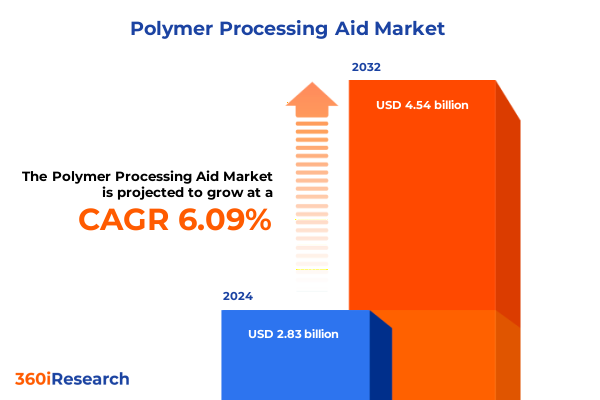

The Polymer Processing Aid Market size was estimated at USD 2.99 billion in 2025 and expected to reach USD 3.16 billion in 2026, at a CAGR of 6.14% to reach USD 4.54 billion by 2032.

An Insightful Overview of Polymer Processing Aid Applications Highlighting Key Drivers and Technological Innovations Shaping Market Dynamics

In an era marked by rapid technological advancements and evolving material demands, polymer processing aids have emerged as indispensable components in modern manufacturing. These specialized additives optimize the flow, stability, and performance of polymer resins, enabling a myriad of applications across packaging, automotive, construction, and beyond. By reducing energy consumption and enhancing product quality, they not only drive cost efficiencies but also support sustainability objectives through improved material utilization.

Amid growing environmental regulations and heightened consumer expectations, manufacturers are under pressure to innovate and deliver superior end products. This imperative has accelerated research into advanced formulations of acrylic-based processing aids, fluoropolymer variants for high-performance uses, and polyethylene-based systems tailored for diverse processing conditions. The intersection of material science innovation and processing technology breakthroughs forms the foundation for the current wave of market evolution.

As global supply chains adapt to geopolitical shifts and regulatory changes, industry stakeholders are actively seeking insights into emerging polymer additive technologies. This executive summary distills the critical factors shaping the landscape, offering a strategic overview of market drivers, challenges, and opportunities. It aims to equip decision-makers with the knowledge required to navigate complexity and capitalize on the transformative potential of polymer processing aids.

Transformative Shifts Reshaping Polymer Processing Aid Landscape Driven by Digitalization Sustainability and Evolving End-User Requirements

Over the past several years, the polymer processing aid landscape has undergone transformative shifts as digitalization and automation reinterpret traditional manufacturing paradigms. Smart production systems equipped with real-time monitoring have enabled precise control over processing aid dosing, minimizing variability and maximizing throughput. This transition toward Industry 4.0 practices has not only improved product consistency but has also opened new avenues for predictive maintenance and resource optimization.

Simultaneously, the sustainability agenda has prompted a reevaluation of additive chemistries. Bio-based and recyclable processing aids are gaining traction among manufacturers committed to circularity. Innovations in biodegradable slip additives and eco-friendly anti-block agents illustrate how environmental imperatives are steering formulation strategies. As regulatory bodies tighten restrictions on nonrenewable feedstock usage, these developments underscore a broader move toward green chemistry across the polymer ecosystem.

Furthermore, end-user industries are driving customization, spurring processing aid suppliers to develop tailored solutions for niche applications. In the packaging sector, for instance, demand for lightweight films with enhanced barrier properties has led to specialized acrylic polymer blends. Meanwhile, the automotive industry’s shift to lightweight composites has expanded the role of fluoropolymers in high-temperature and chemical-resistant applications. These application-driven shifts highlight the dynamic interplay between material performance requirements and processing technology evolution.

Looking ahead, collaborative innovation models are set to take center stage as stakeholders forge partnerships across the value chain. From resin producers to equipment manufacturers and end users, a collective push toward co-development projects is establishing new best practices. By aligning R&D efforts and sharing technical insights, the industry is poised to accelerate the adoption of next-generation processing aid solutions that address both performance targets and sustainability goals.

