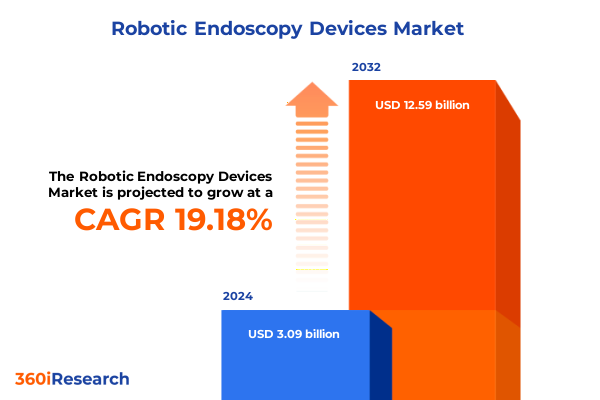

The Robotic Endoscopy Devices Market size was estimated at USD 3.70 billion in 2025 and expected to reach USD 4.35 billion in 2026, at a CAGR of 19.12% to reach USD 12.59 billion by 2032.

Discovering the Transformative Potential of Robotic Endoscopy Devices in Revolutionizing Precision Diagnostics and Therapeutic Interventions

Robotic endoscopy devices represent a paradigm shift in minimally invasive diagnostics and therapeutics, blending advanced robotics with state-of-the-art imaging to achieve unprecedented precision. These systems enable clinicians to navigate complex anatomical pathways with greater control and accuracy than traditional endoscopes, improving diagnostic yield while reducing patient discomfort. As the global healthcare landscape evolves, the convergence of robotics, artificial intelligence, and enhanced visualization technologies has elevated endoscopic procedures into a new era of performance and safety.

Over recent years, continuous advancements in actuation mechanisms, real-time image processing, and haptic feedback have driven remarkable improvements in both diagnostic and therapeutic capabilities. The most notable innovations have focused on enhancing flexibility and miniaturization, permitting access to previously unreachable regions within the gastrointestinal and bronchial tracts. Manufacturers have invested heavily in refining the design of working channels and tool integration to support complex interventions such as tissue resection and hemostasis. Consequently, robotic endoscopy has become integral to precision medicine strategies.

Looking ahead, the continued fusion of machine learning algorithms with robotic platforms promises to automate procedural steps, anticipate anatomical variations, and offer decision support to endoscopists. As healthcare providers strive to optimize clinical outcomes and throughput, these intelligent systems are poised to transform patient pathways. This introduction sets the stage for exploring the transformative shifts shaping the market, the implications of new U.S. tariffs, and the critical segmentation, regional, and competitive insights that will define the future of robotic endoscopy devices.

Uncovering the Pivotal Shifts Redefining the Robotic Endoscopy Market Driven by Technological Breakthroughs and Evolving Clinical Demands

The robotic endoscopy market has undergone several transformative shifts driven by rapid technological evolution and changing clinical demands. First, the integration of high-resolution imaging modalities and three-dimensional reconstruction has elevated diagnostic accuracy. Innovations such as real-time optical coherence tomography and fluorescence imaging have empowered clinicians to detect early-stage lesions with greater confidence, reshaping screening protocols for gastrointestinal and pulmonary diseases.

Simultaneously, improvements in robotic actuation and control algorithms have enabled the development of flexible endoscopes capable of complex articulation within tortuous anatomy. These systems now offer submillimeter precision in tip movement, allowing for intricate therapeutic maneuvers including tissue ablation and endoluminal suturing. In parallel, capsule endoscopes have transitioned from passive imaging tools to active, steerable platforms with onboard sensors and wireless communication, expanding their role beyond small-bowel visualization into targeted interventions.

Clinician preferences have also shifted toward platforms that facilitate collaborative workflows and remote operation. The rise of tele-endoscopy, accelerated by global health challenges, has underscored the need for interoperable systems that integrate seamlessly with hospital networks and cloud-based analytics. Moreover, rising demand for minimally invasive procedures in aging populations has driven the adoption of robotic endoscopy in ambulatory surgery centers and specialized clinics. These pivotal shifts underscore the market’s trajectory toward intelligent, versatile, and user-centric solutions.

