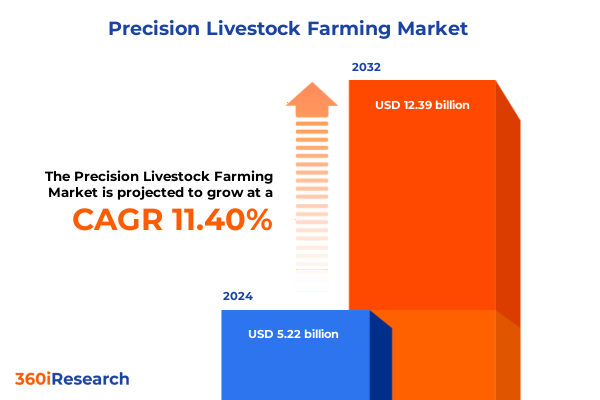

The Precision Livestock Farming Market size was estimated at USD 5.80 billion in 2025 and expected to reach USD 6.42 billion in 2026, at a CAGR of 11.43% to reach USD 12.39 billion by 2032.

Harnessing Innovation and Data-Driven Strategies to Revolutionize Animal Welfare and Production Efficiency in Modern Farming Operations

In recent years, livestock operations worldwide have integrated advanced digital tools to optimize productivity while safeguarding animal welfare. By leveraging real-time data capture and intelligent analysis, producers are now able to monitor individual animals at scale, diagnosing health anomalies before they escalate into widespread issues. This paradigm shift from reactive to proactive management has not only enhanced biosecurity measures but also reduced resource waste across feed, water, and pharmaceuticals. Moreover, the emergence of connected devices and edge computing platforms has intensified the speed at which critical information flows from barn to dashboard, enabling operators to make swift, evidence-based decisions.

As farms evolve into high-tech ecosystems, the industry is witnessing a fusion of traditional husbandry expertise with systems engineering principles. Stakeholders across the value chain-from animal nutritionists to veterinarians-are collaborating with data scientists to refine algorithms that predict growth trajectories and optimize reproductive cycles. Furthermore, regulatory bodies are adapting frameworks to accommodate digital traceability solutions, reinforcing consumer trust. Consequently, precision livestock farming has emerged not merely as a toolset but as a holistic strategy for sustainable intensification, balancing economic viability with environmental stewardship.

Drawing on contributions from both field practitioners and technology providers, this report dissects the evolution of precision solutions within livestock sectors. It outlines the critical technology building blocks, examines the policy and trade dynamics influencing market trajectories, and presents a roadmap of strategic opportunities. Decision-makers will find actionable perspectives on overcoming implementation challenges and harnessing data-centric approaches to drive profitability, resilience, and ethical stewardship.

Exploring the Convergence of Internet of Things, Artificial Intelligence, and Sustainability to Drive Next-Generation Precision Livestock Farming Practices

Innovation has accelerated the convergence of the Internet of Things, artificial intelligence, and advanced analytics within livestock environments. Sensors embedded in wearable tags, drone-mounted cameras, and fixed imaging systems continuously capture behavioral, physiological, and environmental parameters. Through machine learning models, these diverse data streams are synthesized to forecast disease outbreaks, optimize feed conversion ratios, and detect stress indicators. As a result, farms are transitioning from manual record keeping to autonomous decision-support frameworks that operate around the clock.

Another notable shift is the growing emphasis on sustainability metrics. Beyond production efficiency, producers are leveraging precision tools to monitor greenhouse gas emissions, manure nutrient content, and water usage. This integrated approach has led to more precise application of interventions, minimizing environmental footprints and enabling compliance with tightening emissions regulations. At the same time, advanced software platforms are facilitating collaboration between producers, processors, and retailers, creating transparent value chains in which each stakeholder can verify product provenance and welfare standards.

Finally, digital connectivity has expanded the reach of precision livestock solutions to small and mid-scale operations. Cloud-based architectures and subscription-based service models are reducing entry barriers, allowing a broader range of producers to adopt real-time monitoring and predictive analytics. This democratization of technology is fostering a culture of continuous improvement, where best practices are shared and scaled across regions, ultimately driving the industry toward higher resilience and profitability.

