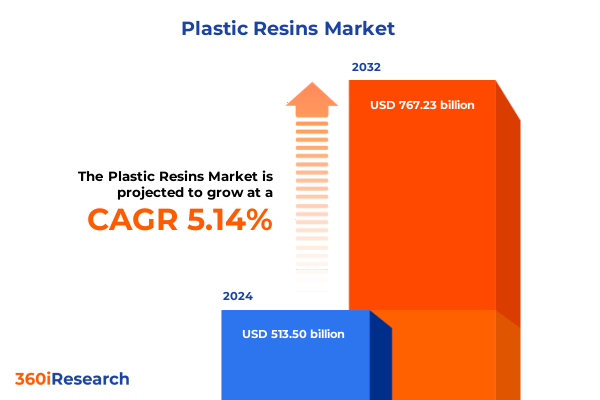

The Plastic Resins Market size was estimated at USD 539.74 billion in 2025 and expected to reach USD 566.57 billion in 2026, at a CAGR of 5.15% to reach USD 767.23 billion by 2032.

A Comprehensive Introduction to Plastic Resins Revealing Their Pivotal Importance and Emerging Drivers in Today’s Global Manufacturing Landscape

Plastic resins underpin a vast array of modern manufacturing and consumer applications, from lightweight automotive components to innovative packaging solutions that enable product preservation and extended shelf life. Over the past decade, the evolution of resin chemistries and processing techniques has not only expanded the functional scope of these materials but also reshaped entire industry value chains. Today, factors such as sustainability mandates, evolving regulatory landscapes, and rapid digitalization are acting as catalysts for the next phase of transformation, demanding a comprehensive understanding of market dynamics and emerging technologies.

In this context, decision-makers across sectors require clarity on how raw material availability, feedstock pricing, and end-user requirements converge to influence resin selection and commercial strategies. This introduction sets the stage by defining core resin categories, identifying the primary value drivers in global supply networks, and framing the key questions that stakeholders must address to navigate volatility and capitalize on growth opportunities. Through a focused lens, the following sections will illuminate the trends, challenges, and strategic imperatives reshaping the plastic resin marketplace.

Unveiling the Most Significant Technological, Regulatory, and Sustainability-Driven Shifts Reshaping the Plastic Resin Industry’s Future Trajectory

In recent years, the plastic resin industry has witnessed transformative shifts driven by converging technological advances, heightened environmental scrutiny, and evolving supply chain models. Innovations in catalyst design and polymerization techniques have enabled producers to tailor molecular structures for enhanced performance characteristics such as impact resistance, barrier properties, and lightweighting potential. Concurrently, the integration of digital twins and advanced analytics into manufacturing operations is accelerating process optimization, reducing downtime, and improving yield consistency across plants.

Regulatory developments are further catalyzing change, as governments and consumer advocacy groups push for reduced greenhouse gas emissions, closed-loop recycling frameworks, and transparent chain-of-custody certifications. This evolving landscape is compelling manufacturers, converters, and brand owners to reassess material choices, invest in emerging recycling technologies, and forge partnerships that ensure compliance while preserving cost efficiency. As a result, the competitive battleground has shifted from basic cost leadership to innovation in sustainable product offerings and agile, data-driven operations.

Analyzing the Far-Reaching Economic and Strategic Consequences of the 2025 United States Tariffs on Plastic Resin Supply Chains and Competitive Dynamics

The implementation of new import tariffs by the United States in early 2025 has introduced a layer of complexity that reverberates through resin sourcing strategies and global trade flows. By raising duties on certain polymer grades imported from specific regions, these measures have altered the incentive structures for both domestic producers and multinational resin purchasers. As a direct consequence, domestic manufacturing capacity utilization has increased, while import volumes from traditional low-cost hubs have moderated to reflect the new cost calculus.

In addition, these tariff changes have prompted resin consumers to diversify their supplier base, seeking competitive alternatives in regions unaffected by U.S. duties. Consequently, secondary markets and intermediaries have gained prominence, leveraging flexible import channels and smaller shipment sizes to service niche demand pockets. This recalibration of trade patterns underscores the importance of strategic sourcing agility and emphasizes the need for real-time visibility into customs classifications, duty schedules, and inventory deployment to ensure uninterrupted production flows.

