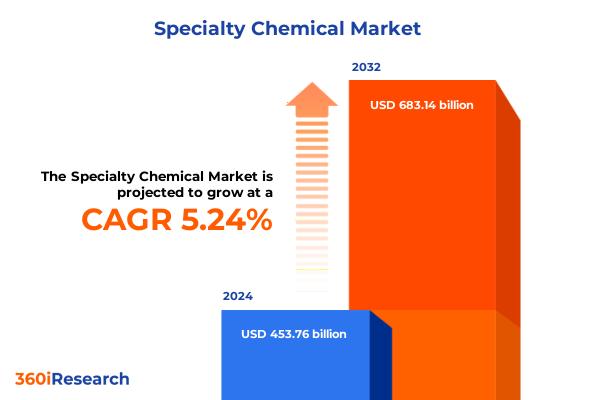

The Specialty Chemical Market size was estimated at USD 472.87 billion in 2025 and expected to reach USD 492.79 billion in 2026, at a CAGR of 5.39% to reach USD 683.14 billion by 2032.

Unlocking the Core Dynamics of the Global Specialty Chemicals Landscape to Illuminate Growth Drivers and Strategic Pathways

The specialty chemical industry stands at a pivotal juncture where innovation, sustainability, and digital transformation converge to redefine its future trajectory. As global demand for high-performance materials continues to surge across diverse end markets, the pressure intensifies on chemical manufacturers and suppliers to deliver advanced formulations that meet stringent quality, regulatory, and environmental standards. Against this dynamic backdrop, stakeholders must develop a rigorous understanding of evolving customer needs and emerging technologies to maintain a competitive edge.

In recent years, the integration of advanced process controls, data analytics, and automation has accelerated product development cycles and optimized production efficiency. Meanwhile, growing regulatory scrutiny around environmental impact and worker safety has fueled the adoption of greener chemistries and rigorous lifecycle management practices. Consequently, industry leaders are restructuring value chains and investing in strategic partnerships to unlock new growth avenues. This report lays the foundation for informed decision-making by contextualizing the market landscape, highlighting critical drivers, and introducing the transformative forces that shape the specialty chemical ecosystem.

Navigating Revolutionary Technological, Environmental, and Regulatory Transformations Reshaping Specialty Chemical Production and Application Paradigms

Breakthroughs in digitalization stand at the forefront of transformation within the specialty chemical sector, enabling manufacturers to harness predictive analytics and smart manufacturing solutions. These technologies are redefining operational resiliency, reducing downtime, and enabling rapid scale‐up of high‐value formulations. Simultaneously, escalating environmental concerns have driven the development of bio-based and biodegradable alternatives, prompting firms to explore feedstocks derived from renewable sources and invest in closed-loop production systems.

In addition to technological and sustainability shifts, tightening regulatory frameworks across major geographies impose rigorous compliance requirements, especially concerning emissions, hazardous substance management, and worker safety protocols. As regulators enforce stricter reporting and transparency mandates, companies are compelled to enhance traceability throughout the supply chain. Furthermore, the evolving dynamic between centralized R&D hubs and decentralized production models enables closer proximity to end markets, accelerating time to market for customized specialty chemicals and strengthening collaborative ecosystems.

Assessing the Far-Reaching Consequences of New Tariff Regimes on United States Specialty Chemical Supply Chains and Competitive Dynamics

The introduction of new tariff measures in 2025 has fundamentally altered the cost structure and competitive positioning of specialty chemical players operating in or exporting to the United States. By imposing higher import duties on key intermediate and finished products, these tariffs have prompted multinational corporations to reevaluate sourcing strategies, with many opting to shift production closer to end-use markets. Consequently, supply chains have become more fragmented, leading to elevated logistics costs and extended lead times for critical raw materials.

In response, domestic producers have accelerated investments in capacity expansion and downstream integration to capture value previously siphoned off by importers. However, smaller suppliers without sufficient scale are facing margin pressures and exploring strategic alliances or joint venture models to mitigate the impact. Despite these challenges, the revised trade policies have also created opportunities for localized innovation, as companies with agile R&D capabilities can leverage tariff-protected niches to introduce premium formulations and differentiated services.

