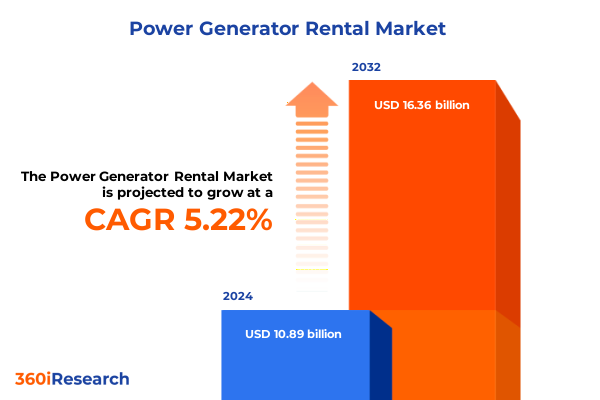

The Power Generator Rental Market size was estimated at USD 11.36 billion in 2025 and expected to reach USD 11.86 billion in 2026, at a CAGR of 5.34% to reach USD 16.36 billion by 2032.

Illuminating the foundational narrative and strategic context driving the power generator rental market landscape for informed strategic decision making

The evolving complexity of energy infrastructure demands an acute understanding of the power generator rental market’s foundational dynamics. Within this context, industry stakeholders are confronted with the challenge of balancing reliability, cost management, and environmental considerations. Toward this end, synthesizing the market’s core drivers-from technological innovation to regulatory frameworks-enables decision makers to navigate shifting terrain with confidence and clarity.

This introduction establishes the strategic backdrop against which rental providers, end users, and investors operate. By framing key variables such as operational resilience, service flexibility, and evolving customer expectations, the narrative sets the stage for deeper analysis. It positions readers to appreciate how the interplay of supply chain intricacies, emergent usage paradigms, and stakeholder priorities shapes the competitive landscape and informs subsequent report sections.

Examining the transformative technological, regulatory, and customer paradigm shifts reshaping the power generator rental ecosystem across global markets and value chains

Technological innovation, regulatory evolution, and changing customer expectations have collectively ushered in a new era for the power generator rental ecosystem. Digitalization initiatives, including remote monitoring platforms and predictive maintenance, are redefining service delivery models. Meanwhile, heightened sustainability mandates have accelerated the shift toward lower-emission hybrid units and alternative fuel integrations. Together, these factors are reshaping how providers design, deploy, and manage rental fleets.

Concurrently, regulatory developments-spanning emissions thresholds to local permitting requirements-have introduced both complexity and opportunity. Rental operators are adapting compliance strategies to navigate an increasingly intricate policy environment. In parallel, customer behavior has evolved; stakeholders now demand flexible rental terms, seamless service experiences, and data-driven insights to optimize asset utilization. These transformative shifts underscore the necessity for agile business models capable of harnessing technological advances while meeting the evolving priorities of a diverse client base.

Assessing the cumulative effects and strategic repercussions of 2025 United States tariff implementations on supply chains, pricing structures, and procurement strategies in power generator rental

The introduction of United States tariffs in 2025 has reverberated across global supply chains, compelling rental operators to reassess procurement and pricing strategies. Tariffs on critical components and finished generator imports have elevated manufacturing costs, prompting many providers to explore domestic sourcing or localized assembly to mitigate cost pressures. This realignment has necessitated closer collaboration with steel and aluminum fabricators as well as engine manufacturers to ensure continuity of supply.

Beyond direct cost implications, the tariffs have accelerated supply chain diversification efforts. Providers are increasingly evaluating multi-sourcing frameworks to buffer against tariff-induced volatility. These strategic shifts aim to preserve service reliability and maintain competitive positioning amidst evolving trade policies. Furthermore, the need to comply with complex customs regulations has driven investment in specialized logistics and compliance expertise. Cumulatively, these developments emphasize the strategic importance of agile procurement processes and regulatory intelligence in safeguarding operational resilience.

