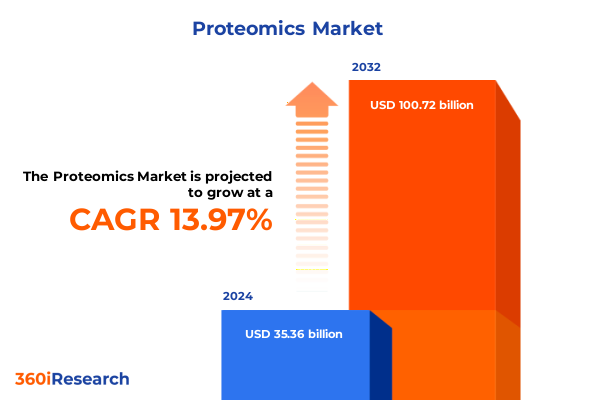

The Proteomics Market size was estimated at USD 40.06 billion in 2025 and expected to reach USD 45.47 billion in 2026, at a CAGR of 14.07% to reach USD 100.72 billion by 2032.

Discover How Proteomics Is Transforming Biomedical Research through High-Resolution Insights, Integrated Technologies, and Emerging Market Opportunities

Proteomics has emerged as a transformative pillar within the life sciences, offering unprecedented insights into the complex repertoire of proteins that govern cellular function, disease progression, and therapeutic response. At its core, proteomics transcends traditional genomic analysis by capturing the dynamic expression, functional interactions, and structural conformations of proteins in real time. This evolution has been propelled by advances in mass spectrometry, high-throughput microarrays, and bioinformatics platforms that streamline data acquisition and interpretation. Consequently, stakeholders across pharmaceutical, biotechnology, and academic sectors are leveraging proteomic approaches to accelerate drug discovery, validate novel biomarkers, and optimize personalized medicine strategies.

In recent years, the integration of automation, cloud-based services, and advanced data analysis tools has democratized access to proteomic workflows, reducing barriers to entry for emerging research institutions and smaller biotechs. Moreover, the convergence of functional proteomics with multi-omics datasets has enabled a systems-level understanding of cellular pathways, driving the identification of novel therapeutic targets. As such, proteomics is no longer confined to specialized laboratories; it is becoming a foundational methodology in preclinical research, clinical diagnostics, and environmental monitoring. This introduction lays the groundwork for a detailed examination of market shifts, regulatory influences, segmentation nuances, and strategic imperatives shaping the global proteomics landscape.

Exploring Major Paradigm Shifts in Proteomics Enabled by AI Integration, Single-Cell Resolution, Multi-Omics Convergence, and Automation Technologies

The proteomics landscape is undergoing a profound metamorphosis driven by four key trends that coalesce to redefine research capabilities and commercial potential. First, the integration of artificial intelligence and machine learning algorithms into protein identification and pathway analysis workflows has significantly enhanced throughput and prediction accuracy. These computational advances deliver refined peptide quantification, enable real-time data interpretation, and facilitate the rapid discovery of disease-specific biomarkers. Second, the rise of single-cell proteomics is illuminating the heterogeneity of cellular populations, thereby unlocking insights into rare cell subsets and dynamic protein expression profiles within complex tissues.

In parallel, multi-omics convergence is fostering holistic investigations that interconnect proteomic data with genomic, transcriptomic, and metabolomic layers. This integrative approach yields multidimensional maps of cellular networks, fostering new avenues for target validation and precision medicine. Finally, automation technologies-from robotic sample preparation to high-capacity fractionation systems-are streamlining workflows and reducing variability across labs. Together, these transformative shifts underscore a market trajectory defined by enhanced data fidelity, reduced time-to-result, and broadening applications across drug discovery, clinical diagnostics, and agricultural biotechnology.

