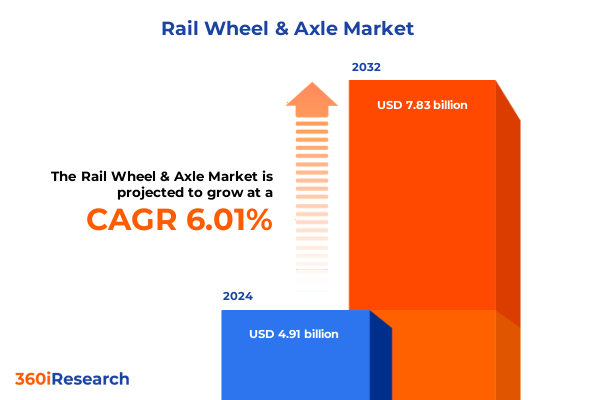

The Rail Wheel & Axle Market size was estimated at USD 5.15 billion in 2025 and expected to reach USD 5.40 billion in 2026, at a CAGR of 6.17% to reach USD 7.83 billion by 2032.

Integrating Core Dynamics and Emerging Drivers That Are Shaping the Rail Wheel & Axle Industry in Today’s Competitive Environment

The rail wheel and axle industry has entered an era marked by rapid transformation and mounting complexity, driven by intertwined technological, operational, and regulatory forces. Emerging propulsion systems and advanced manufacturing techniques are converging to reshape the design and production of these critical components. Meanwhile, an escalating focus on sustainability and lifecycle performance has raised the bar for material selection and maintenance practices. Against this backdrop, stakeholders must cultivate a nuanced understanding of the market’s foundational dynamics to navigate both immediate challenges and long-term strategic imperatives.

As global rail networks expand and modernize, the integration of digital monitoring platforms and predictive maintenance solutions is becoming a standard rather than an exception. This shift toward data-driven asset management amplifies the importance of material science innovations that extend service intervals and reduce environmental footprints. In conjunction with evolving safety regulations and performance benchmarks, the industry is witnessing a gradual yet profound realignment of priorities. From new high-speed corridors to last-mile urban transit projects, the rail wheel and axle segment serves as a linchpin in advancing connectivity, reliability, and cost efficiency across diverse modalities and geographies.

Examining the Critical Technological, Operational, and Sustainability-Driven Transformations Reshaping the Rail Wheel & Axle Sector at an Accelerated Pace

In recent years, the rail wheel and axle landscape has been revolutionized by breakthroughs in metallurgy and composite engineering. These material advancements are not only enhancing load-bearing capacities and fatigue resistance but are also facilitating weight reductions that improve energy efficiency on high-speed and freight lines. Concurrently, digitalization has permeated every stage of the value chain, from design simulation and additive manufacturing to real-time condition monitoring powered by IoT sensors. This integration has unlocked unprecedented insights into wear patterns, enabling predictive analytics to proactively prevent failures and optimize maintenance intervals.

Moreover, sustainability considerations have gained center stage, with manufacturers exploring low-carbon steelmaking and recyclable composite blends. This eco-centric approach is further bolstered by circular economy initiatives, which promote remanufacturing and end-of-life material recovery. As a result, partnerships between material scientists, OEMs, and infrastructure operators are intensifying, creating a collaborative ecosystem that accelerates innovation. Taken together, these transformative shifts underscore a departure from legacy processes toward a more agile, data-driven, and environmentally responsible paradigm within the rail wheel and axle sector.

Analyzing the Compounding Effects of Recent United States Tariff Measures on Supply Chains, Cost Structures, and Competitive Positioning in 2025

The imposition of new United States tariffs in early 2025 has reverberated throughout the rail wheel and axle supply chain, compelling both domestic and international stakeholders to reassess sourcing strategies and cost structures. Imported raw materials, particularly specialized steel and alloy components, experienced elevated duties that have incrementally driven up production expenses for axle forging and wheel rolling operations. Consequently, manufacturers have been prompted to diversify procurement channels, exploring alternative suppliers in tariff-exempt jurisdictions and evaluating nearshoring opportunities to mitigate duty-related burdens.

