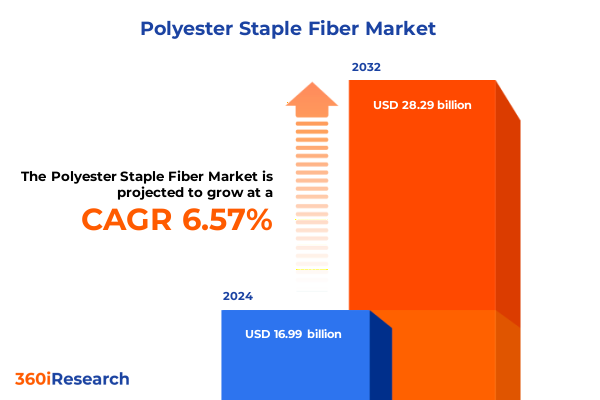

The Polyester Staple Fiber Market size was estimated at USD 18.04 billion in 2025 and expected to reach USD 19.18 billion in 2026, at a CAGR of 6.63% to reach USD 28.29 billion by 2032.

Unraveling the Polyester Staple Fiber Revolution: Market Dynamics and Emerging Opportunities Defining Future Industrial and Textile Landscapes

Polyester staple fiber stands at the intersection of performance and versatility, offering unparalleled tensile strength, resilience, and cost-effectiveness that underpin its widespread adoption across textile and nonwoven industries. Known for its ability to maintain structural integrity under repeated stress, this synthetic fiber has become a preferred choice for manufacturers seeking consistent quality in apparel, home furnishings, and industrial applications. Transitioning seamlessly between technical and consumer segments, polyester staple fiber’s fiber morphology enables properties such as moisture wicking, thermal insulation, and ease of dyeing, driving innovation across traditional and emerging end uses.

Despite mounting environmental concerns, reliance on virgin polyester has intensified, with recent industry data indicating a rise to 57 percent of global fiber usage in 2023. This predominance is fueled by the material’s lower cost compared to recycled alternatives and the industry’s accelerated production cycles, which have collectively contributed to a substantial increase in greenhouse gas emissions. In parallel, market players are exploring sustainability pathways through chemical and mechanical recycling processes, as exemplified by Repreve, which has transformed over 42 billion PET bottles into fiber while reducing greenhouse emissions by approximately 60 percent compared to virgin polyester. This dual narrative of performance and environmental accountability sets the stage for a dynamic market evolution in the polyester staple fiber landscape.

Embracing Sustainability, Artificial Intelligence, and Circular Economy Breakthroughs Reshaping the Polyester Staple Fiber Landscape

Over the past two years, the polyester staple fiber sector has undergone transformative shifts driven by sustainability imperatives and digital innovation. Industry participants are embracing artificial intelligence and machine learning to optimize production processes, enhance fiber quality consistency, and predict maintenance needs, thereby minimizing downtime and reducing operational costs. Concurrently, regulatory pressures and consumer demand for traceable supply chains have accelerated the adoption of blockchain-enabled digital platforms, enabling full chain-of-custody transparency for both virgin and recycled polyester fibers.

Circular economy initiatives are reshaping raw material flows, with mechanical and chemical recycling technologies unlocking new performance thresholds for recycled polyester staple fiber. Partnerships between feedstock suppliers, fiber producers, textile manufacturers, and major apparel brands are scaling closed-loop systems, driving efficiencies in depolymerization, monomer recovery, and fiber spinning. At the same time, emerging fiber modifications-such as antimicrobial, moisture-wicking, and UV-resistant properties-cater to premium segments in sportswear, healthcare, and filtration applications. These converging forces are redefining competitive dynamics, positioning the polyester staple fiber industry for continued innovation and accelerated growth.

