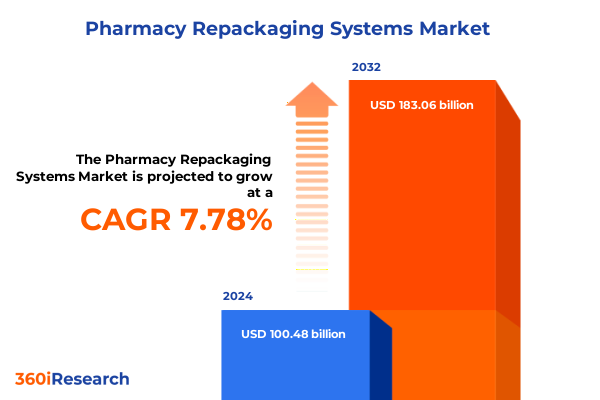

The Pharmacy Repackaging Systems Market size was estimated at USD 108.17 billion in 2025 and expected to reach USD 116.45 billion in 2026, at a CAGR of 7.80% to reach USD 183.06 billion by 2032.

Unlocking the Transformative Power of Pharmacy Repackaging Systems by Examining Foundational Trends, Technological Drivers, and Market Opportunities

Pharmacy repackaging systems have emerged as a critical component in the healthcare delivery ecosystem, serving as the bridge between pharmaceutical manufacturers and patients who require precise, safe, and convenient dosage formats. These systems streamline operations by automating or enhancing manual processes, thus reducing errors and elevating patient safety standards. Over the past decade, advances in robotics, barcoding, and software integration have transformed repackaging workflows, supporting the shift from bulk dispensing toward personalized, unit-dose formats that cater to diverse patient needs. With increasing pressure from regulatory bodies to ensure traceability and compliance, repackaging solutions have become indispensable for hospital pharmacies, long-term care facilities, and retail chains alike.

As the industry evolves, stakeholders are compelled to reassess legacy practices, embrace digital transformation, and prioritize interoperability across devices and software platforms. Emerging trends such as data analytics, cloud connectivity, and artificial intelligence are enabling real-time monitoring, predictive maintenance, and tighter integration with electronic health record systems. In parallel, patient-centric initiatives are driving demand for adherence-focused packaging that supports at-home care and hospital discharge protocols. Consequently, pharmacy repackaging has shifted from a back-office function to a strategic enabler of value-based care, fostering efficiencies that extend across supply chain stakeholders and ultimately enhancing patient outcomes.

Charting the Major Transformative Shifts Reshaping the Landscape of Pharmacy Repackaging Systems Amid Regulatory, Technological, and Operational Evolution

Over the last several years, the landscape of pharmacy repackaging systems has undergone profound transformations as a result of regulatory revisions, technological breakthroughs, and evolving operational demands. Heightened regulatory scrutiny has compelled providers to adopt advanced serialization, track-and-trace, and tamper-evident mechanisms, thereby reshaping system architectures to ensure end-to-end visibility. In tandem, the proliferation of smart automation has facilitated the transition from manual and semi-automated workflows to fully automated, high-throughput solutions capable of processing complex medication regimens with minimal human intervention. Consequently, organizations are reconfiguring their infrastructure to accommodate modular, scalable platforms that can evolve alongside shifting compliance requirements.

Moreover, the industry has witnessed a paradigm shift toward patient-centric packaging, driven by growing awareness of medication adherence challenges. Customized multi-dose and compliance packaging formats, supported by vision systems and robotics, are enabling more sophisticated repackaging profiles that address polypharmacy and home-care needs. Sustainability considerations have further influenced system design, prompting the adoption of recyclable materials and energy-efficient technologies. Taken together, these transformative shifts underscore the need for adaptable, future-proof repackaging solutions that align with the intersection of regulatory mandates, technological innovation, and patient-focused care models.

Analyzing the Cumulative Impact of Newly Imposed United States Tariffs in 2025 on the Supply Chain and Cost Structures of Pharmacy Repackaging Systems

The introduction of new United States tariffs in 2025 has exerted multifaceted pressures across the pharmacy repackaging value chain, significantly affecting procurement costs, supply timelines, and vendor relationships. Tariffs imposed on imported packaging components-ranging from blister films and vials to robotics subassemblies-have led to an upward shift in material expenses, compelling repackagers to reassess supplier portfolios and explore domestic sourcing alternatives. As a result, procurement teams are balancing the trade-off between cost containment and quality assurance, while finance leaders recalibrate budgets to accommodate evolving duty structures.

Furthermore, these tariffs have had ripple effects on capital expenditure decisions for equipment upgrades and technology deployments. Organizations considering investments in advanced robotics or vision systems are now integrating tariff-related contingencies into their total cost of ownership analyses. In response, some solution providers have accelerated localized manufacturing initiatives, forging strategic partnerships with U.S.-based component fabricators to mitigate exposure. This recalibration is not merely reactive; it is fostering a wave of innovation in cost-efficient materials, circular economy practices, and collaborative supply-chain models. Ultimately, the cumulative impact of 2025 tariffs is accelerating a strategic pivot toward resilience, localization, and diversified sourcing within the pharmacy repackaging sector.

