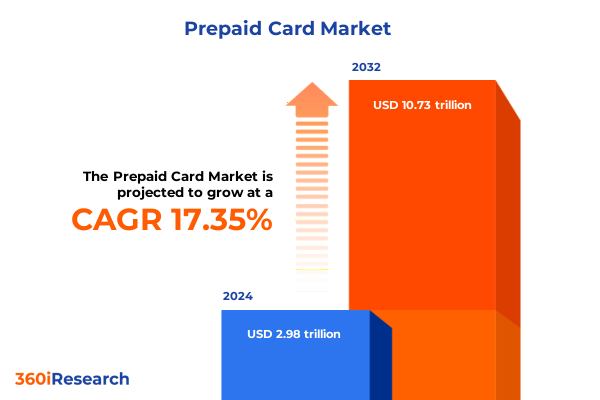

The Prepaid Card Market size was estimated at USD 3.47 trillion in 2025 and expected to reach USD 4.03 trillion in 2026, at a CAGR of 17.50% to reach USD 10.73 trillion by 2032.

Unveiling the Strategic Importance and Emerging Opportunities in the Prepaid Card Market Within a Rapidly Evolving Financial Ecosystem

The prepaid card segment has emerged as a pivotal element in the broader payments ecosystem, uniquely addressing the needs of underbanked populations, corporate disbursement programs, and consumer gifting solutions. By decoupling spending from traditional bank accounts, prepaid cards offer enhanced control over funds and streamlined expense management, making them a preferred choice for individuals and businesses alike. In recent years, market adoption has been propelled by widespread acceptance at retail outlets, growing e-commerce integration, and the seamless interoperability of contactless and mobile wallet platforms. Moreover, regulatory emphasis on financial inclusion and KYC compliance has encouraged issuers to innovate user onboarding processes, reducing friction while maintaining security.

Amid evolving consumer preferences, the prepaid card industry has capitalized on digital issuance capabilities, enabling instantaneous virtual card provisioning through mobile applications. This shift not only accelerates time to market for new programs but also empowers cardholders with real-time account visibility and dynamic control features. Simultaneously, closed-loop gift and incentive solutions have grown in prominence, allowing merchants to cultivate loyalty and drive repeat engagement. As corporates increasingly adopt prepaid payroll and expense reimbursement tools, the demand for customizable and integrated payment solutions has surged, reinforcing the strategic relevance of prepaid cards across various applications.

Exploring the Key Technological and Regulatory Shifts Reshaping the Prepaid Card Landscape and Driving Future Innovation

The prepaid card landscape is undergoing a profound reconfiguration driven by technological breakthroughs and regulatory evolution. Open banking frameworks and API-first architectures have opened new avenues for issuers and fintech partners to collaborate on seamless card issuance and account management services. In addition, the proliferation of tokenization and enhanced encryption protocols has elevated transaction security, fostering greater consumer trust and accelerating adoption in both retail and corporate environments. Concurrently, the advent of real-time payment initiatives has redefined expectations for fund availability, prompting prepaid solutions to integrate instant load and payout capabilities.

Regulatory bodies continue to refine guidelines around data privacy, anti-money laundering, and cross-border settlement operations, compelling market participants to invest in robust compliance infrastructures. The accelerated shift toward contactless transactions, spurred by health and safety concerns, has underscored the importance of NFC-enabled cards and digital wallet compatibility. Furthermore, exploratory pilots leveraging distributed ledger technology are reshaping settlement processes and foreign exchange management for multi-currency travel and cross-border incentive programs. Collectively, these transformative forces are not only redefining operational models but also unlocking novel value propositions that will steer the prepaid card sector’s next wave of innovation.

Assessing the Comprehensive Consequences of United States 2025 Tariff Adjustments on the Prepaid Card Supply Chain and Issuers

The implementation of new tariff measures by the United States in 2025 has introduced a fresh layer of complexity for prepaid card issuers, manufacturers, and distributors. Increased duties on plastic substrates, integrated chip components, and metallic foils have driven up input costs, compelling card producers to reevaluate global sourcing strategies. As a result, many issuers have accelerated the transition to virtual card solutions to mitigate exposure to rising production expenses, thereby reducing reliance on imported physical inventory.

In parallel, the heightened cost environment has stimulated discussions around nearshoring card personalization and fulfillment centers to minimize lead times and logistical overhead. Issuers have sought partnerships with domestic printers and laminators to secure preferential tariff classification and optimize total landed cost. At the same time, corporate customers have voiced concerns over potential delays in card deployment, prompting solution providers to enhance digital onboarding frameworks that deploy virtual credentials instantly while physical cards remain in transit. Overall, the cumulative impact of these tariff adjustments underscores the critical need for agility in procurement and distribution, while revealing opportunities for market players to differentiate through flexible issuance models and supply chain resilience.