In response to these cost pressures, several producers have accelerated investments in localized manufacturing capacities. By establishing or expanding production facilities closer to major U.S. rail hubs, companies aim to reduce reliance on tariff-affected imports while also shortening lead times. However, the transition entails capital-intensive infrastructure upgrades and workforce development programs to cultivate the necessary technical expertise. At the same time, these dynamics have spurred heightened collaboration between OEMs and regulatory bodies to navigate tariff classifications and secure relief mechanisms under trade agreements. Collectively, these adaptive measures illustrate the far-reaching, cumulative impact of the 2025 tariff landscape on operational resilience and competitive positioning within the rail wheel and axle ecosystem.

Uncovering How Application, Material, Product, End User, and Distribution Channel Segmentation Drive Diverse Growth Patterns Within the Rail Wheel & Axle Market

Diving into the market’s segmentation, the application spectrum stretches from heavy freight operations and high-speed passenger corridors to light rail networks and urban metros. Within these passenger realms, commuter services contend with high-frequency, short-haul cycles, whereas intercity lines demand robustness for extended distances at elevated speeds. Shifting over to material considerations, aluminum alloys are prized for their lightweight properties in certain high-speed contexts, while cast iron retains its standing for heavy-duty freight applications. Composite blends, emerging in niche use cases, offer promising fatigue resistance and recyclability, and premium steel formulations continue to underpin most conventional wheel and axle designs.

From a product standpoint, the core delineation spans axles, wheels, and fully assembled wheel sets, each entailing distinct manufacturing workflows and quality control imperatives. On the demand side, original equipment manufacturers drive specification-led production cycles, whereas the aftermarket segment emphasizes maintenance, refurbishment, and turnaround responsiveness. Finally, distribution channels vary from specialist service providers focusing on retrofit solutions to direct manufacturer sales and broad networks of industrial distributors. This multi-dimensional segmentation landscape underscores the importance of targeted strategies that align material choices, production capabilities, and outreach models to specific end-user requirements and procurement modalities.

This comprehensive research report categorizes the Rail Wheel & Axle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

- Distribution Channel

Exploring Regional Variations in Demand Dynamics, Infrastructure Development, and Regulatory Frameworks Across the Americas, EMEA, and Asia-Pacific Markets

As regional rail infrastructure agendas diverge, growth trajectories in the rail wheel and axle market reflect distinct patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, legacy freight corridors and urban commuter systems are undergoing phased modernization, prompting a steady demand for durable steel wheel sets and high-capacity axles. Investments in transnational freight links and North American cross-border initiatives continue to anchor the region’s procurement pipelines.

Across the Europe, Middle East & Africa landscape, stringent safety and environmental regulations are accelerating the adoption of advanced composites and low-carbon steel variants, particularly on high-speed rail projects linking major European capitals and burgeoning metro networks in Middle Eastern cities. Concurrently, maintenance alliances in Africa aim to bolster local refurbishment hubs to reduce dependency on overseas overhauls.

The Asia-Pacific market is characterized by unprecedented network expansions and high-speed corridor deployments, with several nations integrating domestic manufacturing capabilities for critical wheel and axle components. This build-out emphasizes lightweight materials for energy-efficient high-speed services, while aftermarket demand surges alongside fleet expansion. Regulatory harmonization efforts across trade blocs further influence material standardization and cross-border component flows, accentuating the region’s pivotal role in shaping global supply dynamics.

This comprehensive research report examines key regions that drive the evolution of the Rail Wheel & Axle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players’ Strategic Moves, Collaborative Ventures, and Technological Innovations Shaping Competitive Advantage in the Rail Wheel & Axle Market

Leading players in the rail wheel and axle landscape are leveraging strategic partnerships, technological licensing agreements, and targeted facility investments to fortify their market positions. Established forging specialists have forged alliances with material science innovators to co-develop novel steel grades optimized for fatigue resistance and recyclability. Integrated component manufacturers are enhancing vertical capabilities by acquiring or collaborating with IoT solution providers, embedding sensor arrays directly into wheel sets for real-time condition tracking.

Several companies have also prioritized sustainability certification programs, securing eco-labels that differentiate their offerings amid increasingly stringent environmental mandates. Others have pursued joint ventures with regional service providers to establish in-country refurbishment hubs, thereby reducing turnaround times and tariff exposure. In parallel, digital twin platforms have been adopted to simulate operational stress profiles and streamline new product introductions. Collectively, these strategic maneuvers highlight a market in which innovation-driven differentiation and ecosystem collaboration are paramount to sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Rail Wheel & Axle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Amsted Rail Company, Inc.

- ArcelorMittal S.A.

- Bharat Forge Limited

- CRRC Corporation Limited

- EVRAZ NTMK

- Interpipe Group

- Japan Steel Works, Ltd.

