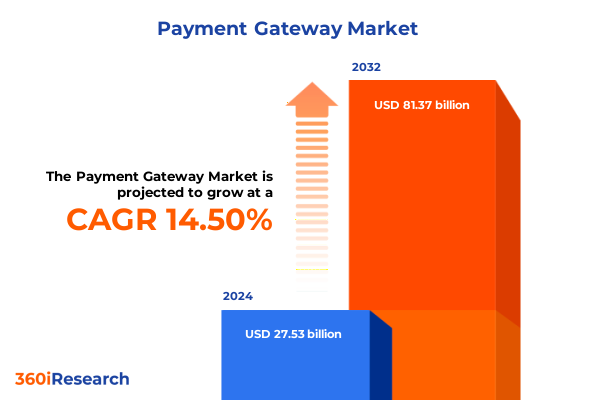

The Payment Gateway Market size was estimated at USD 27.53 billion in 2024 and expected to reach USD 31.23 billion in 2025, at a CAGR of 14.50% to reach USD 81.37 billion by 2032.

Empowering Secure and Seamless Payment Experiences to Accelerate Digital Commerce Through Advanced Gateway Technologies and Customer-Centric Design

In an era defined by accelerating digital transformation, payment gateways have emerged as indispensable enablers of secure, efficient, and frictionless financial interactions. As e-commerce volumes surge and consumers demand seamless experiences, organizations must rely on sophisticated gateway solutions to authenticate transactions, manage risk, and optimize user journeys. The convergence of mobile commerce, contactless payments, and cross-border digital trade has expanded the role of payment gateways beyond mere transaction processors to strategic gateways into global markets.

Amid evolving consumer expectations and heightened security imperatives, modern gateways have embraced advanced encryption, tokenization, and adaptive authentication mechanisms. These innovations not only safeguard sensitive financial data but also deliver near-instant settlement and unparalleled reliability. By integrating with digital wallets, loyalty programs, and emerging financial networks, gateways are transforming the way businesses engage customers and monetize digital channels. Recognizing their critical role in revenue generation and brand trust, industry leaders are increasingly prioritizing gateway modernization as part of broader digital commerce initiatives.

Navigating Disruptive Shifts in Payment Infrastructure Driven by Open Banking AI Innovations and Emerging Real-Time Financial Networks

The payment gateway landscape is in the midst of a profound transformation driven by regulatory mandates, technological breakthroughs, and evolving consumer behaviors. The rise of open banking frameworks has compelled incumbents to expose APIs and collaborate with challenger fintechs, fostering a more interconnected financial ecosystem. This shift has unlocked new revenue streams through value-added services such as account aggregation, real-time account verification, and embedded finance offerings that blur the lines between payments and banking.

Simultaneously, artificial intelligence and machine learning algorithms are revolutionizing fraud prevention and risk management. By analyzing vast datasets in real time, these systems deliver predictive scoring and adaptive controls that detect sophisticated fraud patterns without compromising the user experience. Emerging distributed ledger technologies and tokenization protocols are further decentralizing transaction settlement, enabling near-instant cross-border transfers with reduced counterparty risk. Collectively, these disruptive trends are redefining the very architecture of payment systems, prompting vendors and merchants to reimagine how they secure, process, and scale digital transactions.

Assessing the Cumulative Impact of 2025 Tariff Measures on US Payment Gateway Ecosystems Supply Chains and Merchant Cost Structures

In 2025, the United States government introduced a new tranche of tariffs on imported payment processing hardware and electronic components, a policy move that has reverberated through the gateway ecosystem. The added duties on point-of-sale terminals, card readers, and embedded IoT payment modules have increased procurement costs for hardware vendors and channel partners. As a result, many service providers have begun reevaluating their supply chains, seeking alternative sourcing strategies and cost mitigation measures to protect profit margins.

