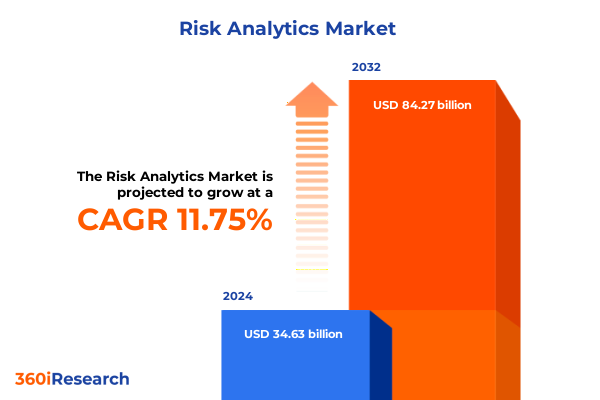

The Risk Analytics Market size was estimated at USD 38.53 billion in 2025 and expected to reach USD 42.90 billion in 2026, at a CAGR of 11.82% to reach USD 84.27 billion by 2032.

Exploring the Rise of Complex Risk Environments and the Imperative for Advanced Analytics, AI Integration, and Strategic Foresight in Decision-Making

In today’s volatile economic landscape, organizations face an unprecedented confluence of geopolitical tensions, regulatory realignments, and rapid technological advancements that are reshaping risk management paradigms. Survey data indicate that North American CFOs have significantly curtailed their appetite for risk amid renewed trade uncertainties and tariff threats, reflecting a cautious stance toward growth initiatives in the wake of policy shifts that reverberate across global supply chains. Concurrently, internal audit functions are contending with evolving challenges-from leveraging generative AI to addressing cybersecurity and fraud risk-underscoring the necessity for agile frameworks that can adapt to an ever-expanding risk universe.

Against this backdrop, risk analytics has emerged as a foundational capability for driving proactive decision-making. Organizations are moving beyond traditional descriptive reporting to embrace predictive and prescriptive models that harness machine learning and advanced data visualization. Insurers and financial services firms are pioneering “predict and prevent” approaches, integrating Internet of Things (IoT) data and AI algorithms to forecast potential losses and intervene before adverse events materialize. At the same time, professionals recognize that AI skill sets are rapidly transitioning from “nice-to-have” to essential, as tax and finance functions explore machine-driven solutions to manage escalating regulatory complexity.

Unveiling Key Shifts Transforming Risk Analytics Landscape Including Generative AI, Regulatory Overhauls, Climate Threats, and Third-Party Risk Dynamics

A new era of risk analytics is being defined by generative and machine learning–driven models that enhance the speed and granularity of scenario analysis. By embedding GenAI capabilities into risk frameworks, organizations can generate realistic stress scenarios and dynamically adjust parameters as new data becomes available. This shift is complemented by the rollout of Global Internal Audit Standards effective January 2025, which mandate that audit functions not only verify compliance but also proactively identify emerging risks through continuous assurance methodologies.

Meanwhile, regulatory landscapes across major jurisdictions are undergoing rapid transformation, driven by evolving ESG mandates, privacy regulations, and refined capital adequacy requirements. Tax and finance leaders face a trifecta of regulatory complexity, economic pressure, and AI innovation as they seek to maintain compliance while leveraging analytics to optimize performance. Organizations are responding by modernizing their data architectures, adopting cloud-native platforms that can scale with fluctuating data volumes, and instituting rigorous governance frameworks to ensure data integrity and audit readiness.

In parallel, climate-related risks and third-party disruptions have ascended to the top of corporate agendas. As extreme weather events and supply chain shocks become more frequent, risk managers are integrating meteorological and vendor performance data into their predictive models. Third-party risk management practices are evolving to emphasize continuous monitoring, transparency, and alignment with ESG criteria, enabling enterprises to mitigate external exposures before they ripple through operations and financial statements.

Assessing the Cumulative Effects of United States Trade Tariffs Announced for 2025 on Supply Chains, Cost Structures, and Financial Resilience

The tariff escalations announced by the United States for 2025 are poised to alter cost structures across multiple industries. Under the more severe downside scenario, the administration’s 10% minimum tariff on all imports, along with 25% levies on steel, aluminum, motor vehicles, and auto parts, could raise the average tariff rate to around 20% for U.S. imports, while retaliation from the European Union and China could drive reciprocal rates to 20% and 34%, respectively. Such tariff spikes are unprecedented in modern U.S. history and may trigger a technical recession by late 2025, as business investment retracts and consumption is eroded by elevated input costs and higher unemployment.

