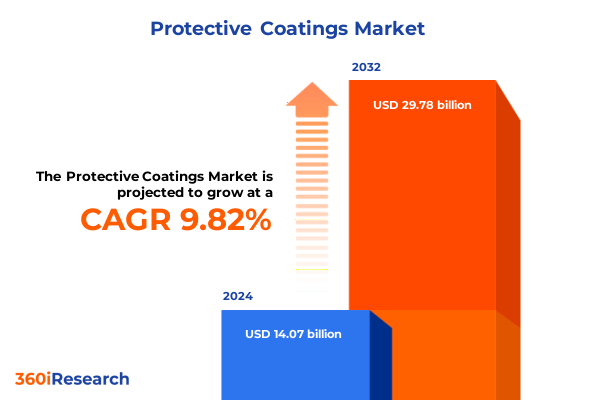

The Protective Coatings Market size was estimated at USD 15.22 billion in 2025 and expected to reach USD 16.46 billion in 2026, at a CAGR of 10.06% to reach USD 29.78 billion by 2032.

Unveiling the Strategic Importance and Market Dynamics Driving the Protective Coatings Industry in a Rapidly Evolving Global Environment

Protective coatings have emerged as indispensable solutions across industries ranging from infrastructure and transportation to energy and marine applications. Their ability to shield surfaces from environmental degradation, chemical attack, and mechanical wear fosters long-term asset protection and operational efficiency. As global supply chains evolve and environmental regulations tighten, the demand for coatings that deliver superior performance under extreme conditions is intensifying. This landscape underscores the strategic importance of understanding the evolving market dynamics that drive innovation, investment decisions, and competitive positioning within the protective coatings sector.

This executive summary sets the foundation for a detailed exploration of key factors shaping the protective coatings industry. It highlights the transformative forces at play, examines the impact of recent policy developments such as U.S. tariffs in 2025, and delves into the critical segmentation insights that define market complexity. Additionally, regional demand patterns, leading corporate strategies, and a robust research methodology are outlined to provide a holistic view. The concluding sections offer actionable recommendations and a compelling call to action for decision-makers seeking a competitive edge.

Exploring the Critical Technological and Sustainability Transformations Redefining Protective Coatings for Industry Resilience

Emerging technological innovations are redefining how protective coatings are formulated, applied, and maintained. Advances in nanotechnology and smart coatings have introduced self-healing capabilities and real-time condition monitoring, fostering proactive maintenance strategies. At the same time, digital tools like artificial intelligence–driven formulation platforms and data analytics are accelerating product development cycles, enabling companies to tailor coatings for specific service conditions with precision. These shifts are complemented by sustainability imperatives, with a growing focus on solvent reduction, renewable raw material sourcing, and life-cycle assessments that minimize environmental footprints.

Regulatory frameworks and end-user expectations further amplify these transformative trends. Stricter emission limits and volatile organic compound regulations have propelled the adoption of waterborne and radiation cured technologies over traditional solvent borne systems. Concurrently, the global emphasis on circular economy principles is steering demand toward coatings that can be reapplied or recycled with minimal substrate disruption. This confluence of regulation, environmental responsibility, and digital innovation is accelerating market realignment and compelling industry players to adopt agile strategies.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Protective Coatings Supply Chains and Industry Economics

The introduction of elevated U.S. tariffs in 2025 has reshaped the cost structure and sourcing strategies within the protective coatings supply chain. Import levies on key raw materials such as epoxy resins and specialty pigments have increased input costs for formulators, prompting many to seek alternative suppliers or intensify local procurement. Domestic manufacturers have experienced a dual effect; while some benefit from reduced foreign competition, others face increased operational expenditures when importing niche components unavailable domestically. These dynamics have triggered a reevaluation of pricing models and contract terms throughout the value chain.

