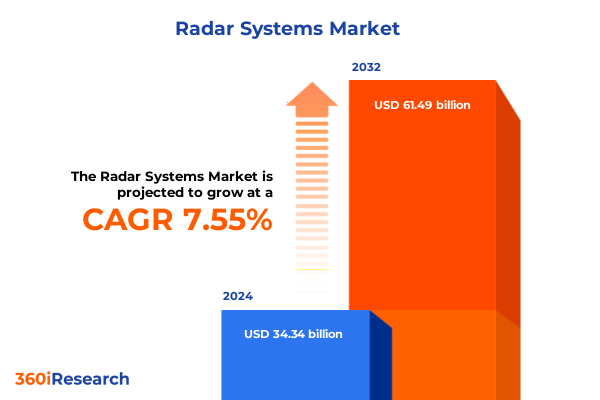

The Radar Systems Market size was estimated at USD 36.94 billion in 2025 and expected to reach USD 39.35 billion in 2026, at a CAGR of 7.55% to reach USD 61.49 billion by 2032.

Pioneering the Future of Radar Systems by Unveiling Market Dynamics and Technological Progress to Equip Decision-Makers with Strategic Insight

Radar technology stands at the crossroads of an unprecedented era of innovation and strategic importance. As nations and industries seek to bolster situational awareness and operational effectiveness, radar systems have evolved from monolithic installations into highly adaptable and integrated networks. This report offers a panoramic view of that evolution, highlighting the convergence of advanced signal processing, artificial intelligence, and next-generation hardware that is redefining detection, tracking, and imaging capabilities. Through this lens, organizations can appreciate how radar is no longer confined to traditional defense roles but is now pivotal in civil aviation safety, automotive autonomy, maritime security, and weather forecasting.

Building on a foundation of rigorous research, this executive summary distills complex market forces into actionable intelligence. The insights presented herein cover transformative shifts in technological architectures, the ramifications of 2025 tariff policies on supply chains, and the nuanced behaviors of key market segments. By examining regional dynamics and profiling leading companies, we illuminate pathways for growth and resilience. Ultimately, this summary equips decision-makers with a strategic framework to navigate an increasingly competitive and interconnected radar landscape.

Examining Cutting-Edge Technological Disruptions and Market Drivers Reshaping the Radar Systems Landscape Across Civil and Defense Sectors

The radar industry is undergoing transformative shifts driven by breakthroughs in active electronically scanned arrays and digital beamforming. These technologies replace mechanically steered antennas with solid-state architectures that deliver faster scan rates, higher resolution, and reduced maintenance overhead. Simultaneously, the integration of machine learning algorithms into signal processing pipelines is enabling adaptive detection capabilities, reducing false alarms, and enhancing target discrimination. As these innovations mature, we observe a migration from legacy long-range air surveillance installations toward multi-modal systems capable of simultaneous civilian and defense applications.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Radar System Supply Chains, Component Costs, and Strategic Sourcing Decisions

The introduction of tariffs by the United States in 2025 targeting key radar components has had a ripple effect across global supply chains. Manufacturers reliant on imported semiconductor foundry services and specialized radio frequency modules have faced increased input costs, driving a reassessment of sourcing strategies. This shift has accelerated efforts to regionalize production, with original equipment manufacturers exploring partnerships with domestic suppliers and diversifying procurement channels to mitigate exposure to trade policy fluctuations.

Beyond direct cost implications, extended customs inspections and licensing requirements have introduced lead-time uncertainties that affect project lifecycles across defense contracts and civil infrastructure upgrades. In response, organizations are investing in inventory buffers and revising procurement windows to safeguard program schedules. Collectively, these adaptations underscore the need for agile supply chain management practices and proactive policy monitoring to sustain radar system modernization efforts.

