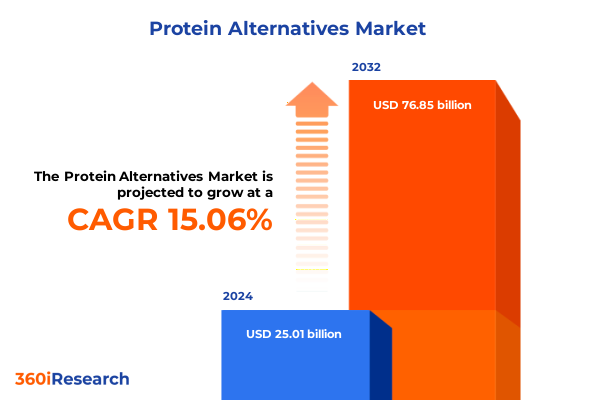

The Protein Alternatives Market size was estimated at USD 28.36 billion in 2025 and expected to reach USD 32.16 billion in 2026, at a CAGR of 15.30% to reach USD 76.85 billion by 2032.

Uncovering How Evolving Consumer Health Priorities and Sustainability Imperatives Are Driving the Transformation of the Protein Alternatives Landscape Globally

The global market for protein alternatives has undergone a remarkable evolution in recent years, driven by a convergence of consumer health priorities and environmental imperatives. As awareness of the link between diet and chronic disease has intensified, more individuals are seeking protein sources that offer functional benefits beyond basic nutrition. This wave of health consciousness has intersected with growing concerns about the environmental footprint of animal agriculture, spurring demand for proteins that deliver on both wellness and sustainability fronts.

Simultaneously, demographic shifts and lifestyle trends have expanded the addressable market. Younger generations, particularly Gen Z and millennials, are embracing flexitarian and plant-centric diets, viewing food choices as extensions of personal values. This consumer-driven momentum has been further amplified by a surge in digital media and social platforms, where narratives around climate impact, animal welfare, and clean-label credentials are shaping purchasing behavior at an unprecedented pace. As a result, industry stakeholders-from ingredient suppliers to finished-product manufacturers-are reorienting their R&D and supply chains to meet these multidimensional expectations.

Against this backdrop, the protein alternatives landscape has diversified far beyond traditional soy and pea isolates. Today’s market features a broad spectrum of sources and production methods, each promising unique functional, sensory, and nutritional advantages. Consumer curiosity is at an all-time high, and the winning strategies will be those that anticipate and address emerging preferences with scientifically validated, transparent solutions. This executive summary offers a panoramic view of the transformative forces at play, equipping decision-makers with the insights needed to navigate a rapidly shifting competitive environment.

Exploring the Pivotal Technological and Consumer-Led Shifts Propelling Growth and Diversification in the Alternative Protein Industry

As the protein alternatives industry matures, technological breakthroughs and shifting consumer mindsets are redefining what constitutes a viable protein source. The surge in fermentation-based offerings exemplifies this trend: precision fermentation platforms are now capable of producing dairy-identical whey and casein proteins without cows, and companies are harnessing microbial processes to generate egg white analogs, collagen substitutes, and novel flavor-modulating ingredients. This trend not only addresses sustainability and animal welfare concerns but also unlocks functional performance attributes-such as heat stability and emulsification-for use in complex formulations.

Meanwhile, investment patterns reveal a notable divergence from the pure plant-based sector. In the first half of 2024, Europe’s fermentation-focused companies secured €164 million in funding, surpassing total plant-based investment for the period and signaling renewed investor confidence in scalable, precision-driven production methods. This capital infusion is accelerating the commercialization of mycoproteins, single-cell proteins, and other microbial-derived ingredients, paving the way for textured meat and fish analogs that rival animal products in taste and mouthfeel.

Another pivotal shift lies in the mainstream acceptance of algae- and fungi-based proteins. Driven by growing concern over land use and deforestation, producers have scaled up cultivation of microalgae strains such as Chlorella and Spirulina, delivering nutrient-rich profiles with minimal water and land requirements. Parallel advances in mycoprotein fermentation have enabled fungal strains to yield fibrous, meat-like textures, capturing the interest of both foodservice operators and retail channels. Mycoprotein adoption grew by an estimated 6.2% year-over-year in 2024, as leading innovators expanded portfolios of ready-to-eat formats-from sausages to dumplings-targeted at flexitarian consumers.

Collectively, these technological and consumer-led transformations are redefining product development paradigms. Ingredient providers are now evaluated not just on cost and functionality, but also on traceability, scalability, and carbon footprint metrics. As firms invest in next-generation bioprocessing infrastructure and forge partnerships spanning biotech, food science, and digital traceability, the protein alternatives sector is poised for a new phase of growth rooted in both innovation and impact.