Evaluating the Mounting Consequences of Recent U.S. Tariff Measures on the Robotic Endoscopy Device Landscape and Supply Chain

In 2025, the United States implemented a series of tariff measures targeting key components and subsystems critical to robotic endoscopy platforms, including high-precision motors, imaging sensors, and specialized surgical instruments. These levies have escalated manufacturing costs for original equipment manufacturers reliant on global supply chains, prompting a reappraisal of sourcing strategies and production footprints. To mitigate cost pressures, several vendors have initiated nearshoring efforts, establishing assembly hubs within North America to reduce exposure to tariff volatility.

The direct consequence of these tariffs has been an increase in the landed cost of advanced robotic endoscopes, which, in turn, has influenced pricing negotiations with healthcare providers and purchasing groups. Amid constrained reimbursement rates, suppliers have sought to absorb a portion of these added expenses while maintaining investment in research and development. Consequently, some companies have prioritized selective feature releases and incremental upgrades to extend the lifecycle of existing platforms.

Furthermore, distributors have adjusted inventory management practices, adopting just-in-time models to minimize tariff burdens associated with stockpiling. These changes in supply chain dynamics have fostered deeper collaborations between device producers and logistics partners, leading to the adoption of predictive analytics for demand forecasting and routing optimization. Ultimately, the cumulative impact of the 2025 U.S. tariffs has catalyzed a strategic shift toward supply chain resilience and regional diversification, underscoring the market’s adaptability in the face of trade policy headwinds.

Illuminating Market Segmentation Dynamics to Unlock Precision Insights Across Device Types, Clinical Applications, Technologies, End Users, and Sales Channels

A nuanced understanding of market segmentation dynamics is essential for identifying high-value opportunities and tailoring product strategies. Within the realm of device types, diagnostic platforms encompass both biopsy instruments and imaging modules, the former facilitating precise tissue sampling while the latter delivers enhanced visualization for early disease detection. Contrastingly, therapeutic devices span ablation, hemostasis, and resection tools, each designed to perform targeted interventions such as lesion removal or bleeding control with maximal accuracy and minimal collateral tissue damage.

Clinical applications further delineate the market by anatomical focus. Bronchial procedures leverage robotic endoscopes to access the pulmonary tree for nodule biopsies, whereas gastrointestinal uses are bifurcated into lower and upper segments, addressing conditions from colorectal polyps to esophageal lesions. Otolaryngological applications have emerged as a niche yet rapidly growing segment, enabling transnasal access for sinus and skull base surgeries. Urological interventions, though less prevalent, are gaining traction for endoluminal enucleation and stricture management within the urinary tract.

On the technology front, capsule endoscopes are gaining ground due to their noninvasive profile, while flexible robotic endoscopes dominate in applications requiring intricate tooling and real-time manipulation. Rigid robotic endoscopes, prized for stability and force transmission, remain integral in specialized resections. End-user segmentation reveals that hospitals continue to command the largest procedural volume, but ambulatory surgical centers and specialized clinics are rapidly scaling adoption owing to cost efficiency and streamlined patient throughput. Meanwhile, research institutes invest in early-stage prototypes and validation studies. Sales channels are characterized by direct sales models facilitating clinical training and customization, alongside distribution networks that expedite regional deployment and service support.

This comprehensive research report categorizes the Robotic Endoscopy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Application

- End User

Exploring Regional Market Nuances to Reveal Growth Drivers, Regulatory Landscapes, and Adoption Patterns in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics within the robotic endoscopy market reveal distinct patterns of adoption, regulatory environments, and growth catalysts. In the Americas, the United States leads in both clinical adoption and technological innovation, driven by favorable reimbursement frameworks and a concentration of specialized medical centers. Canada and select Latin American countries follow suit, albeit at a more measured pace due to budgetary constraints and varying degrees of infrastructure readiness.

Across Europe, the Middle East, and Africa, heterogeneous regulatory landscapes present both challenges and opportunities. The European Union’s unified CE marking process streamlines market entry for compliant devices, yet differing national health technology assessment protocols influence purchasing decisions. Key markets such as Germany, the United Kingdom, and the Gulf Cooperation Council countries have demonstrated robust uptake, spurred by initiatives to modernize endoscopic services and enhance diagnostic pathways for gastrointestinal and ENT disorders.