Unveiling Key Market Segmentation Insights to Illuminate End User, Product Type, Packaging Type, Application, and Technology Dynamics

The end-user dimension of the pharmacy repackaging market reflects diverse operational requirements, with hospital pharmacies prioritizing high-volume, complex formulation handling and long-term care facilities emphasizing compliance packaging to support resident safety. Mail order pharmacies leverage both fully automated and semi-automated systems to manage bulk prescription volumes and customized blister packs, while retail pharmacies balance manual and automated workflows to serve walk-in patients with rapid turnaround times. These distinctions inform vendor strategies, as solution providers tailor their offerings to align with throughput demands, facility footprints, and staff expertise levels.

Product type segmentation further differentiates market dynamics, where fully automated lines drive efficiency and error reduction in large facilities, manual repackaging remains relevant in lower-volume or resource-constrained settings, and semi-automated solutions bridge the gap for mid-sized operations seeking flexibility without extensive capital investment. Packaging type influences material handling and system configuration: blister packaging supports unit dosing for compliance and mail-order applications, pouch and strip formats enhance patient convenience and waste reduction, and vials remain integral to hospital and retail contexts requiring rapid dispensing. Overlaying these layers, application-focused modules deliver compliance packaging designs, multi-dose regimens, and unit-dose systems, all of which are enabled by barcoding, RFID, robotics, and vision systems technologies. Barcoding advances, including linear and two-dimensional scans, ensure accurate tracking, while active and passive RFID options bolster inventory visibility. Articulated and collaborative robots automate repetitive tasks, and two-dimensional and three-dimensional vision systems validate label integrity and dosage accuracy. Together, these segmentation insights reveal a nuanced ecosystem in which technology and application priorities converge to shape repackaging strategies.

This comprehensive research report categorizes the Pharmacy Repackaging Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Technology

- Application

- End User

Examining the Distinct Regional Dynamics of the Americas, Europe Middle East & Africa, and Asia-Pacific in Shaping Pharmacy Repackaging Systems Growth

In the Americas, established healthcare infrastructures and mature regulatory frameworks have driven widespread adoption of both automated and semi-automated repackaging systems. The United States, in particular, continues to lead in implementing serialization and track-and-trace standards, compelling domestic operators to upgrade legacy lines. Canada’s focus on patient safety and rural healthcare access has fueled investments in portable, modular repackaging stations, while Latin American markets are gradually embracing mid-tier manual and semi-automated solutions to address growing pharmacy networks.

Conversely, the Europe, Middle East & Africa region illustrates a mosaic of regulatory nuances and investment capacities. European markets, guided by centralized EU regulations, are rapidly standardizing tamper-evident technologies, fostering cross-border interoperability among repackaging centers. Middle Eastern nations are channeling government funding toward hospital pharmacy modernization, with an emphasis on robotics and vision systems to ensure quality control. Meanwhile, healthcare providers in Africa are navigating resource constraints by deploying cost-effective manual and semi-automated systems that support essential repackaging at scale.

The Asia-Pacific region is characterized by robust growth driven by burgeoning patient populations, government-sponsored digital health initiatives, and rapid urbanization. Japan and South Korea maintain strong preferences for cutting-edge automation and barcoding solutions, while Southeast Asian economies are accelerating infrastructure builds and adopting mid-range robotics to enhance service delivery. In India and China, manufacturing hubs for packaging materials and system components are converging with escalating domestic demand, creating unique opportunities for localized production and technology transfer partnerships.

This comprehensive research report examines key regions that drive the evolution of the Pharmacy Repackaging Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Driving Innovation, Collaboration, and Competitive Dynamics in the Pharmacy Repackaging Systems Sector Across Global Markets

Leading players in the pharmacy repackaging systems sector continue to refine their value propositions through strategic collaborations, mergers, and technology-centric partnerships. Key vendors are integrating advanced analytics platforms to offer predictive maintenance services, minimizing downtime and extending equipment lifecycles. Others are expanding portfolios by acquiring specialized robotics firms or forging alliances with vision-system innovators to deliver turnkey solutions that span mechanical automation, software integration, and compliance reporting.

Competitive dynamics are further shaped by companies with robust global footprints that leverage localized manufacturing and service networks to reduce lead times and tariff exposures. Innovators focusing on modular architectures enable customers to scale capacity in line with fluctuating demand, while software solution providers are embedding AI-driven error detection and workflow optimization tools into their control systems. Academic and clinical partnerships have also become instrumental, as technology leaders collaborate with healthcare institutions to pilot novel packaging formats, test new materials, and refine user-interface design. Through these concerted efforts, the sector is witnessing accelerated innovation cycles, with forward-thinking companies setting new benchmarks for operational efficiency, regulatory compliance, and patient safety.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pharmacy Repackaging Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccuDose Systems, LLC

- ARxIUM, Inc.

- Baxter International Inc.

- Becton, Dickinson and Company

- Capsa Solutions, Inc.

- Deenova S.r.l.

- Euclid Medical Products, Inc.

- Fagron Group N.V.