Deriving Actionable Insights from Comprehensive Market Segmentation Spanning Application, Platform, End User, Frequency Bands, and Evolving Technologies

Insight into market segmentation reveals that radar applications span air traffic control environments-where approach control, area control, and secondary surveillance capabilities are being enhanced-through to automotive systems, optimizing adaptive cruise control and collision avoidance. In defense arenas, systems designed for missile guidance, reconnaissance, surveillance, and target tracking are evolving to meet demands for higher precision and networked interoperability. Concurrently, maritime navigation infrastructures are being fortified with coastal navigation and port surveillance radars, and weather monitoring solutions are improving precipitation analysis and storm tracking to bolster forecasting accuracy.

Platform segmentation further delineates growth vectors across airborne installations on fixed wing, rotary wing, and unmanned aerial vehicles, while ground-based solutions range from mobile to stationary deployments. Naval markets are witnessing increased adoption of shipborne and submarine-mounted arrays, and space platforms in GEO, LEO, and MEO orbits are unlocking new possibilities for persistent, global coverage. End user analysis highlights distinct investment priorities among automotive manufacturers serving commercial and passenger vehicles, civil and general aviation operators, defense forces encompassing air, land, and naval branches, commercial shipping and leisure marine sectors, meteorological agencies in government bodies and private institutes, and telecommunication operators delivering both ground-based and satellite connectivity.

From a frequency band perspective, C, Ka, Ku, S, and X bands each cater to unique performance profiles-balancing range, resolution, and atmospheric penetration. Technological segmentation shows a steady increase in continuous wave implementations alongside frequency modulated continuous wave deployments for both long and short-range monitoring. Pulse radar technologies, whether coherent or non-coherent, continue to serve traditional tracking roles, while pulse Doppler variants are being refined for specialized airborne and ground applications.

This comprehensive research report categorizes the Radar Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Frequency Band

- Technology

- Application

- End User

Uncovering Distinct Regional Dynamics Influencing Radar Systems Adoption and Growth Patterns Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on radar adoption and investment patterns. In the Americas, the confluence of defense modernization programs and civil airspace renewal initiatives has created a robust pipeline for radar upgrades. Both U.S. and Canadian agencies are allocating resources toward next-generation secondary surveillance radars and coastal surveillance networks, ensuring dominance in regional security and air traffic management.

Across Europe, Middle East, and Africa, market drivers range from unmanned aerial vehicle integration over European skies under SESAR initiatives to extensive defense procurement programs in the Gulf and Africa. European meteorological agencies are prioritizing S-band weather systems for enhanced storm tracking, while naval powers in the region continue to invest in shipborne X-band and Ka-band radars for littoral operations.

The Asia-Pacific region exhibits accelerated demand stemming from significant defense modernization efforts in India and China, expansion of space-based observation platforms in low Earth orbit, and automotive radar mandates in offshore manufacturing hubs. Japan’s commitment to upgrading weather monitoring networks and Australia’s focus on coastal security further underscore the region’s diverse radar requirements.

This comprehensive research report examines key regions that drive the evolution of the Radar Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives That Are Driving Innovation and Competitive Advantage in Radar Technology Market

Leading defense contractors are reinforcing their positions through continuous technological investment and strategic collaborations. Raytheon Technologies is expanding its active electronically scanned array portfolio, integrating advanced GaN semiconductor components to boost power efficiency and range. Northrop Grumman has intensified efforts in digital signal processing, enabling multi-mode sensors that seamlessly transition between surveillance and fire-control roles.

European incumbents are also innovating; Thales has broadened its maritime radar suite with enhanced surface search and navigation solutions, while Leonardo is focusing on compact, lightweight weather radar systems suitable for both civil and military applications. Saab is advancing sensor fusion capabilities to deliver consolidated situational awareness displays, and Lockheed Martin is deepening partnerships with unmanned aerial vehicle platforms to offer turnkey airborne radar packages. Collectively, these companies are shaping the competitive landscape by addressing interoperability, modularity, and cost-effectiveness across diverse operational theaters.

This comprehensive research report delivers an in-depth overview of the principal market players in the Radar Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Aselsan A.Ş.

- BAE Systems plc

- General Dynamics Corporation

- HENSOLDT AG

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Meteksan Savunma Sanayii A.Ş.

- Mitsubishi Electric Corporation

- Northrop Grumman Corporation

- NXP Semiconductors N.V.

