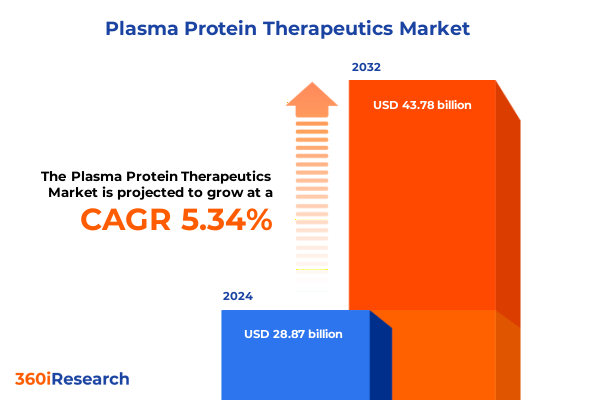

The Plasma Protein Therapeutics Market size was estimated at USD 30.38 billion in 2025 and expected to reach USD 31.97 billion in 2026, at a CAGR of 5.35% to reach USD 43.78 billion by 2032.

Exploring the Evolving Landscape of Plasma Protein Therapeutics and Key Drivers Shaping Innovation and Patient Care in Modern Healthcare Ecosystems

Plasma protein therapeutics have emerged as indispensable modalities in modern medicine, addressing a broad spectrum of life-threatening conditions ranging from immunodeficiency disorders to coagulation abnormalities. Over the past decade, the convergence of an aging demographic, rising incidence of chronic diseases, and heightened awareness of immune-mediated pathologies has driven unprecedented demand for albumin, coagulation factors, immunoglobulins, and hyperimmune globulins. In addition, the global response to pandemic-related complications underscored the critical role of plasma-derived products, as healthcare systems leaned heavily on convalescent plasma therapies and targeted immune globulins to mitigate severe respiratory and infectious outcomes. Consequently, stakeholders across biopharmaceutical and clinical care sectors have intensified efforts to streamline plasma collection and fractionation workflows while ensuring compliance with stringent safety standards.

In parallel, regulatory bodies have advanced guidelines to safeguard donor health and product integrity, prompting manufacturers to invest in sophisticated process analytical technologies and pathogen inactivation techniques. Supply chain resilience has become a strategic imperative, as recent disruptions highlighted vulnerabilities in donor recruitment, cold-chain logistics, and geographical concentration of fractionation facilities. At the same time, novel upstream methodologies, such as immunoaffinity separation and continuous chromatography, are gaining traction to optimize yield and purity profiles. Therefore, this executive summary sets the stage for an in-depth exploration of the prevailing drivers, competitive dynamics, and strategic priorities shaping the plasma protein therapeutics landscape today.

Uncovering the Groundbreaking Scientific, Technological, and Regulatory Shifts Defining the Next Era of Plasma Protein Therapeutic Development

Recent years have witnessed a profound transformation in the scientific underpinnings of plasma protein therapeutics, driven by breakthroughs in recombinant expression, enhanced fractionation platforms, and precision separation technologies. Continuous processing techniques have redefined batch production paradigms, reducing cycle times and elevating consistency across albumin and immunoglobulin manufacture. Meanwhile, the integration of monoclonal antibody engineering and bispecific formats has broadened the therapeutic repertoire, enabling targeted interventions for autoimmune disorders and hemophilia. At the same time, advances in gene-editing tools have begun to inform next-generation plasma factor production, blurring the lines between cell and plasma-derived modalities. These innovations have catalyzed a shift from conventional bulk fractionation toward modular, flexible production lines capable of rapid response to emergent clinical needs.

Concurrently, regulatory authorities worldwide are converging on harmonized frameworks to streamline product approval and post-market surveillance, fostering cross-border collaboration on donor screening standards and pathogen safety protocols. This regulatory alignment has encouraged the adoption of digital donor registries, which leverage biometric verification and blockchain-enabled traceability to safeguard provenance. In addition, manufacturers are embracing advanced analytics and real-world evidence to inform dose optimization and personalized treatment regimens, while patient-centric infusion models are reshaping care delivery in ambulatory and home settings. Taken together, these scientific and regulatory shifts are redefining value chains across the plasma protein sector, laying the groundwork for more resilient, efficient, and patient-focused therapeutic ecosystems.