Merchants and financial institutions have felt the impact through elevated equipment lease rates and higher upfront purchase prices. To counterbalance these cost pressures, gateway providers have accelerated their push toward cloud-based and virtualized payment endpoints that reduce dependence on physical hardware. This shift not only helps alleviate tariff-induced cost burdens but also enhances scalability and remote management capabilities. Moreover, the tariff environment has catalyzed greater adoption of software-centric digital wallet solutions, which bypass hardware altogether and offer a more resilient, platform-agnostic approach to transaction processing.

Unveiling Key Insights from Payment Gateway Segmentation Across Payment Mode Industry Vertical Organization Size and Deployment Preferences

Examining payment gateways through the lens of payment mode reveals distinct usage patterns and technological requirements. Credit and debit cards continue to dominate volume, yet the rapid ascent of digital wallets underscores a preference for mobile-first, tokenized payments. Net banking retains a niche among high-value B2B transactions, especially where integrated invoicing and reconciliation workflows are essential. Each payment mode carries unique risk profiles and compliance demands, shaping how gateways design authentication protocols and fraud mitigation controls.

Industry vertical segmentation uncovers further nuances in gateway utilization. Financial services and healthcare sectors often demand stringent regulatory compliance, necessitating robust data security and audit trail capabilities. Retail and e-commerce merchants require high throughput and seamless checkout integrations, whether in brick-and-mortar outlets or online storefronts. Within the travel and hospitality space, airlines prioritize rapid ticketing and refunds, while hotel operators emphasize secure guest payments and loyalty program integrations. Understanding these vertical-specific requirements enables gateway vendors to tailor feature sets, pricing models, and service level agreements to diverse customer needs.

Organizational size also influences gateway adoption strategies. Large enterprises invest heavily in custom API integrations, global acquiring arrangements, and multi-currency reconciliation services, reflecting their complex operations and international reach. In contrast, small and medium businesses favor turnkey solutions with simplified onboarding, transparent pricing, and plug-and-play integrations that minimize technical overhead. This divergence drives product roadmaps toward modular architectures that can scale feature complexity according to customer scale.

Finally, deployment type preferences illustrate a growing tilt toward cloud-based gateway infrastructure. Public cloud offerings provide rapid provisioning and elastic scaling, appealing to merchants with variable demand cycles. Private cloud environments, by contrast, deliver dedicated resources and enhanced customization for organizations with rigorous security mandates. On-premises installations, while diminishing in popularity, remain relevant for clients with legacy system dependencies or regulatory restrictions on data residency. Together, these segmentation dimensions offer a granular framework for assessing market needs and aligning solution portfolios accordingly.

This comprehensive research report categorizes the Payment Gateway market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Gateway Type

- Payment Method

- Mode of Payment

- Deployment Type

- Industry Vertical

- Organization Size

Illuminating Regional Dynamics in Payment Gateway Adoption Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in payment gateway adoption reflect a complex interplay of regulatory frameworks, digital infrastructure maturity, and consumer preferences. In the Americas, North American markets lead in advanced authentication mandates and real-time payments adoption, driven by initiatives such as the FedNow service. Latin American markets, by contrast, exhibit strong growth in digital wallets and bank transfer solutions, fueled by high underbanked populations and mobile penetration rates.

Europe, the Middle East, and Africa present a tapestry of regulatory harmonization and fragmentation. The European Union’s revised payments directive (PSD3) has standardized open banking protocols and mandated seamless cross-border euro transactions, fostering competition and innovation. Meanwhile, Middle Eastern markets are investing heavily in national digital currencies and contactless payment programs, aligning with broader smart city agendas. African economies, led by digital microfinance initiatives, leverage low-cost mobile money networks to handle high transaction volumes in regions with limited banking infrastructure.

Asia-Pacific is characterized by a duality of mature and emerging economies. In established markets such as Japan and South Korea, sophisticated payment terminals and multi-layered authentication create a high bar for gateway feature sets. Southeast Asian markets, including Indonesia and the Philippines, drive innovation in QR code payments and super-app integrations, supported by governments promoting cashless policies. Australia and New Zealand emphasize cross-border reconciliation services to support vibrant tourism and business travel sectors. This regional diversity underscores the need for flexible gateway architectures that can adapt to varying levels of digital readiness and regulatory complexity.

