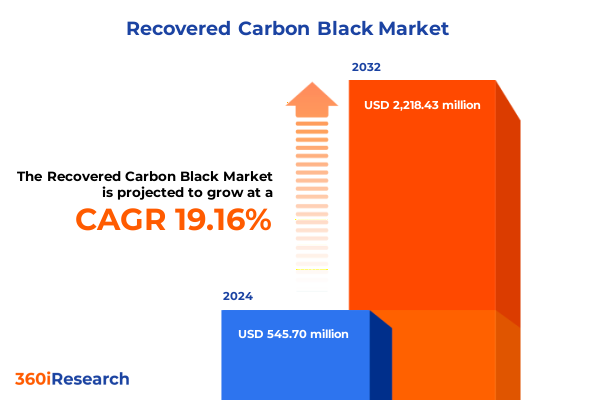

The Recovered Carbon Black Market size was estimated at USD 642.29 million in 2025 and expected to reach USD 758.73 million in 2026, at a CAGR of 19.37% to reach USD 2,218.43 million by 2032.

A concise executive introduction to recovered carbon black emphasizing performance parity, supply security, and the strategic pivot toward circular feedstocks

Recovered carbon black is emerging as a strategic feedstock at the intersection of circularity goals, resource security priorities, and changing product-performance expectations. Over the past several years, attention has shifted from linear supply chains toward recovery, reuse, and closed-loop manufacturing-drivers that now sit at the center of executive agendas across chemicals, tires, coatings, and battery sectors. Recovered carbon black occupies a unique place in that transition: it can substitute for virgin carbon black in many applications while offering companies a pathway to reduce lifecycle emissions and exposure to upstream supply shocks. Consequently, leaders in procurement, product development, and sustainability are reassessing where and how recovered carbon black fits within existing material specifications and regulatory reporting frameworks.

As companies move from pilot projects to commercial-scale integration, three cross-cutting considerations have come to the fore. First, performance parity with virgin grades remains the gating factor for adoption in high-value applications such as tires and specialty elastomers. Second, feedstock sourcing and the reproducibility of process outputs-whether via chemical recovery or pyrolysis-determine the economics and the consistency of product form available to customers. Third, regulatory signals and trade policy are reshaping commercial planning horizons and investment timelines. Taken together, these forces mean that recovered carbon black is no longer a niche sustainability narrative; it is a strategic input that requires coordinated decisions across technical, commercial, and policy functions.

How process innovation, downstream specification changes, and shifting trade policy are remapping supply chains and creating commercial windows for recovered carbon black

The landscape for recovered carbon black is undergoing transformative shifts driven by technology maturation, downstream specification demands, and evolving trade and regulatory frames. Technological advances in chemical recovery and pyrolysis have reduced process variability and improved the controllability of surface chemistry, particle structure, and aggregate distribution-attributes that directly influence performance in tires, rubber goods, inks, and select battery applications. As process control improves, recycled outputs move from commodity-grade substitutes toward higher-value specialty blacks, enabling new commercial relationships with original equipment manufacturers who demand tighter tolerances.

Downstream, formulators and product engineers are increasingly specifying recovered materials by function rather than origin. This shift means that producers who can demonstrate consistent conductivity, reinforcement characteristics, and dispersion behavior will capture disproportionate interest from electronics, coatings, and polymer converters. Meanwhile, circular-economy commitments and extended producer responsibility frameworks are prompting brand owners to quantify embedded carbon and material circularity; this is accelerating demand for verified recovered carbon black in markets where sustainability credentials carry a price premium. In parallel, trade-policy updates that raise duties on imported battery materials and critical minerals have strengthened the case for domestic recycling solutions and remanufacturing of carbonaceous feedstocks, tightening the rationale for investment in local recovery capacity. Together these technological, commercial, and policy shifts are remapping value chains and creating windows of opportunity for vertically integrated recyclers and innovators to capture value previously held by primary producers.

