to mitigate trade uncertainties and align with local regulatory frameworks. Investments in phosphate processing facilities in North America and sulfuric acid plants in Europe exemplify moves to secure upstream feedstocks. On the digital front, companies are deploying agronomic decision-support platforms that combine starter fertilizer selection guidance with satellite imagery and soil sensor data. This convergence of formulation expertise, digital tools, and strategic partnerships underscores a competitive landscape in which innovation velocity and adaptability to regional dynamics define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Starter Fertilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAMA Agricultural Solutions Limited

- Agrium Inc.

- AgroLiquid

- BASF SE

- Bayer AG

- CHS Inc.

- Compass Minerals International, Inc.

- Conklin Company Inc.

- EC Grow, Inc.

- Grassland Agro

- GROWMARK, Inc.

- Helena Agri-Enterprises, LLC

- Hydrite Chemical Co.

- ICL Specialty Fertilizers

- K+S Aktiengesellschaft

- Kugler Company

- Miller Seed Company

- Nachurs Alpine Solutions

- Nufarm Ltd.

- StollerUSA

- Sumitomo Chemicals Co. Ltd.

- Syngenta Crop Protection AG

- The Scotts Company LLC

- UPL India Ltd.

- Yara UK Ltd.

Actionable Strategic Recommendations Enabling Industry Leaders to Navigate Regulatory Shifts and Technological Advances in Starter Fertilizer Applications

Industry leaders should prioritize integration of precision application technologies with next-generation starter formulations to optimize nutrient placement and minimize environmental impact. Investing in research and development of advanced coatings and biologically augmented starters can yield measurable agronomic advantages, particularly when aligned with variable-rate deployment strategies. Furthermore, cultivating strategic partnerships with equipment manufacturers, digital agronomy providers, and academic institutions will accelerate product validation, enhance market credibility, and expand technical support networks.

To navigate evolving regulatory and tariff environments, firms must diversify supply chains by developing domestic production capabilities and establishing alternative import channels. Engaging proactively with policymakers and participating in nutrient stewardship initiatives will help shape regulations that balance environmental objectives with agronomic efficacy. Finally, expanding outreach through targeted training programs and digital engagement platforms will empower growers to leverage the full potential of starter fertilizers, ultimately strengthening brand loyalty and driving sustained adoption across multiple crop systems.

Outlining Rigorous Research Methodologies Employing Primary Interviews Secondary Data Triangulation and Quantitative Analytics for Accurate Industry Insights

This research employed a rigorous methodology combining primary qualitative insights with comprehensive secondary data analysis to ensure accuracy and relevance. In-depth interviews were conducted with agronomists, distribution channel executives, and technology providers to capture firsthand perspectives on emerging formulation trends and application challenges. Concurrently, a broad spectrum of secondary sources-including academic publications, government reports, and peer-reviewed studies-was systematically reviewed to triangulate findings and validate technical assumptions.

Quantitative analytics were applied to historical application data and import-export statistics, enabling identification of significant shifts in supply chain dynamics and regional uptake patterns. Data normalization techniques ensured comparability across diverse geographies and cropping systems. The methodology prioritized transparency and replicability, with detailed documentation of data sources, interview protocols, and analytical frameworks. Expert peer review by a panel of independent crop nutrition specialists further enhanced the robustness of conclusions and the reliability of actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Starter Fertilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Starter Fertilizers Market, by Nutrient Type

- Starter Fertilizers Market, by Product Form

- Starter Fertilizers Market, by Crop Type

- Starter Fertilizers Market, by Application

- Starter Fertilizers Market, by Distribution Channel

- Starter Fertilizers Market, by Region

- Starter Fertilizers Market, by Group

- Starter Fertilizers Market, by Country

- United States Starter Fertilizers Market

- China Starter Fertilizers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Strategic Imperatives and Forward Looking Perspectives to Unlock the Potential of Starter Fertilizer Innovations in Dynamic Agricultural Ecosystems

The evolving starter fertilizer market presents practitioners with both unprecedented opportunities and complex challenges. Strategic imperatives include harnessing precision application platforms, advancing formulation technologies, and forging resilient supply chains that can withstand tariff fluctuations and regulatory shifts. A concerted focus on research and development, supported by strong partnerships across the value chain, will be essential to unlocking enhanced nutrient efficiency and sustainable production gains.

Looking ahead, the integration of digital agronomy, bio-enhanced nutrient carriers, and responsive distribution frameworks will define the next wave of innovation in crop nutrition. Stakeholders who proactively adapt their product portfolios and engagement models will be well positioned to capture growth in diverse regional markets, drive agronomic performance improvements, and foster environmental stewardship. This synthesis of insights underscores a clear pathway for optimizing the impact of starter fertilizers and shaping resilient, future-ready agricultural ecosystems.

Encouraging Direct Engagement with Ketan Rohom to Secure In-Depth Starter Fertilizer Market Research Insights and Propel Your Strategic Growth Initiatives

In today’s competitive agricultural landscape, accessing specialized insights is the difference between maintaining status quo and achieving breakthrough performance. Ketan Rohom stands ready to guide you through the intricacies of starter fertilizer trends, regulatory influences, and technological innovations shaping tomorrow’s crop nutrition strategies. Through a direct engagement, you gain customized analysis tailored to your specific operational priorities, whether that involves optimizing granular versus liquid formulations, addressing tariff-driven supply chain shifts, or refining precision application techniques.

Don’t miss the opportunity to leverage in-depth expertise that transforms complex data into clear, actionable pathways. Contact Ketan Rohom to secure your comprehensive report and position your organization at the forefront of sustainable, growth-oriented fertilizer solutions. Propel your strategic objectives forward by tapping into specialized research insights that drive confident decision making and measurable results.

- How big is the Starter Fertilizers Market?

- What is the Starter Fertilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?