Consequently, the tariff environment has also sparked innovation in material substitution and process optimization. Coating producers are experimenting with hybrid resin systems that balance performance requirements against cost pressures, and some have accelerated the development of in‐house pigment dispersion capabilities. In parallel, partnerships with regional raw material suppliers have gained traction as companies strive for greater supply security and predictable pricing. Overall, the cumulative impact of 2025 tariff policies underscores the need for strategic flexibility and proactive supply chain management in securing competitive advantage.

Driving Market Understanding Through Multifaceted Segmentation Across Resin Types, Technologies, and End-Use Applications

Insights derived from a multi-dimensional segmentation framework reveal how resin composition, application methodology, and functional attributes shape market dynamics. The study has explored a diverse range of resin types including acrylic, alkyd, epoxy, fluoropolymer, and polyurethane, each offering unique performance profiles for resistance to abrasion, chemicals, and ultraviolet exposure. Alongside resin choice, technology platforms such as powder coating, radiation cured methods, solvent borne formulations, and waterborne solutions define product positioning across industrial sectors. This layered analysis enables stakeholders to pinpoint high-value segments and align product development with evolving customer requirements.

Equally critical to market understanding are the various application techniques and end-use environments that drive product selection. Whether coatings are applied via brush, dip, electrostatic spray, flow, roll, or conventional spray methods, the choice of application method impacts operational efficiency and coating integrity. Functional requirements such as abrasion resistance, anti-corrosive behavior, chemical tolerance, heat endurance, and UV protection further influence decision-making. Finally, the form factor-whether presented as liquid or powder-affects storage, handling, and environmental considerations. Together, these segmentation dimensions create a comprehensive view of demand patterns and performance expectations.

This comprehensive research report categorizes the Protective Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Function

- Form

- Application

- End Use Industry

Mapping Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Protective Coatings Demand Patterns

Regional demand patterns in the protective coatings market reflect diverse industrial compositions and regulatory landscapes. In the Americas, investment in infrastructure renewal and a resurgence in oil and gas exploration have spurred demand for corrosion-resistant coatings and specialty formulations tailored to harsh service conditions. North American manufacturers are increasingly prioritizing low-VOC and sustainable solutions in response to evolving environmental standards and end-user expectations for greener alternatives. Meanwhile, Latin American markets show potential for growth driven by expanding construction and automotive sectors seeking long-lasting protective finishes.

Across Europe, the Middle East, and Africa, stringent environmental regulations and a mature industrial base drive innovation in high-performance coatings. European markets emphasize sustainability through circular coating initiatives and strict compliance with emission regulations, while Middle Eastern marine and energy applications demand coatings that withstand extreme temperature fluctuations and saltwater exposure. In Africa, infrastructure investments are fostering new opportunities for durable coatings in the building and transportation sectors. Meanwhile, the Asia-Pacific region remains a powerhouse of demand due to robust manufacturing, rapidly expanding infrastructure projects, and strong automotive production, with governments incentivizing local production and technology transfers to support industry growth.

This comprehensive research report examines key regions that drive the evolution of the Protective Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Highlight Strategic Approaches and Competitive Advantage in Protective Coatings Market

Leading corporations in the protective coatings market leverage extensive R&D capabilities, vast distribution networks, and diversified product portfolios to maintain competitive edge. Global players have intensified collaboration with raw material suppliers, academic institutions, and end users to accelerate innovation, particularly in next-generation waterborne systems and sustainable resin alternatives. Their strategies often include strategic acquisitions that enhance geographic reach and broaden application expertise, along with targeted investments in digital tools for formulation and supply chain visibility.

At the same time, agile specialty coatings firms differentiate themselves by offering customized solutions for niche applications such as offshore platforms, power generation, and high-performance automotive coatings. These companies prioritize customer intimacy by providing technical support, on-site training, and rapid-response service models. Their lighter organizational structures enable swift adaptation to emerging regulations and client specifications, fostering strong partnerships in markets where responsiveness and tailored performance are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Protective Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems, LLC

- BASF SE

- Berger Paints India Limited

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- Teknos Group Oy

- The Sherwin-Williams Company

Implementing Strategic Actions for Growth, Sustainability, and Innovation to Navigate the Protective Coatings Market Successfully

Industry leaders must prioritize investment in sustainable technology platforms to stay ahead of regulatory shifts and customer preferences. By accelerating the development of low-VOC waterborne systems and exploring bio-based resin alternatives, companies can address environmental mandates and differentiate their offerings. Concurrently, expanding capabilities in digital formulation and predictive maintenance analytics can enhance product performance and reduce development timelines. Strategic partnerships with raw material suppliers and research institutions will provide access to novel chemistries and improve supply chain resilience.