An evidence-based assessment of how U.S. tariff adjustments and ensuing policy uncertainty in 2025 reshape procurement choices, investment timing, and domestically focused recovery strategies

U.S. tariff actions in 2024 and 2025 that targeted batteries, battery parts, and certain critical minerals have produced ripple effects across material supply chains and commercial economics that touch recovered carbon black demand and procurement strategies. Policymakers adjusted duties on a range of battery-related imports and signaled broader intent to prioritize domestic manufacturing and upstream supply-chain resilience. These policy moves recalibrate incentives for recycling of carbonaceous materials and for domestic processing of feedstocks historically sourced offshore, giving recovered carbon black a strategic role in reducing exposure to tariff risk and import volatility. As a result, companies that rely on imported battery inputs or graphite-related materials are actively reassessing their sourcing matrices and pilot-testing internally produced or third-party recycled carbon materials as contingency and long-term supply options.

Beyond tariff rate changes themselves, the legal and diplomatic developments surrounding tariff orders in early 2025 have created an environment of policy uncertainty. Stakeholders must now incorporate scenario planning into commercial negotiations, where different bilateral or multilateral outcomes could affect cross-border flows of feedstock, intermediates, and finished goods. In practical terms, procurement teams are expanding supplier panels to include regional recyclers and pyrolysis service providers, while R&D functions are accelerating qualification work to reduce time-to-approval for recycled substitutes. Meanwhile, project sponsors and capital providers are re-evaluating the expected timelines for returns on recovery infrastructure investments, since policy-induced shifts in comparative advantage can compress or expand payback assumptions. These dynamics create both upside for domestically oriented recovery players and downside risks for participants heavily exposed to jurisdictions affected by elevated tariffs.

Detailed segmentation insights explaining how variations in carbon black type, recovery process, physical form, end-use requirements, and distribution channels determine commercial pathways

Understanding commercial potential requires close attention to product and process segmentation because each axis defines different quality expectations, cost structures, and customer pathways. In terms of carbon black type, reinforcing blacks, semi-reinforcing blacks, and specialty blacks present distinct technical and certification hurdles: reinforcing grades demand precise structure and surface chemistry for tire and high-performance rubber applications, while specialty blacks are evaluated for conductivity, color strength, and compatibility with advanced polymers and coatings. Process segmentation separates chemical recovery from pyrolysis, and the two routes yield different impurity profiles, aromatic content, and particle morphology; these distinctions influence both downstream compatibility and qualification timelines for end users. Form matters as well, because pellets and powder forms affect handling, dust control, and compounding behavior-pellets often ease dosing and reduce dust exposure while powders can offer faster dispersion and are favored in certain coatings or high-speed compounding lines.

End-use application segmentation further clarifies the pathways to commercial scale. Batteries and electronics place an emphasis on conductivity, low ash, and batch-to-batch reproducibility; inks and coatings prioritize color, tint strength, and surface treatments that affect pigment wetting. Plastics converters judge recycled carbon black on performance across extrusion, film, and molding operations-each processing route interacts differently with particle size and surface chemistry to influence mechanical and aesthetic outcomes. Rubber goods and tire manufacturers demand rigorous testing for reinforcement, abrasion resistance, and aging characteristics before adopting recycled substitutes at scale. Distribution channels complete the picture because direct sales, distributors, and online platforms each impose different expectations for logistic reliability, documentation, and technical support. For example, partnerships with tier-one elastomer manufacturers often require direct commercial and technical engagement, whereas industrial compounders may prefer the flexibility of distributor stocking and immediate availability. Integrating insights across these segmentation axes enables a more precise commercial strategy that aligns product specification, process investments, and go-to-market design with targeted end-use demands.

This comprehensive research report categorizes the Recovered Carbon Black market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Carbon Black Type

- Production Technology

- Form Factor

- Grade Profile

- Quality Metrics

- Price Tier

- Application

- End-Use Industry

- Distribution Channel

Regional strategic insights on how regional policy, feedstock availability, and end-use market composition drive adoption and scale-up of recovered carbon black solutions