Assessing the Far-Reaching Impacts of United States Safeguard Measures and Tariff Actions on Fine Denier Polyester Staple Fiber Imports

United States trade actions in 2024 and early 2025 have fundamentally altered the competitive landscape for fine denier polyester staple fiber imports. Pursuant to Presidential Proclamation 10857, effective November 23, 2024, a four-year quantitative restriction was established on Temporary Importation Under Bond entries of fine denier polyester staple fiber, initially setting the annual quota to zero kilograms through November 22, 2025 and phasing in graduated limits thereafter. By targeting imports under HTSUS statistical reporting numbers 9813.00.0520 and 5503.20.0025, this safeguard measure seeks to facilitate positive adjustment by the domestic industry facing injury from surging imports.

In addition to quantitative restrictions, the effective tariff rate on certain polyester staple fiber categories imported from China rose to approximately 24.3 percent on March 4, 2025, further increasing landed costs and eroding China’s previous cost advantage. This tariff escalation has incentivized importers to pivot to suppliers in South Korea, which enjoys zero-tariff access under the Korea-US Free Trade Agreement, as well as to regional players in Thailand, India, and Vietnam, despite residual cost pressures associated with the new duties.

Decoding Key Market Segmentation Dimensions in Polyester Staple Fiber by End Use, Fiber Characteristics, and Raw Material Origins

Market segmentation in the polyester staple fiber industry reveals nuanced dynamics that shape competitive strategies and product development roadmaps. In the apparel domain, sub-categories such as children’s wear, men’s wear, and women’s wear exhibit distinct performance requirements, with women’s and men’s activewear driving demand for advanced moisture-management fibers while children’s wear emphasizes softness and safety standards. Home furnishing applications span bedding, carpets, curtains, and upholstery, where premium aesthetics and functional attributes like stain resistance inform fiber selection. Industrial uses encompass agrotextiles, filtration, geotextiles, and nonwoven materials, each demanding tailored fiber specifications for durability, tensile strength, and chemical resistance.

Fiber length also exerts significant influence on processability and end-use performance. Long-length fibers above 64 mm enable higher productivity in spinning operations and enhanced yarn tenacity, whereas medium-length fibers between 38 and 64 mm offer a balance of strength and cost efficiency. Short-length fibers under 38 mm find favor in nonwoven and filler applications for their shorter staple requirements. Concurrently, denier classification-ranging from less than 1.5 dpf, through 1.5 to 3 dpf, to above 3 dpf-governs fineness, hand feel, and cover performance in textiles, with the 1.5 to 3 dpf range representing the most versatile sweet spot for apparel and home furnishing products.

Crimp type differentiates fibers based on their mechanical processing characteristics. Crimped fibers contribute to bulk, resilience, and thermal insulation properties critical for bedding and carpet applications, while non-crimped fibers are prized in high-precision industrial processes for their uniformity and stability. At the raw material level, the choice between DMT-derived and PTA-derived polyester influences polymer chain architecture, melt viscosity, and downstream processing parameters, guiding producers toward specific feedstock strategies aligned with performance targets and cost constraints.

This comprehensive research report categorizes the Polyester Staple Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Denier

- Fiber Length

- Crimp Type

- Manufacturing Process

- Finish Type

- Luster

- End-Use Industry

- Distribution Channel

Exploring Regional Heterogeneity and Growth Drivers in the Americas, Europe Middle East & Africa and Asia-Pacific Polyester Staple Fiber Markets

Divergent regional dynamics underpin the global polyester staple fiber market, reflecting variations in regulatory landscapes, supply chain infrastructures, and end-use demand profiles. In the Americas, North America leads through robust investments in sustainability initiatives, technological modernization, and closed-loop recycling projects. Manufacturers are capitalizing on government incentives for clean technology and circular-economy practices, establishing interactive pilot plants that integrate AI-powered quality control and mechanical recycling capabilities to produce high-performance recycled fibers. Latin America, while smaller in scale, is experiencing growth driven by rising automotive production and expanding home furnishings sectors, prompting regional producers to adapt fiber portfolios for filtration and upholstery applications.