Unveiling Crucial Insights Across Indispensable Market Segments in Specialty Chemicals to Guide Targeted Strategic Development Efforts

Insight into market segmentation reveals nuanced growth trajectories driven by the distinct requirements of each category. Within product typologies, adhesives demonstrate noteworthy evolution as solvent-based and water-based formulations respond to stringent VOC regulations and sustainability goals. Advanced ceramic materials continue to advance performance thresholds in electronics and aerospace applications, while cosmetic ingredients leverage bio-active molecules to meet consumer demand for clean-label offerings. Electronic segments encompass conductive polymers, PCB laminates, photoresists and ancillaries, silicon wafers, and specialty gases, each experiencing tailored growth through miniaturization and higher integration densities. Lubricating oil additives such as antioxidants, detergents, dispersants, extreme pressure agents, and viscosity index improvers remain critical for extending equipment life and reducing emissions. Plastic additives-including flame retardants or stabilizers, impact modifiers, nucleating agents, and plasticizers-drive polymer performance in construction and packaging markets. Rubber accelerators and antidegradants enhance durability in tire and industrial applications, while specialty oilfield chemicals such as demulsifiers, inhibitors, rheology modifiers, and biocides optimize extraction processes. Textile coatings, colorants, desizing and finishing agents, and surfactants enable advanced performance fabrics, and water treatment chemistries like biocides, chelating agents, coagulants, inhibitors, and scale inhibitors safeguard critical infrastructure.

Functionally, antioxidants, biocides, catalysts, demulsifiers, separation membranes, specialty coatings, enzymes, pigments, and surfactants serve as integral enablers in myriad applications. Distribution channels range from traditional offline networks to burgeoning online platforms, influencing go-to-market strategies and customer engagement. Ultimately, end-user sectors in aerospace, agriculture, automotive, construction, electronics, healthcare, oil & gas, personal care, pulp & paper, and textiles drive tailored demand patterns, with each vertical presenting unique performance and regulatory criteria.

This comprehensive research report categorizes the Specialty Chemical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Distribution Channel

- End-user

Decoding Distinct Growth Patterns and Strategic Imperatives Within Key Global Regions Shaping Specialty Chemical Market Evolution

Regional dynamics play a pivotal role in shaping the strategic priorities of specialty chemical stakeholders. In the Americas, nearshoring trends and incentives for domestic manufacturing have bolstered capacity additions in North America, while South American nations focus on leveraging abundant natural resources to support local production. Cross-border trade agreements and infrastructure investments continue to streamline logistics corridors, enabling suppliers to pivot quickly in response to shifting demand.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and ambitious decarbonization targets have galvanized investments in renewable feedstocks and recycling technologies. Countries in Western Europe drive innovation through robust public-private partnerships, whereas key markets in the Middle East tap into petrochemical integration opportunities. Meanwhile, North African nations are emerging as competitive sourcing hubs, spurred by supportive macroeconomic policies.

In Asia-Pacific, the fastest-growing region, expanding manufacturing capacities and government incentives for chemical parks have strengthened supply chains. China serves as a technological leader in specialty formulations, while Southeast Asian markets focus on export-oriented growth. Japan and South Korea continue to invest heavily in high-performance materials and advanced biotech applications, underscoring the region’s critical role in global value networks.

This comprehensive research report examines key regions that drive the evolution of the Specialty Chemical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Organizations and Innovative Collaborations Driving Accelerated Progress in Specialty Chemical Solutions and Value Creation

Leading players in the specialty chemical arena are forging ahead with strategic mergers, acquisitions, and collaborative ventures to secure key technologies and expand geographic reach. Global leaders are directing R&D investments toward next-generation catalysts and sustainable chemistries, while mid-sized innovators are carving out niches by focusing on highly specialized applications and custom service offerings. Collaborative research consortia between industry and academia are fueling breakthroughs in nanomaterials, bio-based polymers, and advanced coatings, underscoring the importance of cross-sector expertise.

Furthermore, digital partnerships with software providers are enabling advanced analytics and supply chain orchestration, allowing organizations to pre-empt disruptions and enhance margin visibility. By leveraging joint ventures in critical markets and integrating downstream service capabilities, companies are differentiating through bundled solutions that go beyond traditional product offerings. As competition intensifies, ecosystem collaboration and open innovation models are becoming essential instruments for sustaining long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Chemical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Albemarle Corporation

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Bayer AG

- Cabot Corporation

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Croda International PLC

- Evonik Industries AG

- Exxon Mobil Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- INEOS Group

- Jost Chemical Co.