Analyzing the Cumulative Effects of the 2025 United States Tariff Measures on Proteomics Supply Chains, Cost Structures, and Innovation Trajectories

The introduction of new United States tariffs in early 2025 has precipitated ripple effects across the proteomics supply chain, influencing both cost structures and strategic sourcing decisions. Instruments such as mass spectrometers and chromatography systems, often manufactured overseas, have faced incremental duties that translate into higher capital expenditures for research institutions and commercial laboratories. Consumables including antibody kits, microarrays, and specialized reagents have similarly been affected, prompting procurement teams to reassess supplier portfolios and explore alternative product offerings that minimize duty impact. As a result, some companies have accelerated partnerships with domestic manufacturers, while others are leveraging bonded warehousing solutions to defer tariff-related costs.

Beyond cost considerations, the tariff environment has sparked a reevaluation of innovation trajectories, with many firms intensifying local R&D efforts to reduce dependency on imported technologies. In particular, the development of homegrown chromatography columns and enzyme formulations has gained momentum. Software licensing models have also adapted, with an increasing shift toward cloud-based subscription services that alleviate upfront hardware importation. These cumulative impacts underscore the importance of agility and strategic foresight, as organizations navigate a landscape where regulatory shifts have direct implications on pricing, supply chain resilience, and competitive positioning within the proteomics arena.

Uncovering Critical Segmentation Dynamics across Types, Product Categories, Technologies, Applications, and End User Profiles in Proteomics Market

A nuanced understanding of the proteomics market emerges when examined through multiple segmentation lenses, each revealing distinct dynamics and growth drivers. By type, expression proteomics continues to dominate early-stage research due to its ability to quantify protein abundance across biological samples, while functional proteomics is increasingly adopted to elucidate protein interactions and post-translational modifications. Structural proteomics, though capital-intensive, is gaining traction among organizations focused on drug design, as it provides critical information about protein conformations that inform ligand development.

Considering product type, consumables remain the bedrock of routine proteomic workflows, encompassing a spectrum from antibody kits and columns to microarrays and reagents such as chemicals, enzymes, and labels. Complementing these are instruments including chromatography systems, mass spectrometers, microarray scanners, and protein fractionation units, which collectively enable high-throughput analysis. The proliferation of service offerings-spanning consulting, custom analysis, and instrument maintenance-underscores the collaborative nature of the field, while software solutions, characterized by bioinformatics platforms, cloud-based services, and data analysis tools such as pathway analysis, protein identification, and quantitative analysis, facilitate interpretation of complex datasets.

Delving into technology, chromatography techniques-both gas chromatography and high-performance liquid chromatography-retain widespread use for sample separation, whereas mass spectrometry remains the gold standard for protein identification and quantification. Advances in protein microarray platforms and X-ray crystallography continue to complement these core technologies, expanding capabilities for high-resolution structural analysis. From an application standpoint, demand is robust in biomarker discovery, disease diagnostics-particularly cancer and infectious disease diagnostics-and drug discovery pipelines. Additionally, proteomic techniques are applied in environmental monitoring, food safety testing, and agricultural research to ensure ecological health and crop optimization. Finally, end-user segmentation reveals diverse adoption patterns: academic research institutions drive foundational science, contract research organizations offer scalable analytical capacity, hospitals and diagnostic labs integrate proteomic assays into clinical workflows, and pharmaceuticals and biotechnology companies invest heavily to accelerate therapeutic programs.

This comprehensive research report categorizes the Proteomics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Type

- Technology

- Proteomics Type

- Application

- End-User

Mapping Regional Proteomics Market Dynamics through Comparative Analysis of Americas, Europe Middle East & Africa, and Asia-Pacific Growth Drivers

Regional nuances significantly influence proteomics market development, as each geography exhibits unique regulatory environments, funding mechanisms, and collaborative networks. In the Americas, strong government and private-sector investments in precision medicine have bolstered the adoption of advanced proteomic platforms. The United States, in particular, benefits from robust clinical trial pipelines and a mature biotech ecosystem that drives continuous demand for high-throughput proteomic analyses. Canada’s research institutions further contribute through cross-border collaborations, supplying specialized instrumentation and consulting services to support North American initiatives.

