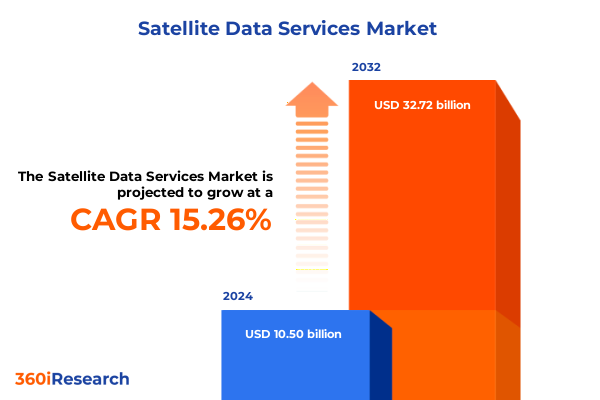

The Satellite Data Services Market size was estimated at USD 12.03 billion in 2025 and expected to reach USD 13.81 billion in 2026, at a CAGR of 15.36% to reach USD 32.72 billion by 2032.

Understanding the Strategic Imperatives and Emerging Opportunities in Satellite Data Services for Informed Decision Making

Satellite data services have emerged as a cornerstone of modern decision making, empowering industries with real time insights that drive efficiency, risk mitigation, and sustainable growth. Over the past decade, advances in sensor technology, data processing algorithms, and cloud computing have converged to unlock unprecedented levels of spatial and temporal resolution, transforming how organizations monitor assets, analyze environmental trends, and forecast operational scenarios. This introduction lays the groundwork by tracing the evolution of satellite data from its origins in basic earth observation to its current status as a multi-dimensional intelligence layer that underpins critical applications in agriculture, defense, energy, and urban planning.

As enterprises increasingly demand predictive and prescriptive analytics rather than static imagery, service providers have shifted toward delivering fully integrated analytics platforms. These platforms blend geospatial data analysis with machine learning models and real time analytics, enabling stakeholders to anticipate disruptions and optimize processes with surgical precision. Meanwhile, image data remains indispensable, with optical imaging and radar imaging systems operating in tandem to overcome weather and lighting constraints. Value-added services, such as alerting systems for anomalous events and customized data visualization dashboards, further extend the reach of core satellite offerings. Through this introduction, readers will gain an appreciation for how satellite data services have matured into a strategic enabler across verticals, setting the stage for a deeper examination of the forces reshaping the landscape today.

Examining the Transformative Technological, Regulatory, and Market Forces Reshaping Satellite Data Services in a Digital Era

The satellite data services landscape is in the midst of a profound transformation, driven by a confluence of technological, regulatory, and market forces. On the technological front, rapid miniaturization of satellite platforms and the proliferation of small satellite constellations have dramatically reduced entry barriers, enabling more frequent revisit rates and granular coverage. At the same time, breakthroughs in hyperspectral and multispectral imaging are providing richer data cubes, while artificial intelligence and machine learning algorithms are automating pattern recognition and anomaly detection at scale.

Regulatory developments also play a critical role in shaping industry trajectories. Spectrum reallocation policies in major markets have expanded access to Ka and Ku band frequencies, while policies governing data sovereignty and cross-border sharing continue to evolve, compelling providers to architect secure, compliant data delivery pipelines. Meanwhile, escalating geopolitical tensions have prompted a reevaluation of supply chains and manufacturing footprints, accelerating the push toward domestically built satellite components and ground stations.

On the market side, demand for environmental monitoring, disaster response, and critical infrastructure surveillance has surged in response to climate change impacts and urbanization pressures. Energy firms are leveraging real time analytics to optimize renewable energy siting and monitor pipeline integrity, while agritech companies deploy high resolution imagery for precision farming. Taken together, these transformative shifts underscore a new era in which satellite data services are not merely observational tools but integrated intelligence systems that inform strategic decision making across the enterprise.

Unpacking the Cumulative Effects of Recent United States Tariff Policies on the Global Satellite Data Services Ecosystem

The introduction of new tariff measures by the United States in early 2025 has created a ripple effect across the global satellite data services value chain. These tariffs, targeting imported satellite components and ground station hardware, have elevated costs for providers reliant on foreign-manufactured parts. As a result, service operators have faced margin compression, prompting many to renegotiate supplier contracts, diversify sourcing strategies, or accelerate investments in domestic manufacturing capabilities.

