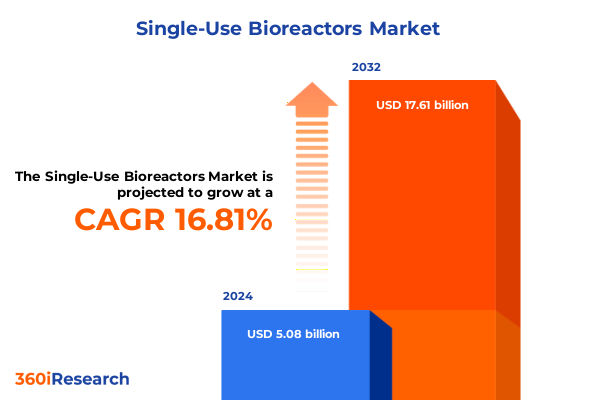

The Single-Use Bioreactors Market size was estimated at USD 5.88 billion in 2025 and expected to reach USD 6.83 billion in 2026, at a CAGR of 16.94% to reach USD 17.61 billion by 2032.

Harnessing Single-Use Bioreactors to Drive Innovation and Efficiency in Modern Bioprocessing Environments with Unprecedented Adaptability

The advent of single-use bioreactors has transformed the foundational underpinnings of biomanufacturing by offering a level of operational flexibility and contamination control previously unattainable with traditional stainless-steel systems. As organizations across the biopharmaceutical spectrum strive for faster development timelines and more agile production capabilities, single-use platforms emerge as critical enablers of modular facility design and rapid changeover between campaigns. This shift in manufacturing paradigm directly addresses the increasing demand for small-batch production and personalized therapies, allowing process engineers to scale operations up or down without extensive cleaning procedures or cross-contamination concerns.

In parallel, the increasing complexity of biologic modalities-including cell and gene therapies, monoclonal antibodies, and next-generation vaccines-has intensified pressure on the supply chain to deliver high-purity products at accelerated paces. Single-use bioreactors support these requirements by reducing capital expenditure and facilitating faster facility qualification, enabling organizations to respond rapidly to new therapeutic targets or unexpected surges in demand. Moreover, the disposability of key components streamlines validation processes, simplifying regulatory submissions and ensuring consistent batch quality.

Transitioning toward these disposable systems also reinforces resilience across global supply networks. By minimizing the need for water-intensive sterilization and reducing turnaround times, single-use bioreactors contribute to sustainability goals while bolstering manufacturing agility. Consequently, industry leaders are redefining operational best practices to integrate single-use platforms, laying the groundwork for new standards in bioprocessing excellence.

Transformative Shifts in Bioprocessing Landscape Driven by Automation, Single-Use Adoption, and Regulatory Evolution Fueling Next-Gen Production

Automation and digitalization constitute the first wave of transformative shifts reshaping the bioprocessing landscape, as advanced control systems and real-time process analytics become integral to single-use operations. Modern platforms increasingly incorporate sensors for pH, dissolved oxygen, and metabolite monitoring, feeding data into digital twins that simulate process performance under varying conditions. This integration enhances process robustness and reduces batch variability, ultimately accelerating technology transfer from development labs to commercial-scale manufacturing.

Furthermore, the rise of continuous manufacturing in biopharma has been closely tied to the capabilities of single-use bioreactors. By facilitating seamless integration of perfusion processes and inline downstream modules, these platforms support sustained culture runs and improved volumetric productivity. In this context, modular facility designs leverage single-use skid assemblies to accommodate continuous workflows, minimizing footprints and enabling rapid deployment of production suites tailored to specific molecule requirements.

Meanwhile, sustainability has emerged as a core consideration driving system innovation. Manufacturers are developing recyclable or bio-based polymer components and partnering with waste management specialists to create circular disposal pathways for single-use assemblies. This ecological emphasis dovetails with regulatory evolution, as agencies worldwide refine guidelines to address quality-by-design principles, supply chain transparency, and environmental impact. The COVID-19 pandemic further catalyzed adoption, demonstrating the strategic value of single-use bioreactors in supporting emergency vaccine production and rapidly scaling critical biologics.

Assessing the Cumulative Effects of 2025 U.S. Tariff Measures on Single-Use Bioreactor Supply Chains and Biomanufacturing Economics

The introduction of new U.S. tariff measures in 2025 targeting imported single-use bioreactor components has produced multifaceted effects across supply chains and procurement strategies. As duties increase on critical disposables such as membrane filtration units, media bags, and temp-controlled sensor modules, end users and contract manufacturers face elevated input costs that reverberate through pricing negotiations and capital allocation decisions. In response, procurement teams are reevaluating vendor agreements and seeking alternative sourcing locations to mitigate duty burdens while maintaining system quality and reliability.