Delivering Deep Segmentation Insights by Form, Process, Resin Type, Sales Channels, and Applications to Illuminate Market Nuances and Opportunities

The plastic resin market can be viewed through multiple analytical lenses that together illuminate critical growth pockets and inform strategic prioritization. When examining the market by form, end users tend to favor pelletized resins for their streamlined feed into extrusion and injection moulding lines, whereas powder resins find specialized application in coatings and additive formulations, and flakes remain integral to circular economy initiatives where post-consumer recycled content is processed and reintroduced.

Turning to the manufacturing process, emulsion polymerization stands out for producing fine-grade resins with uniform particle distribution suited to adhesives and specialty coatings. Gas-phase polymerization, with its solvent-free operation, supports high-purity applications such as geomembranes and biaxially oriented films. Solution polymerization methods continue to deliver versatile resin grades for fiber and film production, while suspension polymerization maintains its role in generating high-impact polystyrene and other engineered resins.

Assessing resin types reveals a diverse landscape: polyethylene dominates with subcategories including high density grades for rigid packaging and durable piping, linear low density for flexible film structures, and low density for applications requiring softness and clarity. Polyethylene terephthalate spans bottle, fiber, and film grades, each optimized through controlled intrinsic viscosity. Polypropylene’s copolymer and homopolymer variants cater to applications ranging from automotive components to consumer appliance parts. Polystyrene grades, from general purpose to high impact formulations, serve insulation and protective packaging roles, while polyvinyl chloride derivatives such as chlorinated PVC and unplasticized formulations underpin profile extrusion and pipe systems.

Exploring sales channels, direct procurement agreements between large end users and resin producers offer cost advantages through volume contracts, while distributors play an essential role in servicing smaller converters and specialty compounders with tailored resin blends and just-in-time logistics. Lastly, application analysis highlights how automotive exteriors and under-the-hood components drive demand for high-performance engineering resins, construction applications like insulation and piping rely on durability and fire resistance, and packaging-both flexible films and rigid containers-remains the largest single consumption category, driven by consumer goods, food and beverage, and healthcare segments.

This comprehensive research report categorizes the Plastic Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Manufacturing Process

- Resin Type

- Sales Channel

- Application

Capturing Regional Dynamics and Emerging Demand Patterns Across the Americas, Europe Middle East Africa, and Asia-Pacific Plastic Resin Markets

Regional analysis reveals that in the Americas, robust infrastructure projects and sustained automotive output are fueling demand for both commodity and specialty resins, with localized recycling mandates further supporting post-consumer resin supply streams. In addition, the presence of major ethylene crackers and integrated petrochemical complexes in the Gulf Coast enhances feedstock affordability, reinforcing the region’s competitive position.

In the Europe, Middle East, and Africa region, regulatory leadership in circular economy initiatives and stringent chemical safety standards is prompting resin manufacturers and converters to prioritize renewable feedstocks, certified recycled content, and advanced compostable polymer solutions. Meanwhile, emerging markets in the Middle East continue to expand capacity for commodity resins, leveraging access to low-cost feedstock and encouraging downstream value chain investments.

Asia-Pacific maintains its status as the largest consumption hub, driven by rapid urbanization, growing middle-class populations, and expansive packaging requirements across food, e-commerce, and personal care. Local producers in China, Southeast Asia, and India are accelerating investment in higher-margin specialty and engineered resin lines, while strategic partnerships with global players are fostering technology transfer and capacity expansions in regions such as Malaysia and the Gulf Cooperation Council states.

This comprehensive research report examines key regions that drive the evolution of the Plastic Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements Partnerships and Innovation Initiatives of Leading Plastic Resin Manufacturers Driving Industry Advancement

Leading players in the plastic resin industry are advancing a diverse range of strategic initiatives to secure long-term growth and resilience. Integrated petrochemical majors are leveraging scale advantages through backward integration into ethylene and propylene production, enhancing feedstock cost control and margin stability. Meanwhile, specialty resin manufacturers are investing in research and development centers focused on next-generation biopolymers, advanced recycling processes, and high-performance compounding technologies.

Collaborations between resin producers and consumer goods companies are becoming increasingly prevalent, aimed at co-developing resin formulations that meet exacting application requirements while ensuring circularity credentials. In parallel, tier-one manufacturers of extrusion and injection moulding equipment are aligning with resin suppliers to optimize process parameters, enabling customers to achieve higher throughput and lower energy consumption.

Furthermore, smaller innovators and startup enterprises are disrupting traditional supply models by offering digitally enabled resin platforms, real-time quality analytics, and decentralized production capabilities. These emerging entities are capturing niche segments, such as advanced color and additive masterbatches, and bespoke resin blends for medical devices, thereby challenging incumbents to elevate their technology roadmaps and service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Asahi Kasei Corporation

- BASF SE

- Borealis AG

- Braskem S.A.