Europe, the Middle East & Africa present a heterogeneous canvas shaped by stringent environmental regulations and shifting consumption patterns. In Western Europe, initiatives such as fast fashion taxes and extended producer responsibility schemes have led to an uptick in sustainable fiber mandates, driving brands to adopt recycled polyester in product lines. Concurrently, the Middle East’s petrochemical-driven fiber capacities are leveraging low-cost feedstocks to supply both regional and export markets, while Africa’s evolving textile and nonwoven sectors are poised for expansion, contingent on infrastructure enhancements and trade facilitation measures.

Asia-Pacific retains its dominance in production and consumption, with China, India, South Korea, and Southeast Asian economies collectively responsible for the majority of global polyester staple fiber output. China’s vast integrated PTA and fiber manufacturing complexes continue to shape global supply flows, although recent policy shifts and trade actions have prompted downstream players to diversify sourcing. India’s textile clusters are scaling up fiber production to meet domestic and export demand, and South Korea leverages free trade agreements to capture share in premium segments, particularly in fine denier and specialty fibers.

This comprehensive research report examines key regions that drive the evolution of the Polyester Staple Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Dynamics and Strategic Positions of Leading Polyester Staple Fiber Producers Emerging Entrants and Innovators

Leading fiber producers and innovators are actively reshaping the polyester staple fiber ecosystem through strategic investments, capacity expansions, and R&D collaborations. Indorama Ventures maintains its position at the forefront of sustainable polyester production, having initiated partnerships that integrate mechanical recycling systems into existing PTA and fiber plants to secure feedstock for its high-quality recycled fiber lines. Similarly, Toray Industries has doubled down on specialty fiber technologies, focusing on hollow and functional fibers for automotive interiors, filtration membranes, and medical textiles.

North American entities such as DAK Americas and Unifi are leveraging regional market intelligence and tailored product offerings to drive growth. DAK Americas has expanded its integrated operations in Texas to include a dedicated line for medium-denier fibers optimized for home furnishing and nonwoven hygiene products. Unifi’s Repreve brand exemplifies the potential of recycled polyester staple fiber, transforming over 42 billion PET bottles into market-sourced fibers and establishing collaborations with global apparel giants to embed recycled content in mass-market collections. In parallel, Darling Fibers, Nan Ya Plastics, and Sun Fiber are actively engaging in trade remedy investigations, underscoring the complex interplay between commercial strategy and regulatory environments in the fine denier segment. These competitive dynamics illustrate the dual imperatives of scalability and sustainability driving the current market leadership landscape

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyester Staple Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALPEK POLYESTER

- Bombay Dyeing by Wadia Group

- Colossustex Private Limited

- DAE YANG INDUSTRIAL CO., LTD

- Diyou Fibre Sdn Bhd

- DT Group Ltd.

- EAST ASIA TEXTILE TECHNOLOGY LTD.

- Far Eastern New Century Corporation

- Green Group SA

- Huvis Corporation

- Indorama Ventures Public Company Limited

- Meadowbrook Inventions, Inc.

- PT Tifico Fiber Indonesia, Tbk.

- Reliance Industries Limited

- Silon, LLC

- Sinopec Yizheng Chemical Fibre Limited Liability Company

- Texofib by Al Khafra Holding Group

- Toray Industries, Inc.

- USFibers

- W.Barnet GmbH & Co. KG

- Wellknown Polyesters Ltd.

- Xin Da Spinning Technology Sdn. Bhd

- Zhejiang Hengyi Group Co., Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Polyester Staple Fiber Market Evolution and Drive Sustainable Growth

To navigate the evolving polyester staple fiber landscape, industry leaders must align their strategies with sustainability, digitalization, and supply chain resilience objectives. Accelerating the deployment of closed-loop recycling initiatives and expanding partnerships across the value chain can secure raw material access and enhance brand credentials in an increasingly eco-conscious marketplace. Investments in advanced process analytics and predictive maintenance powered by artificial intelligence will reduce production variability, optimize energy consumption, and ensure consistent fiber quality across diverse product portfolios.