Concurrently, many organizations have pivoted toward regional diversification strategies to enhance supply chain resilience against tariff volatility. This has prompted the establishment of production and assembly facilities closer to end markets, enabling faster turnaround times and reduced import exposure. By partnering with local suppliers and exploring in-region manufacturing hubs, stakeholders offset duty increases and strengthen collaborative innovation pipelines, particularly in North America and nearshore economies.

These shifts have also influenced the dynamics within contract development and manufacturing organizations (CDMOs), which are adapting their service portfolios to accommodate tariff-induced cost pressures. Through long-term supply agreements, joint investments in component standardization, and strategic inventory planning, CDMOs and biopharma sponsors align to sustain project timelines while safeguarding margin integrity. Moving forward, maintaining agility in procurement and fostering cross-functional dialogue remain critical to navigating the evolving trade landscape.

Delving into Diverse Segmentation Dimensions to Uncover Nuanced Insights Across Bioreactor Types, Cell Lines, and Application Scales

Exploring segmentation by bioreactor type reveals distinct adoption pathways: Bubble-column systems retain a niche in academic and research settings due to their simplified design and cost-effective footprint, enabling rapid iteration in early-stage process development. Stirred-tank platforms continue to dominate pilot and production scales, offering robust mixing and gas transfer characteristics essential for monoclonal antibody and vaccine manufacturing. In contrast, wave-induced bioreactors have captured interest in cell therapy development, where gentle rocking motions support shear-sensitive culture formats and facilitate process intensification in compact systems.

When considering product types, the interplay between filtration assemblies, media bags, and complete single-use bioreactor systems underscores modularity as a competitive advantage. Filtration units designed for Quick Change assembly and low hold-up volumes streamline downstream integration, while high-performance media bags ensure consistency in nutrient delivery and process pH control. End-to-end single-use systems integrate these elements into unified platforms, accelerating time to deployment and reducing the number of validation steps for quality assurance teams.

Differentiating by cell type highlights the varied biochemical and mechanical demands of bacterial cultures versus mammalian cell lines and yeast strains. Bacterial systems leverage high-density fermentation protocols within disposable reactors to drive enzyme and recombinant protein yields, whereas mammalian platforms necessitate precise control of shear stress and oxygen transfer to protect cell viability. Yeast-based production occupies a strategic niche in specialty applications, where rapid growth kinetics can be harnessed for vaccine antigen and small-molecule precursor synthesis.

Capacity scale segmentation from laboratory bench tops to pilot-scale skids and full-scale production suites informs technology selection based on throughput requirements and process validation cycles. Laboratory-scale models prioritize ease of use and flexibility for early process characterization, while pilot-scale bioreactors focus on replicating the hydrodynamics and mass-transfer characteristics of commercial lines. Production-scale single-use systems marry these insights with reinforced structural design and enhanced clean-in-place compatibility to support sustained, high-volume manufacturing runs.

Analyzing segments based on molecule type-from gene-modified cell therapies to monoclonal antibodies, stem cell derivatives, and vaccine antigens-reveals tailored performance criteria. Gene-modified cell manufacturing demands stringent contamination control and cold-chain readiness, whereas monoclonal antibody production benefits from integrated perfusion workflows. Stem cell platforms emphasize gentle handling and cryopreservation compatibility, and vaccine development prioritizes rapid campaign changeover and high volumetric yields.

Application-focused segmentation distinguishes between bioproduction and research & development needs, each driving unique feature sets. R&D workflows require seamless scaling from bench to pilot operations, whereas bioproduction environments emphasize closed systems and regulatory compliance to support cGMP requirements. End-user segmentation further refines adoption insights: academic and research institutes favor flexible, cost-effective layouts, contract research and manufacturing organizations prioritize standardized operations for client reproducibility, and pharmaceutical and biopharmaceutical companies target turnkey solutions that align with global quality standards.