Regional dynamics shape both demand profiles and the feasibility of scaling recovered carbon black solutions, and leaders must align geographical strategy with regional policy, feedstock availability, and end-use market depth. In the Americas, strong sustainability commitments among brand owners, coupled with growing regulatory scrutiny around waste streams and domestic supply security priorities, have increased appetite for recycled carbon solutions; North American tire and automotive supply chains are particularly receptive to locally sourced recycled carbon blacks to reduce exposure to tariff volatility and to meet corporate sustainability targets. Moving eastward, Europe, the Middle East & Africa display a mix of regulatory drivers and market maturity: Europe’s regulatory frameworks and circular-economy targets create high demand for verified recycled inputs and favor traceability and certification, while some markets in the Middle East show nascent interest driven by industrial diversification strategies; parts of Africa are exploring pilot-scale recovery projects where informal feedstock streams may be formalized and upgraded. Asia-Pacific remains diverse and pivotal: some markets retain large primary carbon black capacities and feedstock processing capability, while others are accelerating investments in recycling infrastructure to support local manufacturing of tires, electronics, and batteries. Across all regions, geographic positioning of recovery facilities relative to major feedstock sources and end-use clusters strongly determines commercial viability and the willingness of downstream buyers to adopt recycled content.

This comprehensive research report examines key regions that drive the evolution of the Recovered Carbon Black market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Corporate strategic observations highlighting how technology providers, materials integrators, and end users structure partnerships and investments to accelerate recovered carbon black adoption

Companies active in this space span a continuum from process innovators and technology licensors to materials integrators, compounders, and end-user manufacturers emphasizing sustainability. Process innovators focus on advancing pyrolysis and chemical recovery platforms to reduce impurity burdens and to tailor surface chemistries; their commercial strategies hinge on licensing models or joint ventures that enable rapid deployment of modular units near feedstock sources. Materials integrators and compounders aim to combine recovered carbon black with formulation science to meet customer-specific performance thresholds and to build trust through rigorous qualification datasets. End-user manufacturers-particularly those in tires, automotive components, and select electronics-are often the ultimate arbiters of adoption and therefore structure long-term take-or-pay agreements, co-development programs, and in some cases equity partnerships with recyclers to secure prioritized access to validated material streams. Financial sponsors and project developers are increasingly attracted to vertically integrated models that link feedstock collection, process conversion, and distribution, because these models can mitigate quality and logistics risks that typically slow commercial uptake.

Across these archetypes, the most successful players emphasize transparent performance validation, third-party testing, and quality assurance programs that reduce the burden of qualification for customers. Strategic alliances with brand owners and compounders accelerate acceptance and create de-risked offtake pathways. In parallel, technology providers that demonstrate scalable unit economics and predictable output quality secure premium valuations in project finance conversations. These patterns suggest that company strategies focused on integration, certification, and downstream partnerships will capture the earliest, most stable commercial traction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Recovered Carbon Black market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Black Bear Carbon B.V.

- Bolder Industries, Inc.

- Cabot Corporation

- CONTEC S.A.

- Continental AG

- Elysium Nordic

- Enrestec, Inc.

- Epsilon Carbon Private Limited

- Finster Black Pvt Ltd.

- Hi-Green Carbon Limited

- Klean Industries Inc.

- Mitsubishi Chemical Corporation

- OCI Company Ltd.

- Orion Corporation

- Pyrum Innovations AG

- RCB Nanotechnologies GmbH

- Scandinavian Enviro Systems AB

- Tokai Carbon Co., Ltd.

Actionable recommendations for executives to accelerate commercialization, de-risk supply chains, and secure durable advantage with recovered carbon black

Industry leaders seeking to convert market opportunity into durable advantage should pursue a coordinated set of actions that align technology, commercial engagement, and public affairs. First, prioritize process validation programs that document performance equivalence to virgin grades across critical metrics such as particle morphology, surface area, ash content, and dispersion behavior; invest in third-party test protocols and pilot-scale trials to accelerate customer qualification cycles. Second, engage downstream partners early through co-development and certification pilots that reduce adoption friction; this includes working with formulators, compounders, and OEMs to embed recycled content requirements into technical specifications where feasible. Third, build flexible commercial models that accommodate different distribution preferences-direct supply relationships for strategic customers, distributor partnerships for volume-focused markets, and online options for smaller or specialized buyers. Fourth, hedge policy and trade risk by diversifying feedstock and processing footprints geographically and by developing contingency sourcing strategies to adapt to tariff-driven cost shifts.

