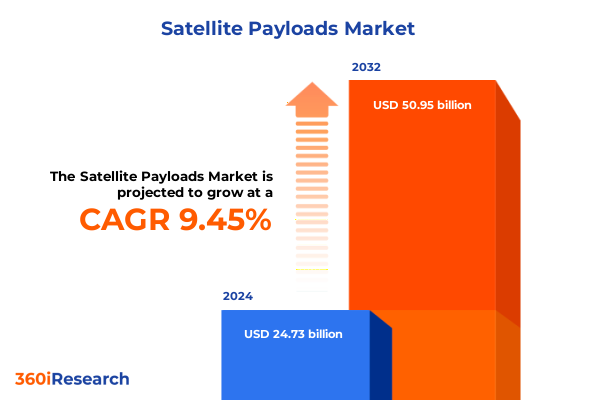

The Satellite Payloads Market size was estimated at USD 27.02 billion in 2025 and expected to reach USD 29.30 billion in 2026, at a CAGR of 9.48% to reach USD 50.95 billion by 2032.

Setting the Stage for Satellite Payload Evolution: Introduction to the Current State and Emerging Opportunities in Spaceborne Instruments

Satellite payloads serve as the mission-critical heart of every spacecraft, enabling a spectrum of capabilities ranging from high-throughput communications to advanced environmental monitoring. Communication payloads form the backbone of global connectivity, facilitating broadcast, fixed, and mobile services that underpin modern telecommunications infrastructure. Concurrently, earth observation instruments harness hyperspectral imaging, optical sensors, and synthetic aperture radar to deliver actionable intelligence for agriculture, resource management, and disaster response; in fact, the global Earth Observation market is on track to exceed $8 billion in valuation by 2033, driven by defense contracts and high-resolution imaging innovations. Navigation payloads provide the precision timing and positioning that empower aviation, logistics, and autonomous systems, while scientific and weather monitoring payloads support research missions, climate modeling, and meteorological forecasting.

Moreover, the industry’s evolution reflects an accelerating democratization of space capabilities. Large satellites continue to offer unsurpassed stability and power budgets for deep-space and high-throughput missions, but the proliferation of small, medium, and microsatellites has diversified deployment models and lowered barriers to entry. This broadening participation spans commercial enterprises, defense integrators, and academic institutions, each pursuing payload architectures tailored to unique mission profiles. Consequently, stakeholders now navigate a heterogeneous ecosystem marked by multifaceted partnerships, dynamic procurement processes, and an expanding array of mission-driven service platforms.

As the sector advances through 2025, payload developers and end users confront both profound opportunity and complex challenges. Technological breakthroughs in digital payload versatility, manufacturing automation, and resilient supply chains promise to refine performance while compressing schedules and costs. Yet geopolitical frictions, evolving trade regulations, and the imperative for sustainability demand strategic foresight and adaptive execution. Against this backdrop, a nuanced understanding of payload typologies, emerging architectures, and market enablers becomes indispensable for decision-makers seeking to capitalize on the next frontier of spaceborne innovation.

Navigating the Era of Disruption: Transformative Technological and Operational Shifts Reshaping the Satellite Payload Landscape

Satellite payload development stands at a watershed moment defined by accelerating innovation cycles and shifting operational paradigms. Rapid miniaturization has fostered the advent of micro- and nanosatellites, enabling constellations that deliver unprecedented revisit rates and global coverage, particularly in Earth observation and low-latency communication services. Simultaneously, advances in software-defined radios and flexible digital processing have unlocked in-orbit reconfiguration, allowing operators to adjust bandwidth, beam patterns, and mission parameters post-launch. This shift from static, hardware-centric payloads to dynamic, software-driven architectures marks a fundamental transformation in design philosophy.

Furthermore, the emergence of in-orbit servicing and assembly is poised to redefine lifecycle management. Robotic refueling, component replacement, and modular integration concepts are maturing through demonstration missions, offering the potential to extend satellite longevity and reduce the total cost of ownership. Progressive payload designs are now incorporating standardized interfaces and built-in test capabilities to support these new service models, reflecting a broader industry shift toward sustainability and circularity.

In parallel, the integration of artificial intelligence and machine learning within payload data processing chains has begun to accelerate autonomous payload operations. On-board analytics reduce the volume of downlinked data by performing real-time feature extraction and anomaly detection, thereby optimizing bandwidth utilization and enabling rapid decision support. This intelligence-at-the-edge capability fosters more responsive disaster monitoring, enhanced security surveillance, and adaptive communication networks.