Analyzing the Far-Reaching Effects of Recent United States Trade Measures on Import Dynamics and Domestic Supply Resilience in 2025

The imposition of antidumping and countervailing duties on imported pea protein from China has had profound implications for supply chains and cost structures in the United States. Beginning in 2023, rates of up to 270% for antidumping duties and 340% for countervailing duties were applied retroactively to shipments dating back to August 2023, targeting high-protein-content pea isolates sourced from the world’s leading exporter. This policy intervention disrupted longstanding sourcing strategies, as domestic manufacturers who historically procured over 96% of their pea protein from China faced steep cost increases almost overnight.

The resultant supply shock triggered reformulation efforts across the food and beverage landscape, with formulators exploring alternative legumes, grains, and fermentation-derived proteins to maintain price and sensory specifications. Some high-volume producers have since announced phased shifts toward North American pea processing, aiming to insulate their operations from trade policy volatility. Yet, these transition strategies require significant capital investment in extraction facilities and logistics, underscoring the need for diversified supply bases.

Concurrently, new tariff risks have emerged for pea protein sourced from Canada. Beyond Meat’s 2025 10-K report cautioned that any countermeasures or additional duties could compel the company to either raise consumer prices, absorb margin compression, or reengineer its product formulations. This heightened uncertainty has prompted industry players to pursue multi-source procurement models, blending domestic extraction, cross-border partnerships, and alternative ingredient categories to mitigate future trade-related disruptions.

Overall, the cumulative impact of U.S. trade measures in 2025 has underscored the strategic imperative of supply chain resilience. Manufacturers are now embedding scenario planning for tariff escalation, investing in localized production capacity, and broadening their ingredient portfolios to ensure continuity of supply and competitive pricing in an environment of unpredictable trade policies.

Deriving Critical Insights from Comprehensive Segmentation Analyses That Illuminate Diverse Protein Alternative Consumer and Product Profiles

To fully capitalize on emerging opportunities, it is essential to understand the nuanced segmentation of the protein alternatives market across multiple dimensions. By source, the industry encompasses distinct categories such as algae-based proteins, which include microalgae strains like Chlorella and Spirulina prized for their complete amino acid profiles and antioxidant content. Fungi-based proteins-principally mycoprotein derived from Fusarium venenatum-offer fibrous textures that mimic meat analogs, while legume-derived proteins such as pea, soy, and wheat provide versatile isolates and concentrates for a myriad of applications. Each source presents unique functional characteristics, from gelation and emulsification to flavor masking and nutritional fortification.

Application segmentation further clarifies how these ingredients integrate into end products. Animal feed formulations have embraced alternative proteins for aquaculture, livestock, and poultry feeds, driven by sustainability goals and concerns over antibiotic use. In the beverage sector, powdered drink mixes and ready-to-drink formulations leverage clean-label proteins to meet consumer demand for on-the-go nutrition. Food applications span bakery, dairy alternatives, meat substitutes, and snacks, where texture, taste, and label transparency are key purchase drivers. Pharmaceutical and supplement markets rely on encapsulated, powdered, and tablet formats to deliver targeted health benefits, from muscle recovery to immune support.

Form preferences reflect consumer convenience and functionality. Bars and ready-to-drink offerings cater to lifestyle nutrition, while liquid proteins are integrated into meal-replacement shakes and functional beverages. Powdered protein remains a mainstay for customized formulations at retail and in foodservice. Capsules occupy pharmaceutical and nutraceutical spaces, ensuring precise dosing and extended shelf stability.

The distribution landscape bridges digital and physical channels. Brand-owned websites and e-commerce platforms have emerged as vital portals for direct-to-consumer engagement, offering subscription models and personalized product bundles. Pharmacies and drug stores maintain strong credibility for supplement-grade proteins, while specialty retailers-such as health food and organic stores-drive trial and education through curated assortments. Mass-market availability through supermarkets and hypermarkets ensures broad consumer reach and price competitiveness.

Finally, end-user segmentation sheds light on target demographics. Athletes seek proteins that optimize performance and recovery, while the elderly prioritize formulations that support bone health and muscle mass retention. The general population pursues balanced wellness, and health-conscious consumers demand non-GMO, allergen-free, and clean-label credentials. Weight management consumers focus on satiety and calorie-controlled formulations. By synthesizing these segmentation lenses, industry leaders can hone product positioning, tailor messaging, and allocate resources for maximum market impact.