Uncovering Strategic Insights from Diverse Prepaid Card Market Segmentation Approaches to Inform Targeted Business Strategies

Insights derived from a nuanced segmentation approach highlight how distinct market categories drive tailored value propositions. Analysis of closed-loop versus open-loop card environments reveals that closed-loop solutions continue to dominate retail gift and incentive applications due to their controlled acceptance footprint, while open-loop cards remain indispensable for payroll and travel programs that demand broader merchant reach and multi-currency settlement. Within application segments, gift solutions demonstrate a clear bifurcation between digital gift cards, which attract tech-savvy consumers seeking instant delivery, and physical gift cards, which maintain broad appeal for traditional gifting occasions. Incentive programs further differentiate into employee-focused campaigns offering personalized rewards and sales incentives designed to motivate channel partners, each necessitating specific customization and reporting tools.

Equally important, distinctions between physical and virtual card formats underscore emerging preferences for digital provisioning and wallet integration, particularly among e-commerce and on-demand service platforms that require rapid issuance. Distribution channel segmentation illuminates the strategic role of corporate B2B platforms and direct sales teams in servicing large enterprise clients with bespoke prepaid solutions. In contrast, agents, distributors, and bank conduits play a pivotal role in broadening market coverage, while online marketplaces and retail points of sale cater to small business and consumer segments. Taken together, these segmentation insights empower issuers and program managers to refine product designs, channel strategies, and customer engagement models for maximum impact.

This comprehensive research report categorizes the Prepaid Card market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Application

- Card Type

Analyzing Regional Distinctions and Growth Drivers across Americas EMEA and Asia-Pacific Prepaid Card Markets for Strategic Advantage

Regional dynamics in the prepaid card sector reveal divergent growth trajectories and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. The Americas continue to benefit from mature gift card ecosystems and well-established payroll and incentive frameworks. Consumer familiarity with prepaid solutions, combined with supportive regulatory environments, has fueled innovations in contactless and mobile issuance, while cross-border travel programs increasingly incorporate multi-currency prepaid options to serve global travelers.

In the Europe, Middle East & Africa corridor, regulatory harmonization around PSD2 and open banking has spurred a competitive landscape in which digital prepaid wallets and niche closed-loop programs flourish. Corporate incentives and promotional card solutions have gained traction as enterprises seek to navigate diverse regional compliance requirements while engaging customers across multiple jurisdictions. Meanwhile, the Asia-Pacific region exhibits rapid expansion driven by financial inclusion initiatives, high smartphone penetration rates, and burgeoning e-commerce markets. Governments in this region are actively piloting regulatory sandboxes to foster fintech experimentation, which has translated into innovative virtual card offerings for merchants, gig economy workers, and cross-border travel segments. Collectively, these regional insights underscore the importance of localized strategies tailored to regulatory contexts, consumer preferences, and channel infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Prepaid Card market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Shaping the Competitive Dynamics of the Prepaid Card Ecosystem

Major industry participants are advancing differentiated strategies to secure competitive positioning within the prepaid card arena. Global payment networks continue to expand partnerships with card issuers and fintech platforms, leveraging existing rails to introduce co-branded closed-loop solutions and open-loop prepaid instruments. Meanwhile, specialist program managers and fintech challengers are forging alliances with digital wallet providers to deliver instant virtual card issuance and seamless integration into mobile ecosystems.

Card personalization and distribution leaders are investing in modular fulfillment platforms to support rapid customization across physical and virtual channels, and to address tariff-driven supply chain risks. At the same time, emerging blockchain-oriented ventures are piloting tokenized prepaid offerings that promise streamlined reconciliation and enhanced transparency for multi-currency travel and incentive disbursements. Distribution partners-including financial institutions, agent networks, and e-commerce platforms-are increasingly adopting self-service portals and API ecosystems to facilitate direct program enrollment and real-time reporting. These strategic initiatives by key players illustrate a concerted industry shift toward end-to-end digitalization, resilience in card production, and value creation through integrated loyalty and data analytics capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Prepaid Card market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com Inc.

- American Express Company

- Apple Inc.

- Bank of America Corporation

- Blackhawk Network Holdings Inc.

- Citigroup Inc.

- Discover Financial Services

- Google LLC

- Green Dot Corporation

- H&R Block Inc.

- InComm Payments

- JPMorgan Chase & Co.

- Mastercard Incorporated

- MetaBank Inc.