Consequently, industry participants are recalibrating R&D investments and strategic roadmaps to align with these transformative trends. Ecosystem collaboration among satellite operators, payload integrators, launch service providers, and data analytics firms has become increasingly critical. By embracing modularity, digitalization, and in-orbit flexibility, the sector is entering a new era of mission agility and operational resilience that will define payload development over the coming decade.

Assessing the Ripple Effects of Tariff Policies on Satellite Component Supply Chains and Program Viability in the United States 2025

The imposition of tariffs on critical satellite components has introduced tangible pressures across the payload supply chain, influencing procurement strategies and program economics. Tariffs applied to raw materials, avionics subsystems, and structural metals have generated cost increases throughout the manufacturing lifecycle, from initial component sourcing to final integration and testing. For projects in early development phases, these tariffs can elevate overall system expenditures by notable margins, prompting engineering and procurement teams to revisit supplier networks and material selections.

Moreover, the accumulation of duties becomes particularly acute when subsystems traverse multiple borders during fabrication and assembly. Components designed in the United States but manufactured overseas may incur cumulative import taxes, raising concerns over the cost efficiency of globalized production models. Consequently, some payload providers are exploring alternative supply chains in regions with more favorable trade relationships, while others consider reshoring certain manufacturing steps to mitigate exposure.

This evolving trade landscape has also introduced financial uncertainty for investors and end users. Ambiguity around tariff renewals and potential retaliatory measures can dampen appetite for new contracts, as stakeholders weigh projected cost escalations against mission timelines and return-on-investment benchmarks. In response, program managers may implement contingency buffers, adjust payload specifications, or negotiate longer lead times to accommodate tariff-induced delays and budgetary fluctuations.

Nevertheless, tariff challenges have catalyzed strategic adaptation across the industry. Some integrators are accelerating vertical integration initiatives to internalize key processes, while others are leveraging additive manufacturing and digital twin technologies to optimize design-to-production cycles. By proactively addressing tariff risks through diversified sourcing, supply chain transparency, and agile manufacturing, payload developers aim to maintain project viability and deliver resilient solutions in an increasingly complex trade environment.

Unlocking Comprehensive Market Dynamics Through Payload Type, Orbital Class, Application Verticals, and Satellite Class Segmentation Insights

An in-depth examination of satellite payload market segmentation reveals distinct dynamics across payload typologies, orbital regimes, end-use applications, and satellite classes. Payload technologies span communication modalities such as broadcast, fixed, and mobile architectures; earth observation instruments encompassing hyperspectral, optical, and synthetic aperture radar sensors; navigation payloads that deliver positioning and timing; weather monitoring systems for meteorological forecasting; and scientific payloads tailored to research missions. Each payload category demands specific performance envelopes, integration protocols, and validation standards, shaping development roadmaps accordingly.

Orbital classification further delineates market characteristics. Geostationary Earth Orbit platforms favor high-power, large-aperture payloads to support continuous coverage, whereas Low Earth Orbit systems exploit compact, low-latency designs conducive to constellation deployments. Medium Earth Orbit operations strike a balance between revisit frequency and coverage, often hosting navigation and specialized observational payloads. Variations in radiation exposure, thermal environment, and link budgets across orbital regimes necessitate custom engineering and qualification processes.

From an application standpoint, the commercial sector pursues payload solutions for broadband connectivity, remote sensing, and IoT services that address enterprise and consumer markets. Government and defense users prioritize secure, hardened payloads with anti-jamming, encryption, and specialized sensing capabilities, while scientific organizations invest in experimental instruments that probe atmospheric, planetary, and astrophysical phenomena.

Satellite class segmentation underscores further contrast. Large satellites accommodate multi-instrument payload suites and extensive power budgets, medium and small satellites optimize for narrower mission sets, and micro, mini, and nanosatellites emphasize cost-effective, rapid deployment of purpose-built sensors. As the satellite class continuum expands, payload integrators must tailor designs to diverse mass, volume, and power constraints, aligning technical feasibility with mission objectives.

This comprehensive research report categorizes the Satellite Payloads market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payload Type

- Orbit

- Application

- Satellite Class

Delineating Regional Contrasts in Satellite Payload Adoption Trends Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional variations in satellite payload adoption reflect differences in space policy, funding priorities, and industrial ecosystems. In the Americas, North American leadership stems from robust government investment in defense and civil space programs, complemented by a thriving commercial NewSpace sector. Payload developers benefit from established supply chains, advanced manufacturing capabilities, and a competitive cluster of aerospace research institutions that drive continuous innovation in sensor technology and digital payload architectures.