This comprehensive research report categorizes the Protein Alternatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Application

- Form

- Distribution Channel

- End User

Unveiling Regional Market Dynamics and Growth Trajectories Across Americas, EMEA, and Asia-Pacific Protein Alternative Demand Patterns

Regional dynamics reveal distinct pathways of adoption and growth within the protein alternatives sector. In the Americas, the United States remains the epicenter of innovation and consumption, underpinned by robust infrastructure for ingredient processing and strong support for local pea and fungal protein production. Canadian producers have also positioned themselves as reliable exporters, especially for high-purity pea isolates, although recent trade tensions have underscored the need for diversified sourcing. Latin American markets-led by Brazil, Argentina, and Chile-are increasingly integrating plant-based proteins into both retail and foodservice offerings, fueled by rising middle-class incomes and shifting dietary patterns.

Europe, Middle East & Africa (EMEA) presents a fragmented yet dynamic landscape. Western Europe spearheads consumer adoption of alternative proteins, driven by stringent environmental regulations and well-established retail channels for plant-based foods. Countries such as the United Kingdom, Germany, and the Netherlands exhibit above-average per-capita consumption and host leading ingredient innovators specializing in fermentation and mycoprotein cultivation. In the Middle East & Africa, urbanization and growing health awareness are creating pockets of demand, although infrastructure constraints and price sensitivity temper immediate expansion.

Asia-Pacific stands out as the fastest-growing region, with China, India, Japan, and Australia emerging as key battlegrounds for protein alternative suppliers. Rising urbanization, a burgeoning middle class, and government initiatives to reduce the environmental impact of livestock agriculture are propelling investments in both traditional plant proteins and next-generation fermentation technologies. In particular, the fungal protein segment in Asia-Pacific is projected to grow at rates exceeding 5.6% annually, reflecting both local R&D advancements and increasing consumer openness to novel protein sources. Additionally, precision fermentation partnerships are gaining traction, as local companies collaborate with global biotech firms to establish production facilities and adapt formulations to regional taste profiles.

This comprehensive research report examines key regions that drive the evolution of the Protein Alternatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation and Competitive Advantage in Protein Alternatives Space

A constellation of pioneering companies is shaping the competitive landscape of protein alternatives, each leveraging distinct core competencies to capture emerging segments. In the pea protein domain, Axiom Foods’ introduction of Vegotein™ N neutral pea protein produced in North America has exemplified how local processing can mitigate tariff-induced supply disruptions and offer producers a cost-competitive, flavor-neutral ingredient alternative. Meanwhile, Puris Proteins, backed by Cargill, successfully secured anti-dumping and countervailing duties against Chinese imports-strengthening the case for domestic capacity expansion and ensuring more stable supply for leading consumer brands.

In the alt-meat segment, Beyond Meat continues to dominate retail visibility, although its 2025 annual report flagged potential tariff risks on Canadian pea protein imports, prompting the brand to explore multi-source strategies to safeguard margin integrity. Complementing these commodity-scale players, mycoprotein specialists such as Quorn Foods and Nature’s Fynd are driving innovation in textured meat analogs, expanding their footprints in frozen and chilled retail formats while forging partnerships with fast-food operators.

On the fermentation front, European Protein’s strategic alliance with Malaysian feed producers and Ajinomoto’s collaboration with AI-driven protein discovery platform Shiru underscore the escalating interest in microbial-derived ingredients that can replicate animal proteins with precision. This convergence of biotech and food science is further supported by venture investors, as evidenced by record-breaking funding rounds for precision fermentation startups in H1 2024.

Beyond ingredient suppliers, major CPG and foodservice operators-ranging from dairy alternative pioneers like Oatly to global restaurant chains-are forging supply agreements, launching co-branded product lines, and investing in captive fermentation facilities. Such integrative strategies reflect a race to secure long-term access to high-performance proteins and illustrate how collaborative ecosystems are instrumental in scaling next-generation solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protein Alternatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Beyond Meat, Inc.

- Conagra Brands, Inc.

- Danone S.A.

- Kellogg Company

- Maple Leaf Foods Inc.

- Nestlé S.A.

- Oatly Group AB

- Tyson Foods, Inc.

- Unilever PLC

Guiding Actionable Strategies for Market Leaders to Capitalize on Emerging Protein Alternative Trends and Strengthen Resilience

To navigate the complexities of a rapidly evolving protein alternatives landscape, industry leaders should prioritize supply chain diversification. Establishing localized extraction and fermentation capabilities will mitigate exposure to geopolitical risks and tariff volatility while supporting shorter lead times and reduced carbon footprints. Concurrently, building partnerships with biotechnology firms can accelerate access to novel protein platforms, from algae and mycoprotein to precision-fermented dairy analogs.

Organizations must also invest in formulation innovation that balances functionality, cost, and clean-label credentials. Leveraging advanced blending techniques-such as hybridizing plant isolates with fermentation-derived proteins-can enable product developers to optimize mouthfeel, taste, and nutritional profiles. Embedding sustainability metrics into R&D frameworks will further reinforce brand positioning among environmentally conscious consumers.