Across Europe, Middle East & Africa, regulatory harmonization efforts and pan-regional funding consortia have facilitated the deployment of proteomics in disease diagnostics and biomarker validation. Western European countries lead in structural proteomics capabilities, backed by extensive crystallography facilities and academic-industrial partnerships. Meanwhile, the Middle East is emerging as a hub for translational research, leveraging proteomic technologies to address regional public health priorities. In Africa, targeted initiatives focus on infectious disease diagnostics, with proteomic methodologies enhancing surveillance and vaccine development programs.

Asia-Pacific stands out for its rapid infrastructure expansion and government-backed proteome research centers. China and Japan are spearheading large-scale proteomic mapping projects, while India and South Korea invest heavily in mass spectrometry and bioinformatics platforms. Collaborative networks within the Asia-Pacific region facilitate knowledge transfer and accelerate technology commercialization, making it a pivotal driver of global proteomics innovation.

This comprehensive research report examines key regions that drive the evolution of the Proteomics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation Strategic Partnerships and Competitive Advantages in the Global Proteomics Landscape

A select group of companies continues to shape the competitive landscape through technology leadership, strategic partnerships, and targeted acquisitions. Major players in instrument manufacturing have introduced next-generation mass spectrometry platforms with enhanced resolution and throughput, thereby raising performance benchmarks. These firms also collaborate with reagent suppliers to co-develop antibody kits and labeling chemistries optimized for their systems, ensuring end-to-end workflow compatibility and superior data quality.

Bioinformatics and software solution providers are likewise expanding their portfolios, integrating cloud-based platforms with artificial intelligence modules for pathway analysis and predictive modeling. Meanwhile, contract research organizations and specialized service providers are forging alliances with academic centers to offer turnkey proteomic services, ranging from sample preparation to data interpretation. In parallel, niche players focusing on structural proteomics instrumentation and microarray technologies have carved out leadership positions in high-value applications such as drug discovery and structural biology. Collectively, these companies define the market’s strategic playbook, balancing innovation with customer-centric service offerings to meet the evolving needs of proteomics end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Proteomics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Alphalyse A/S

- Applied Biomics, Inc.

- BGI Group

- Bio-Rad Laboratories, Inc.

- Biogenity ApS

- Bruker Corporation

- CD Genomics

- CovalX AG

- Creative Proteomics

- Danaher Corporation

- Evosep ApS

- Illumina, Inc.

- JPT Peptide Technologies GmbH

- Merck KGaA

- Metware Biotechnology Inc.

- MS Bioworks LLC

- PerkinElmer Inc.

- PolyQuant GmbH

- Proteome Factory AG

- Proteomics International Pty Ltd.

- Rapid Novor Inc.

- Thermo Fisher Scientific Inc

- VProteomics

- Waters Corporation

Strategic Roadmap for Industry Leaders to Navigate Emerging Proteomics Trends Optimize Operations and Capitalization on Market Opportunities

Industry leaders should prioritize investment in automation and AI-driven analytics to streamline proteomic workflows and accelerate time to insight. By integrating robotic sample handling with machine learning–enabled data processing, organizations can minimize variability and maximize reproducibility across large-scale studies. Concurrently, forging strategic collaborations with regional instrument manufacturers and reagent developers can mitigate tariff exposure and enhance supply chain resilience, ensuring consistent access to critical components.

Expanding in-house bioinformatics capabilities or partnering with cloud-based solution providers is essential to harness the full potential of proteomic datasets. Implementing modular software architectures that support pathway analysis, quantitative assessment, and custom reporting will empower multidisciplinary teams to derive actionable conclusions rapidly. Furthermore, deploying hybrid business models that combine product sales with service offerings-such as instrument maintenance, consulting, and custom analytical services-can generate recurring revenue streams and deepen customer engagement.