By contrast, the Europe, Middle East, and Africa region engages a broader tapestry of national space agencies, commercial ventures, and research consortia. European payload integrators leverage multinational frameworks such as ESA programs to co-develop Earth observation and navigation instruments, while Middle Eastern and African stakeholders are accelerating investments in remote sensing and connectivity payloads to address environmental monitoring and digital infrastructure objectives. Interregional partnerships within EMEA foster technology transfer and shared resource platforms that enhance payload development efficiency and capability diversity.

Asia-Pacific has emerged as a focal point for rapid expansion, fueled by national strategic initiatives and growing private venture activity. Regional governments in China, India, Japan, and Australia support indigenous payload research and manufacturing, targeting both domestic and export markets. This momentum is accompanied by collaboration agreements with external technology providers to co-develop advanced spectral sensors, synthetic aperture systems, and next-generation communication payloads. Consequently, APAC actors are poised to reshape supply chain topologies and competitive dynamics on a global scale.

Overall, these regional insights underscore the necessity for payload integrators and investors to align market entry strategies with localized regulatory regimes, partnership ecosystems, and technology development agendas. By tailoring offerings to regional imperatives, stakeholders can capitalize on emerging demand patterns and collaborative innovation frameworks.

This comprehensive research report examines key regions that drive the evolution of the Satellite Payloads market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation, Strategic Partnerships, and Competitive Positioning in the Satellite Payload Sector

Leading players in the satellite payload marketplace drive innovation through strategic alliances, proprietary technology platforms, and end-to-end integration services. Ball Aerospace and Thales Alenia deliver advanced optical and synthetic aperture radar payloads for premier defense and civil missions, leveraging decades of flight heritage and rigorous qualification processes. Airbus Defence and Space and Maxar Technologies complement this landscape with high-capacity communication transponders and hyperspectral instruments, underpinned by vertically integrated supply chains that span component fabrication to system-level testing.

Emerging entrants are rapidly gaining traction through disruptive payload architectures and agile development methodologies. Companies such as Astroscale and Northrop Grumman expand the frontier of in-orbit servicing and assembly payloads, integrating robotic interfaces and modular design standards. Innovative smallsat integrators like Planet Labs and Spire Global harness commercial off-the-shelf electronics and cloud-native data pipelines to deploy mass-produced optical and radar payloads at scale, democratizing remote sensing services.

Collaboration between established primes and specialized niche providers fosters a vibrant ecosystem of co-development programs. Joint ventures, cross-licensing arrangements, and consortia partnerships enable access to complementary capabilities, accelerate time to market, and distribute technical risk. Furthermore, technology spin-in from adjacent sectors-such as terrestrial wireless communications and photonics research-fuels payload design diversification and performance enhancements.

As competitive dynamics evolve, the ability to integrate multi-payload platforms, streamline manufacturing workflows, and deliver comprehensive end-user support will define market leadership. Stakeholders who align product roadmaps with emerging mission requirements and leverage ecosystem synergies will position themselves to capture sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Satellite Payloads market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Defence and Space

- BAE Systems

- Blue Canyon Technologies

- GomSpace

- Honeywell International Inc.

- L3Harris Technologies

- Lockheed Martin

- Maxar Technologies

- MDA Ltd.

- Mitsubishi Electric Corporation

- Northrop Grumman

- OHB SE

- Planet Labs PBC

- Raytheon Technologies

- Rocket Lab

- Sierra Nevada Corporation

- SpaceX

- Surrey Satellite Technology Limited

- Thales Alenia Space

- The Boeing Company

Actionable Strategies for Industry Leaders to Strengthen Supply Chains, Embrace Emerging Technologies, and Accelerate Payload Development

Industry leaders should adopt an integrated approach that fortifies supply chain resilience, accelerates technological adoption, and optimizes program economics. First, diversifying sourcing strategies across geographies with favorable trade relations and localized manufacturing hubs can reduce tariff exposure and shorten lead times. By forging partnerships with regional component suppliers and leveraging advanced additive manufacturing, organizations can mitigate disruption risks and maintain schedule fidelity.

Next, prioritizing modular, software-defined payload architectures will enhance in-orbit flexibility and enable post-launch functionality updates. Investing in open-architecture interfaces and digital payload toolchains accelerates development cycles and lowers integration complexity. This agility supports rapid reprogramming of mission parameters and facilitates incremental upgrades without comprehensive hardware redesign.

