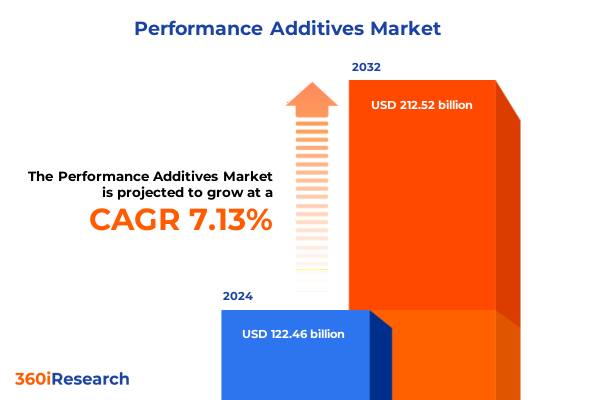

The Performance Additives Market size was estimated at USD 131.13 billion in 2025 and expected to reach USD 140.42 billion in 2026, at a CAGR of 7.14% to reach USD 212.52 billion by 2032.

Exploring the Dynamic World of Performance Additives and Setting the Stage for Industry Imperatives and Opportunities

Performance additives serve as specialized chemical agents that enhance the attributes of base materials, adding critical functionalities such as UV resistance, flame retardancy, and improved processability. These additives are embedded in polymers, coatings, elastomers, and fibers to meet performance specifications that go beyond the capabilities of unmodified materials. By selectively integrating agents like antioxidants and UV stabilizers, manufacturers can significantly prolong product lifespan, reinforce environmental resilience, and satisfy evolving regulatory mandates on toxicity and sustainability. Transitioning from inert fillers to multifunctional chemistries, the performance additives industry has become indispensable for sectors ranging from automotive lightweighting to advanced electronics.

Unveiling the Transformative Shifts Shaping the Future of Material Performance and Industry Resilience

The performance additives landscape is experiencing a paradigm shift driven by the accelerating demand for eco-friendly chemistries and rigorous sustainability standards. Companies are innovating bio-based antioxidants and low-VOC stabilizers to align with circular economy principles while preserving additive efficacy. Regulatory bodies in North America and Europe are tightening restrictions on legacy halogenated flame retardants, spurring rapid reformulation efforts and heightened investment in green chemistry. Concurrently, digital transformation is redefining formulation workflows, with AI-powered predictive modeling and digital twins enabling precise compatibility screening and reducing trial iterations. These advanced computational tools are accelerating R&D cycles and bolstering collaboration between additive suppliers and OEMs across multiple geographies.

Moreover, supply chain resilience has emerged as a focal point as geopolitical tensions and feedstock price volatility intensify. Firms are diversifying sourcing by developing regional production hubs and qualifying alternative raw materials to mitigate tariff-related disruptions. This shift toward end-to-end visibility and strategic stockpiling is strengthening operational continuity in an increasingly uncertain trade environment. As a result, the industry’s competitive edge now hinges on agility-balancing rapid innovation with robust, region-aware supply networks.

Assessing the Cumulative Impact of 2025 U.S. Tariffs on Supply Chains, Costs, and Global Market Dynamics

The introduction and expansion of U.S. tariffs in 2025 have imposed significant cost pressures on global chemical exports, with ripple effects throughout the performance additives sector. In early summer, a threatened 50% levy on Brazilian chemical exports led to the abrupt cancellation of numerous supply contracts as importers preemptively pulled back orders in anticipation of steep duties. This reactive market contraction underscored the fragility of heavily integrated supply chains and triggered a scramble for alternative sources in Asia and domestic markets.

European exporters have equally felt the strain, as a looming tit-for-tat tariff scenario jeopardized a projected 3% growth in Spain’s chemical output for 2025. Feique, the Spanish chemical industry association, warned that without a mutual zero-for-zero tariff deal, the sector’s expansion would nearly stall, highlighting the potential for stalled innovation and delayed regulatory compliance initiatives in downstream applications. Collectively, these measures have elevated raw material costs by an estimated one-third in some segments, dampening margins for additive formulators and end-users alike.

Faced with these headwinds, U.S. manufacturers have shifted toward domestic feedstock alternatives, absorbing higher production costs to maintain supply continuity. Meanwhile, Asian and European exporters are redirecting volumes to emerging markets, intensifying regional competition and logistical complexity. Although certain bulk commodity chemicals remain exempt from duties, the evolving exclusion lists create uncertainty around future liabilities, compelling businesses to adopt dynamic hedging and regional stockpile strategies to safeguard operations.