- RADA Electronic Industries Ltd.

- Raytheon Technologies Corporation

- Reutech Radar Systems Pty Ltd.

- Saab AB

- Thales S.A.

- WEIBEL Scientific A/S

Formulating Strategic Roadmaps and Recommendations to Enhance Market Positioning, Foster Technological Leadership and Navigate Evolving Radar Ecosystems

To capitalize on emerging opportunities, industry leaders should prioritize investment in artificial intelligence and machine learning frameworks that can be embedded directly into radar signal chains. By leveraging adaptive algorithms for clutter suppression and automatic target recognition, organizations can deliver differentiated performance in contested and congested environments. In parallel, establishing multi-tiered supplier partnerships will be essential to insulate production schedules from trade policy shifts and to accelerate adoption of domestically produced high-reliability components.

Moreover, collaboration with platform integrators in both civil and defense segments can unlock cross-domain applications, such as combining automotive collision avoidance radars with infrastructure-based sensors for smart city deployments. Embracing open architecture standards will facilitate upgrades and future expansion, while scenario-based testing and digital twin simulations can reduce development cycles. Finally, tailoring product portfolios to specific end-user profiles-including commercial vehicle makers, telecommunication operators, and meteorological agencies-will reinforce market relevance and drive customer loyalty.

Outlining Rigorous Research Approaches and Data Acquisition Techniques Underpinning Our Comprehensive Analysis of Radar System Industry Trends

Our research methodology integrates primary and secondary approaches to ensure comprehensive coverage and balanced perspectives. In the primary phase, structured interviews were conducted with chief technology officers, radar system integrators, regulatory authorities, and leading end-user organizations. These discussions provided granular insights into procurement hurdles, performance requirements, and evolving operational doctrines across both defense and civil sectors.

Secondary research included a thorough review of technical journals, policy papers, trade publications, and patent filings to map emerging technological trajectories. Quantitative data was triangulated across multiple sources to validate segment definitions and regional allocations. All findings were subjected to rigorous expert validation, ensuring that trends and strategic imperatives are both current and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Radar Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Radar Systems Market, by Platform

- Radar Systems Market, by Frequency Band

- Radar Systems Market, by Technology

- Radar Systems Market, by Application

- Radar Systems Market, by End User

- Radar Systems Market, by Region

- Radar Systems Market, by Group

- Radar Systems Market, by Country

- United States Radar Systems Market

- China Radar Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Synthesizing Key Findings to Deliver a Cohesive Narrative That Illuminates Radar System Market Opportunities and Strategic Imperatives

The radar market is experiencing a confluence of technological innovation, policy influences, and diversified end-user demands. Advanced beamforming techniques and AI-driven signal processing are recalibrating performance benchmarks, while tariff-induced supply chain realignments are reshaping procurement strategies. A fine-grained segmentation analysis underscores the importance of tailoring solutions across applications ranging from automotive autonomy to space-based observation, and regional insights reveal a spectrum of investment priorities from North America’s defense radars to Asia-Pacific’s rapid modernization programs.

Leading industry players are forging partnerships and expanding product portfolios to secure competitive advantage, but success will hinge on the ability to anticipate user requirements and mitigate trade-policy risks. As organizations refine their strategic roadmaps, they must adopt flexible architectures and digital-first validation environments. Together, these actions will unlock new avenues for growth and reinforce the critical role that radar systems play in global security, transportation safety, and environmental monitoring.

Empowering You to Secure Exclusive Radar System Market Intelligence with Personalized Guidance from Associate Director Ketan Rohom

We invite stakeholders across defense, aviation, automotive, maritime, and meteorological domains to secure a comprehensive understanding of evolving radar system dynamics with a bespoke briefing tailored to your strategic objectives. Engage directly with Associate Director Ketan Rohom for an in-depth consultation that aligns cutting-edge insights to your organization’s priorities, empowering you to translate market intelligence into decisive action. Elevate your competitive edge by acquiring the full market research report and unlocking customized perspectives to guide your roadmap.

- How big is the Radar Systems Market?

- What is the Radar Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?