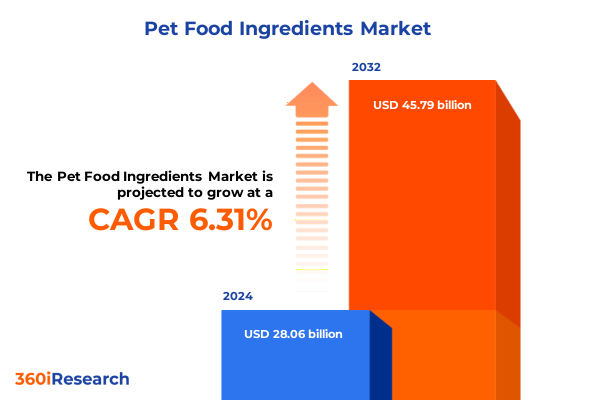

The Pet Food Ingredients Market size was estimated at USD 29.85 billion in 2025 and expected to reach USD 31.53 billion in 2026, at a CAGR of 6.30% to reach USD 45.79 billion by 2032.

In a Landscape Where Pets Are Family, Ingredient Transparency, Functionality, and Sustainability Drive Pet Food Innovation

The bond between humans and their pets has never been stronger, with emerging generations elevating companion animals to integral family members. This shift has driven pet owners to seek products that mirror the quality and transparency standards they demand for themselves, elevating ingredient integrity from a nice-to-have to a non-negotiable expectation. In response, the pet food ingredients landscape is expanding in complexity, encompassing a broader spectrum of functional additives and specialized nutrients aimed at addressing health, wellness, and environmental concerns.

Amid this evolving dynamic, industry stakeholders face the dual challenge of ensuring ingredient traceability while innovating formulations that deliver demonstrable benefits. This transformation is underpinned by a resilient foundation of growing pet ownership; recent industry data indicates that 94 million U.S. households now share their homes with a pet, underscoring a sustained consumer commitment to pet care and nutrition. As the market matures, decision-makers must navigate multifaceted consumer expectations, regulatory frameworks, and supply chain disruptions to deliver products that resonate with discerning pet parents.

Revolution in Pet Nutrition: Sustainability Imperatives and Technological Advances Are Transforming Ingredient Choices Across the Industry

The pet food ingredients sector is experiencing a profound transformation driven by sustainability imperatives and technological innovation. Consumers now expect greater transparency in sourcing, compelling brands to adopt traceable supply chains and eco-friendly practices. The rise of upcycled ingredients and insect proteins exemplifies this shift, offering nutritionally robust and resource-efficient alternatives to traditional animal-derived components.

Concurrent with sustainability demands, personalization and premiumization are reshaping product development. Direct-to-consumer platforms enable bespoke formulations closely aligned with individual pet health profiles, while functional additives like probiotics, prebiotics, and joint-support nutrients are moving from niche to mainstream. Technology integration further amplifies these trends, with AI-driven manufacturing processes optimizing ingredient performance and reducing waste, and data analytics supporting predictive supply chain management to mitigate disruptions.

US Trade Policy Overhaul Pressures Ingredient Sourcing and Costs, Forcing Collaborative Advocacy and Strategic Adaptations

In early 2025, sweeping revisions to U.S. trade policy imposed baseline tariffs on imported ingredients, sparking concerns over rising production costs across pet food manufacturers. Ingredients sourced from China faced tariffs as high as 145%, while Canada, Mexico, and the EU saw new 10% duties on select commodities. Although many of these measures were paused for 90 days under a U.S.-China tariff reduction agreement, the interim uplift to 30% on Chinese imports underscores persistent volatility.

The industry’s response has been notably collaborative, with leading associations, including the American Pet Products Association and the Pet Food Institute, forming a coalition to advocate for tariff relief and supply chain resilience. This unified effort underscores the sector’s recognition that tariff-induced cost pressures cannot be addressed unilaterally. Meanwhile, trading partners such as the EU have prepared countermeasures targeting U.S. exports-including pet food-further complicating market access scenarios and accelerating the need for strategic sourcing diversification.

Multi-Dimensional Segmentation Reveals Distinct Ingredient, Source, Pet Type, Product Form, and Channel Dynamics Shaping Market Strategies

Market segmentation reveals the nuanced drivers influencing ingredient selection and innovation. When examined by ingredient type, stakeholders navigate a matrix comprising additive supplements-from flavor enhancers and preservatives to probiotic cultures-complex carbohydrate sources segmented into grains and pulses, diverse fat and oil classes spanning animal-based fats like chicken, fish, and lard and vegetable oils including canola, palm, and soybean, varied proteins of animal and plant origin, and distinct vitamin and mineral blends. Parallel analysis by source distinguishes ingredients of animal, plant, or synthetic origin, each with subcategories such as dairy, fish, meat, poultry, cereal, oilseed, pulse, synthetic additive, mineral, and vitamin components. Pet type segmentation further differentiates nutritional formulations across adult, juvenile, and senior life stages for both cats and dogs, while product form stratification across dry kibble and pellets, treats like biscuits, chews, and dental variants, and wet formats including canned, pouches, and trays shapes ingredient innovation priorities. Finally, distribution channels from e-commerce to ingredient distributors and direct pet food manufacturers uniquely impact market access and formulation strategies.