Deriving Critical Insights from In-Depth Segmentation of Additive Chemistries, Applications, Industries, and Physical Forms

Evaluation of performance additives by additive type reveals a highly granular landscape, with functions encompassing anti-fog and antistatic treatments as well as UV stabilization and flame retardancy. Anti-fog agents, subdivided into amide and amine chemistries, are critical for transparent films and lenses, whereas hindered phenols and phosphites in the antioxidant category protect polymers from oxidative stress. Cationic and nonionic antistatic agents ensure optimal handling and performance in electronics, while halogenated, inorganic, and phosphorus-based flame retardants cater to stringent fire safety standards.

From an application perspective, performance additives integrate into adhesives and sealants-such as epoxy, hot melt, and polyurethane systems-enhancing bond strength and processability. Coating formulations span architectural and industrial segments, requiring dispersants and rheology modifiers to deliver uniform coverage. Elastomers, both natural and synthetic, rely on vulcanization agents and plasticizers to achieve desired elasticity, while fibers and plastics leverage UV absorbers and slip agents-erucamide and oleamide variants-to resist environmental degradation and improve manufacturability.

End-use industries reflect the breadth of additive deployment, from greenhouse and mulch films in agriculture to aftermarket and OEM applications in automotive. Construction materials, including roofing, insulation, and flooring, benefit from specialized additives that bolster durability and thermal performance. In electrical and electronics, consumer devices and wire & cable applications demand EMI shielding and dielectric stability, whereas packaging converters turn to flexible and rigid films fortified with barrier and antistatic chemicals. Additionally, the physical form of additives-ranging from granules and liquids to masterbatch concentrates and powders-enables seamless integration into diverse processing platforms.

This comprehensive research report categorizes the Performance Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Additive Type

- Form

- Application

- End Use Industry

Uncovering Critical Regional Dynamics and Regulatory Drivers Shaping the Additives Market Across Three Key Global Regions

The Americas region remains a cornerstone of the performance additives market, supported by robust automotive production, advanced electronics manufacturing, and expanding packaging initiatives. The U.S. Infrastructure Investment and Jobs Act has stimulated demand for high-durability coatings and flame retardant composites in construction, while reshoring incentives have catalyzed greater domestic capacity for specialty additive compounding. Canada and Mexico also contribute through trade flows under USMCA, enhancing supply chain synergies and localized formulation capabilities.

Across Europe, the Middle East, and Africa, stringent REACH and ECHA regulations are steering formulators toward non-toxic, biodegradable alternatives. Western Europe leads in patent filings for multifunctional additives, with Germany and Switzerland hosting major R&D centers. In parallel, Middle Eastern petrochemical hubs in the UAE and Saudi Arabia are leveraging vertical integration to supply feedstock while exploring additive innovations for oilfield and infrastructure applications. Africa’s nascent manufacturing sector presents growing opportunities for packaging and agricultural films, spurred by initiatives to enhance food security and cold-chain logistics.

Asia-Pacific is the fastest-growing region, capturing nearly half of global additive demand and benefiting from rapid industrialization and government-driven infrastructure projects. China, Japan, and South Korea dominate production of high-dispersion pigments, anti-scratch agents, and electronic-grade stabilizers, while India and ASEAN nations emerge as low-cost hubs for coating, packaging, and fiber additives. Strategic investments in capacity and technology transfer are deepening regional expertise, positioning Asia-Pacific as both a consumption powerhouse and an innovation leader.

This comprehensive research report examines key regions that drive the evolution of the Performance Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Dynamics and Innovation Strategies Among Leading and Emerging Performance Additive Manufacturers

The performance additives market is characterized by a fragmented competitive landscape, where the top five players collectively account for approximately 14 to 14.5 percent of total industry revenue. Leading global corporations have strengthened their positions through targeted investments in sustainable production lines and strategic alliances. BASF, for example, has commissioned a next-generation manufacturing unit for controlled free radical polymerization dispersants, balancing environmental compliance with scale efficiencies.

Evonik has broadened its distribution network for VESTENAMER rubber additives across the EMEA region in partnership with Biesterfeld Performance Rubber, while Arkema showcased its comprehensive portfolio of vulcanization agents at major Chemspec forums in mid-2025. Solvay’s collaboration with Hankook to develop circular silica from biosourced and waste materials underscores the industry’s pivot to circular economy solutions. Other notable players, including Dow, Clariant, Eastman Chemical, Nouryon, and The Lubrizol Corporation, continue to differentiate through product innovation, targeted mergers and acquisitions, and localized technical service offerings.

Emerging and regional manufacturers maintain the remaining 85.5 to 86 percent of market share, fueling competitive pricing and localized specialty offerings. These smaller entities often excel at niche chemistries or regional compliance support, compelling larger players to expand collaborative and open-innovation models to capture adjacent opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Performance Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Clariant AG

- Clariant International Ltd.