Analyzing the Cumulative Impact of United States Tariffs Implemented in 2025 on Polymer Processing Aid Supply Chains and Competitive Dynamics

In 2025, the cumulative impact of United States tariffs on chemical imports has reverberated throughout the polymer processing aid sector, prompting recalibrations in sourcing and pricing strategies. With additional duties imposed on select fluoropolymers and specialty acrylic resins, manufacturers have faced increased input costs that erode margins and necessitate cost pass-through to downstream customers. Consequently, procurement teams are actively seeking alternative supply routes and regional partners to alleviate tariff burdens.

These tariff measures have also triggered shifts in trade flows, as domestic producers capitalize on government incentives to ramp up local manufacturing capacity. Investments in new polymerization facilities and compounding plants underscore a strategic pivot toward nearshoring, aimed at enhancing supply security and reducing exposure to international trade tensions. As a result, North American production hubs are witnessing augmented activity, bolstering employment in processing aid formulation and distribution.

Moreover, tariff-induced cost pressures have accelerated efforts to optimize additive performance. R&D teams are intensifying work on higher-efficiency formulations that achieve target processing enhancements at lower dosages. By fine-tuning molecular architectures and leveraging co-additive synergies, these next-generation aids deliver comparable or superior results with reduced material inputs, thereby mitigating the financial impact of elevated raw material expenses.

Overall, the interplay between tariffs and market innovation has underscored the sector’s resilience. While short-term disruptions have challenged traditional sourcing models, proactive adaptation through regional diversification and enhanced additive performance has positioned industry players to sustain growth amid evolving trade policies.

Revealing Key Segmentation Insights Across Polymer Types Processing Techniques Additive Classes and Application Domains Influencing Strategic Decisions

Market participants have sharpened their focus on detailed segmentation insights to inform portfolio optimization and strategic planning. By polymer type, acrylic-based processing aids, including ethyl acrylate and methyl methacrylate derivatives, continue to dominate when superior clarity and film strength are required, while fluoropolymer options such as expanded fluoropolymers and perfluoroalkoxy fluoropolymers serve critical roles in high-temperature and chemically aggressive environments. Meanwhile, polyethylene-based aids, exemplified by high-density and low-density polyethylene formulations, maintain prominence in cost-sensitive applications where ease of processing and mechanical toughness are essential.

Turning to processing techniques, blown film extrusion processes leverage co-extrusion and mono-extrusion variants to balance multilayer film performance with production efficiency, whereas calendering operations rely on single and twin nip configurations to deliver uniform sheet thickness and surface finish. In extrusion disciplines, blow molding and pipe extrusion benefit from tailored processing aid chemistries that reduce melt fracture and enhance throughput, and injection molding applications utilize thermoplastic and thermoset injection molding aids to improve mold release and cycle times in high-volume production.

When considering additive types, the market’s demand for anti-block additives and slip agents has grown in lockstep with the packaging sector’s drive for friction control and processing reliability. Anti-static agents have also garnered attention in wire and cable applications, ensuring optimal electrical performance, while antioxidants and plasticizers play vital roles in extending material longevity and flexibility under diverse operating conditions. Each additive class continues to evolve through molecular innovations that address both performance targets and environmental regulations.

Finally, application-based segmentation underscores the versatility of polymer processing aids. In fibers and raffia manufacturing, the focus lies on enhancing drawability and surface finish to meet textile industry standards. Pipe and tube producers seek additives that improve extrusion stability and minimize die deposits, reflecting stringent infrastructure quality requirements. Within the wire and cable domain, processing aids facilitate precise conductor encapsulation and ensure consistent electrical insulation properties, aligning with rigorous safety and performance benchmarks.

By integrating these segmentation insights, manufacturers and suppliers can more effectively align their R&D and commercial strategies with end-user demands, enabling optimized product portfolios that cater to specialized application needs and processing environments.

This comprehensive research report categorizes the Polymer Processing Aid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Type

- Processing Techniques

- Additive Types

- Application

Examining Regional Dynamics in the Polymer Processing Aid Market Spanning Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics within the polymer processing aid market reveal divergent growth trajectories and strategic imperatives. In the Americas, strong demand from packaging and automotive sectors has fueled investment in advanced processing aid production capacities. Sustainability initiatives in North America, coupled with robust agricultural film consumption in South America, underscore the region’s dual focus on environmental stewardship and infrastructure development.