Organizations are already recalibrating their risk models to account for these policy shifts. Supply chain risk algorithms are being updated to factor in tariff-induced cost variances and lead-time delays, while scenario analysis tools are stress-testing the impact on pricing strategies and margin preservation. CFOs and risk leaders are expanding their use of what-if simulations to evaluate hedging strategies and alternative sourcing scenarios, recognizing that tariff volatility represents both a threat to operational resilience and an opportunity for those capable of agile realignment.

Deriving Actionable Insights from Multifaceted Market Segmentation Spanning Components, Risk Types, Applications, and Industry Verticals

The component segmentation underscores how service-driven models and software-centric solutions coalesce to meet diverse client requirements. Managed and professional services provide the human expertise and implementation support that form the backbone of risk programs, while risk modeling, monitoring, and reporting software deliver the analytical rigor necessary for real-time insights. By mapping these offerings to distinct risk types-ranging from compliance and credit to market and operational risk-vendors can fine-tune their value propositions and align with the evolving threat landscape.

Deployment choices further differentiate risk analytics adoption, as organizations weigh the flexibility and scalability of cloud environments against the security and control of on-premise installations. Large enterprises often leverage hybrid architectures to balance performance and governance, whereas small and medium enterprises may gravitate toward fully managed cloud services to minimize infrastructure overhead. Application-based segmentation-spanning anti-money laundering, enterprise risk management, fraud detection, and insurance risk management-drives the development of specialized modules and accelerators, enabling rapid time to value. Across industry verticals such as banking and financial services, government, healthcare, IT and telecom, and retail, nuanced compliance mandates and operational priorities shape the configuration and deployment of analytics engines to address sector-specific exposures.

This comprehensive research report categorizes the Risk Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Risk Type

- Deployment

- Organization Size

- Application

- Industry Vertical

Revealing Strategic Regional Variations and Growth Drivers in Risk Analytics Adoption across the Americas, EMEA, and Asia-Pacific Markets

In the Americas region, mature financial markets and stringent regulatory frameworks have fostered a robust ecosystem for risk analytics innovation. Financial institutions in the United States and Canada are at the vanguard, deploying real-time monitoring systems and AI-driven credit scoring models to meet requirements under Basel III and the Dodd-Frank Act. Meanwhile, enterprises across Latin America are increasingly adopting cloud-based fraud detection platforms as digital payment volumes surge, supported by government initiatives to enhance financial inclusion and cybersecurity resilience.

Europe, the Middle East, and Africa represent a complex tapestry of regulatory regimes and market maturity levels. The European Union’s rigorous data privacy mandates have spurred demand for analytics solutions that can reconcile advanced modeling techniques with compliance, especially in GDPR and sustainability reporting. In the Middle East, digital transformation programs emphasize anti-money laundering controls and operational resilience, while African markets are gradually embracing digital financial services and corresponding risk management tools to support economic growth. Asia-Pacific’s dynamic economies are driving significant investments in risk modeling and reporting systems; East Asian powerhouses focus on sophisticated analytics for credit and market risk, Southeast Asia prioritizes anti-fraud measures for e-commerce expansion, and South Asian markets emphasize liquidity risk frameworks to bolster financial stability.

This comprehensive research report examines key regions that drive the evolution of the Risk Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Risk Analytics Solution Providers Shaping the Future of Predictive Modeling, Fraud Detection, and Compliance

Leading risk analytics solution providers are coalescing around two strategic imperatives: platform integration and vertical specialization. Major vendors like IBM and SAS offer end-to-end platforms that consolidate risk data across multiple domains, embedding machine learning pipelines and governance controls. SAS’s Risk Management suite and IBM’s OpenPages platform rank among the highest in industry comparisons for modeling flexibility and workflow integration, enabling users to configure stress tests, scenario simulations, and regulatory reporting within a unified interface.

At the same time, specialized firms such as Moody’s and RiskSpan are carving out niches with deep domain expertise. Moody’s Analytics integrates economic research with advanced credit risk modeling, drawing on tools like Market Implied Ratings and Expected Default Frequency software to provide early warning indicators for counterparties. RiskSpan’s cloud-native Edge Platform delivers data management and analytics for structured finance and mortgage portfolios, allowing institutions to share real-time insights with stakeholders and meet stringent reporting demands with reduced operational friction. Meanwhile, Verisk Analytics leverages proprietary datasets in catastrophe modeling and weather risk to serve insurance and energy sectors, underpinning its leadership in predictive risk assessment and decision support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Risk Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Capgemini SE

- Cloud Software Group, Inc.

- Fidelity National Information Services, Inc.

- Finastra

- Genpact LLC

- Gurucul Solutions, LLC.