For smaller satellite integrators and startups, the increased import duties have presented a dual challenge: the need to maintain competitive pricing while securing essential hardware. Some firms have responded by forging strategic partnerships with domestic manufacturers, which has stimulated local supply chain development but also introduced lead time variables that affect deployment schedules. Larger enterprises, by contrast, have leveraged economies of scale to absorb tariff impacts, using their bargaining power to secure volume discounts or to pass a portion of additional costs to end users through tiered service pricing structures.

The cumulative impact of these tariff policies extends beyond hardware procurement. Ground station network operators have also seen elevated prices for critical electronics and antenna components, prompting a reevaluation of remote site expansions. Despite these headwinds, the industry has demonstrated resilience by doubling down on research into software-defined payloads and modular hardware architectures that can be manufactured domestically. These adaptive strategies illustrate the sector’s capacity to navigate complex trade environments while continuing to advance geospatial intelligence offerings.

Leveraging Deep Segmentation Analysis to Illuminate Diverse Service Types, Frequency Bands, Orbits, Resolutions, and Application Verticals

A granular segmentation analysis reveals distinct growth vectors within the satellite data services sector. Service type segmentation highlights that data analytics, encompassing geospatial data analysis, predictive analytics, and real time analytics, is emerging as the linchpin of value creation. Organizations are moving beyond basic image delivery to integrated analytics platforms that fuse earth observation data with AI-powered insights. Likewise, image data services, spanning hyperspectral imaging, multispectral imaging, optical imaging, and radar imaging (SAR), continue to expand capability sets, offering complementary data layers that address cloud cover limitations and enable all-weather monitoring.

Frequency band segmentation exposes the strategic importance of C Band for broad coverage and resilience to rain fade, while Ka Band is prized for high throughput, and Ku Band offers a balance of data speed and antenna size. Meanwhile, L Band’s penetration capabilities are critical for Internet of Things tracking, S Band serves safety-critical communications, and X Band remains the domain of defense-grade applications. Each band provides unique trade-offs, allowing service providers to tailor offerings to specific requirements.

Orbital segmentation differentiates between geostationary orbit, which enables continuous regional observation; highly elliptical orbit for high-latitude coverage; low earth orbit constellations that deliver ultra-frequent revisit rates; and medium earth orbit systems suited to navigation and broadband distribution. Resolution segmentation stratifies offerings from very high resolution capturing sub-0.3 meter detail, to high resolution between 0.3 and 1 meter, medium resolution up to 10 meters, and low resolution suited for large-scale environmental monitoring at coarser scales. Finally, application segmentation underscores agriculture use cases such as crop monitoring, irrigation management, and soil health analysis; defense and security applications like border monitoring, disaster response, and surveillance; energy and power scenarios including oil and gas exploration, pipeline monitoring, and renewable energy planning; environmental monitoring for climate change analysis, deforestation tracking, and pollution monitoring; logistics applications encompassing fleet tracking, maritime monitoring, and route optimization; and urban planning services that enable infrastructure development, land use zoning, and smart city initiatives.

This comprehensive research report categorizes the Satellite Data Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Frequency Band

- Satellite Orbit

- Resolution

- Application

Mapping Regional Dynamics to Highlight Growth Drivers, Regulatory Frameworks, and Infrastructure Milestones Across Key Global Markets

Regional dynamics in the satellite data services market are being driven by varied investment patterns, regulatory landscapes, and infrastructure maturation. In the Americas, a strong focus on commercial satellite operators and a robust ecosystem of analytics startups has fostered high levels of innovation. Government initiatives to modernize agriculture and bolster disaster response capabilities have fueled demand for both optical and radar imaging solutions, leading to a proliferation of regional ground station networks and data distribution partnerships.