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Covestro AG

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- LANXESS AG

- LG Chem Ltd.

- Lotte Chemical Corporation

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Group Corporation

- Reliance Industries Limited

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Trinseo PLC

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Market Complexity Capitalize on Trends and Sustain Competitive Advantage

To navigate the evolving plastic resin landscape, industry leaders should prioritize the development of integrated circularity strategies that align with both regulatory expectations and consumer preferences. Investing in advanced mechanical and chemical recycling capabilities will not only reduce feedstock risk but also unlock premium pricing for certified recycled resin grades. Pursuing strategic alliances with waste management firms and technology providers can accelerate time-to-market for closed-loop material solutions.

Additionally, companies must harness digital transformation to achieve operational excellence. Deploying predictive maintenance systems, real-time process monitoring, and supply chain visibility platforms will enhance asset utilization and mitigate disruptions. At the same time, engaging in collaborative research partnerships with academic institutions and industry consortia can spur the discovery of high-value resin chemistries and sustainable feedstock alternatives.

Finally, a forward-looking approach to market expansion requires the identification of underserved application spaces-such as lightweight composite matrices in electric vehicles or barrier-enhanced films for pharmaceutical packaging-where differentiated resin properties can command added value. By integrating market intelligence with agile product development processes, organizations can respond swiftly to emerging end-user needs and secure competitive advantage.

Outlining Rigorous Research Methodology Data Collection Techniques and Analytical Frameworks Ensuring Comprehensive Plastic Resin Market Intelligence

This analysis is grounded in a robust research framework combining primary and secondary data collection to ensure the highest degree of accuracy and comprehensiveness. Primary research involved in-depth interviews with senior executives across resin producers, converters, equipment manufacturers, and major end-user organizations, capturing firsthand perspectives on market challenges and emerging opportunities. These qualitative insights were complemented by quantitative data gathered through detailed surveys and validated against industry association reports and publicly available financial disclosures.

Secondary research encompassed a thorough examination of technical white papers, patent filings, and scientific journals to identify advancements in polymer chemistry, processing technologies, and recycling methodologies. Trade publications and regulatory databases were monitored to track tariff developments, sustainability legislation, and international standards impacting resin production and usage. Data triangulation techniques were employed to reconcile information from diverse sources, ensuring consistency and reliability of the findings.

Analytical frameworks such as Porter’s Five Forces, SWOT analysis, and value chain mapping were utilized to contextualize competitive dynamics and identify critical leverage points within the supply network. Forecast accuracy was enhanced through scenario modeling that incorporated variations in crude oil pricing, feedstock availability, and policy shifts. The combination of methodological rigor and domain expertise underpins the strategic insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Resins Market, by Form

- Plastic Resins Market, by Manufacturing Process

- Plastic Resins Market, by Resin Type

- Plastic Resins Market, by Sales Channel

- Plastic Resins Market, by Application

- Plastic Resins Market, by Region

- Plastic Resins Market, by Group

- Plastic Resins Market, by Country

- United States Plastic Resins Market

- China Plastic Resins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Concluding Reflections on Key Findings Market Imperatives and the Critical Paths Forward for Stakeholders in the Plastic Resin Sector

In sum, the plastic resin industry stands at a pivotal juncture where technological innovation, policy imperatives, and shifting end-user demands converge to redefine value creation. The dynamic interplay of sustainable material adoption, digitalization of manufacturing, and evolving trade policies underscores the need for a holistic strategic approach. By aligning circular economy principles with rigorous process optimization and targeted application development, stakeholders can unlock new pathways for growth and resilience.

The insights offered in this summary illuminate both the challenges and opportunities that will shape the trajectory of the resin market. Whether navigating tariff-induced supply chain realignments, pursuing novel resin chemistries, or forging partnerships to enhance market reach, organizations equipped with actionable intelligence will be best positioned to thrive in an increasingly competitive and sustainability-driven domain.

Encouraging Engagement and Next Steps with Ketan Rohom to Secure In-Depth Market Research Insights on Plastic Resin Trends and Strategic Directions

To explore these insights in greater depth and gain tailored strategic guidance, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through purchase options and customized engagement models. Reach out today to secure comprehensive access to the full breadth of market intelligence and position your organization to capitalize on the critical trends shaping the plastic resin industry’s future.

- How big is the Plastic Resins Market?

- What is the Plastic Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?