Assessing the Broad Economic, Supply Chain, and Clinical Implications of Newly Enacted United States Tariffs on Plasma Protein Therapeutics in 2025

In early 2025, the United States government implemented a comprehensive tariff regime targeting select plasma protein imports, aiming to reinforce domestic manufacturing and address perceived supply vulnerabilities. The tariff structure imposed differential duties on key fractions including immunoglobulins, albumin, and coagulation factors, reflecting an effort to incentivize local fractionation investments and mitigate reliance on overseas suppliers. This policy measure was accompanied by tightened import licensing requirements and enhanced customs inspections, underscoring a strategic pivot toward self-sufficiency in critical biologics. Historically, the U.S. market has balanced robust donor networks with a significant volume of imported finished products, rendering the new tariff framework a significant inflection point for manufacturers, payers, and healthcare providers alike.

The immediate consequence of heightened import duties has been a recalibration of cost models across the value chain, manifesting in elevated list prices and pressure on reimbursement rates. Hospitals and clinics have begun revisiting supplier contracts, negotiating margin cushions, and exploring bulk-purchase agreements to soften the financial impact. In response, several leading fractions producers have expedited investments in domestic plasma collection centers and modular fractionation facilities, while alternative sourcing strategies have emerged within neighboring free-trade partners. Clinicians, in turn, are monitoring inventory levels closely to preempt any disruptions to patient care, particularly for rare indications requiring high-purity factors. Looking ahead, stakeholders are evaluating hedging mechanisms and public-private collaborations to ensure sustainable access, even as the tariff dialogue continues to evolve.

Delving into Strategic Product, Indication, Administration, and End User Segmentation Trends Driving Focused Growth in Plasma Protein Therapeutics

A granular analysis of product segmentation reveals that albumin offerings are distinguished by concentration tiers, with the five percent formulation maintaining broad utility in volume expansion protocols and the twenty-five percent variant gaining traction for its rapid colloid replenishment in critical care settings. Within the coagulation factor category, Factor VIII remains a cornerstone for hemophilia A management, while Factor IX innovations are reshaping the hemophilia B therapeutic landscape; concurrently, prothrombin complex concentrates are accruing preference for emergency reversal of anticoagulation. Hyperimmune globulin segments, notably hepatitis B, rabies, tetanus, and varicella zoster formulations, continue to respond to region-specific immunization programs and emerging pathogen outbreaks, reinforcing the strategic importance of adaptable production capacity. Furthermore, the dichotomy between intravenous and subcutaneous immunoglobulins underscores evolving patient and provider preferences, as subcutaneous delivery gains momentum through home-based infusion models that enhance adherence and convenience.

Beyond product nuances, therapeutic indications cluster into cardiovascular, neurological, primary immunodeficiency, secondary immunodeficiency, and trauma applications, each exhibiting distinct clinical drivers and reimbursement dynamics. The route of administration segmentation-encompassing intramuscular, intravenous, oral, and subcutaneous pathways-mirrors a broader shift toward minimally invasive, patient-focused regimens maximizing tolerability. In parallel, the end user landscape bifurcates between clinic and hospital settings, with ambulatory infusion centers expanding their footprint amid value-based care initiatives. By weaving these segmentation layers together, industry participants can identify high-impact niches, refine portfolio strategies, and align resource allocation with evolving patient and payer expectations, thereby unlocking sustainable growth avenues within the plasma protein therapeutics domain.

This comprehensive research report categorizes the Plasma Protein Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Indication

- Route Of Administration

- End User

Highlighting Regional Dynamics and Comparative Growth Drivers across Americas, Europe Middle East Africa, and Asia Pacific Plasma Protein Therapeutics Markets

The Americas region commands a pivotal position in the global plasma protein therapeutics arena, buoyed by a mature infrastructure of dedicated donor centers and well-established fractionation plants. In the United States and Canada, pronounced regulatory support and incentivized donor programs underpin a steady supply of source plasma, while collaborative research initiatives drive continuous process improvements. The region’s robust reimbursement frameworks and scalable logistics networks further facilitate swift deployment of immunoglobulins and coagulation factors, enabling healthcare systems to respond effectively to both routine and emergent clinical demands. Looking forward, strategic partnerships between local manufacturers and academic institutions are poised to accelerate innovation in high-purity fractions and novel indications.

Across Europe, the Middle East, and Africa, the landscape is characterized by a mosaic of regulatory pathways and wide variations in reimbursement policies. The European Medicines Agency’s efforts toward regulatory harmonization have reduced approval timelines for key plasma-derived therapies, yet national price controls and budgetary constraints continue to shape market access dynamics. In the Middle East and Africa, growing healthcare expenditures and investments in cold-chain infrastructure are catalyzing wider adoption of immunoglobulin therapies, particularly for primary immunodeficiency. Meanwhile, the Asia-Pacific corridor is distinguished by rapid healthcare modernization, with governments in China, India, Australia, and Southeast Asia bolstering local plasma collection mandates and fostering technology transfer agreements. These regional nuances collectively inform targeted go-to-market strategies and highlight areas for capacity expansion and cross-border collaboration.