- Fulcrum, Inc.

- Healthmark Industries Co., Ltd.

- Kardex Remstar

- McKesson Corporation

- Medical Packaging, Inc.

- Meditec Group

- MTS Medication Technologies, Inc.

- Noritsu Pharmacy Automation Co., Ltd.

- Omnicell, Inc.

- Parata Systems, LLC

- Pearson Medical Technologies, Inc.

- RxSafe, LLC

- Swisslog Healthcare Solutions, Inc.

- Takazono Corporation

- TCGRx, LLC

- Yuyama Co., Ltd.

Empowering Industry Leaders with Data-Driven Recommendations to Navigate Competitive, Regulatory, and Technological Challenges in Pharmacy Repackaging

Industry leaders aiming to maintain or enhance market positions must prioritize investment in adaptable technologies that can seamlessly integrate with existing infrastructure. By conducting thorough audits of current repackaging workflows, organizations can identify bottlenecks and tailor automation roadmaps that align with both near-term ROI objectives and long-term strategic goals. In addition, fostering cross-functional teams that include pharmacy, IT, and supply-chain stakeholders will facilitate cohesive decision-making, ensuring technology selections address clinical, operational, and financial requirements simultaneously.

Moreover, cultivating strategic supplier relationships is essential to navigate tariff fluctuations and component shortages. Engaging with a diverse vendor ecosystem, including domestic manufacturers and alternative material providers, supports supply chain resilience. Establishing data governance frameworks and interoperability standards will further enhance system agility, enabling seamless integrations with enterprise resource planning and electronic health record platforms. Finally, investing in workforce training and continuous improvement programs will empower staff to leverage new technologies effectively, sustaining high levels of accuracy and throughput as the industry continues to evolve.

Detailing the Rigorous Methodology Behind Quantitative and Qualitative Analyses, Data Verification, and Validation Processes in Pharmacy Repackaging Research

This research leveraged a comprehensive multi-stage methodology to ensure the rigor and credibility of the findings. The process commenced with an extensive review of publicly accessible regulatory filings, technical white papers, and industry association publications to establish a robust understanding of historical trends and current compliance mandates. Subsequently, a series of in-depth interviews with senior executives, hospital pharmacy directors, and technology solution architects provided qualitative insights into emerging operational challenges, investment rationales, and innovation roadmaps.

To complement primary data collection, the study incorporated quantitative analyses of equipment shipment volumes, installation rates, and purchasing patterns sourced from proprietary supply-chain databases. These metrics were triangulated with pricing structures and tariff schedules to model potential cost drivers. Throughout the research, rigorous data validation measures were employed, including cross-verification against multiple independent sources and peer reviews by subject matter experts. The final step involved synthesizing qualitative and quantitative findings into thematic frameworks, ensuring that recommendations reflect both real-world applicability and methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pharmacy Repackaging Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pharmacy Repackaging Systems Market, by Product Type

- Pharmacy Repackaging Systems Market, by Packaging Type

- Pharmacy Repackaging Systems Market, by Technology

- Pharmacy Repackaging Systems Market, by Application

- Pharmacy Repackaging Systems Market, by End User

- Pharmacy Repackaging Systems Market, by Region

- Pharmacy Repackaging Systems Market, by Group

- Pharmacy Repackaging Systems Market, by Country

- United States Pharmacy Repackaging Systems Market

- China Pharmacy Repackaging Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Forward-Looking Implications for Stakeholders in the Evolving Pharmacy Repackaging Systems Ecosystem Globally

In summary, the pharmacy repackaging systems landscape is witnessing a confluence of regulatory reforms, technological breakthroughs, and strategic supply-chain realignments that collectively redefine operational paradigms. Stakeholders must remain vigilant in monitoring evolving tariff regimes and compliance standards while embracing automation and data-driven tools that enhance efficiency and patient safety. Regional variations underscore the importance of localized approaches, as market maturity and healthcare priorities differ across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Looking ahead, the integration of artificial intelligence, advanced robotics, and interoperable software platforms will continue to elevate the capabilities of repackaging solutions. Companies that proactively invest in scalable architectures, diversify sourcing strategies, and foster collaborative industry partnerships will be best positioned to capitalize on emerging opportunities. Ultimately, the ability to adapt to shifting regulatory landscapes, leverage technological innovations, and deliver patient-centric value will distinguish industry leaders in this dynamic ecosystem.

Engaging with Associate Director Ketan Rohom to Secure Your Customized Pharmacy Repackaging Systems Market Research Report and Gain Competitive Advantage

To gain unparalleled access to cutting-edge insights, industry benchmarks, and tailored strategic guidance, reach out to Associate Director Ketan Rohom. By securing your customized market research report, you can harness the power of in-depth analysis, seize emerging opportunities, and strengthen your competitive positioning. Take the next step in elevating your pharmacy repackaging operations by connecting directly with a seasoned industry specialist who understands your unique challenges and ambitions. Engage today to unlock actionable intelligence that drives innovation and growth across your organization.

- How big is the Pharmacy Repackaging Systems Market?

- What is the Pharmacy Repackaging Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?