Behind these technological advancements lies a growing ecosystem of data interoperability standards and API-driven integrations. Startups and established firms alike are collaborating to develop open protocols that facilitate data exchange between disparate systems, reducing friction and enabling more comprehensive insights. This emphasis on seamless connectivity not only enhances scalability but also fosters a competitive landscape where best-in-class solutions can coalesce into unified platforms. As these standards mature, stakeholders can expect accelerated innovation cycles and more agile responses to emerging challenges such as zoonotic threats and climate variability.

Assessing the Long-Term Consequences of United States Tariffs Imposed in 2025 on Equipment Imports and Supply Chain Resilience

Implementation of the 2025 U.S. tariffs on imported agricultural machinery, electronic sensors, and customized monitoring hardware has had nuanced effects on the precision livestock farming landscape. Initially designed to protect domestic manufacturing, these measures prompted several global equipment suppliers to establish local assembly operations or seek tariff exemptions under existing trade agreements. Consequently, many end-users are experiencing modest increases in acquisition costs for specialized devices, though these incremental hikes are gradually being offset by accelerated localization trends.

In parallel, supply chain resilience has become a strategic priority among technology providers and farming enterprises alike. The introduction of tariffs has underscored vulnerabilities in extended logistics networks, spurring investments in dual sourcing strategies and onshore inventory buffers. As a result, companies have begun to diversify their supplier portfolios, integrating domestic component manufacturers with established offshore partners to ensure continuity of supply while managing overall cost structures.

Furthermore, the tariff regime has incentivized end users to conduct total cost of ownership analyses, assessing not only upfront equipment expenses but also operational costs related to maintenance, firmware updates, and system upgrades. Producers are increasingly negotiating bundled service agreements that lock in predictable rates for installation and ongoing technical support. This holistic view of investment helps mitigate the short-term financial impact of tariffs and aligns provider offerings with customer expectations for long-term value creation.

Long term, the cumulative impact of the tariffs may catalyze innovation within the domestic equipment sector. By incentivizing R&D and production closer to end markets, the policy shift has opened opportunities for local startups and established players to collaborate on next-generation sensor designs and modular system architectures. While some market participants initially faced margin compression, the evolving trade environment is fostering a more self-reliant ecosystem that balances competitive pricing with increased control over critical technology lifecycles.

Unveiling Critical Insights from Livestock Types, Technological Components, Application Domains, and Deployment Modalities Shaping Market Dynamics

Segmentation based on livestock type reveals that aquaculture operations are refining sensor deployments to address water quality fluctuations affecting fish and shrimp health. In cattle systems, precision tools are tailored to differentiate beef cattle growth patterns from dairy cows’ lactation cycles, optimizing feed formulations and milking schedules. Poultry producers are segmenting solutions between broiler and layer flocks, focusing on behavioral monitoring for feed efficiency in meat birds and egg production quality in layers. In swine farming, technologies for breeding stock emphasize reproductive management, whereas finishing operations prioritize weight gain tracking and disease surveillance.

Component segmentation underscores the interplay between hardware, services, and software offerings. Identification systems and RFID tags form the backbone of asset tracking, while imaging and weighing platforms capture data on animal performance. Sensor suites, including activity, gas, pH, and temperature monitors, feed raw metrics into analytics engines. Complementary consulting, installation, maintenance, and training services ensure system uptime and data integrity. Software layers-from monitoring dashboards to decision support and farm management applications-translate signals into actionable insights, guiding on-farm interventions.

When viewed through the lens of application, behavior monitoring solutions leverage activity and feeding behavior profiles to detect anomalies early. Disease detection frameworks harness temperature and symptom monitoring to flag emerging health incidents. Reproductive management modules automate estrus and pregnancy detection, reducing manual inspections. Performance management and quality assurance platforms evaluate growth trajectories and product grading, creating a closed-loop feedback system that informs operational improvements. Deployment models further differentiate offerings as cloud-based services, whether in private or public environments, or as on-premises installations, accommodating varied preferences for data sovereignty and IT infrastructure integration.

This comprehensive research report categorizes the Precision Livestock Farming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Livestock Type

- Component

- Application

- Deployment

Comparative Examination of Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Precision Livestock Farming

In the Americas, precision livestock adoption is driven by large-scale commercial farms seeking to optimize operational margins. North American producers are integrating advanced imaging and machine learning solutions to streamline dairy and beef cycles, while South American aquaculture operations leverage cost-effective sensor networks in emerging shrimp and tilapia regions. Heightened regulatory focus on environmental impact has accelerated uptake of emission monitoring tools, reinforcing a trend toward holistic farm management platforms.