Asia-Pacific exhibits the fastest growth trajectory, supported by government-driven healthcare digitization programs, rising clinical trial activity, and expanding hospital networks. Japan and South Korea boast mature ecosystems for endoscopic robotics, while China’s domestic manufacturers are rapidly scaling capabilities to meet surging demand. Australia and Southeast Asian markets are also embracing these systems, focusing on training programs to build clinical expertise. Together, these regional insights elucidate where market entrants and incumbents should prioritize resource allocation and partnership development to capitalize on localized growth drivers.

This comprehensive research report examines key regions that drive the evolution of the Robotic Endoscopy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Initiatives and Competitive Positioning of Leading Developers Shaping the Robotic Endoscopy Device Marketplace

Major stakeholders in the robotic endoscopy arena have implemented differentiated strategies to capture market share and sustain innovation pipelines. One leading manufacturer has pursued strategic acquisitions of imaging technology firms to integrate high-resolution sensors and artificial intelligence algorithms into its platforms. Another competitor has focused on modular designs, enabling healthcare providers to upgrade components such as tip actuators and visualization modules independently, thereby preserving capital investments and extending device lifecycles.

Several developers have established consortiums with academic medical centers to conduct multicenter clinical studies, generating robust data sets that validate safety and efficacy while accelerating regulatory approvals. Among them, one prominent organization has pioneered remote-training programs, equipping endoscopists across emerging markets with the skills necessary to adopt advanced robotic systems. Concurrently, a handful of mid-sized companies are differentiating through cost-effective flexible endoscopes, targeting ambulatory surgical centers and clinics with scaled-down feature sets tailored to high-volume screening procedures.

Collaboration between device manufacturers and software specialists has given rise to integrated procedure management platforms, combining patient data, real-time analytics, and post-procedure reporting in a unified interface. These strategic alliances underscore a broader trend toward ecosystem play, where hardware providers partner with digital health companies to deliver end-to-end solutions. Overall, key players are leveraging acquisitions, clinical partnerships, and platform integration to fortify their competitive positioning and address the evolving needs of healthcare providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Robotic Endoscopy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- Asensus Surgical, Inc.

- avateramedical GmbH

- Boston Scientific Corporation

- Brainlab AG

- CMR Surgical Ltd.

- Cook Group Incorporated

- EndoMaster Pte Ltd

- Endotics

- Globus Medical, Inc.

- Intuitive Surgical, Inc.

- KARL STORZ SE & Co. KG

- Medtronic PLC

- MicroPort Scientific Corporation

- Olympus Corporation

- Otsuka Holdings Co., Ltd.

- Renishaw PLC

- Ronovo Surgical

- Stryker Corporation

- Virtuoso Surgical, Inc.

Delivering Targeted Strategic Recommendations to Propel Innovation, Optimize Market Entry, and Drive Sustainable Growth in Robotic Endoscopy Development

To capitalize on the evolving landscape of robotic endoscopy, decision-makers should prioritize investment in flexible endoscope R&D that enhances articulation precision and integrates advanced imaging modalities. Emphasizing modularity in design will enable scalable platform upgrades, reducing long-term capital expenditure for healthcare institutions and fostering customer loyalty through incremental enhancements.

Strengthening domestic manufacturing capabilities or establishing nearshore assembly operations will mitigate exposure to tariff-induced cost fluctuations and supply chain disruptions. This approach not only secures continuity of device availability but also aligns with procurement preferences in markets favoring locally produced medical equipment. Simultaneously, forming alliances with logistics and distribution partners adept at navigating regional regulatory requirements will streamline market entry and after-sales support.

Engaging in collaborative clinical research with leading medical centers can accelerate evidence generation to support both regulatory approvals and payer reimbursement discussions. Early collaboration on real-world data initiatives will bolster the value proposition of robotic endoscopy systems. Additionally, integrating digital health tools - such as procedure analytics dashboards and predictive maintenance algorithms - will differentiate offerings and create new revenue streams through service contracts and analytics subscriptions.

Finally, tailoring sales strategies to address the specific needs of ambulatory surgery centers, specialty clinics, and research institutions will optimize market penetration. By delivering targeted training programs and flexible financing models, manufacturers can reduce adoption barriers and foster long-term partnerships.