Revealing critical segmentation insights from fuel type through capacity tiers to application models and end user dynamics driving differentiated value in generator rentals

Insight into market segmentation reveals nuanced opportunities driven by fuel type versatility, capacity differentiation, and varied application demands. Rental fleets that encompass diesel, gas, and hybrid units enable providers to tailor solutions to cost sensitivities, emission requirements, and evolving sustainability goals. Meanwhile, distinct power output brackets-from sub-50 kilowatt units to installations exceeding one megawatt-address diverse operational scales and performance thresholds.

Application type further refines service offerings, with continuous setups delivering uninterrupted power, prime models catering to variable demand profiles, and standby generators ensuring emergency backup capability. Rental periods range from short-term assignments for event or project contingency to medium-term allocations during maintenance cycles and long-term contracts supporting extended infrastructure projects. End use industries span construction, healthcare, IT and data centers, manufacturing, mining, oil and gas, and utilities, with commercial and residential construction segments requiring unique service and compliance approaches.

Customer categories-commercial, industrial, and residential-exert distinct purchasing behaviors, while sales channels from dealer networks to direct rental divisions and online platforms shape acquisition and service experiences. Understanding these layered dimensions empowers providers to align fleet composition, pricing structures, and customer engagement strategies.

This comprehensive research report categorizes the Power Generator Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Power Output Capacity

- Application Type

- Rental Period

- End Use Industry

- Customer Type

- Sales Channel

Unpacking regional performance dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific to highlight distinctive growth drivers and market nuances

Geographically, market dynamics vary considerably across the Americas, Europe Middle East and Africa, and Asia Pacific regions. In the Americas, robust infrastructure development programs and disaster recovery planning drive sustained demand for both portable and stationary rental units. Providers are capitalizing on increasing deployment in remote oil and gas fields as well as temporary power requirements for industrial expansions.

Within Europe Middle East and Africa, stringent emissions regulations and a strong emphasis on renewable energy integration are influencing fleet composition and service offerings. Rental operators are prioritizing hybrid solutions and investing in inventory with advanced emissions control to comply with regional policy frameworks. In parallel, Africa’s growing infrastructure initiatives and energy access projects are creating demand for versatile rental models.

Asia Pacific’s rapid urbanization and industrialization underpin significant rental uptake, particularly in construction and manufacturing sectors. Governments’ focus on energy security and distributed generation is supporting the adoption of modular rental assets. Across each region, varying regulatory landscapes, infrastructure priorities, and economic drivers dictate differentiated approaches to fleet management, customer engagement, and value proposition development.

This comprehensive research report examines key regions that drive the evolution of the Power Generator Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling key industry leaders and competitive strategic positioning among market frontrunners pioneering innovation, service excellence, and operational efficiency in power generator rentals

Competitive positioning in the power generator rental market is shaped by a handful of leading providers distinguished by fleet diversity, service excellence, and technological innovation. Global specialists with extensive portfolios leverage modular fleets, including high-capacity units and hybrid offerings, to serve large-scale infrastructure projects and data center clients. Regional champions differentiate through nimble local support networks, customizable maintenance programs, and rapid deployment capabilities that cater to market-specific requirements.

Strategic alliances between rental firms and engine or component manufacturers are enhancing operator advantages through preferential access to next-generation technologies. Service differentiation also emerges from digital platforms that enable real-time asset monitoring, predictive maintenance, and streamlined invoicing processes. As service level expectations rise, providers investing in advanced analytics, remote diagnostics, and sustainability reporting tools are gaining a competitive edge. Additionally, consolidation trends, driven by targeted mergers and acquisitions, are reshaping market share dynamics and expanding geographic footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Generator Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aggreko plc

- AKSA Power Generation

- APR Energy Ltd

- Ashtead Group plc

- Atlas Copco AB

- Caterpillar Inc.

- Cramo Oyj

- Cummins Inc.

- Generac Power Systems

- Herc Holdings Inc

- Himoinsa S.L.

- HSS Hire Group plc

- Kohler Co.

- Ramirent plc

- Speedy Hire plc

- United Rentals, Inc.