- Kemira Oyj

- Lanxess AG

- Merck KGaA

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Nouryon Chemicals Holding B.V.

- Novozymes A/S

- PPG Industries, Inc.

- Saudi Basic Industries Corporation

- SMC Global

- Solvay S.A.

- SONGWON Industrial Group

- Sumitomo Chemical Co., Ltd.

- The Dow Chemical Company

- The Lubrizol Corporation

- Vibrantz Technologies Inc.

- Vinati Organics Limited

Formulating Strategic and Actionable Recommendations to Empower Industry Leaders in Capturing Emerging Opportunities Within Specialty Chemical Markets

Industry leaders should prioritize investments in sustainable feedstock research and circular economy principles to align with global decarbonization objectives and emerging regulatory mandates. Concurrently, integrating advanced digital tools such as AI-driven process optimization and predictive maintenance will enable operational excellence and rapid scale-up of high-value formulations. It is imperative to cultivate strategic alliances across the value chain, including partnerships with equipment vendors, raw material suppliers, and end-users, to accelerate co-development of differentiated solutions.

In addition, organizations must adopt agile supply chain strategies, including flexible manufacturing footprints and dynamic inventory models, to mitigate tariff uncertainties and geopolitical risks. Expanding presence in high-growth Asia-Pacific markets through localized R&D centers and joint ventures can unlock new applications and customer segments. Lastly, fostering continuous talent development in advanced analytics, regulatory affairs, and green chemistry will ensure that the workforce is equipped to drive innovation and maintain compliance in an evolving global landscape.

Elucidating Rigorous Research Framework and Methodological Approaches Underpinning Robust Specialty Chemical Market Analysis and Insights

This research employed a multifaceted approach, combining extensive secondary research with primary interviews to validate critical insights. Secondary sources included industry journals, regulatory publications, and patent databases to map technology trends and competitive landscapes. Primary data were gathered through structured interviews with executives across global specialty chemical manufacturers, distributors, and end-user segments, ensuring a balanced perspective on market drivers and challenges.

Quantitative analysis involved triangulating data from multiple proprietary and public databases, enabling accurate mapping of production capacities, feedstock flows, and technology adoption rates. Expert panels provided qualitative context on emerging application areas and regulatory impacts. Rigorous data validation protocols were applied, including cross-referencing multiple independent sources and running scenario analyses to test sensitivity to tariff changes and regulatory shifts. This methodology ensures a robust, actionable framework that stakeholders can rely on for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Chemical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Chemical Market, by Type

- Specialty Chemical Market, by Function

- Specialty Chemical Market, by Distribution Channel

- Specialty Chemical Market, by End-user

- Specialty Chemical Market, by Region

- Specialty Chemical Market, by Group

- Specialty Chemical Market, by Country

- United States Specialty Chemical Market

- China Specialty Chemical Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Comprehensive Takeaways to Illuminate Strategic Pathways and Future Outlooks for Specialty Chemical Industry Stakeholders

The specialty chemical industry is poised for sustained transformation driven by technological innovation, sustainability mandates, and evolving trade policies. As market participants navigate the complex interplay of regulatory requirements, digital adoption, and tariff landscapes, agility and strategic foresight will differentiate successful organizations. Firms that proactively align R&D initiatives with emerging application areas and invest in circular economy solutions will capture higher margins and strengthen market positioning.

Moreover, the ability to leverage advanced analytics for supply chain resilience and to forge collaborative ecosystems will be critical to sustaining long-term growth. Regional variations in regulatory priorities and manufacturing capabilities underscore the need for tailored market entry and expansion strategies. Ultimately, those who integrate these insights into their strategic planning processes will be best positioned to thrive in a rapidly evolving specialty chemical landscape.

Discover How Your Organization Can Leverage In-Depth Market Intelligence to Drive Competitive Advantage by Engaging with Associate Director Ketan Rohom

To gain full access to the detailed market research findings and in-depth strategic analysis, please connect with Associate Director Ketan Rohom. His expert guidance will help you navigate critical insights, tailor investment decisions, and accelerate your organization’s growth within the specialty chemical sector. Reach out today to schedule a personalized discussion and explore custom research solutions designed to support your unique objectives and drive competitive advantage.

- How big is the Specialty Chemical Market?

- What is the Specialty Chemical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?