This comprehensive research report examines key regions that drive the evolution of the Payment Gateway market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Payment Gateway Providers and Their Strategic Approaches to Innovation Partnerships and Market Differentiation

The payment gateway arena features a competitive landscape of legacy incumbents, agile fintechs, and emerging platform players. Major providers have differentiated through global acquiring networks, advanced fraud detection suites, and strategic partnerships with cloud hyperscalers. Innovative startups, on the other hand, have gained traction by focusing on niche verticals or specialized payment modalities, such as cryptocurrency settlement or buy-now, pay-later integrations.

Partnership and merger activity has intensified as companies seek to broaden their service capabilities and geographic reach. Acquisitions of specialized risk management firms have bolstered fraud prevention toolsets, while joint ventures with banking partners have accelerated open banking API rollouts. Alliances with digital wallet issuers and loyalty program operators offer cross-promotional opportunities, enabling gateways to embed ancillary services that elevate user engagement. As competition heats up, each provider’s strategic playbook hinges on cultivating ecosystems that blend payments, data analytics, and value-added services into a cohesive commerce platform.

This comprehensive research report delivers an in-depth overview of the principal market players in the Payment Gateway market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide, Inc.

- Adyen N.V.

- Amazon.com, Inc.

- Ant Group Co., Ltd.

- BitPay Inc.

- Block, Inc.

- CAMSPay

- Cardstream Limited

- Cashfree Payments India Private Limited

- CCBill, LLC

- Easy Payment Gateway Ltd.

- Fiserv, Inc.

- Global Payments Inc.

- GoCardless Ltd.

- Infibeam Avenues Limited

- Instamojo Technologies Pvt. Ltd.

- JPMorgan Chase & Co.

- Mindeed Technologies and Services Pvt Ltd.

- NTT DATA Group Corporation

- PAYMENT GATEWAY SOLUTIONS PVT. LTD.

- PayPal, Inc.

- Payroc LLC

- Paytm Payments Services Limited, Inc

- PayU Group

- PhonePe Private Limited

- Primer API Limited

- Razorpay Software Limited

- Resilient Innovations Private Limited

- Shift4 Payments, LLC

- Skrill Limited by Paysafe Holdings UK Limited.

- Stripe Inc.

- Tazapay PTE. LTD.

- VeriFone, Inc.

- Volume Payments Limited

- Wave Financial Inc.

- Worldline SA

- Zaakpay by MobiKwik Systems Limited

Delivering Tailored Strategic Recommendations for Industry Leaders to Enhance Gateway Performance Drive Growth and Mitigate Emerging Risks

To thrive in the evolving payment gateway landscape, industry leaders must embrace a proactive strategic roadmap. Investing in artificial intelligence–powered risk engines is paramount to detect and prevent sophisticated fraud schemes while minimizing false declines that erode customer trust. Simultaneously, adopting an API-first design philosophy will facilitate seamless integration with partner platforms and fintech ecosystems, unlocking new revenue channels through embedded finance services.

Enhancing cross-border payment capabilities is another critical imperative. By integrating real-time settlement rails and multi-currency reconciliation modules, gateway providers can deliver faster, more transparent cross-border experiences that attract global merchants and international travelers. At the same time, optimizing the consumer checkout experience through progressive onboarding, biometric authentication, and one-click payment flows will drive higher conversion rates and foster long-term loyalty.

Operational resilience and regulatory compliance must remain focal points. Diversifying infrastructure across public and private cloud environments will mitigate downtime risks and accommodate fluctuating transaction volumes. Establishing dedicated compliance monitoring teams to navigate shifting tariff policies, data privacy laws, and open banking mandates will safeguard market access and reduce time to market. Finally, cultivating strategic alliances with card networks, banking partners, and fintech innovators will ensure gateway portfolios remain at the forefront of industry trends and customer expectations.