Across Europe, the Middle East, and Africa, regulatory drivers such as the European Green Deal have catalyzed innovation in bio-based and recyclable processing aids. Suppliers are collaborating with chemical clusters in Germany and the Netherlands to develop next-generation additives that meet stringent emission and recyclability criteria. Meanwhile, infrastructure projects in the Middle East and rising consumer electronics manufacturing in Africa present additional avenues for market expansion.

In the Asia-Pacific region, rapid industrialization and growing packaging demand in countries such as China and India have sustained high-volume consumption of acrylic and polyethylene-based processing aids. At the same time, government incentives in Southeast Asia are encouraging foreign direct investment in local compounding facilities. This emphasis on regional self-sufficiency not only reduces reliance on imports but also accelerates technology transfer and capacity building within emerging markets.

Overall, each region’s unique regulatory environment, end-use sector strengths, and trade policies are shaping localized strategies. Stakeholders aiming to secure competitive positions must therefore tailor their product development and market entry approaches to align with these region-specific drivers and challenges.

This comprehensive research report examines key regions that drive the evolution of the Polymer Processing Aid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies of Leading Polymer Processing Aid Manufacturers and Suppliers Driving Innovation through Collaboration and Diversification

Leading companies in the polymer processing aid arena are leveraging strategic alliances, technology licensing, and targeted acquisitions to bolster their competitive edge. Established chemical conglomerates have broadened their portfolios by integrating complementary additive technologies, thereby offering one-stop solutions that address multiple processing challenges. Through selective collaborations with specialty resin manufacturers, these players are co-developing bespoke aid systems optimized for proprietary polymer grades.

Mid-tier enterprises, in turn, are carving out niche positions by focusing on high-performance or eco-friendly additives. By investing in modular production lines and flexible manufacturing platforms, they can swiftly adapt to evolving customer specifications and regulatory requirements. Their agility in trialing novel chemistries and scaling up successful formulations has attracted partnerships with major tier-one resin producers looking for customized processing aid solutions.

Furthermore, regional suppliers in Asia-Pacific and Latin America are expanding their footprints beyond domestic markets, seeking to challenge traditional incumbents through cost-competitive offerings and local service networks. These companies are forging joint ventures with global formulators to access cutting-edge R&D capabilities, while also leveraging their proximity to key raw material suppliers to maintain attractive pricing structures.

Collectively, these competitive moves highlight a market characterized by both collaboration and differentiation. As additive manufacturers refine their value propositions, industry stakeholders will need to navigate a landscape marked by converging technological expertise and evolving customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polymer Processing Aid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accurate Color & Compounding, Inc.

- Akrochem Corporation

- Ampacet Corporation

- Arkema S.A.

- Avient Corporation

- Barentz International BV

- BASF SE

- Borouge PLC

- Cargill, Incorporated.

- Clariant AG

- Compagnie de Saint-Gobain S.A.

- Daikin Industries, Ltd.

- Dover Chemical Corporation

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Fine Organic Industries Limited

- INDEVCO Group

- J J Plastalloy Pvt. Ltd.

- Kandui Industries Private Limited

- LyondellBasell Industries N.V.

- Miracle Masterbatches

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Momentive Performance Materials Inc.

- Nexeo Plastics, LLC.

- Plastiblends India Limited

- Solvay S.A.

- Techmer PM, LLC

- The Chemours Company

- Tosaf Compounds Ltd. by Ravago S.A.

- Wacker Chemie AG

- Wells Performance Materials Ltd.

Actionable Strategic Recommendations for Industry Leaders to Enhance Operational Resilience and Capitalize on Emerging Opportunities in Polymer Processing

To thrive amid shifting trade policies and technological disruption, industry leaders should pursue a balanced approach encompassing supply chain agility and product innovation. Firstly, diversifying raw material sources and establishing regional production hubs can insulate operations from tariff shocks and logistical bottlenecks. At the same time, forging strategic partnerships with resin producers and equipment OEMs will enable collaborative co-development of processing aids tailored to next-generation polymer grades.

In parallel, investing in advanced formulation platforms that prioritize reduced dosage efficiency can mitigate cost pressures while meeting sustainability mandates. Incorporating renewable feedstocks and biodegradable chemistries will not only align with regulatory expectations but also resonate with environmentally conscious end users. Enhancing R&D capabilities through data-driven experimentation and high-throughput screening will accelerate the development of breakthrough additive systems.