This comprehensive research report examines key regions that drive the evolution of the Plasma Protein Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Partnerships, Pipeline Diversification, and Competitive Positioning of Key Global Players in Plasma Protein Therapeutics Space

Leading companies in the plasma protein therapeutics sector have embarked on multifaceted strategic initiatives to fortify their market positions and expand global reach. Grifols, for example, has accelerated the commissioning of modular fractionation facilities while forging supply agreements with key healthcare systems to secure long-term demand commitments. CSL has invested heavily in novel anti-hemophilic factor variants and biosimilar immunoglobulin lines, leveraging its global network of plasma collection centers. Takeda’s emphasis on targeted hyperimmune globulin research has resulted in multiple licensing collaborations aimed at addressing emergent infectious threats. Similarly, Octapharma and LFB are pursuing joint ventures to optimize upstream plasma sourcing and advance next-generation pathogen safety technologies. Collectively, these incumbents continue to reinforce their competitive moats through capacity expansions and strategic mergers and acquisitions.

In addition to established market leaders, a cohort of biotechnology innovators is redefining the competitive landscape. Startups are deploying digital donor engagement platforms that integrate predictive analytics to enhance recruitment and retention, while technology providers are partnering with manufacturers to implement continuous fractionation and real-time quality monitoring. Sustainability imperatives have also prompted several firms to adopt closed-loop water systems and green energy sources for their processing operations. Taken together, these company-level initiatives demonstrate a clear emphasis on reinforcing supply reliability, accelerating product pipelines, and embedding resilience across the end-to-end value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plasma Protein Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADMA Biologics, Inc.

- Baxter International, Inc.

- Bio Products Laboratory Ltd

- Biotest AG

- China Biologic Products Holdings, Inc.

- CSL Behring

- GC Pharma

- Grifols, S.A.

- Hualan Biological Engineering Inc.

- Kamada Ltd.

- Kedrion Biopharma

- LFB S.A.

- Octapharma AG

- Sanquin Plasma Products B.V.

- Takeda Pharmaceutical Company Limited

Empowering Industry Leaders with Strategies to Optimize Supply Chains, Innovate Pipelines, and Navigate Regulatory Hurdles in Plasma Protein Therapeutics

To navigate the evolving complexities of plasma protein therapeutics, industry leaders should prioritize diversification of their supply networks by establishing additional donor collection sites in underpenetrated regions. By investing in modular, geographically dispersed fractionation units, organizations can mitigate risk exposure to localized disruptions and regulatory shifts. Moreover, directing capital toward advanced process analytical technologies, such as continuous chromatography and inline viral safety assays, will accelerate cycle times and enhance product consistency. In parallel, cultivating strategic alliances with academic institutions and government agencies can facilitate co-development of hyperimmune globulins tailored to emerging public health needs.

Further, companies should leverage digital health platforms to harness real-world data, enabling more precise patient stratification and dose optimization. Early engagement with regulatory authorities on adaptive licensing pathways and conditional approvals can shorten time to market for breakthrough therapies. Additionally, negotiating innovative payment models with payers, such as outcome-based agreements, can align economic incentives with therapeutic value and foster broader adoption. Embracing patient-centric infusion models, including home-based subcutaneous delivery, will improve adherence and reduce hospital burden. Lastly, forging consortium-level partnerships across the industry to share best practices in donor recruitment, sustainability, and cost management can yield collective benefits. By implementing these actionable steps, stakeholders will enhance operational agility, drive portfolio innovation, and ensure enduring access to life-saving plasma protein therapies.

Detailing the Comprehensive Research Framework Combining Secondary Intelligence, Primary Expert Engagement, and Rigorous Data Validation Techniques

Our research methodology combined rigorous secondary intelligence gathering with targeted primary engagement to ensure comprehensive coverage of the plasma protein therapeutics domain. Initially, we conducted an exhaustive review of publicly accessible sources including regulatory authority publications, clinical trial registries, peer-reviewed scientific journals, and corporate annual reports. This phase established a foundational understanding of historical developments, technological innovations, and policy trajectories. We complemented these insights with desk analyses of supply chain workflows, reagent procurement patterns, and patent landscapes to map competitive dynamics and identify emerging hotspots.