Finally, invest in traceability and chain-of-custody systems that enable credible sustainability claims and ease compliance with regulatory regimes focused on circularity. These systems should be designed to support both customer-level reporting and broader ESG disclosures. Taken together, these actions reduce the time-to-adoption for buyers, strengthen margins for suppliers through differentiated service offerings, and increase the likelihood that recovered carbon black transitions from niche usage to an accepted input across multiple end-markets.

Transparent research methodology describing stakeholder engagement, technical validation, scenario analysis, and cross-checked secondary research to support conclusions

The research approach underpinning this analysis combined primary engagement with material stakeholders and a structured review of publicly available policy and technical literature to ensure rigor and practical relevance. Primary research included in-depth interviews with process technology developers, compounders, tire manufacturers, battery material specialists, and procurement leaders to validate technical constraints, qualification timelines, and commercial preferences. These conversations were supplemented by site visits and pilot-program reviews where available to assess real-world process scalability and handling practices. Secondary research encompassed trade and regulatory notices, peer-reviewed technical studies on pyrolysis and chemical recovery outputs, and industry association briefings to map policy trajectories and to triangulate statements from market participants.

Analytical methods included qualitative thematic synthesis to identify common adoption barriers and enablers, plus techno-economic sensitivity analysis to understand how feedstock variability, process yields, and distribution logistics alter commercial outcomes. The study also applied scenario planning to model the implications of alternative trade-policy outcomes and to stress-test recommendations under policy uncertainty. Throughout, findings were validated through iterative consultation with subject-matter experts and cross-checked against public regulatory filings to ensure accuracy and relevance for commercial decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Recovered Carbon Black market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Recovered Carbon Black Market, by Carbon Black Type

- Recovered Carbon Black Market, by Production Technology

- Recovered Carbon Black Market, by Form Factor

- Recovered Carbon Black Market, by Grade Profile

- Recovered Carbon Black Market, by Quality Metrics

- Recovered Carbon Black Market, by Price Tier

- Recovered Carbon Black Market, by Application

- Recovered Carbon Black Market, by End-Use Industry

- Recovered Carbon Black Market, by Distribution Channel

- Recovered Carbon Black Market, by Region

- Recovered Carbon Black Market, by Group

- Recovered Carbon Black Market, by Country

- United States Recovered Carbon Black Market

- China Recovered Carbon Black Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2862 ]

Concluding synthesis emphasizing why integrated technical validation, commercial pilots, and policy engagement are essential to scale recovered carbon black adoption

Recovered carbon black is no longer peripheral to conversations about circularity and supply resilience; it is an emergent strategic material whose commercial trajectory will be determined by the intersection of process maturity, downstream qualification, and policy context. As process technologies reduce variability and as brands codify recycled-content preferences, the path to meaningful adoption becomes clearer but still requires deliberate actions from both suppliers and buyers. Policy developments and trade measures in 2024–2025 have heightened the strategic value of domestic recovery and processing capacity, but they have also increased the premium on operational excellence, traceability, and close collaboration with end users.

In conclusion, organizations that approach recovered carbon black with an integrated strategy-combining robust technical validation, targeted commercial pilots, and proactive policy engagement-will be best positioned to convert sustainability commitments into resilient supply chains and differentiated products. Those that wait for perfectly stable policy or economics risk ceding early-mover advantages to vertically integrated players who can capture offtake relationships and set technical expectations for recycled material use.

Take the next step to secure the recovered carbon black research report with a tailored briefing and purchasing options coordinated by the Associate Director of Sales and Marketing

To acquire the full recovered carbon black market research report and gain access to detailed datasets, strategic appendices, and bespoke consulting options, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can arrange a tailored briefing that aligns the report’s insights with your commercial priorities, coordinate a preview of the report’s methodology and chapter breakdown, and discuss licensing options for single-use, multi-user, or enterprise subscriptions. Many organizations find it most productive to schedule an introductory call to review the report’s table of contents and sample exhibits before completing a purchase decision; Ketan can facilitate that engagement and connect you with the research leads for subject-matter follow-up. If you prefer a customized deliverable, he will coordinate bespoke analysis scopes, secondary research add-ons, and paid workshops that translate the report’s findings into rapid implementation roadmaps for procurement, R&D, manufacturing, and commercial teams.

- How big is the Recovered Carbon Black Market?

- What is the Recovered Carbon Black Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?