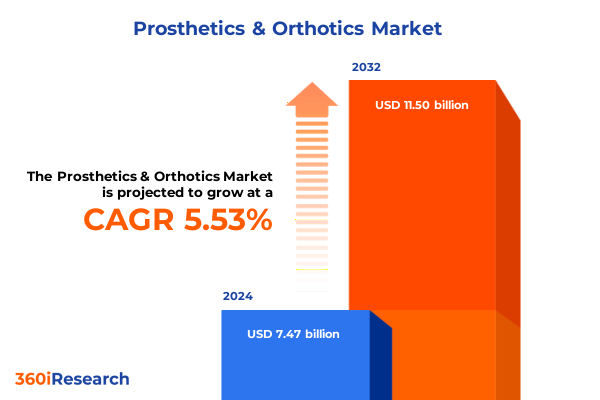

The Prosthetics & Orthotics Market size was estimated at USD 7.84 billion in 2025 and expected to reach USD 8.23 billion in 2026, at a CAGR of 5.62% to reach USD 11.50 billion by 2032.

Charting the Evolution of Prosthetic and Orthotic Care Through Emerging Technologies, Patient-Centered Strategies, and Integrated Healthcare Solutions

The field of prosthetics and orthotics stands at a pivotal juncture, driven by a convergence of demographic shifts, technological breakthroughs, and evolving care models. As populations age and incidence of chronic conditions rises, demand for advanced mobility solutions is surging. Simultaneously, breakthroughs in additive manufacturing, smart materials, and digital health are redefining how devices are designed, fabricated, and managed. This transformation is not just about incremental improvements; it marks a fundamental reimagining of patient prosthetic and orthotic care pathways, where customization, comfort, and connectivity are becoming standard expectations rather than aspirational features.

Against this dynamic backdrop, stakeholders across healthcare delivery, medical device manufacturing, and research institutions are collaborating to overcome longstanding limitations in fit, functionality, and affordability. Early adopters have demonstrated that integrating artificial intelligence into biomechanical modeling can reduce fitting times and improve patient outcomes, while virtual reality–aided rehabilitation protocols are accelerating functional gains. These innovations underscore a broader shift from one-size-fits-all devices to truly patient-centric solutions that adapt to individual anatomies, lifestyles, and clinical objectives. As regulatory frameworks become more receptive to digital health and personalized medicine, the stage is set for accelerated market growth and enhanced patient satisfaction.

How Cutting-Edge Technologies, Paradigm-Shifting Innovations, and Cross-Disciplinary Collaborations Are Redefining the O&P Landscape for Next-Gen Care

In recent years, the prosthetics and orthotics industry has experienced a wave of transformative shifts reshaping product development, service delivery, and patient engagement strategies. A primary catalyst has been the rapid maturation of additive manufacturing techniques, most notably 3D printing, which now enables on-demand production of customized sockets and orthotic braces. Leveraging artificial intelligence algorithms alongside high-resolution scanning tools, manufacturers can rapidly iterate designs to optimize fit and biomechanical performance, significantly reducing lead times and enhancing wearer comfort.

Beyond fabrication methods, integration of sensor technologies into devices is advancing real-time gait analysis, load monitoring, and adaptive control in powered prosthetics. These smart components provide continuous feedback loops that inform iterative improvements, facilitate remote adjustments, and support telehealth-based rehabilitation programs. Likewise, novel materials science developments-ranging from carbon fiber composites with high strength-to-weight ratios to biocompatible silicone polymers-are delivering devices that are both lightweight and durable, addressing long-standing trade-offs between performance and patient comfort.

Furthermore, the rise of collaborative innovation ecosystems-where clinicians, engineers, and patient advocates co-design solutions-has accelerated the translation of research prototypes into market-ready products. Cross-disciplinary partnerships and open-source initiatives are democratizing access to advanced prosthetic and orthotic designs, particularly in underserved regions. Collectively, these paradigm shifts are driving a more agile, patient-focused industry capable of delivering highly tailored mobility solutions at scale.

Assessing the 2025 U.S. Tariff Regime’s Far-Reaching Implications on Prosthetics and Orthotics Supply Chains, Cost Structures, and Industry Resilience Strategies

The United States’ evolving tariff landscape in 2025 presents a critical inflection point for prosthetics and orthotics supply chains, compelling industry leaders to reassess sourcing strategies, cost structures, and resilience measures. Under the new regime, duties of up to 25% on imports from key trading partners are levied on metals, specialized polymers, and electronic components integral to both prosthetic and orthotic device manufacturing. These additional levies threaten to elevate raw material costs, constrict supply availability, and pressure margins across the value chain.