The primary research component involved in-depth interviews with more than 25 key opinion leaders, encompassing executives from fractionation facilities, clinicians specializing in immunodeficiency and hemostasis, and executives from regulatory agencies. These discussions provided qualitative validation of quantitative trends identified in secondary research, enabling us to refine segmentation hypotheses and validate supplier capacities. Data triangulation was achieved through cross-referencing interview inputs with transactional databases and proprietary intelligence platforms. Quality control measures included consistency checks, anomaly detection algorithms, and peer reviews by subject matter experts. Additionally, we incorporated scenario modeling to gauge the impact of potential policy changes, such as tariff adjustments and regulatory realignments, on supply economics. Ethical considerations around donor welfare and equitable access informed our analysis framework, ensuring that recommendations align with both commercial and social imperatives. While this methodology prioritizes accuracy and relevance, readers should note potential limitations inherent to expert recall bias and evolving regulatory landscapes. Overall, our framework is designed to deliver actionable, empirically grounded insights for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plasma Protein Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plasma Protein Therapeutics Market, by Product

- Plasma Protein Therapeutics Market, by Indication

- Plasma Protein Therapeutics Market, by Route Of Administration

- Plasma Protein Therapeutics Market, by End User

- Plasma Protein Therapeutics Market, by Region

- Plasma Protein Therapeutics Market, by Group

- Plasma Protein Therapeutics Market, by Country

- United States Plasma Protein Therapeutics Market

- China Plasma Protein Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights to Illuminate Strategic Imperatives and Future Opportunities in the Plasma Protein Therapeutics Industry Landscape

This executive summary synthesizes critical insights across scientific innovation, policy shifts, market segmentation, and regional dynamics in the plasma protein therapeutics landscape. Key themes include the transformative impact of next-generation fractionation and recombinant expression technologies, the strategic ramifications of newly enacted U.S. tariffs in 2025, and the nuanced segmentation by product, indication, administration route, and end user. Importantly, the interplay between patient-centric care models and payer-driven value assessments emerges as a pivotal determinant of market access strategies. Regional analyses highlight the resilient supply networks in the Americas, the harmonization challenges across Europe, the Middle East, and Africa, and the rapid expansion of healthcare infrastructure in Asia-Pacific. Company-level intelligence illustrates how leading providers and agile biotech entrants are reshaping competitive positioning through partnerships, capacity expansions, and digital donor engagement platforms. The actionable recommendations provided herein offer a clear blueprint for optimizing supply chains, accelerating pipeline development, and proactively navigating regulatory pathways.

As the plasma protein sector advances, emerging modalities such as gene-edited factors and affinity-engineered immunoglobulins are poised to redefine therapeutic possibilities, while digital health integration will enable more personalized treatment regimens. Furthermore, the increasing emphasis on sustainability-encompassing green manufacturing practices and water recycling in production plants-underscores the sector’s broader responsibility to environmental stewardship. Providers that integrate circular economy principles will not only reduce operational costs but also meet rising stakeholder expectations around corporate social responsibility. Stakeholders must balance innovation with a steadfast commitment to supply reliability, donor welfare, and cost sustainability. Future opportunities will arise at the intersection of public health imperatives and technological breakthroughs, offering avenues for enhanced patient outcomes and commercial growth. By championing strategic foresight and collaborative engagement, organizations can capitalize on the evolving landscape and drive enduring value for patients, providers, and shareholders alike.

Secure Your Comprehensive Plasma Protein Therapeutics Market Report Today by Connecting with Ketan Rohom for Immediate Access and Expert Guidance

To obtain the full market research report and unlock comprehensive intelligence on plasma protein therapeutics, we invite you to reach out to Ketan Rohom, Associate Director of Sales and Marketing. Ketan will guide you through a detailed discussion of the report’s scope, including in-depth analyses of regulatory developments, competitive strategies, and emerging scientific breakthroughs. By securing this report, you will gain the strategic insights and actionable recommendations necessary to navigate the dynamic plasma protein landscape with confidence.

Connect directly with Ketan to discuss customizable licensing options, enterprise subscription packages, and expedited delivery timelines. Empower your organization with data-driven foresight, align your strategic priorities with market realities, and stay ahead of industry shifts. Our team stands ready to schedule an executive briefing to walk through key findings and answer any questions specific to your organizational needs. Take proactive steps today by engaging with Ketan Rohom and secure access to the insights that will define your competitive edge in 2025 and beyond.

- How big is the Plasma Protein Therapeutics Market?

- What is the Plasma Protein Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?