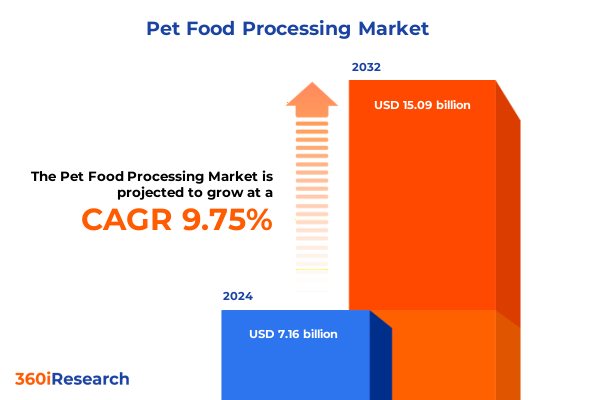

The Pet Food Processing Market size was estimated at USD 7.88 billion in 2025 and expected to reach USD 8.51 billion in 2026, at a CAGR of 9.72% to reach USD 15.09 billion by 2032.

Unveiling the Rapid Evolution in Pet Food Processing Driven by Innovative Technologies and Escalating Global Pet Ownership Trends

Over the past decade, the pet food processing industry has undergone remarkable transformation, reflecting surging pet ownership rates, evolving consumer preferences, and rapid technological adoption. Pet ownership has reached unprecedented levels across North America and Europe, with a noticeable upward trajectory in urban markets throughout the Asia-Pacific region. This demographic expansion has prompted manufacturers to reevaluate traditional processing methods, investing heavily in automation, extrusion technologies, and high-precision formulation equipment to meet growing demand.

Moreover, consumer interest in premium, niche, and health-oriented products has intensified, driving a shift away from mass-market formulations toward value-added offerings. Manufacturers are increasingly integrating novel protein sources, functional ingredients, and clean-label components to satisfy discerning pet parents. As regulatory bodies worldwide tighten allergen protocols and nutritional labeling requirements, processing facilities must adapt their operations to ensure compliance and maintain product integrity.

In this executive summary, the following sections will examine transformative shifts in manufacturing landscapes, the implications of recent trade policies, key segmentation dynamics, regional market variances, corporate strategies, and actionable recommendations for industry stakeholders. By synthesizing extensive market intelligence and qualitative insights, this overview aims to equip decision-makers with a clear understanding of the forces shaping the pet food processing sector and the opportunities that lie ahead.

Navigating Pivotal Transformations Reshaping Pet Food Processing with Advanced Manufacturing Techniques and Consumer-Centric Innovations

The pet food processing landscape has entered a period defined by transformative shifts, marked by the convergence of digitalization, sustainability, and personalized nutrition. Smart manufacturing platforms now enable real-time monitoring of critical process parameters, allowing for adaptive adjustments in extrusion pressure, temperature profiles, and ingredient dosing. This data-driven approach not only enhances operational efficiency but also elevates product consistency and safety, reinforcing trust among consumers and retailers.

Simultaneously, sustainability imperatives have prompted companies to reengineer supply chains and adopt circular economy principles. Waste reduction initiatives leverage byproduct valorization, transforming plant-based residues and animal protein off-cuts into nutrient-rich meal alternatives. Water and energy conservation strategies are being integrated within production lines through closed-loop systems and high-efficiency equipment, reducing both environmental footprint and long-term operational expenditures.

Moreover, the rise of pet-centric personalization is reshaping formulation strategies. Manufacturing platforms are now capable of producing small-batch, breed-specific, and life-stage-tailored products without significant trade-offs in throughput. Collaborative partnerships between ingredient suppliers, nutrigenomics firms, and processing technology providers facilitate co-development of functional blends, thereby creating a competitive edge for companies that can rapidly bring differentiated offerings to market.