Finally, cultivating talent through targeted training programs in single-cell proteomics, multi-omics integration, and structural analysis will equip organizations to address emerging research challenges. Establishing internal centers of excellence, complemented by external academic and industry partnerships, provides a robust platform for continuous innovation and ensures that companies remain at the forefront of proteomic discovery.

Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Robust Validation Techniques for Market Insights

To deliver comprehensive insights, this research employed a multi-tiered methodology combining primary and secondary data sources with rigorous validation protocols. Initially, extensive secondary research was conducted, encompassing peer-reviewed journals, patent databases, regulatory filings, and scientific conference proceedings. This foundational work established baseline industry definitions, technology taxonomies, and competitive landscapes.

Subsequently, primary research involved in-depth interviews with more than 50 stakeholders, including academic researchers, instrument manufacturers, reagent suppliers, bioinformatics solution providers, and end-user organizations. These discussions provided qualitative perspectives on market drivers, technological bottlenecks, and adoption barriers. Quantitative data points-such as shipment volumes, pricing trends, and service portfolio expansions-were triangulated through company disclosures, financial reports, and industry associations.

The gathered inputs underwent multiple validation layers, incorporating cross-verification between primary interview responses and secondary source data. Any discrepancies were flagged for follow-up or corrected through supplier audits and expert panel reviews. Finally, data synthesis integrated segmentation analyses, regional dynamics, and competitive benchmarking to produce a holistic view of the proteomics market, ensuring that the findings align with real-world industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Proteomics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Proteomics Market, by Type

- Proteomics Market, by Product Type

- Proteomics Market, by Technology

- Proteomics Market, by Proteomics Type

- Proteomics Market, by Application

- Proteomics Market, by End-User

- Proteomics Market, by Region

- Proteomics Market, by Group

- Proteomics Market, by Country

- United States Proteomics Market

- China Proteomics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concluding Insights Highlighting Proteomics Market Trajectory Core Drivers and Strategic Imperatives for Stakeholders to Consider

The proteomics landscape is rapidly evolving, driven by technological breakthroughs, shifting regulatory frameworks, and dynamic funding environments. As instrumentation, consumables, and software platforms become increasingly sophisticated and interconnected, stakeholders must remain vigilant to harness new opportunities. The interplay between tariffs, regional initiatives, and collaborative networks underscores the importance of strategic agility in both procurement and innovation.

By understanding segmentation nuances-ranging from expression and functional proteomics to end-user adoption patterns-organizations can tailor their offerings to meet specific research requirements. Leading companies will continue to differentiate through integrated solutions and service excellence, while emerging players may find growth potential in niche applications such as single-cell analysis and structural biology. Ultimately, the stakeholders that invest in automation, AI-driven analytics, and cross-sector partnerships will be best positioned to drive proteomic discoveries, support translational research, and deliver value across the life sciences continuum.

Connect with Ketan Rohom to Unlock In-Depth Proteomics Market Intelligence and Secure Your Comprehensive Research Report Today

Engaging with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) empowers you to delve deeper into the nuances of the proteomics market and obtain tailored data analytic services. By initiating a conversation with Ketan, you gain direct access to bespoke research packages that align precisely with your strategic goals. Whether you require exhaustive competitive landscapes, granular segmentation breakdowns, or forecasting models tailored to your supply chain, Ketan’s expertise ensures that each deliverable resonates with your unique business context.

Taking the next step is simple: reach out to Ketan Rohom today to schedule a personalized consultation. He will guide you through the comprehensive report’s key sections, address any specific queries you may have, and outline flexible licensing options. Harness this opportunity to accelerate your market entry, refine your product roadmap, and stay ahead of emerging trends with data-driven insights. Contact Ketan to secure your copy of the proteomics market research report and transform raw data into actionable strategy.

- How big is the Proteomics Market?

- What is the Proteomics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?