Furthermore, firms should cultivate agile business models that allow rapid deployment of new coatings in growth markets and niche segments. Establishing regional innovation centers and localizing production can mitigate tariff impacts and shorten lead times. Training programs for applicators and end users will ensure optimal coating performance and foster customer loyalty. By integrating these action points into corporate strategy, organizations can secure sustainable revenue streams and solidify their position in an increasingly competitive landscape.

Detailing Comprehensive Research Methodology Integrating Primary Interviews, Secondary Analysis, and Rigorous Data Verification Processes

The research methodology underpinning this report combines rigorous primary and secondary approaches to ensure robust, validated insights. Primary research involved structured interviews with key stakeholders across the value chain, including raw material suppliers, formulators, applicators, and end users. These conversations provided firsthand perspectives on market challenges, emerging trends, and product performance criteria. Secondary research encompassed a thorough review of industry publications, technical papers, regulatory filings, and financial reports from publicly available sources to supplement and corroborate primary findings.

Data triangulation was applied to reconcile conflicting information, with quantitative data points cross-verified against multiple reputable sources. Segmentation analysis was implemented using a systematic framework that categorizes the market by resin type, technology platform, application method, end use industry, functional attributes, and form. Geographic coverage spans the Americas, Europe, Middle East & Africa, and Asia-Pacific, with regional nuances accounted for in demand projections and competitive intelligence. This comprehensive approach ensures the report delivers a balanced, accurate, and actionable market perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Protective Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Protective Coatings Market, by Resin Type

- Protective Coatings Market, by Technology

- Protective Coatings Market, by Function

- Protective Coatings Market, by Form

- Protective Coatings Market, by Application

- Protective Coatings Market, by End Use Industry

- Protective Coatings Market, by Region

- Protective Coatings Market, by Group

- Protective Coatings Market, by Country

- United States Protective Coatings Market

- China Protective Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Strategic Insights and Key Considerations to Guide Decision-Makers in the Evolving Protective Coatings Landscape

The protective coatings market continues to evolve under the influence of technological innovation, regulatory pressures, and shifting global supply chains. Companies that embrace sustainable formulations and invest in digital capabilities will be best positioned to capture emerging opportunities and withstand policy-driven disruptions. Strategic agility-enabled by localized production, flexible supply networks, and collaborative partnerships-will differentiate market leaders from laggards. Recognizing the nuanced demands of diverse end-use industries and regional markets is imperative for developing coatings that meet rigorous performance and environmental criteria.

In summary, a deep understanding of segmentation dimensions, regional dynamics, and competitive strategies is critical to informing investment decisions and product portfolios. Industry executives should leverage this analysis to refine strategic roadmaps, optimize resource allocation, and drive innovation in protective coatings. By aligning operational priorities with market intelligence, organizations can secure sustainable growth and deliver high-value solutions that address the complex requirements of today’s demanding applications.

Connect with Ketan Rohom to Access the Full Protective Coatings Market Research Report and Unlock Strategic Competitive Intelligence

I invite you to reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discover how this comprehensive report can empower your strategic planning and accelerate market growth.

By engaging with Ketan Rohom, you will gain tailored insights that address your unique business challenges and unlock actionable intelligence. His expertise will guide you through the report’s in-depth analysis and demonstrate how its findings can inform your next critical decisions. Don’t miss this opportunity to leverage advanced market perspectives and position your organization at the forefront of protective coatings innovation.

- How big is the Protective Coatings Market?

- What is the Protective Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?