Assessing the Aggregate Consequences of 2025 United States Trade Tariffs on Pet Food Processing Supply Chains and Cost Structures Across the Industry Ecosystem

In 2025, a series of new tariff measures introduced by the United States government have had a material impact on the pet food processing sector, particularly affecting the importation of key ingredients such as pea protein, lentil flour, and specialty grains. Cost pressures have intensified as processors contend with higher landed costs for imported raw materials, prompting many to reevaluate their sourcing strategies. At the same time, domestic suppliers of pulses and grains have seen increased demand, spurring investments in local crop cultivation and processing capacity.

The ripple effects of these trade policies extend beyond ingredient sourcing. Packaging components sourced from overseas, including multilayer barrier films and specialty plastics, have experienced longer lead times and elevated prices, necessitating tighter inventory management and renegotiation of supplier agreements. Furthermore, processors have had to adjust pricing structures to accommodate cost pass-through, balancing margin preservation with consumer sensitivity to retail price fluctuations.

Within this environment, industry stakeholders have explored tariff mitigation strategies, such as leveraging free trade agreements with Canada and Mexico under revised North American trade protocols, and qualifying for tariff exclusions through regulatory petitions. As a result, agility in trade compliance and proactive engagement with policy developments have become critical success factors. The cumulative impact of these measures underscores the need for robust risk assessment frameworks and flexible procurement models to navigate evolving trade landscapes.

Illuminating Critical Segmentation Dynamics in Pet Food Processing Across Animal Type Product Variety Ingredient Preferences Packaging Formats and Distribution Channels

Diving into segmentation reveals distinct dynamics that shape product strategies and operational priorities across the pet food processing domain. Analysis by animal type underscores divergent formulation requirements and market potentials for cat versus dog products, where feline demand trends toward grain-free and high-protein blends, while canine offerings emphasize joint health and weight management functionalities. This differentiation drives manufacturers to maintain dual platforms capable of handling specialized ingredient loading and mixing protocols.

By product type, dry food lines command substantial throughput through continuous extrusion processes optimized for consistency and shelf life. In contrast, wet food production relies on retortable systems and aseptic filling for pouches and trays, necessitating investments in high-pressure sterilization and temperature control. Semi-moist food and treat segments further diversify the processing spectrum by introducing binders and humectants that require precise moisture regulation and specialized conditioning chambers.

Ingredient type classification highlights the growing prominence of natural, organic, and vegan formulations. While conventional protein sources remain foundational, consumer demand for plant-based alternatives and organic certifications compels processors to implement segregated handling and traceability protocols. This evolution also impacts allergen management, requiring rigorous cleaning procedures and dedicated lines to prevent cross-contamination.

Packaging type considerations influence both material selection and equipment design. Traditional cans and plastic bags continue to serve mass-market channels, whereas flexible pouches and rigid trays cater to premium and frozen platforms, integrating advanced sealing and vacuum technologies. Concurrently, distribution channel segmentation drives tailored packaging solutions: direct-to-consumer e-commerce models prioritize shelf-ready, lightweight designs, pet store partnerships leverage branded, high-impact formats, and veterinary clinics emphasize single-serve, clinical-grade pouches suitable for specialized diets.

This comprehensive research report categorizes the Pet Food Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Ingredient Type

- Packaging Type

- Distribution Channel

Unlocking the Diverse Regional Dynamics Shaping Pet Food Processing Across the Americas Europe Middle East Africa and Asia-Pacific Territories

Regional insights reveal a heterogeneous growth mosaic shaped by demographic, regulatory, and economic factors. In the Americas, North America leads with mature processing infrastructures, extensive cold-chain networks, and a robust culture of pet wellness. This environment accelerates adoption of niche product lines, including functional supplements and veterinarian-endorsed diets, while Latin American markets exhibit rising demand for affordable premium offerings, driving capacity expansions in Brazil and Mexico.

Across Europe, Middle East, and Africa, regulatory harmonization within the European Union fosters high standards for ingredient sourcing and labeling, compelling processors to navigate complex compliance regimes. Sustainability benchmarks are particularly stringent, encouraging the use of renewable energy in production facilities and the implementation of eco-friendly packaging. Concurrently, emerging markets in the Middle East and Africa are attracting investments in local manufacturing hubs to meet rising discretionary spending on pet care.