Concurrently, embedding artificial intelligence and edge-computing capabilities into payload data paths amplifies system autonomy and optimizes bandwidth utilization. By deploying machine learning algorithms on-board, operators can perform real-time data filtering, anomaly detection, and adaptive sensor control, thereby improving mission responsiveness and reducing data processing costs on the ground.

Finally, aligning product development with emerging service models-such as in-orbit servicing, multi-mission platforms, and subscription-based data provision-will unlock new revenue streams and reinforce value propositions. Establishing collaborative frameworks with satellite operators, launch providers, and data analytics firms ensures that payload portfolios align with end-user requirements and emerging market demands. Through these strategic initiatives, payload developers can drive sustainable growth and sustain competitive advantage in a rapidly evolving industry landscape.

Rigorous Research Framework: Methodological Approach for Data Gathering, Validation, and Analytical Rigor in Satellite Payload Analysis

This analysis integrates a robust research framework combining primary and secondary methodologies to ensure rigor and validity. Primary data was gathered through in-depth interviews with payload integrators, satellite operators, component suppliers, and regulatory experts. These qualitative insights were synthesized to identify emerging trends, operational challenges, and strategic imperatives directly from industry stakeholders.

Secondary research encompassed an extensive review of trade publications, technical briefings, regulatory filings, and academic literature. Authoritative sources, including industry journals and government reports, provided contextual data on payload typologies, orbital environments, and trade policy impacts. This phase triangulated quantitative and qualitative information to underpin the narrative and verify factual accuracy.

Analytical rigor was maintained through cross-comparison of multiple data points, sensitivity checks, and scenario mapping. Emerging technology readiness levels and supply chain risk factors were assessed using standardized evaluation frameworks, while competitive landscape dynamics were examined via benchmarking against leading product portfolios and partnership announcements.

Finally, the research methodology incorporated iterative validation sessions with select industry participants to refine assumptions and ensure the analysis resonates with real-world program experiences. This structured, multi-layered approach delivers a comprehensive and credible assessment of the satellite payload ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Satellite Payloads market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Satellite Payloads Market, by Payload Type

- Satellite Payloads Market, by Orbit

- Satellite Payloads Market, by Application

- Satellite Payloads Market, by Satellite Class

- Satellite Payloads Market, by Region

- Satellite Payloads Market, by Group

- Satellite Payloads Market, by Country

- United States Satellite Payloads Market

- China Satellite Payloads Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights and Future Outlook for Satellite Payload Solutions Amidst Evolving Technological and Geopolitical Landscapes

The satellite payload sector stands at the confluence of technological innovation and strategic repositioning. Miniaturized designs, digital payload architectures, and in-orbit servicing capabilities are redefining performance benchmarks and mission paradigms. Concurrently, supply chain complexities-amplified by trade policy shifts-necessitate adaptive procurement and manufacturing strategies.

Regional dynamics underscore the importance of localized partnerships, as market entrants navigate diverse regulatory landscapes and investment priorities across the Americas, EMEA, and Asia-Pacific. Meanwhile, established and emerging payload developers alike are pushing the envelope in sensor miniaturization, digital signal processing, and autonomous operations to meet the evolving needs of commercial, defense, and scientific users.

As the industry advances, organizations that integrate flexible architectures, resilient supply chains, and ecosystem collaborations will sustain a competitive edge. By aligning R&D roadmaps with emerging service models and prioritizing modularity, artificial intelligence, and sustainable design, leaders can unlock new capabilities and drive long-term value.

Ultimately, the future of satellite payloads will be shaped by the capacity to innovate responsively, manage geopolitical and trade complexities, and deliver mission-critical solutions that address the accelerating demands of global connectivity, environmental monitoring, and space exploration.

Seize the Opportunity to Deepen Your Market Intelligence: Connect with Ketan Rohom to Acquire the Definitive Satellite Payload Research Report

To explore detailed segmentation, competitive benchmarking, and strategic imperatives within the rapidly evolving satellite payload domain, reach out to our Associate Director, Sales & Marketing, Ketan Rohom. He can guide you through tailored research deliverables, exclusive market insights, and customized advisory support designed to accelerate your program planning and investment decisions. Act now to secure comprehensive access to proprietary data, expert analysis, and forward-looking scenario planning that will inform your roadmap through 2025 and beyond.

- How big is the Satellite Payloads Market?

- What is the Satellite Payloads Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?