Moreover, industry leaders must strengthen their digital infrastructure to support real-time monitoring of processing aid performance and predictive maintenance of compounding equipment. Implementing IoT-enabled sensors and analytics dashboards will provide actionable insights into process variations, thereby improving yield consistency and reducing operational downtime. Such digital transformation efforts are essential to maintain competitiveness in an increasingly automated manufacturing environment.

Finally, organizations should adopt customer-centric commercialization strategies, offering technical service agreements and training programs that enable end users to maximize additive performance. By positioning processing aids as integral components of holistic solution packages, companies can deepen customer relationships and differentiate their offerings in a crowded marketplace.

Comprehensive Research Methodology Outlining Data Sources Analytical Frameworks and Validation Techniques Ensuring Rigorous Market Intelligence

Our research methodology combined exhaustive secondary research with targeted primary interactions to ensure a holistic view of the polymer processing aid landscape. Secondary sources included industry journals, regulatory filings, and technical publications, which were systematically reviewed to map technology trends and regulatory shifts. Additionally, company literature and patent databases provided insights into the competitive positioning of key players and the evolution of formulation innovations.

To validate and enrich these insights, we conducted in-depth interviews with executives and technical experts across the polymer value chain, including resin producers, equipment manufacturers, and end users. These dialogues offered firsthand perspectives on market challenges, regional dynamics, and the performance characteristics of emerging processing aid chemistries. By triangulating qualitative feedback with quantitative data, we ensured robustness and consistency in our findings.

Data synthesis involved cross-referencing historical performance indicators with current market developments, such as tariff impacts and regional investment flows. Analytical frameworks, including SWOT and scenario analysis, were applied to evaluate strategic implications for stakeholders, while materiality assessments helped prioritize critical issues such as sustainability and digitalization. This multifaceted approach underpinned the rigor of our market intelligence.

Finally, all data points and strategic conclusions underwent validation through peer review sessions with independent subject-matter experts. This iterative process of feedback and refinement enhanced the accuracy of the research and ensured that the final deliverables reflect real-world complexities and forward-looking insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polymer Processing Aid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polymer Processing Aid Market, by Polymer Type

- Polymer Processing Aid Market, by Processing Techniques

- Polymer Processing Aid Market, by Additive Types

- Polymer Processing Aid Market, by Application

- Polymer Processing Aid Market, by Region

- Polymer Processing Aid Market, by Group

- Polymer Processing Aid Market, by Country

- United States Polymer Processing Aid Market

- China Polymer Processing Aid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Conclusive Reflections on Polymer Processing Aid Industry Trends and Strategic Implications for Stakeholders Operating in a Dynamic Market Environment

In conclusion, the polymer processing aid sector stands at a crossroads of technological innovation, sustainability imperatives, and evolving trade landscapes. The convergence of digitalized manufacturing, green chemistry advancements, and adaptive supply chain strategies has created a fertile ground for growth and differentiation. Stakeholders equipped with deep segmentation understanding and regional market awareness are best positioned to capitalize on this momentum.

As tariffs and regulatory pressures continue to reshape competitive dynamics, industry participants must maintain agility through diversified sourcing and collaborative R&D initiatives. Embracing data-driven formulation development and investing in digital process monitoring will further enhance operational resilience. Ultimately, a strategic focus on customer-centric solutions that integrate high-performance additives with comprehensive technical support will determine market leadership in the years ahead.

By leveraging the insights and recommendations outlined in this executive summary, decision-makers can navigate complexity with confidence and drive sustained value creation across the polymer processing aid value chain.

Connect with Associate Director Ketan Rohom to Access the Full Polymer Processing Aid Market Research Report and Unlock Tailored Insights

To explore the comprehensive findings and gain bespoke insights into polymer processing aid trends and opportunities, connect directly with Ketan Rohom, Associate Director of Sales and Marketing at our firm. His depth of knowledge and industry perspective will guide you through tailored solutions designed to align with your strategic objectives and operational needs.

Engage with Ketan today to secure your copy of the full polymer processing aid market research report and benefit from expert consultation on how to leverage these insights for competitive advantage and sustained growth

- How big is the Polymer Processing Aid Market?

- What is the Polymer Processing Aid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?