On the commercial front, cultivating direct-to-consumer channels through e-commerce platforms and subscription models can enhance data-driven engagement and allow for rapid iteration based on real-world feedback. Meanwhile, strategic alliances with foodservice distributors and retail partners will expand reach and foster cross-category collaboration, such as plant-based menu integrations in quick-service restaurants.

Finally, organizations should implement robust scenario planning to anticipate regulatory shifts, such as potential adjustments to tariff policies or novel food approvals. By integrating market intelligence, legal insights, and supply chain analytics, executives can develop agile strategies that maintain operational resilience and capitalize on emergent opportunities before competitors.

Detailing Rigorous Research Methodology Underpinning Market Insights, Data Collection, and Analysis Processes for Robust Findings

This analysis draws upon a multifaceted research methodology combining both primary and secondary data sources. Primary insights were acquired through in-depth interviews with industry executives, ingredient suppliers, and formulators, ensuring that frontline perspectives on supply chain challenges and innovation dynamics inform our conclusions. Complementing these interviews, quantitative surveys of consumer attitudes provided a granular understanding of evolving purchase drivers, from functional benefits to sustainability preferences.

Secondary research encompassed a rigorous review of trade and regulatory filings, patent databases, and financial disclosures to trace tariff measures, investment flows, and capacity expansions across key markets. Proprietary data triangulation methods were applied to harmonize disparate data points-such as production volumes, import-export statistics, and funding rounds-thereby validating trends and identifying potential inflection points.

In addition, advanced analytic techniques, including scenario modeling and sensitivity analysis, were employed to assess the impact of trade policy changes and supply chain disruptions. This approach enabled estimation of cost pressures and sourcing elasticity under diverse regulatory environments. Geographic insights were enriched through regional market reports and localized case studies, highlighting variations in consumer behavior and infrastructure maturity.

Ethical considerations guided the entire process, with transparency in data sourcing, conflict-of-interest disclosures, and adherence to relevant research standards. The resulting framework provides a robust foundation for strategic decision-making, equipping stakeholders with actionable intelligence tailored to the protein alternatives market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protein Alternatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protein Alternatives Market, by Source

- Protein Alternatives Market, by Application

- Protein Alternatives Market, by Form

- Protein Alternatives Market, by Distribution Channel

- Protein Alternatives Market, by End User

- Protein Alternatives Market, by Region

- Protein Alternatives Market, by Group

- Protein Alternatives Market, by Country

- United States Protein Alternatives Market

- China Protein Alternatives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Executive Summary Key Takeaways to Illuminate the Strategic Value and Future Opportunities in Protein Alternatives Market

The protein alternatives market is at a pivotal juncture, shaped by converging trends in health, sustainability, and technological innovation. Consumers are demanding ingredients that not only deliver on performance and nutrition but also align with broader societal and environmental objectives. Simultaneously, trade policy interventions and shifting investment patterns underscore the strategic importance of supply chain resilience and adaptive business models.

Key transformative drivers include the rise of precision fermentation and cellular agriculture, which are expanding the portfolio of viable protein sources beyond traditional plant isolates. Algae and mycoprotein technologies are gaining momentum, backed by growing investor confidence and regulatory support. At the same time, novel tariff dynamics have accelerated the localization of production and spurred collaborative ventures aimed at insulating the sector from geopolitical headwinds.

Segmentation analysis reveals a landscape rich in opportunity: diverse source materials, application channels, product formats, distribution networks, and end-user niches all present avenues for differentiation. Regional insights underscore heterogeneity in adoption rates, with mature Western markets coexisting alongside high-growth corridors in Asia-Pacific and Latin America. Leading companies are responding with targeted strategies-ranging from R&D partnerships and facility expansions to direct-to-consumer engagement models and regulatory advocacy.

The path forward will favor organizations that combine strategic foresight with operational agility. By integrating robust analytics, embracing cross-sector collaborations, and embedding sustainability metrics into core functions, industry participants can capture value in a market projected to reshape the future of food. Our findings equip decision-makers with the clarity and confidence to invest wisely, innovate boldly, and lead the protein alternatives revolution.

Seize the Competitive Edge with an In-Depth Protein Alternatives Report—Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence

To gain an authoritative understanding of evolving consumer preferences, supply chain dynamics, and regulatory influences shaping the protein alternatives sector, connect with Ketan Rohom. As an accomplished Associate Director of Sales & Marketing, Ketan can provide tailored guidance on how your organization can leverage emerging opportunities and mitigate risks highlighted by our comprehensive analysis. Reach out today to secure your copy of the full market research report and ensure your strategic decisions are underpinned by the latest, most robust intelligence.

- How big is the Protein Alternatives Market?

- What is the Protein Alternatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?