In the Asia-Pacific region, rapid urbanization and expanding middle-class populations are catalyzing pet ownership, especially in China, India, and Southeast Asia. This surge has outpaced local processing capacity, creating opportunities for joint ventures, greenfield investments, and technology transfers. However, infrastructural constraints, including inconsistent power supply and logistical bottlenecks, require tailored approaches to facility design and distribution planning. Overall, each region demands a nuanced strategy that aligns global best practices with local market realities.

This comprehensive research report examines key regions that drive the evolution of the Pet Food Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Pet Food Processing Enterprises Pursuing Strategic Innovation Operational Excellence and Market Expansion to Sustain Competitive Edge

A cadre of leading companies is at the forefront of innovation, operational excellence, and strategic expansion in pet food processing. Global giants have leveraged their scale to invest in state-of-the-art extrusion and retorting facilities, while agile mid-sized enterprises have carved out niches through proprietary formulations and targeted marketing campaigns. Collaboration between ingredient suppliers and technology providers has resulted in co-developed platforms capable of multi-protein blending and automated quality control.

Mergers and acquisitions remain prominent as major players consolidate their portfolios to enhance category penetration. Joint ventures with regional partners facilitate market entry and local ingredient sourcing, reducing lead times and regulatory complexities. In tandem, strategic alliances with research institutions and universities have spurred innovations in functional ingredient extracts, such as omega-3-enriched algae and plant-derived antioxidants.

On the operational front, companies are adopting lean manufacturing principles and digital twins to simulate process modifications before shop floor implementation. This approach minimizes downtime during line changeovers, accelerates product launch cycles, and maintains stringent hygiene standards. Collectively, these corporate initiatives underscore the importance of integrated capabilities spanning R&D, production, and go-to-market execution in sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Food Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Baramati Agro Limited

- Colgate-Palmolive Company

- Farmina Pet Foods Holding B.V.

- General Mills, Inc.

- IB Group (Drools Pet Food Private Limited)

- LUPUS Alimento Private Limited

- Mars, Incorporated

- Nestlé Purina PetCare Company

- Orange Pet Nutrition Private Limited

- Pranav Agro Industries Limited

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- The J.M. Smucker Company

- Urja Foods And Agro Private Limited

- Vetrina Healthcare Private Limited

- Virbac S.A.

- Vivaldis Health & Foods Private Limited

- Wellness Pet Company, Inc.

Delivering Actionable Strategic Imperatives for Pet Food Processing Industry Leaders to Drive Growth Sustainability and Operational Resilience in a Competitive Landscape

Industry leaders should consider a multifaceted strategy to thrive amid intensifying competition and evolving consumer expectations. Prioritizing investments in flexible processing technologies will enable rapid shifts between product formats and ingredient profiles, reducing time-to-market for new launches and mitigating capacity constraints. Simultaneously, establishing strategic partnerships with domestic raw material suppliers can buffer against import tariffs and supply chain disruptions, while supporting local agricultural ecosystems.

Advancing sustainability initiatives by integrating renewable energy systems and water recycling loops will not only lower operational costs but also resonate with eco-conscious consumers. Embedding traceability solutions, such as blockchain-based tracking, can further reinforce brand integrity and compliance with evolving regulatory mandates. Moreover, expanding direct-to-consumer channels through digital platforms offers opportunities to gather actionable consumer data, refine product offerings, and strengthen brand loyalty.

Finally, cultivating cross-functional teams that bridge R&D, production, marketing, and procurement will foster a holistic innovation culture. By aligning internal capabilities with external market intelligence, organizations can anticipate trend shifts, tailor formulations to emerging nutritional insights, and secure a first-mover advantage. Together, these actionable recommendations form a blueprint for navigating the complexities of the pet food processing industry with agility and foresight.