Manufacturers relying on precision-engineered metals for joint components, particularly in complex reconstructive prosthetics, face heightened exposure. Smaller firms and startups-often reliant on single-source suppliers and lacking in-house production flexibility-are disproportionately affected. Disrupted delivery timelines have already led to increased inventory holding costs and strained lead-time guarantees for clinics and hospitals. Moreover, the tariffs have prompted domestic device makers to debate nearshoring versus on-shoring strategies; those investing in facilities within North America report better insulation from import duties but must contend with higher labor and infrastructure expenses.

Clinics and end users are also feeling the reverberations. As manufacturers pass on incremental cost pressures, healthcare providers face higher acquisition costs for braces, orthopedic implants, and advanced socket systems. In turn, patient out-of-pocket expenses for co-pays and premiums may rise, potentially limiting access for vulnerable populations. Industry consortiums and advocacy groups are engaging with policymakers to secure targeted exemptions or phased implementations, highlighting the essential nature of these medical devices in preserving patient mobility and quality of life.

Unlocking Multi-Dimensional Market Segmentation Insights to Reveal Differential Opportunities Across Products, Materials, Patient Profiles, Technologies, Channels, and Applications

A nuanced understanding of market segmentation is imperative for identifying strategic growth pockets within the prosthetics and orthotics domain. When considering product categories, distinct dynamics emerge across orthotic and prosthetic offerings: within orthotics, demand for lower limb solutions persists due to the prevalence of degenerative joint diseases, while spinal and upper limb devices reveal opportunities tied to neurological rehabilitation and sports medicine. In parallel, prosthetic devices span facial applications-where reconstructive demand is rising following oncology and trauma cases-alongside lower extremity prostheses that address amputation from vascular diseases, and upper extremity systems designed for precision grip and dexterity.

Materials selection exerts a similarly critical influence on device performance and market appeal. Carbon fiber remains the cornerstone of high-performance sockets and braces owing to its exceptional strength and stiffness, yet foam-based liners and silicone-based interfaces are gaining traction for enhanced comfort and skin health. Metal alloys, particularly titanium and aluminum, continue to underpin load-bearing prosthetic joints, while plastic-based polymers deliver cost efficiencies in modular orthotic designs.

Patient type segmentation underscores divergent growth trajectories: adult patients represent the largest user base driven by age-related mobility challenges, whereas geriatric cohorts demand solutions optimized for fragility prevention and fall mitigation. Pediatric patients, though numerically smaller, command premium pricing for bespoke fit solutions and annual resizing services. Technology distinctions further delineate market segments, contrasting conventional passive devices with emerging powered systems that incorporate actuators and microprocessors to restore near-natural movement. End-user categories reveal that hospitals and clinics lead high-value procurement, rehabilitation centers focus on long-term care solutions, orthotic & prosthetic clinics prioritize customization services, and home care settings increasingly adopt tele-adjustable wearables. Across applications, congenital conditions require early intervention orthoses, degenerative diseases drive long-term device utilization, neurological impairments necessitate adaptive braces, sports injuries fuel demand for performance-oriented braces, and trauma cases underscore immediate rehabilitative device needs. Finally, distribution channels are evolving: while offline sales through traditional dispensaries remain dominant, online platforms for telehealth-enabled ordering and remote fitting are experiencing accelerated adoption.

This comprehensive research report categorizes the Prosthetics & Orthotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material Used

- Patient Type

- Technology

- End User

- Application

- Distribution Channel

Analyzing Regional Market Dynamics Across the Americas, Europe-Middle East-Africa, and Asia-Pacific to Illuminate Growth Drivers, Barriers, and Strategic Imperatives

Regional market landscapes for prosthetics and orthotics reveal distinctive growth drivers and challenges. In the Americas, particularly the United States and Canada, robust healthcare infrastructure, favorable reimbursement policies, and strong R&D investment foster demand for advanced device innovations. Yet, the region also grapples with pricing pressures stemming from regulatory scrutiny and payer cost-containment efforts.