- MoneyGram International Inc.

- Netspend Holdings Inc.

- PayPal Holdings Inc.

- Starbucks Corporation

- Target Corporation

- The Western Union Company

- UniRush LLC

- Visa Inc.

- Wells Fargo & Company

Defining Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends and Maximize Value in the Prepaid Card Sector

Industry leaders should prioritize building flexible issuance models that combine physical and virtual card capabilities, thereby meeting diverse customer demands and mitigating supply chain constraints. By integrating open banking APIs and partnering with fintech innovators, issuers can significantly accelerate time to market for new programs while enriching user experiences through real-time account management tools. Simultaneously, stakeholders must diversify sourcing strategies for card manufacturing and personalization to navigate tariff uncertainties, including exploring nearshore fulfillment hubs and multi-supplier agreements.

Program managers are encouraged to leverage advanced analytics platforms to refine customer segmentation and personalize reward structures across gift, incentive, payroll, and travel applications. Cultivating strategic alliances with corporate B2B platforms and digital marketplaces will expand distribution reach, while continuous investment in tokenization and encryption will reinforce transaction security and regulatory compliance. Finally, adopting agile governance frameworks that monitor tariff developments and regulatory shifts will enable swift adaptation, ensuring that organizations maintain cost competitiveness and uphold seamless user journeys.

Outlining Rigorous Mixed Methodologies and Data Collection Frameworks Underpinning the Integrity of the Prepaid Card Market Study

This study combines qualitative and quantitative research methodologies to deliver a robust understanding of the prepaid card market. Primary research involved in-depth interviews with senior executives from card issuers, program managers, distribution partners, and regulatory bodies, alongside structured surveys of end-user organizations spanning corporate and retail segments. Secondary research drew from publicly available sources, including regulatory filings, industry whitepapers, trade association reports, and peer-reviewed academic literature.

Data triangulation techniques were applied to validate findings across multiple inputs and to reconcile discrepancies. Industry benchmarks were established through comparative analysis of leading solution providers’ product portfolios and go-to-market strategies. An expert advisory panel reviewed preliminary insights, ensuring methodological rigor and relevance. Finally, tariff impact scenarios were modeled through supply chain mapping and cost component analysis, contextualized by current United States tariff schedules. Together, these mixed research approaches underpin the credibility, transparency, and strategic applicability of the market assessment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Prepaid Card market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Prepaid Card Market, by Card Type

- Prepaid Card Market, by Application

- Prepaid Card Market, by Card Type

- Prepaid Card Market, by Region

- Prepaid Card Market, by Group

- Prepaid Card Market, by Country

- United States Prepaid Card Market

- China Prepaid Card Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Strategic Implications of the Prepaid Card Market Analysis to Guide Future Decision-Making and Investment Priorities

The prepaid card market is at a pivotal juncture, shaped by converging technological, regulatory, and economic forces. The accelerated shift toward digital issuance and contactless payments is revolutionizing consumer and corporate adoption pathways, while tariff adjustments are redefining cost structures and supply chain strategies. Segmentation analysis reveals distinct value propositions across closed-loop and open-loop environments, varied application use cases, and physical versus virtual formats.

Regional insights underscore the need for market participants to tailor strategies to local regulatory requirements and consumer behaviors, from mature ecosystems in the Americas to dynamic fintech corridors in Europe, Middle East & Africa and rapidly expanding digital landscapes in Asia-Pacific. Leading players are responding with strategic alliances, platform investments, and innovative issuance technologies, collectively driving market sophistication.

In this intricate landscape, success will depend on the ability to combine agility in supply chain management, precision in customer segmentation, and foresight in regulatory compliance. By synthesizing these core findings, industry stakeholders can make informed decisions that align with emerging trends, mitigate risk, and capture new growth opportunities.

Engage with Ketan Rohom to Unlock Comprehensive Prepaid Card Market Insights and Secure Your Customized Research Report Investment Today

To gain a comprehensive understanding of the complex forces shaping the prepaid card market and to equip your organization with actionable strategies, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with this tailored research offering, you will receive exclusive insights into market drivers, segmentation nuances, regional dynamics, and regulatory impacts. Ketan’s expert guidance will ensure you access the precise data and strategic recommendations needed to navigate tariff challenges, leverage emerging technologies, and optimize distribution channels. Don’t miss this opportunity to secure a customized research report that provides clarity, depth, and foresight. Connect with Ketan Rohom today to explore how this in-depth market analysis can accelerate your decision-making, drive growth, and position your business at the forefront of the prepaid card industry.

- How big is the Prepaid Card Market?

- What is the Prepaid Card Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?