- Croda International Plc

- Dow Inc.

- Elementis plc

- Evonik Industries AG

- HEXPOL AB

- Innospec Inc.

- Italmatch Chemicals S.p.A

- Lanxess AG

- Solvay SA

- The Lubrizol Corporation

Implementing Actionable Strategies Centered on Sustainability, Digital Innovation, and Supply Chain Resilience for Industry Leadership

To thrive in a landscape defined by regulatory complexity and supply chain volatility, industry leaders must accelerate the adoption of green chemistry platforms and expand partnerships with sustainable feedstock suppliers. This proactive stance not only future-proofs product portfolios against tightening environmental mandates but also aligns with growing end-user demands for circular materials. Concurrently, integrating AI-driven formulation algorithms and digital twins into R&D workflows can slash development timelines and enable rapid adaptation to new performance criteria and raw material constraints.

Building resilient supply networks is paramount; companies should secure multi-regional sourcing agreements, establish strategic stockpiles of critical intermediates, and leverage trade-compliant warehousing solutions. Engaging with policymakers via trade associations will help shape exclusion lists and tariff negotiations, ensuring sustained access to key imports. Additionally, forging collaborative innovation consortia with OEMs and converters can embed additive expertise early in product design, accelerating market entry and reinforcing customer loyalty.

Finally, leaders should cultivate a talent ecosystem adept at both chemistry and data analytics. Investing in workforce upskilling and cross-functional teams that blend formulation scientists with digital specialists will foster a culture of continuous improvement. By orchestrating these measures, companies can navigate external pressures, drive sustainable growth, and maintain a competitive edge.

Detailing a Robust Research Framework Combining Primary Interviews, Secondary Analysis, and Data Triangulation for Comprehensive Insights

This research synthesizes findings from an extensive secondary review of academic journals, patent databases, regulatory filings, and industry publications to establish foundational insights. Primary research was conducted through in-depth interviews with executives from leading additive suppliers, OEMs, and trade associations to validate market dynamics and emerging trends. Quantitative data were triangulated using trade statistics, customs records, and proprietary sales data to ensure consistency and accuracy.

Segmentation analyses were built upon a rigorous classification of additive chemistries, applications, end-use industries, and physical forms. Regional insights leveraged country-level regulatory frameworks, infrastructure spending reports, and local production capacities. Competitive profiling combined company disclosures, expert roundtables, and patent landscaping tools. Finally, impact assessments of U.S. tariffs incorporated real-time monitoring of exclusion lists and stakeholder feedback to capture evolving policy implications.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Performance Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Performance Additives Market, by Additive Type

- Performance Additives Market, by Form

- Performance Additives Market, by Application

- Performance Additives Market, by End Use Industry

- Performance Additives Market, by Region

- Performance Additives Market, by Group

- Performance Additives Market, by Country

- United States Performance Additives Market

- China Performance Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Critical Findings to Illuminate Strategic Imperatives and a Blueprint for Long-Term Market Success

Performance additives are at the forefront of material innovation, enabling critical enhancements across industries from automotive and electronics to construction and packaging. The convergence of sustainability imperatives, digital transformation, and complex trade policies is reshaping strategic priorities and operational models. Companies that swiftly integrate bio-based chemistries, harness AI-powered R&D tools, and secure resilient supply chains will be best positioned to capture growth in this dynamic market.

Regional variations underscore the importance of targeted strategies: while Asia-Pacific offers scale and rapid adoption, EMEA’s regulatory rigor accelerates green innovation, and the Americas drive demand through infrastructure investments. Competition remains intense, with leading players leveraging strategic alliances and technological leadership to expand differentiated offerings. In contrast, agile niche manufacturers continue to influence pricing and customization, emphasizing the need for continuous collaboration and open innovation.

Ultimately, the firms that excel in performance additives will be those that balance technical excellence with strategic foresight-anticipating regulatory shifts, optimizing formulation workflows, and fostering partnerships throughout the value chain. By adhering to these principles, stakeholders can navigate uncertainty and chart a path toward sustainable, high-value growth.

Connect with Ketan Rohom to Unlock Strategic Market Intelligence and Propel Your Performance Additives Business Forward

For tailored insights and to secure comprehensive market intelligence on performance additives, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the report’s strategic frameworks, detailed segmentation analyses, and up-to-date regional and regulatory perspectives so your organization can capitalize on emerging opportunities and mitigate risks effectively. Reach out today to unlock the full potential of this market research report and inform your next strategic move.

- How big is the Performance Additives Market?

- What is the Performance Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?