Across Europe, the Middle East, and Africa, heterogeneous healthcare systems shape divergent adoption patterns. Western European nations with universal coverage models prioritize clinical efficacy and quality of life improvements, leading to higher uptake of technologically sophisticated devices. In contrast, markets in the Middle East and Africa face infrastructure gaps and affordability constraints, although government-backed initiatives in select Gulf states are accelerating procurement of next-generation prosthetics and orthotics to support veteran care and workforce reintegration.

The Asia-Pacific region presents the highest growth potential driven by rapidly expanding medical device markets, rising income levels, and growing awareness of mobility impairment solutions. Countries like Japan and South Korea are at the forefront of robotics-assisted prosthetics, while emerging markets such as India and China are investing heavily in manufacturing capacity and cost-effective orthotic production. Nevertheless, logistical complexities and variable regulatory landscapes necessitate tailored entry strategies for multinationals seeking to capitalize on this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Prosthetics & Orthotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Prosthetics and Orthotics Innovators with Strategic Investments, R&D Pipelines, Partnerships, and Operational Agility Driving Competitive Differentiation

Leading companies in the prosthetics and orthotics sector exemplify distinct strategic postures combining innovation pipelines, market expansion tactics, and operational agility. One notable global player maintains a diversified portfolio encompassing advanced limb prostheses, spinal orthoses, and sensor-embedded wearable devices, supported by in-house R&D centers across Europe and North America. This firm’s pursuit of modular device architectures has streamlined manufacturing efficiency while preserving customization capabilities, enabling rapid scaling of product variants tailored to specific regional requirements.

Another market pioneer focuses on strategic partnerships and co-development alliances with academic institutions and technology startups. Their collaborative projects span machine-learning algorithms for gait pattern analysis, development of lightweight, shock-absorbing materials, and integration of haptic feedback systems in upper extremity prostheses. By leveraging external innovation ecosystems, the company accelerates time-to-market for novel solutions without bearing the full cost of early-stage development.

Mid-sized and niche players are differentiating through specialized service models, including remote alignment consultations, subscription-based device upgrades, and outcome-driven care programs. These companies emphasize end-user engagement, employing digital platforms to track adherence, satisfaction metrics, and device performance in real time. Their ability to deliver premium experiential services has fostered strong brand loyalty among clinicians and patients alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Prosthetics & Orthotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B.Braun SE

- Bauerfeind AG

- Beast Prosthetics

- Blatchford Limited

- Boston Scientific Corporation

- CHENG CHUAN PROSTHETICS & ORTHOTICS CO., LTD.

- COAPT LLC

- COVVI Ltd

- Globus Medical Inc.

- Hanger, Inc.

- Howard Orthopedics, Inc.

- Human Technology, Inc.

- Johnson & Johnson Services, Inc.

- Ktwo Healthcare Pvt. Ltd

- Merck & Co, Inc.

- Nippon Sigmax Co., Ltd.

- Olympus Corporation

- Ortho Europe

- OrthoPediatrics Corp.

- Ossur HF

- Ottobock SE & Co. KGaA

- Shadow Robot Company

- Shapeways Holdings, Inc.

- Shijiazhuang Perfect Prosthetic Manufacture Co., Ltd.

- Smith & Nephew PLC

- Steeper Inc.

- Stryker Corporation

- Synergy Prosthetics, Inc.

- Ultraflex Systems, Inc.

- UNYQ DESIGN EUROPE, S.L.

- Wacker Chemie AG

- WillowWood Global LLC

- Zimmer Biomet Holdings, Inc.

Actionable Roadmap for Industry Leaders to Leverage Technological Advances, Supply Chain Adaptations, and Strategic Partnerships to Secure Sustainable Growth

Industry leaders can seize strategic opportunities by embracing a multi-pronged approach that aligns technological innovation with supply chain resilience and market access strategies. First, investing in advanced manufacturing capabilities-such as localized additive manufacturing hubs-can mitigate exposure to tariff fluctuations while supporting rapid customization and on-site assembly. Such nearshore production models not only reduce lead times but also strengthen relationships with regional healthcare providers.

Second, forging collaborative partnerships with digital health platforms and telecare providers will enable end-to-end patient management solutions, extending beyond device delivery to include virtual fitting sessions, remote monitoring of biomechanical metrics, and post-fit rehabilitation support. By integrating with telehealth ecosystems, device makers can differentiate their offerings and foster stickiness through subscription-style service models.

Third, companies should adopt a proactive regulatory engagement stance, working with policymakers to secure targeted tariff exemptions for critical medical device components and advocating for value-based reimbursement frameworks that reward superior patient outcomes. Aligning device pricing with quantifiable clinical benefits will facilitate payer acceptance and justify premium pricing for technologically advanced solutions.