In Europe, the Middle East, and Africa, robust animal welfare directives have mandated real-time traceability systems, compelling farmers and integrators to adopt end-to-end monitoring solutions. European livestock operations benefit from extensive telecommunications infrastructure, enabling real-time data sharing across value chains. In the Middle East, arid climate conditions have spurred innovation in water quality sensors for aquaculture, whereas African markets are exploring scalable, solar-powered devices to overcome power challenges. Across the region, service providers are tailoring modular offerings to accommodate diverse farm sizes and investment capacities.

Asia-Pacific markets are characterized by rapid modernization and government-led initiatives to enhance food security. Countries such as China and India deploy integrated hardware and analytics platforms across cooperative farming schemes, while Australia and New Zealand focus on precision grazing and disease management in cattle systems. The region’s dynamic balance between high-tech integration and affordability underscores a collaborative ecosystem that brings advanced solutions to both developed and emerging markets.

This comprehensive research report examines key regions that drive the evolution of the Precision Livestock Farming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Technology Providers and Agritech Innovators Driving Breakthrough Advances in Precision Livestock Farming Solutions

In examining key industry players, technology providers have increasingly formed strategic alliances to expand solution portfolios. Leading equipment manufacturers integrate sensor capabilities into feeding and milking systems to enhance value propositions. Agritech startups focusing on advanced image recognition have forged partnerships with major processors to deliver health classification tools. Software vendors collaborate with hardware firms to unify farm management platforms from identification through predictive analytics.

Service-focused enterprises have emerged as critical enablers, offering consulting, installation, and maintenance packages that accelerate adoption curves. These providers leverage domain expertise to customize implementation roadmaps, ensuring rapid time to value. Market consolidation is reshaping competitive dynamics as larger firms acquire niche innovators to bolster their technology stacks and extend geographic reach, creating comprehensive end-to-end offerings.

Cross-sector partnerships between solution providers and research institutions are driving future innovations. Joint ventures in genetic data integration and microbiome monitoring are paving the way for more precise disease prevention tools and performance optimization strategies. Through open innovation frameworks, companies are pooling resources to overcome technical challenges and accelerate product development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Precision Livestock Farming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afimilk Ltd.

- AgriWebb Pty Ltd.

- Allflex Livestock Intelligence

- BouMatic LLC

- Cainthus Ltd.

- Connecterra B.V.

- Dairymaster Holdings Ltd.

- DeLaval International AB

- FANCOM B.V.

- Fullwood Packo SAS

- GEA Group Aktiengesellschaft

- IceRobotics Ltd.

- Lely International N.V.

- Moocall Ltd.

- Nedap N.V.

- OPTIfarm Ltd.

- Rex Animal Health Inc.

- Trioliet B.V.

- VDL Agrotech B.V.

- Waikato Milking Systems Ltd.

Strategic Imperatives and Pragmatic Steps for Industry Leaders to Harness Precision Livestock Farming Innovations Effectively

Industry leaders should prioritize the integration of interoperable systems, ensuring that hardware and software components communicate seamlessly across the entire livestock lifecycle. By adopting open architecture platforms, organizations can avoid vendor lock-in and incorporate emerging applications with minimal disruption. Furthermore, executives must invest in workforce development programs that equip on-farm personnel with data literacy skills, reinforcing a culture of continuous improvement and proactive management.

Moreover, decision-makers should chart a phased deployment strategy that begins with pilot implementations on representative operations. This approach enables rapid feedback loops, allowing teams to refine configurations based on real-world performance metrics before scaling to full portfolios. Concurrently, stakeholders must establish robust data governance protocols, protecting sensitive information while enabling secure collaboration between producers, service providers, and regulatory agencies.

Another priority for leaders is to establish clear performance indicators tied to precision objectives. By defining metrics for data quality, system uptime, and ROI timelines, organizations can monitor progress and course-correct proactively. Collaborative forums and industry consortiums offer platforms to benchmark these KPIs against peers, fostering a transparent environment where success stories and cautionary tales alike inform collective learning. Adopting such governance structures ensures that technology deployments deliver on their promise and continuously evolve to meet emerging operational challenges.