Detailing Robust Research Methodology Integrating Primary Expert Interviews, Secondary Data Sources, and Analytical Frameworks for Rigorous Insights

The research methodology underpinning this executive summary combines rigorous primary and secondary approaches to ensure analytical robustness and practical relevance. Primary research comprised in-depth interviews with surgeons, biomedical engineers, and procurement executives across leading hospitals, clinics, and ambulatory surgical centers. These structured conversations provided firsthand insights into clinical preferences, procedural challenges, and purchasing considerations.

Secondary research involved a comprehensive review of peer-reviewed journals, patent filings, regulatory databases, and publicly available corporate disclosures. This phase integrated findings from industry white papers and conference proceedings to contextualize technological trends and competitive strategies. Emphasis was placed on identifying validated case studies of clinical adoption and documented outcomes from multicenter trials.

Analytical frameworks such as SWOT analysis, PESTEL examination, and competitive benchmarking were employed to dissect market drivers, regulatory influences, and ecosystem dynamics. Segmentation analysis drew upon procedural volumes, application specificity, and technology maturity to cluster opportunities and assess growth potential. Regional assessments leveraged macroeconomic data and health policy reports to pinpoint areas of rapid adoption and infrastructure readiness.

Finally, internal validation workshops convened industry experts to review preliminary findings, challenge assumptions, and refine interpretations. This iterative process ensured that conclusions and recommendations are grounded in real-world observations, delivering reliable strategic guidance for stakeholders navigating the complex robotic endoscopy domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Robotic Endoscopy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Robotic Endoscopy Devices Market, by Device Type

- Robotic Endoscopy Devices Market, by Technology

- Robotic Endoscopy Devices Market, by Application

- Robotic Endoscopy Devices Market, by End User

- Robotic Endoscopy Devices Market, by Region

- Robotic Endoscopy Devices Market, by Group

- Robotic Endoscopy Devices Market, by Country

- United States Robotic Endoscopy Devices Market

- China Robotic Endoscopy Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the Strategic Imperatives and Emerging Opportunities in Robotic Endoscopy to Guide Informed Decision-Making Across Stakeholders

Throughout this analysis, several strategic imperatives have emerged as critical for stakeholders seeking to unlock the full potential of robotic endoscopy. Foremost among these is the imperative to innovate continuously in both hardware and software domains, developing systems that cater to the fine balance between procedural complexity and user accessibility. Organizations that embed scalability and interoperability into their platforms will be best positioned to withstand evolving clinical requirements and regulatory scrutiny.

Supply chain resilience has surfaced as another key factor, as recent trade policy shifts and tariff impositions have underscored the risks of reliance on concentrated manufacturing hubs. Establishing diversified production networks and collaborative logistics partnerships will be essential to ensure uninterrupted device availability and cost predictability. Moreover, as reimbursement landscapes adapt to technological advances, data-driven evidence generation through collaborative clinical studies will influence market access and pricing negotiations.

Segment-focused strategies should guide product development and go-to-market plans, matching device capabilities to the specific clinical needs of application areas such as bronchoscopy, gastrointestinal diagnostics, and otolaryngology. Regional variation in regulatory processes and healthcare infrastructure demands tailored approaches to market entry and after-sales support. By aligning innovation, operational resilience, and market intelligence, organizations can seize the growth opportunities presented by this dynamic and rapidly maturing field.

Contact Ketan Rohom to Secure Comprehensive Robotic Endoscopy Market Intelligence and Empower Your Strategic Planning and Investment Decisions

To obtain an in-depth understanding of the robotic endoscopy landscape, reach out to Ketan Rohom, whose extensive market expertise and consultative approach will equip your organization with actionable intelligence. By engaging directly with the associate director of sales and marketing, you will gain tailored guidance on leveraging emerging technology trends, navigating regulatory complexities, and optimizing market entry strategies. Secure immediate access to comprehensive analyses of competitive positioning, segmentation breakdowns, and regional dynamics, enabling your team to make informed investment and partnership decisions. Connect with Ketan Rohom to initiate a customized briefing that aligns with your specific business objectives and discover how this market research can serve as a catalyst for driving innovation and sustainable growth within your organization.

- How big is the Robotic Endoscopy Devices Market?

- What is the Robotic Endoscopy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?