- Wacker Neuson SE

- Wärtsilä Corporation

Articulating actionable strategic recommendations for industry leaders to capitalize on emerging trends, mitigate risks, and enhance competitive advantage in generator rentals

Industry leaders should prioritize digital transformation initiatives, integrating remote monitoring systems and data analytics to enhance fleet utilization and minimize downtime. By embedding predictive maintenance algorithms into asset management practices, operators can preempt service disruptions and optimize resource allocation. Simultaneously, broadening fuel type offerings to include advanced hybrid configurations and low-emission solutions will address tightening environmental regulations and evolving client sustainability mandates.

Moreover, establishing flexible procurement frameworks that incorporate multi-sourcing strategies will mitigate tariff-driven cost fluctuations and strengthen supply chain resilience. Cultivating strategic partnerships with engine manufacturers and component suppliers can secure preferential access to critical parts and streamline regulatory compliance. Investing in customer experience enhancements-through user-friendly online platforms, transparent pricing models, and dedicated account management-will foster loyalty and drive repeat business. Lastly, expanding service capabilities in underserved regions and industry verticals can unlock untapped demand and reinforce market leadership.

Outlining the rigorous and transparent research methodology combining qualitative expert insights, secondary data triangulation, and quantitative analytical rigor underpinning the report

This report is underpinned by a rigorous research methodology that blends qualitative expert dialogues with robust secondary data analysis. Primary insights were garnered through in-depth interviews with industry executives, procurement specialists, and technical service managers. These conversations provided a nuanced understanding of operational challenges, strategic priorities, and evolving customer expectations.

Secondary research involved comprehensive review of regulatory filings, industry association publications, and technical white papers. Data integrity and triangulation were ensured through cross-referencing corporate disclosures, trade press releases, and market intelligence databases. The analytical framework combined thematic analysis of qualitative inputs with structured evaluation of emerging trends and competitive dynamics. Throughout the research process, findings were subjected to expert validation, ensuring accuracy, relevance, and actionable insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Generator Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Generator Rental Market, by Fuel Type

- Power Generator Rental Market, by Power Output Capacity

- Power Generator Rental Market, by Application Type

- Power Generator Rental Market, by Rental Period

- Power Generator Rental Market, by End Use Industry

- Power Generator Rental Market, by Customer Type

- Power Generator Rental Market, by Sales Channel

- Power Generator Rental Market, by Region

- Power Generator Rental Market, by Group

- Power Generator Rental Market, by Country

- United States Power Generator Rental Market

- China Power Generator Rental Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing core insights and strategic imperatives to underscore the critical takeaways guiding stakeholders toward informed decisions in generator rental markets

The confluence of technological advancements, regulatory shifts, and evolving customer demands is redefining the power generator rental landscape. Stakeholders must navigate tariff-induced supply complexities, regional performance nuances, and segmented market requirements with strategic agility. Critical takeaways highlight the importance of diversified fleets, digital service models, and robust procurement frameworks.

For decision makers, the imperative is clear: align operational strategies with emerging trends in sustainability, digitalization, and regional market dynamics. By leveraging the insights presented, rental providers, end users, and investors can make informed decisions that enhance reliability, optimize costs, and drive long-term competitiveness. The strategic imperatives outlined throughout this report offer a roadmap for navigating market complexities and capturing growth opportunities in power generator rentals.

Empowering next steps and direct engagement opportunity with Ketan Rohom Associate Director Sales and Marketing for securing the comprehensive power generator rental market intelligence report

By engaging directly with Ketan Rohom, Associate Director Sales and Marketing, stakeholders can access tailored insights and personalized support to ensure the report fully addresses their strategic priorities. His expertise in aligning market intelligence with organizational objectives guarantees that each reader receives a bespoke consultation highlighting the most relevant applications and opportunities for their business context. Prospective clients will benefit from a streamlined purchasing process, ensuring timely delivery of the comprehensive power generator rental market intelligence report that underpins critical decision making.

Secure direct engagement now to refine your understanding of emerging rental trends and regulatory shifts with expert guidance. Connect to initiate your organization’s pathway toward informed investments and operational excellence in power generator rentals.

- How big is the Power Generator Rental Market?

- What is the Power Generator Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?