Across Europe, the Middle East & Africa, policy frameworks emphasizing data sovereignty and cross-border collaboration under initiatives like the European Space Policy have shaped market growth. In Europe, public-private consortia are advancing climate change monitoring and smart city deployments, while in the Middle East investments in national space programs are accelerating the development of regional Earth observation constellations. In Africa, efforts to leverage satellite data for agricultural resilience and infrastructure planning are gaining traction, although limited ground infrastructure poses challenges that international partnerships are working to address.

The Asia-Pacific region exhibits a blend of saturated markets with advanced economies investing in cutting-edge sensor technologies, alongside emerging economies scaling satellite programs to support maritime surveillance, disaster management, and precision agriculture. Countries with established space agencies are collaborating with private sector innovators to expand orbital coverage, while burgeoning commercial players in East Asia and India are driving competitive pricing and service differentiation. These regional insights underscore the necessity of tailoring market approaches to the unique regulatory, infrastructural, and application-driven priorities of each geography.

This comprehensive research report examines key regions that drive the evolution of the Satellite Data Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Advantage in the Satellite Data Services Sector

Leading players in the satellite data services sector are distinguished by their diversified service portfolios, strategic partnerships, and investments in next-generation technologies. Some global innovators have built vertically integrated models, encompassing satellite manufacturing, ground segment operations, and analytics delivery, enabling end-to-end solutions for enterprise clients. Others have adopted a platform approach, forging alliances with third-party sensor providers and cloud computing partners to offer plug-and-play analytics modules tailored to specific industries.

Strategic collaborators have also shaped the competitive landscape. Partnerships between satellite operators and geospatial analytics firms have yielded specialized intelligence products for critical infrastructure monitoring and environmental compliance. Joint ventures with telecom carriers are enabling hybrid offerings that combine satellite backhaul with terrestrial networks, addressing connectivity gaps in remote and underserved regions. Moreover, acquisitions of AI startups by established satellite service providers have strengthened in-house capabilities for automated feature extraction and real time anomaly detection.

These key companies insights reveal that success hinges on a balanced approach to innovation, where investments in proprietary sensor technologies and AI algorithms are complemented by ecosystem collaboration. By aligning product roadmaps with evolving customer use cases-such as precision agriculture, pipeline integrity monitoring, and smart city sensing-market leaders are reinforcing their competitive advantage and setting benchmarks for service quality and reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Satellite Data Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Antrix Corporation Limited

- Astro Digital Inc.

- Ceinsys Tech Ltd.

- Earth-i Ltd.

- EchoStar Corporation

- Eutelsat S.A.

- Geospatial Intelligence Pty Ltd.

- Globalstar, Inc.

- ICEYE Oy

- Inmarsat Global Ltd. by ViaSat Inc.

- Iridium Communications Inc.

- KVH Industries, Inc.

- Mallon Technology Ltd.

- Maxar Technologies Holdings Inc.

- NV5 Geospatial Solutions, Inc.

- Planet Labs, Inc.

- Remote Sensing Solutions GmbH

- Satellite Imaging Corporation

- Satellogic Inc.

- Satpalda

- Singapore Telecommunications Limited

- Telesat Corporation

- The Sanborn Map Company, Inc.

- Trimble Inc.

- Ursa Space Systems Inc.

Implementing Proactive Strategic Initiatives to Enhance Resilience, Foster Innovation, and Strengthen Collaboration Across Satellite Data Services Industry

Industry leadership in satellite data services demands proactive strategies that enhance resilience, foster innovation, and strengthen collaboration across the value chain. Organizations should prioritize the development of modular payload architectures and software-defined satellites to reduce dependency on single-source suppliers and mitigate tariff impacts. By adopting flexible manufacturing partnerships, companies can pivot quickly in response to evolving trade policies and supply chain disruptions.

In parallel, integrating advanced analytics into core service offerings is essential. Providers must invest in scalable cloud infrastructures, deploy machine learning pipelines that can handle diverse data streams, and offer intuitive visualization tools that translate complex geospatial insights into business-ready intelligence. Cultivating an ecosystem of domain experts-from agronomists to energy engineers-ensures analytics models are rigorously validated and aligned with real world requirements.