- Lucchini RS S.p.A.

- Nippon Steel Corporation

- Progress Rail, Inc.

- Siemens Mobility GmbH

- Titagarh Wagons Limited

- voestalpine AG

Outlining Strategic Imperatives and Operational Best Practices for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Evolving Market Risks

To navigate the evolving rail wheel and axle ecosystem, industry leaders should prioritize the integration of advanced materials and digital monitoring capabilities within their product portfolios. By aligning research investments with emerging regulatory benchmarks for sustainability and safety, companies can position themselves as preferred partners for both new infrastructure projects and ongoing fleet maintenance. It is also imperative to reassess supply chain architectures with a view toward localization, leveraging nearshore manufacturing to mitigate tariff-induced cost volatility and enhance responsiveness.

Furthermore, establishing collaborative platforms with cross-functional stakeholders-ranging from material scientists and equipment OEMs to rail operators and regulatory agencies-will facilitate the co-development of next-generation solutions, accelerating time-to-market and ensuring compliance with performance standards. Strengthening aftermarket service networks through strategic alliances and certification programs will drive recurring revenue streams and deepen customer loyalty. Lastly, embracing predictive analytics and digital twin frameworks will enable proactive asset management, reducing lifecycle costs and elevating operational reliability in high-demand rail corridors.

Detailing the Comprehensive Research Approach, Data Collection Techniques, and Analytical Framework Employed to Deliver Actionable Insights for Stakeholders

This research exercise combined an exhaustive review of publicly available technical papers, industry standards documentation, and regulatory filings with primary interviews conducted across multiple stakeholder groups, including rail operators, OEM executives, material science experts, and infrastructure policymakers. Data triangulation was achieved by cross-referencing interview insights with proprietary manufacturing databases and in-field performance case studies.

Analytical rigour was maintained through the deployment of advanced statistical methods to identify trend correlations and sensitivity analyses, while thematic synthesis distilled qualitative feedback into actionable intelligence. Validation workshops were convened with subject matter specialists to vet key findings and refine interpretation of emerging patterns. By integrating both exploratory and confirmatory research stages, this methodology ensures a balanced and robust representation of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Rail Wheel & Axle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Rail Wheel & Axle Market, by Product Type

- Rail Wheel & Axle Market, by Material Type

- Rail Wheel & Axle Market, by Application

- Rail Wheel & Axle Market, by End User

- Rail Wheel & Axle Market, by Distribution Channel

- Rail Wheel & Axle Market, by Region

- Rail Wheel & Axle Market, by Group

- Rail Wheel & Axle Market, by Country

- United States Rail Wheel & Axle Market

- China Rail Wheel & Axle Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing Core Findings, Strategic Implications, and Future Considerations to Guide Informed Decision-Making Within the Rail Wheel & Axle Industry Landscape

In summation, the rail wheel and axle sector is experiencing a confluence of material innovation, digital integration, and regulatory evolution that is reshaping traditional production and maintenance paradigms. The ripple effects of new tariffs, regional infrastructure investments, and segmentation-driven demand profiles underscore the need for agile strategies and collaborative ecosystems. Companies that adeptly navigate this complex landscape by leveraging advanced materials, localized supply chains, and predictive analytics will secure a decisive competitive edge.

Looking ahead, the interplay between sustainability mandates and network modernization projects will continue to drive product and process innovation. As stakeholders align around shared safety and environmental objectives, the industry’s capacity to scale adaptive solutions across global markets will define success. This synthesis of core trends and strategic insights provides a roadmap for decision-makers to steer their organizations toward resilient growth and long-term value creation.

Engage Directly with Associate Director of Sales & Marketing Ketan Rohom to Secure Your Essential Rail Wheel & Axle Market Research Report and Drive Strategic Growth

To explore in depth the strategic insights and actionable guidance presented within this rail wheel & axle market report, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the report’s contents, discuss customized licensing options, and address any specific areas of interest to ensure you derive maximum value from this research. Engaging with Ketan will streamline your procurement process and help align this intelligence with your organizational objectives. Reach out today and empower your team with the comprehensive knowledge required to strengthen your competitive position in the evolving rail wheel & axle industry. An informed investment in this report will equip you to capitalize on emerging trends and mitigate risks with confidence.

- How big is the Rail Wheel & Axle Market?

- What is the Rail Wheel & Axle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?