Concurrent with technological advancements, companies should proactively engage with trade policymakers and monitor safeguard measures to mitigate tariff and quota risks. Diversifying geographic sourcing strategies by leveraging free trade agreement benefits and regional production capacities can minimize the impact of import restrictions and maintain competitive cost structures. Finally, expanding the development of specialty fibers with tailored attributes-such as flame retardancy, moisture management, and antimicrobial performance-will unlock new applications in filtration, healthcare, and technical textiles, positioning fiber producers to capture higher-value market segments and fortify long-term profitability

Illuminating the Rigorous Multimethod Research Framework Behind Our In-Depth Analysis of the Global Polyester Staple Fiber Market

Our research methodology integrates a robust multimethod framework combining primary and secondary data sources to ensure comprehensive market insights. Primary research encompassed in-depth interviews with senior executives, technical directors, and procurement specialists across fiber manufacturing, textile conversion, and end-use industries, facilitating qualitative perspectives on technology adoption, regulatory impacts, and customer requirements. Secondary research leveraged trade databases, including United States International Trade Commission filings, U.S. Customs and Border Protection quota bulletins, cross-border shipment data, and company financial disclosures to corroborate quantitative trends and validate supply chain dynamics.

Analytical triangulation was applied to reconcile potential discrepancies across sources, underpinned by rigorous data cleansing and normalization procedures. Segmentation analysis was conducted using predefined criteria-end use, fiber length, denier, crimp type, and raw material origin-to dissect market heterogeneity and identify growth pockets. Regional assessments integrated macroeconomic indicators, trade policies, and infrastructure readiness to map demand trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific. This methodological rigor ensures that findings reflect current market realities and actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyester Staple Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyester Staple Fiber Market, by Product Type

- Polyester Staple Fiber Market, by Raw Material

- Polyester Staple Fiber Market, by Denier

- Polyester Staple Fiber Market, by Fiber Length

- Polyester Staple Fiber Market, by Crimp Type

- Polyester Staple Fiber Market, by Manufacturing Process

- Polyester Staple Fiber Market, by Finish Type

- Polyester Staple Fiber Market, by Luster

- Polyester Staple Fiber Market, by End-Use Industry

- Polyester Staple Fiber Market, by Distribution Channel

- Polyester Staple Fiber Market, by Region

- Polyester Staple Fiber Market, by Group

- Polyester Staple Fiber Market, by Country

- United States Polyester Staple Fiber Market

- China Polyester Staple Fiber Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 3180 ]

Concluding Perspectives Highlighting the Critical Role and Future Potential of Polyester Staple Fiber in Evolving Industrial and Consumer Sectors

As polyester staple fiber continues to underpin critical applications in textiles, nonwovens, and industrial substrates, the market stands at a pivotal juncture characterized by innovation, sustainability, and regulatory complexity. Technological breakthroughs in recycling and fiber functionalization are reshaping product portfolios, while digital supply chain solutions enhance transparency and traceability. At the same time, safeguard measures and evolving tariff regimes require agile commercial strategies to preserve market access and protect downstream stakeholders.

Looking ahead, the confluence of consumer demand for eco-friendly materials, governmental mandates for circular economy practices, and advancements in fiber engineering will drive differentiation across the value chain. Producers that harness integrated sustainability investments, foster collaborative partnerships, and maintain adaptive trade risk management will be best positioned to capture emerging opportunities and deliver resilient growth. Polyester staple fiber’s versatility and performance attributes will remain indispensable in addressing evolving industry challenges, cementing its role as a foundational material in the sustainable textile and industrial ecosystems of the future.

Engage with Associate Director Ketan Rohom to Unlock Comprehensive Polyester Staple Fiber Market Intelligence and Propel Informed Decision-Making

To explore comprehensive insights and strategic implications of the polyester staple fiber market, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you gain access to in-depth analysis, tailored data and expert guidance on market dynamics, trade impacts and innovation trends shaping the industry’s future. Secure your market research report today to inform supply chain decisions, investment priorities and product development roadmaps with data-driven clarity and industry expertise.

- How big is the Polyester Staple Fiber Market?

- What is the Polyester Staple Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?