Detailing the Robust Research Framework and Methodology Underpinning Comprehensive Analysis of the Pet Food Processing Ecosystem and Data Integrity Measures

The insights presented in this report are derived from a rigorous, multi-stage research methodology that combines primary and secondary data collection, thorough validation, and robust analysis frameworks. Initially, an extensive review of industry publications, regulatory filings, academic studies, and financial disclosures provided a foundational understanding of market trends and technological capabilities. This secondary research phase was augmented by a series of structured interviews with senior executives, research scientists, and procurement specialists to capture nuanced perspectives on operational challenges and strategic priorities.

To ensure data integrity, findings from secondary sources and expert interviews were triangulated through cross-referencing with publicly available statistical databases and proprietary industry intelligence. A segmentation framework, encompassing animal type, product category, ingredient orientation, packaging format, and distribution channel, guided the disaggregation of insights, enabling targeted analysis of distinct market segments. Geographic variances across the Americas, Europe, Middle East, Africa, and Asia-Pacific were assessed using regional case studies and on-site facility visits, where feasible.

Quality assurance protocols included iterative reviews by subject-matter experts and peer benchmarking against industry benchmarks. Analytical models employed both top-down and bottom-up approaches to validate patterns and identify emerging inflection points. This comprehensive research approach ensures that conclusions and recommendations are grounded in reliable evidence and reflect the latest market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Food Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Food Processing Market, by Animal Type

- Pet Food Processing Market, by Product Type

- Pet Food Processing Market, by Ingredient Type

- Pet Food Processing Market, by Packaging Type

- Pet Food Processing Market, by Distribution Channel

- Pet Food Processing Market, by Region

- Pet Food Processing Market, by Group

- Pet Food Processing Market, by Country

- United States Pet Food Processing Market

- China Pet Food Processing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Strategic Takeaways to Highlight the Future Trajectory of Pet Food Processing Amid Evolving Market Conditions

The pet food processing sector stands at a pivotal juncture where technological innovation, regulatory change, and shifting consumer expectations converge to redefine market parameters. Manufacturers that proactively embrace digitalization, optimization of resource use, and sustainable practices will be best positioned to capitalize on new opportunities and mitigate emerging risks. As tariffs and trade policies reshape supply chain strategies, the ability to adapt sourcing models and maintain operational flexibility will become increasingly critical.

Segmentation insights underscore the necessity of portfolio diversification, as variations in dietary preferences, packaging requirements, and distribution channels demand tailored processing approaches. Regional dynamics further emphasize that a one-size-fits-all strategy is insufficient; instead, localized market intelligence and strategic partnerships can unlock growth potential in high-opportunity territories. Corporate case studies illustrate that aligning R&D initiatives with consumer trends and regulatory expectations fosters a cycle of continuous improvement and competitive differentiation.

In conclusion, the industry’s trajectory hinges on its collective capacity to integrate advanced manufacturing technologies, uphold stringent quality standards, and respond agilely to market disruptions. Stakeholders who leverage holistic insights, invest in resilient infrastructures, and cultivate cross-sector collaborations will navigate the evolving landscape with confidence and deliver sustained value to end consumers.

Engage with the Associate Director to Access Tailored Pet Food Processing Market Research and Drive Strategic Business Growth

To secure comprehensive, data-driven intelligence tailored to the evolving pet food processing environment, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. By initiating a conversation with Ketan, decision-makers can obtain exclusive access to an in-depth market research report that delves into production technologies, supply chain resilience, segmentation nuances, regional performance comparisons, and competitive positioning insights. Partnering with Ketan ensures you receive tailored support in aligning your strategic objectives with actionable findings, facilitating timely execution of growth initiatives and operational improvements. Reach out through professional networking channels to arrange a personalized consultation, explore bespoke data packages, and position your organization for sustained success in the dynamic pet food processing landscape

- How big is the Pet Food Processing Market?

- What is the Pet Food Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?