Lastly, leaders are encouraged to explore collaborative innovation models such as consortiums and public-private partnerships. By co-developing solutions with academic institutions and technology vendors, organizations can share risks and pool expertise. Engaging in standardization initiatives will further ensure compatibility across products, fostering an ecosystem where best practices are codified and widely disseminated. Through these strategic levers, industry players can navigate complexity, unlock value, and chart a sustainable growth trajectory in precision livestock farming.

Comprehensive Overview of Methodological Approaches Integrating Primary and Secondary Research for Rigorous Market Intelligence

This research integrates a comprehensive mix of primary and secondary data collection methodologies to deliver rigorous market insights. Primary inputs were gathered through in-depth interviews with livestock producers, technologists, and industry consultants, providing real-world perspectives on adoption drivers, challenges, and investment priorities. Supplementary workshops and field demonstrations offered direct observations of system performance across diverse livestock operations, ensuring contextual accuracy and operational relevance.

Secondary research encompassed a thorough review of academic journals, trade publications, regulatory filings, and publicly available industry reports. Analytical frameworks were applied to synthesize quantitative and qualitative data, cross-validating key trends and identifying emerging themes. Data triangulation techniques were employed to reconcile disparate sources, enhancing confidence in findings and reducing bias.

In defining the research scope, developments from the past five years and regional dynamics were examined to capture both foundational innovations and current breakthroughs. A steering committee of independent analysts and subject matter experts reviewed draft findings to uphold objectivity and methodological rigor. Quantitative analyses utilized statistical methods to evaluate deployment patterns and adoption rates, while thematic coding of interview transcripts enabled the identification of strategic imperatives. This multifaceted approach underpins robust conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Precision Livestock Farming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Precision Livestock Farming Market, by Livestock Type

- Precision Livestock Farming Market, by Component

- Precision Livestock Farming Market, by Application

- Precision Livestock Farming Market, by Deployment

- Precision Livestock Farming Market, by Region

- Precision Livestock Farming Market, by Group

- Precision Livestock Farming Market, by Country

- United States Precision Livestock Farming Market

- China Precision Livestock Farming Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Illuminate Future Opportunities and Challenges in the Evolving Precision Livestock Farming Landscape

The transformation of livestock operations through precision technologies has reached a pivotal moment, where data-driven approaches are no longer optional but essential for competitiveness. By synthesizing advances in sensing, connectivity, and analytics, producers can optimize productivity, enhance animal welfare, and mitigate environmental footprint concurrently. As trade policies reshape equipment supply chains, resilient sourcing strategies and localized innovation will underpin sustained growth in varied operating environments.

Looking ahead, the integration of genetic, microbiome, and behavioral data promises further breakthroughs in disease resistance and performance optimization. Cross-sector collaborations and open innovation frameworks will remain critical, enabling stakeholders to co-create technologies that address evolving operational and regulatory demands. Moreover, the rise of edge AI hardware will enable more localized decision-making, reducing latency and reliance on constant network connectivity. Large-scale pilots in these areas indicate significant potential to enhance disease resilience and resource use efficiency, signaling a future in which precision livestock farming is fully embedded within smart farming ecosystems.

Ultimately, precision livestock farming stands as a cornerstone of the future food system, driving efficiency gains while aligning with societal imperatives for sustainability and transparency.

Engaging with Expert Associate Director Ketan Rohom to Secure Actionable Insights and Access the Full Precision Livestock Farming Market Report

To gain a deeper understanding of these insights and secure access to the complete Precision Livestock Farming market report, industry professionals are invited to connect with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will provide tailored guidance on how these findings apply to your organization’s strategic roadmap. Reach out today to explore subscription options and customized research deliverables designed to empower informed decision-making and accelerate innovation adoption across your livestock operations.

Whether you represent a commercial farm, equipment manufacturer, or service provider, engaging with this report will equip you with the clarity and intelligence needed to navigate complex trade environments and evolving technological frontiers. Ketan Rohom can facilitate customized briefings, answer specific queries regarding segmentation analyses, and coordinate trial access to data visualization dashboards. Act now to partner with an industry specialist who can align actionable insights with your strategic objectives and accelerate your path to operational excellence.

- How big is the Precision Livestock Farming Market?

- What is the Precision Livestock Farming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?