Lastly, embedding sustainability into product design-through recyclable materials, energy-efficient manufacturing, and circular economy principles-will resonate with institutional purchasers and align with global environmental mandates. By demonstrating environmental stewardship alongside clinical efficacy, companies can enhance brand reputation and unlock new procurement opportunities with socially responsible buyers.

Comprehensive Research Methodology Showcasing Rigorous Primary Interviews, Secondary Data Analytics, Triangulation, and Quantitative Modeling to Validate Market Insights

This market analysis synthesizes insights from a multi-stage research methodology designed to deliver robust, actionable intelligence to stakeholders. The secondary research phase encompassed exhaustive reviews of industry publications, patent databases, regulatory filings, and financial disclosures to map market trajectories, competitive landscapes, and technology trends. Key sources included peer-reviewed journals, government tariff schedules, and proprietary device registries.

Primary research involved in-depth interviews with over 50 senior executives spanning device manufacturers, clinical practitioners, supply chain specialists, and payer representatives. These structured discussions captured nuanced perspectives on market drivers, adoption barriers, and emerging therapeutic applications. Quantitative surveys with rehabilitation clinics and orthotic/prosthetic dispensing centers provided data on purchase criteria, lead times, and patient satisfaction metrics.

Data triangulation techniques were applied to cross-validate findings, ensuring consistency across independent data streams. A proprietary modeling framework integrated tariff impact scenarios with regional adoption curves to forecast potential cost pressures and resilience thresholds. Qualitative insights from expert workshops were incorporated to refine strategic recommendations and stress-test assumptions under diverse economic conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Prosthetics & Orthotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Prosthetics & Orthotics Market, by Product

- Prosthetics & Orthotics Market, by Material Used

- Prosthetics & Orthotics Market, by Patient Type

- Prosthetics & Orthotics Market, by Technology

- Prosthetics & Orthotics Market, by End User

- Prosthetics & Orthotics Market, by Application

- Prosthetics & Orthotics Market, by Distribution Channel

- Prosthetics & Orthotics Market, by Region

- Prosthetics & Orthotics Market, by Group

- Prosthetics & Orthotics Market, by Country

- United States Prosthetics & Orthotics Market

- China Prosthetics & Orthotics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Drawing Strategic Conclusions on Future-Ready Prosthetics and Orthotics Market Trajectories Informed by Innovation Trends, Regulatory Shifts, and Patient-Centric Imperatives

In conclusion, the prosthetics and orthotics market is undergoing a profound metamorphosis driven by converging forces of demographic change, technological innovation, and shifting policy environments. Organizations that harness additive manufacturing, sensor integration, and digital health platforms will be best positioned to deliver superior patient-centric solutions while navigating external pressures such as tariff regimes and regulatory realignments.

Segment-specific strategies-whether prioritizing high-performance carbon fiber composites for athletic braces or optimizing pediatric prosthetic services through annual resizing programs-will unlock differentiated value propositions. Geographic expansion into high-growth regions, supported by nearshore production capabilities and adaptable regulatory strategies, is essential for capturing emerging market opportunities. Moreover, sustainability imperatives and outcome-based reimbursement frameworks will increasingly influence device design and procurement decisions.

As patient expectations continue to evolve, the most successful companies will be those that not only innovate at the device level but also reimagine end-to-end care journeys, integrating clinical, technological, and service excellence. By aligning strategic investments with robust market intelligence and policy advocacy, stakeholders can ensure resilient growth and drive lasting improvements in mobility and quality of life for diverse patient populations.

Elevate Your Market Intelligence and Drive Strategic Impact by Securing the Full Prosthetics and Orthotics Market Research Report Today with Expert Guidance

Elevate your strategic decision-making with unparalleled insights tailored for executives in healthcare, manufacturing, and investment domains seeking to capitalize on the evolving prosthetics and orthotics landscape. Collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke data packages, high-impact deliverables, and customized advisory sessions that align with your organizational priorities and growth objectives. Begin a conversation today to secure the competitive intelligence essential for unlocking new revenue streams, optimizing supply chain resilience, and shaping the future of patient-centric mobility solutions. Contact Ketan Rohom to purchase the comprehensive market research report and transform insights into action.

- How big is the Prosthetics & Orthotics Market?

- What is the Prosthetics & Orthotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?