- International Business Machines Corporation

- Marsh LLC

- Mastercard Incorporated

- OneSpan Inc.

- Oracle Corporation

- Provenir Group

- RELX Group

- Risk Edge Solutions

- Riskonnect, Inc.

- RSM UK Group LLP

- SAP SE

- SAS Institute Inc.

- Sphera Solutions, Inc. by Blackstone

- TATA Consultancy Services Limited

- TIBCO by Cloud Software Group, Inc.

- Verisk Analytics, Inc.

Implementing Practical Strategies for Industry Leaders to Enhance Risk Management Agility, Data Integration, and Preventive Service Offerings

To stay ahead in a rapidly evolving environment, industry leaders should adopt a multi-pronged strategy that balances technological innovation with robust governance. First, organizations must accelerate the integration of AI and machine learning into their risk frameworks, ensuring that data scientists and risk managers collaborate closely to validate model outputs and mitigate bias. By applying generative AI to scenario generation, companies can stress-test emerging threats-such as macroeconomic shocks and policy shifts-faster and with greater precision.

Second, strengthening third-party risk management practices is essential. Continuous monitoring of vendor performance and supply chain metrics can preempt disruptions before they propagate through operations. Incorporating ESG criteria into these assessments not only aligns with stakeholder expectations but also uncovers hidden vulnerabilities related to climate and social governance. Finally, firms should expand preventive service offerings, transforming risk analytics from a cost center into a fee-based revenue stream. Insurers and consulting firms can monetize predictive analytics and advisory services, offsetting underwriting exposures and fostering deeper client engagement through outcome-based contracts.

Outlining the Rigorous Mixed-Method Research Framework Employed to Ensure Data Integrity, Expert Validation, and Analytical Rigor

This analysis is grounded in a rigorous mixed-method research framework that synthesizes both primary and secondary data sources. Primary insights were obtained through structured interviews with senior risk executives, audit leaders, and technology providers, enabling firsthand perspectives on evolving priorities and deployment challenges. These qualitative interviews were complemented by a comprehensive review of publicly available financial disclosures, regulatory filings, and authoritative thought leadership from leading consultancies.

Quantitative validation involved triangulating data points from multiple industry databases and proprietary trackers to ensure consistency and reliability. Advanced analytical techniques, including cluster analysis and trend extrapolation, were applied to identify thematic patterns across segmentation dimensions and regional markets. Data integrity was maintained through cross-validation against benchmark metrics, while an iterative review process with subject-matter experts ensured that findings accurately reflect the current state of risk analytics adoption and future imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Risk Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Risk Analytics Market, by Component

- Risk Analytics Market, by Risk Type

- Risk Analytics Market, by Deployment

- Risk Analytics Market, by Organization Size

- Risk Analytics Market, by Application

- Risk Analytics Market, by Industry Vertical

- Risk Analytics Market, by Region

- Risk Analytics Market, by Group

- Risk Analytics Market, by Country

- United States Risk Analytics Market

- China Risk Analytics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Takeaways to Reinforce the Transformative Value of Risk Analytics in Enhancing Resilience and Guiding Informed Decision-Making

As organizations confront an increasingly interconnected and volatile risk landscape, advanced analytics emerges as a critical enabler of resilience and strategic clarity. By integrating generative AI, real-time monitoring, and scenario-based stress testing, enterprises can move from reactive firefighting to proactive risk orchestration. Tailored segmentation insights reveal that adoption curves vary significantly by component, risk type, deployment model, and industry, emphasizing the need for customized approaches that align with organizational maturity and regulatory context.

Regional nuances underscore the importance of market-specific strategies, as rulebooks, digital infrastructure, and economic drivers differ across the Americas, EMEA, and Asia-Pacific. Leading technology and service providers are responding with both platform-centric ecosystems and industry-specialized solutions, addressing demands for scalability, compliance, and deep domain expertise. By embracing the actionable recommendations outlined herein-fostering AI integration, strengthening third-party governance, and expanding preventive services-industry leaders can harness risk analytics as a competitive differentiator and safeguard long-term growth.

Engage with Ketan Rohom to Secure Comprehensive Risk Analytics Insights Customized to Your Strategic Objectives and Organizational Needs

For tailored insights and strategic guidance on navigating the complexities of risk analytics and trade policy impacts in 2025, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep expertise in customizing research deliverables to address your organization’s unique challenges and growth objectives. Reach out to explore how our comprehensive market intelligence report can empower your decision-making, refine your risk management strategies, and drive measurable outcomes.

- How big is the Risk Analytics Market?

- What is the Risk Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?