Outlining a Robust Multi-Method Research Methodology Integrating Primary Stakeholder Engagement Secondary Data Triangulation and Analytical Rigor

This research draws upon a rigorous, multi-layered methodology designed to ensure the highest levels of accuracy and relevance. Primary data collection involved structured interviews with senior executives from payment gateway providers, financial institutions, merchant associations, and technology vendors. These conversations illuminated real-world implementation challenges and strategic imperatives that shape product roadmaps and market dynamics.

Secondary research encompassed an exhaustive review of industry publications, regulatory filings, vendor whitepapers, and academic studies to contextualize primary findings within broader market trends. Data triangulation techniques reconciled information from disparate sources, including public procurement records, technology adoption surveys, and anonymized transaction analytics from gateway platforms. This process validated emerging patterns and minimized biases.

Key segmentation and regional analyses were conducted using both quantitative and qualitative approaches. Market participants were categorized by payment mode, industry vertical, organization size, and deployment preference to identify nuanced technology requirements and growth inhibitors. Regional studies incorporated macroeconomic indicators, digital infrastructure metrics, and regulatory landscapes to map adoption trajectories. Rigorous peer review and stakeholder workshops ensured methodological transparency and reinforced the credibility of this report’s insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Payment Gateway market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Payment Gateway Market, by Payment Gateway Type

- Payment Gateway Market, by Payment Method

- Payment Gateway Market, by Mode of Payment

- Payment Gateway Market, by Deployment Type

- Payment Gateway Market, by Industry Vertical

- Payment Gateway Market, by Organization Size

- Payment Gateway Market, by Region

- Payment Gateway Market, by Group

- Payment Gateway Market, by Country

- United States Payment Gateway Market

- China Payment Gateway Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Concluding Strategic Perspectives on Payment Gateway Evolution Emerging Opportunities Imperatives and a Roadmap for Sustained Competitive Advantage

As payment gateways continue to evolve, driven by technological innovation and shifting regulatory frameworks, organizations must remain vigilant and adaptable. The convergence of open banking APIs, AI-driven risk management, and real-time settlement rails is redefining the boundaries of transaction processing. Simultaneously, tariff-induced hardware cost pressures and regional regulatory variations underscore the importance of flexible, software-centric gateway architectures.

Key segmentation insights highlight the need for tailored solutions across payment modes, industry verticals, organization sizes, and deployment models. Regional intricacies demand localized strategies that account for digital maturity, consumer behavior, and policy environments. Leading providers differentiate through strategic partnerships, advanced analytics, and customer-centric feature sets that deliver value beyond core transaction processing.

By operationalizing the strategic recommendations outlined herein, industry leaders can enhance gateway resilience, drive sustainable growth, and maintain competitive advantage in an increasingly complex ecosystem. The future of payment gateways will be shaped by those who can seamlessly blend innovation, operational excellence, and customer insights into their technology platforms.

Encouraging Direct Engagement with Our Associate Director of Sales and Marketing Ketan Rohom to Secure Your Copy of the Comprehensive Payment Gateway Market Research Report Today

To gain deeper insights into the payment gateway market and make informed strategic decisions, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. As an expert in market dynamics and customer engagement strategies, Ketan can guide you through the comprehensive market research report, tailored to address your organization’s unique objectives and challenges. By partnering with him, you can explore customized data modules, exclusive value-added services, and flexible licensing arrangements that align with your budgetary and operational requirements.

Reaching out to Ketan will enable you to secure early access to the latest findings on payment gateway innovations, tariff impacts, segmentation nuances, and regional growth drivers. His expertise will ensure you extract maximum value from the report’s actionable recommendations and advanced analytical frameworks. Schedule a personalized consultation today to discuss package options, receive a sample executive summary, or arrange a live demonstration of our interactive data dashboard. Unlock the full potential of your payment gateway strategy by contacting Ketan Rohom and taking the next step toward market leadership.

- How big is the Payment Gateway Market?

- What is the Payment Gateway Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?