This comprehensive research report categorizes the Single-Use Bioreactors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bioreactors Type

- Product Type

- Cell Type

- Capacity Scale

- Molecule Type

- Application

- End-User

Exploring Regional Dynamics Shaping Single-Use Bioreactor Adoption Patterns from the Americas through EMEA to Asia-Pacific Markets

In the Americas, robust biotech clusters and established contract manufacturing networks underpin widespread uptake of single-use bioreactors. Leading pharmaceutical hubs in North America benefit from deep expertise in system integration, regulatory support, and a mature supply chain that fosters iterative process improvements. Latin American markets show growing interest in localized manufacturing solutions, driven by initiatives to bolster vaccine self-sufficiency and enhance regional research capacity.

Within Europe, Middle East, and Africa, regulatory harmonization initiatives such as ICH guidelines and region-specific quality frameworks are shaping single-use adoption patterns. Western European nations leverage strong academic–industry collaborations to pilot innovative reactor designs, while emerging biopharma markets in Eastern Europe and the Gulf region invest in modular facilities to address supply needs with flexible manufacturing technologies. These dynamics collectively elevate EMEA as a center of excellence that balances compliance and innovation.

The Asia-Pacific region exhibits the fastest growth trajectory for single-use bioreactors, propelled by government-led biotechnology initiatives and substantial capital infusion into domestic manufacturing infrastructure. China and India lead in scaling vaccine and biosimilar production, prompting suppliers to localize component fabrication and technical support services. Additionally, emerging markets such as South Korea, Japan, and Australia drive research-intensive applications, establishing themselves as key nodes for cell therapy development and advanced biologics experimentation.

This comprehensive research report examines key regions that drive the evolution of the Single-Use Bioreactors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Driving Advancements in Single-Use Bioreactor Technology and Commercialization

Leading equipment manufacturers are continuously enhancing single-use portfolios through strategic research investments and collaborative partnerships. Industry frontrunners have integrated digital control units and advanced sensor arrays into their platforms, enabling seamless data capture and predictive maintenance capabilities. At the same time, these companies are forging alliances with software developers to deliver end-to-end analytics solutions that optimize process performance and ensure compliance with evolving regulatory standards.

Emerging technology providers are also making significant inroads by focusing on specialized applications such as cell-and-gene therapy bioprocessing, closed-system aseptic sampling, and automated cleaning workflows. These companies often collaborate with academic centers and contract manufacturing organizations to validate novel designs, positioning themselves as agile partners capable of co-developing tailored bioreactor modules for niche markets.

Strategic mergers and acquisitions continue to reshape competitive dynamics, as larger corporations seek to augment their disposables portfolios with niche innovations. Concurrently, supply chain integration efforts aim to reduce lead times and enhance local support networks, while service-oriented business models evolve to include preventative maintenance contracts and on-demand training programs. Together, these initiatives underscore a collective drive toward more resilient and customer-centric approaches in single-use bioreactor commercialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single-Use Bioreactors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABEC, Inc.

- Broadley-James Corporation

- Cellexus Ltd.

- DH Life Sciences, LLC.

- Distek, Inc.

- Entegris, Inc.

- Eppendorf AG

- Esco Micro Pte. Ltd.

- Getinge AB

- Infors AG

- Meissner Corporation.

- Merck KGaA

- PBS Biotech, Inc.

- Pierre Guerin SAS

- Rentschler Biopharma SE

- Sartorius AG

- Sepragen Corporation

- Solaris Biotechnology Srl

- Solida Biotech GmbH

- Thermo Fisher Scientific Inc.

- VWR International, LLC.

Implementing Strategic Frameworks for Maximizing Operational Flexibility, Cost Efficiency, and Regulatory Compliance in Single-Use Bioreactor Deployment

Industry leaders should pursue advanced digital integration by embedding real-time analytics and automated feedback loops within single-use bioreactor platforms to elevate process consistency and reduce manual intervention. Establishing a unified data architecture can facilitate cross-site comparability, enabling rapid troubleshooting and continuous improvement without compromising production timelines.

Diversifying the supplier base is essential to mitigate risks associated with trade policy shifts and component shortages. Organizations are advised to cultivate long-term partnerships with multiple vendors across different regions, structuring supply agreements that incentivize flexibility in lead times and volume commitments. This approach ensures continuity of operations even when geopolitical landscapes evolve unpredictably.

Sustainability initiatives should be elevated from peripheral programs to central strategic objectives. By collaborating with materials engineers and waste management experts, companies can develop circular disposal models, explore recyclable polymer blends, and implement energy-efficient process sequences. These efforts not only align with environmental stewardship goals but also bolster stakeholder confidence in corporate social responsibility commitments.