This comprehensive research report categorizes the Pet Food Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Source

- Pet Type

- Product Form

- Distribution Channel

Regional Dynamics Unveil Divergent Priorities and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Pet Food Markets

Across regions, market dynamics diverge in response to local consumer preferences, regulatory environments, and supply chain infrastructures. In the Americas, premiumization remains a hallmark, with U.S. and Canadian consumers driving demand for clean-label and functionally enhanced ingredients that deliver digestive health, coat and skin support, and joint mobility benefits, while e-commerce proliferation accelerates access to niche formulations. Europe, the Middle East, and Africa face rigorous regulatory scrutiny under evolving frameworks such as EU feed additive directives, propelling investments in compliant, sustainable sourcing models and circular economy initiatives that align with the bloc’s Farm to Fork strategy. In Asia-Pacific, rapid urbanization and rising disposable incomes fuel appetite for premium and natural ingredients, driving innovation in plant-based proteins, insect-sourced nutrients, and functional additives aimed at gut health, as regional companies pilot novel solutions like black soldier fly larvae and tofu byproduct proteins to meet both nutritional and environmental goals.

This comprehensive research report examines key regions that drive the evolution of the Pet Food Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Ingredient Innovators Propel Industry Forward Through Strategic Partnerships, Novel Formulations, and Sustainable Sourcing Models

Leading ingredient suppliers are crystallizing their competitive positions through strategic investments and breakthrough formulations. dsm-firmenich has spotlighted its Veramaris Pets and DHAgold omega-3 solutions at premier industry forums, leveraging algal sources to deliver high-potency EPA and DHA while reducing reliance on marine stocks, and inaugurating a dedicated Kansas premix facility to enhance traceability and production scale. Cargill has advanced gut health innovation with its TruPet ultra-concentrated postbiotic ingredient, earning the Fi Europe Pet Food Innovation Award for its robustness under extrusion and retort conditions, and partnered with Nestlé Purina on regenerative agriculture to decarbonize grain supply chains across North America. These developments underscore a broader industry trajectory toward sustainable, efficacy-driven solutions backed by scientific validation and global supply networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pet Food Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AFB International

- Alltech, Inc.

- Archer-Daniels-Midland Company

- Balchem Corporation

- BASF SE

- Cargill, Incorporated

- Corbion N.V.

- Darling Ingredients Inc.

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Ingredion Incorporated

- Kemin Industries, Inc.

- Kerry Group plc

- Lallemand Animal Nutrition

- Nestlé Purina PetCare Company

- Novus International, Inc.

- Roquette Frères

- Tate & Lyle PLC

- Virbac SA

Proactive Strategies for Decision-Makers to Optimize Supply Chains, Embrace Ingredient Innovation, and Navigate Regulatory Complexities

To thrive in this intricate environment, industry leaders should prioritize diversified sourcing strategies that balance cost, quality, and sustainability. Establishing multi-regional supply alliances will mitigate tariff exposure and logistical disruptions, while investments in traceability technologies such as blockchain can reinforce transparency commitments. Concurrently, R&D roadmaps focused on alternative proteins, precision fermentation, and functional ingredient blends will align product portfolios with consumer health and wellness expectations. Engaging proactively with policymakers and trade associations remains essential to shape fair regulatory frameworks and advocate for industry-favorable trade policies. Finally, fostering cross-industry collaborations-between ingredient suppliers, pet food manufacturers, and animal health experts-will catalyze integrated innovation and reinforce brand differentiation in a competitive market.

Rigorous Mixed-Methods Research Approach Combining Comprehensive Secondary Analysis and Expert Primary Interviews Ensures Holistic Insights

This analysis integrates a comprehensive secondary research phase, encompassing review of regulatory documentation, trade policy announcements, and public financial statements, supplemented by insights from industry publications and association reports. Primary research involved structured interviews with senior executives from ingredient suppliers, pet food manufacturers, and advocacy organizations, providing nuanced perspectives on sourcing challenges, tariff impacts, and R&D priorities. Data triangulation techniques ensured consistency between quantitative trade data and qualitative market observations. Finally, expert validation workshops were convened to refine key findings and recommendations, ensuring the report’s relevance and applicability to executive-level decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pet Food Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pet Food Ingredients Market, by Ingredient Type

- Pet Food Ingredients Market, by Source

- Pet Food Ingredients Market, by Pet Type

- Pet Food Ingredients Market, by Product Form

- Pet Food Ingredients Market, by Distribution Channel

- Pet Food Ingredients Market, by Region

- Pet Food Ingredients Market, by Group

- Pet Food Ingredients Market, by Country

- United States Pet Food Ingredients Market

- China Pet Food Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Converging Trends in Humanization, Sustainability, and Trade Policy Demand Agile Responses to Secure Ingredient Advantage and Market Growth

In summary, the pet food ingredients landscape is at an inflection point shaped by evolving consumer priorities, regulatory recalibrations, and supply chain complexities. Humanization trends continue to elevate expectations for ingredient integrity and product efficacy, while sustainability and alternative proteins redefine sourcing paradigms. Simultaneously, trade policy volatility underscores the critical need for agile supply chain management and collaborative advocacy. By leveraging multi-dimensional segmentation, regional market intelligence, and strategic R&D partnerships, stakeholders can capitalize on growth opportunities while mitigating emerging risks. The interplay of these converging forces demands decisive, informed action to secure ingredient advantage and maintain leadership in a rapidly transforming industry.

Engage with Ketan Rohom to Acquire the Definitive Pet Food Ingredients Market Research Report and Drive Strategic Growth Decisions

If you are ready to elevate your strategic planning and gain a competitive edge in the evolving pet food ingredients landscape, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report. Ketan’s expertise in tailoring insights to executive needs will ensure you access actionable intelligence that addresses your organization’s unique challenges and opportunities. Connect with Ketan today to accelerate your decision-making with data-driven recommendations and proprietary analysis.

- How big is the Pet Food Ingredients Market?

- What is the Pet Food Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?