Collaboration remains a critical lever for growth. Establishing joint innovation labs with research institutions and cross-industry consortia can accelerate technology transfer and standardize data interoperability protocols. Engaging with regulatory bodies to shape spectrum allocation and data privacy frameworks will further safeguard long-term market access. Through these actionable measures, industry leaders can reinforce their market positions, unlock new use cases, and deliver resilient satellite data services that drive strategic outcomes for end users.

Detailing Comprehensive Research Methodology Encompassing Primary Insights, Secondary Data, and Rigorous Analytical Frameworks for Robust Findings

The research methodology underpinning this market intelligence encompasses a balanced blend of primary and secondary data collection techniques, ensuring robustness and credibility of findings. Secondary research involved an extensive review of industry whitepapers, patent filings, regulatory documents, and publicly available satellite mission data. This provided context on historical technology adoption curves, spectrum policy evolutions, and regional infrastructure investments.

Primary research efforts included structured interviews with senior executives at satellite operators, analytics providers, ground station network managers, and end users across agriculture, defense, energy, and urban planning verticals. These expert discussions delivered nuanced perspectives on market dynamics, vendor selection criteria, and emerging use cases. Data triangulation was employed to validate insights through cross-comparison of interview feedback, proprietary vendor databases, and trade association reports.

Analytical frameworks applied in the study incorporated SWOT analyses for key segments, Porter’s Five Forces to assess competitive intensity, and scenario planning to evaluate potential impacts of tariff changes and regulatory shifts. The methodology emphasized transparency in data sourcing, rigorous validation of qualitative inputs, and iterative review cycles with industry stakeholders to ensure findings are both accurate and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Satellite Data Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Satellite Data Services Market, by Service Type

- Satellite Data Services Market, by Frequency Band

- Satellite Data Services Market, by Satellite Orbit

- Satellite Data Services Market, by Resolution

- Satellite Data Services Market, by Application

- Satellite Data Services Market, by Region

- Satellite Data Services Market, by Group

- Satellite Data Services Market, by Country

- United States Satellite Data Services Market

- China Satellite Data Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights and Strategic Implications to Guide Stakeholders in Navigating the Evolving Satellite Data Services Environment

This executive summary has synthesized key insights across technological innovations, tariff implications, segmentation analyses, regional dynamics, and competitive strategies within the satellite data services sector. The emergence of small satellite constellations and AI-driven analytics platforms is redefining value creation, while recent tariff measures underscore the importance of supply chain agility and domestic manufacturing capabilities. Segmentation insights have highlighted the critical role of differentiated service offerings-spanning analytics, image data, frequency bands, orbits, resolution tiers, and specialized applications-in meeting diverse end-user requirements.

Regionally, the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibit unique regulatory and infrastructural drivers, necessitating market approaches tailored to local contexts. Insights into leading companies have revealed that ecosystem collaboration, strategic partnerships, and investments in proprietary technologies are key competitive levers. Actionable recommendations emphasize the need for modular hardware designs, scalable analytics infrastructure, and collaborative innovation frameworks to navigate evolving trade and regulatory environments.

Collectively, these findings offer a comprehensive view of the current satellite data services environment, equipping stakeholders with the strategic perspective required to capitalize on emerging opportunities and mitigate potential risks. The insights presented herein serve as a roadmap for decision makers seeking to harness satellite intelligence for transformative business impact.

Engage Directly with Our Expert to Secure Tailored Satellite Data Services Intelligence for Strategic Decision Making and Market Leadership

Ready to elevate your strategic initiatives with unparalleled satellite data intelligence? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive market research report tailored to your organization’s unique objectives. This specialized resource delivers actionable insights drawn from extensive primary interviews, rigorous secondary data analysis, and in-depth segmentation studies covering service types, frequency bands, orbital classifications, resolution tiers, and diverse application verticals. By engaging with Ketan, you’ll benefit from personalized guidance on how to integrate the latest technological innovations and regulatory developments into your growth strategies, ensuring you stay ahead in an increasingly competitive environment. Don’t miss this opportunity to leverage expert support and unlock new revenue streams through targeted satellite data service offerings. Reach out today to secure your copy and begin transforming raw satellite intelligence into strategic advantage.

- How big is the Satellite Data Services Market?

- What is the Satellite Data Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?