Proactive engagement with regulatory bodies and standardization consortia is vital for shaping industry guidelines that reflect the unique attributes of disposable systems. Contributing to working groups and pilot programs allows organizations to help define best practices for validation, traceability, and quality assurance, thereby smoothing the approval pathway for novel single-use technologies.

Finally, investing in workforce development ensures that technical teams possess the competencies required to manage increasingly automated and data-driven operations. Structured training programs, cross-functional project rotations, and partnerships with academic institutions can cultivate the next generation of bioprocess engineers equipped to drive innovation in single-use bioreactor environments.

Outlining Robust Research Methodologies Integrating Qualitative and Quantitative Approaches for Comprehensive Single-Use Bioreactor Market Analysis

The research framework integrates a blend of qualitative and quantitative methodologies to capture a holistic view of the single-use bioreactor ecosystem. Initial phases involve a comprehensive literature review of peer-reviewed journals, patent filings, and technical white papers to map technological evolutions and identify emerging performance benchmarks. This groundwork informs the development of targeted interview guides and survey instruments.

Primary research activities include in-depth interviews with bioprocess engineers, quality assurance managers, and procurement specialists from leading biopharmaceutical companies and contract organizations. These discussions yield nuanced perspectives on system performance, integration challenges, and process optimization strategies. Simultaneously, an online survey gathers quantitative data on adoption drivers, technology preferences, and perceived barriers, ensuring a statistically robust complement to qualitative insights.

Secondary research extends to regulatory databases, standards publications, and corporate disclosures, providing clarity on compliance frameworks, capital investment trends, and strategic alliances. Data is triangulated across multiple sources to validate findings and uncover discrepancies. Analytical techniques such as cross-tabulation and thematic coding distill complex information into actionable intelligence.

To ensure accuracy and relevance, key findings undergo peer validation through a panel of industry experts. This iterative review process refines the research narrative and confirms the robustness of conclusions, establishing the report as a dependable resource for strategic planning and technology evaluation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single-Use Bioreactors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single-Use Bioreactors Market, by Bioreactors Type

- Single-Use Bioreactors Market, by Product Type

- Single-Use Bioreactors Market, by Cell Type

- Single-Use Bioreactors Market, by Capacity Scale

- Single-Use Bioreactors Market, by Molecule Type

- Single-Use Bioreactors Market, by Application

- Single-Use Bioreactors Market, by End-User

- Single-Use Bioreactors Market, by Region

- Single-Use Bioreactors Market, by Group

- Single-Use Bioreactors Market, by Country

- United States Single-Use Bioreactors Market

- China Single-Use Bioreactors Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Illuminate Future Trajectories and Strategic Imperatives in Single-Use Bioreactor Technologies and Applications

The synthesis of this report underscores the profound impact of single-use bioreactor technologies in shaping the future of biomanufacturing. From transformative technological integrations such as real-time process analytics and modular continuous operations to strategic supply chain realignments driven by tariff considerations, the landscape is defined by agility, innovation, and sustainability. Segmentation and regional analyses highlight the tailored requirements of diverse user groups, molecule modalities, and geographic markets, illuminating pathways for targeted growth and strategic differentiation.

Moving forward, the interplay between digitalization and environmental stewardship will serve as a primary driver of next-generation bioprocessing solutions. Artificial intelligence–enabled control systems and circular economy initiatives promise to extend the value proposition of single-use platforms beyond cost and convenience, positioning them as linchpins in robust, future-ready manufacturing networks. In parallel, collaborative efforts with regulatory bodies and standardization committees will pave the way for smoother technology adoption and quality assurance across global operations.

By embracing the actionable recommendations presented herein-ranging from supplier diversification and sustainability roadmaps to comprehensive workforce development-industry leaders can navigate evolving market dynamics with confidence. Ultimately, the convergence of technological prowess, strategic partnerships, and regulatory alignment holds the key to unlocking the full potential of single-use bioreactor technologies in delivering life-changing therapeutics.

Connect with Ketan Rohom to Unlock Comprehensive Single-Use Bioreactor Market Intelligence and Accelerate Your Strategic Decision-Making Process

Engaging deeply with detailed insights and industry-proven strategies can redefine how organizations leverage single-use bioreactor technologies for maximum operational impact. To explore the nuanced findings of this market analysis and translate them into actionable roadmaps, connect directly with Ketan Rohom, Associate Director, Sales & Marketing, whose expertise can guide your team toward informed decision-making and competitive differentiation.

- How big is the Single-Use Bioreactors Market?

- What is the Single-Use Bioreactors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?