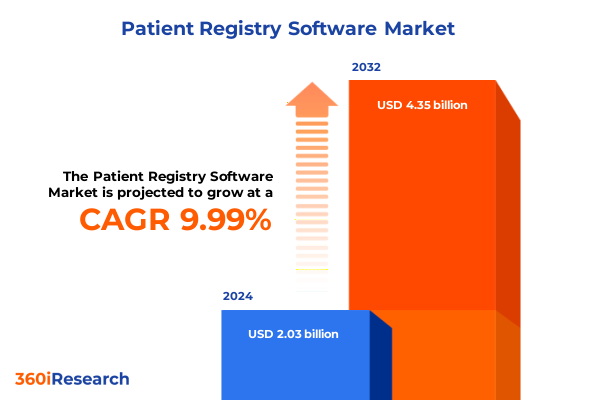

The Patient Registry Software Market size was estimated at USD 2.22 billion in 2025 and expected to reach USD 2.44 billion in 2026, at a CAGR of 10.05% to reach USD 4.35 billion by 2032.

Unlocking the Critical Role of Patient Registry Software in Advancing Healthcare Outcomes and Facilitating Data-Driven Decision Making Across Stakeholders

Patient registry software is a foundational technology solution that enables systematic collection, storage, and analysis of patient data across diverse healthcare settings. By capturing longitudinal records of individuals with specific conditions or exposures, registry platforms support clinicians, researchers, and health system administrators in generating real-world evidence that informs clinical decision making. These solutions streamline patient enrollment, automate data validation, and standardize reporting workflows, thereby reducing administrative burden and enhancing operational efficiency in both clinical care and research contexts.

Beyond data capture, patient registry software plays a pivotal role in meeting regulatory requirements and quality metrics, as national and international health authorities increasingly mandate comprehensive reporting on outcomes and safety indicators. Consequently, registry platforms have evolved to integrate robust compliance features, including audit trails, access controls, and customizable dashboards that align with evolving guidelines. As a result, healthcare organizations can more readily demonstrate adherence to clinical protocols, support value-based care initiatives, and optimize reimbursement pathways through transparent performance tracking.

Moreover, the adoption of advanced analytics and visualization tools within registry software empowers stakeholders to identify patterns in treatment responses, monitor disease progression, and conduct comparative effectiveness studies. This capability not only accelerates medical research but also enables personalized patient care by highlighting risk factors and outcomes at both individual and population levels. In turn, data-driven insights foster collaborative networks among multidisciplinary teams, bridging gaps between academic institutions, community providers, and industry partners.

As the digital health landscape continues to mature, patient registry software is poised to serve as a critical infrastructure component that unifies fragmented data sources. By harmonizing electronic health record systems, claims databases, and patient-reported outcomes, these platforms deliver actionable intelligence that drives strategic decisions across healthcare ecosystems. This introduction sets the stage for a deeper exploration of the transformative shifts, regulatory impacts, segmentation insights, regional nuances, company strategies, and recommendations that shape the future of this vital market.

Navigating Accelerated Digital Transformation and Interoperability Imperatives Redefining Patient Registry Software Across Modern Healthcare Networks Globally

Healthcare is undergoing an accelerated digital transformation that is reshaping the architecture and capabilities of patient registry software. Cloud-native deployments have emerged as a cornerstone of this evolution, enabling scalable storage, real-time data exchange, and seamless integration with existing electronic health record systems. In addition, the proliferation of open standards such as HL7 FHIR has heightened interoperability imperatives, compelling solution providers to design APIs and data models that facilitate cross-platform communication. Consequently, modern registry platforms are evolving from siloed databases into interconnected hubs that support end-to-end clinical and operational workflows.

Furthermore, the integration of artificial intelligence and machine learning algorithms is transforming how registry data is analyzed and applied. Predictive analytics modules can assess patient risk profiles, forecast disease progression, and recommend personalized intervention strategies, thereby enhancing clinical decision support. At the same time, natural language processing capabilities enable the extraction of insights from unstructured clinical notes, broadening the scope of real-world evidence captured within registry datasets. These technological advancements are complemented by user-centric interfaces that prioritize intuitive visualization, mobile accessibility, and collaborative features, driving user engagement and adoption across diverse stakeholder groups.

However, this surge in digital innovation is accompanied by escalating demands around data privacy, security, and regulatory compliance. Stricter mandates relating to patient consent, data residency, and cybersecurity protocols require registry software vendors to implement encrypted databases, multi-factor authentication, and continuous monitoring. As a result, companies that can demonstrate adherence to established frameworks while maintaining agile development cycles hold a distinct competitive advantage.

Collectively, these transformative shifts underscore a dynamic landscape in which patient registry software must adapt to evolving technological, clinical, and regulatory expectations. The following section examines how recent policy measures, including the United States tariffs of 2025, further shape market dynamics and strategic decision making.

Assessing the Strategic and Economic Repercussions of the 2025 United States Tariffs on Patient Registry Software Supply Chains and Adoption Dynamics

Beginning in early 2025, the United States government enacted a series of tariffs targeting imported software components, hardware infrastructure, and cloud services associated with patient registry platforms. These measures, aimed at bolstering domestic technology manufacturing and balancing trade deficits, have generated strategic and economic repercussions across the healthcare IT sector. Vendors reliant on international data center equipment and proprietary middleware encountered immediate cost pressures, prompting reassessment of supply chain configurations and vendor partnerships.

In the wake of these tariffs, software providers with vertically integrated offerings and domestic server networks gained an operational edge. Conversely, companies dependent on offshore data hosting or third-party solutions faced potential margin erosion. To mitigate these impacts, some market leaders renegotiated contracts with hardware suppliers, adopted multi-sourcing strategies, and restructured pricing frameworks to distribute costs more equitably among clients. Meanwhile, healthcare institutions conducted rigorous total cost of ownership analyses to evaluate on-premise versus cloud-based deployment models in light of tariff-induced expense shifts.

Moreover, the imposed tariffs have catalyzed increased interest in open-source and locally developed registry software alternatives, as buyers seek to minimize exposure to volatile import duties. This pivot has also reinforced the importance of modular architectures that allow seamless integration of vendor-agnostic components. Despite the near-term challenges, these dynamics could accelerate innovation in domestic markets and attract investment into in-country software development and data center expansion.

Ultimately, the cumulative impact of the 2025 United States tariffs extends beyond immediate cost considerations, reshaping vendor strategies and influencing procurement decisions. The next section delves into how granular segmentation analysis reveals nuanced market opportunities that can guide stakeholders in this evolving environment.

Unlocking Insights from Patient Registry Software Segmentation by Registry Type, Platform Format, Functionality, Pricing, Database, Deployment, and End Users

An in-depth segmentation of patient registry software reveals critical insights into how different market segments align with distinct use cases and stakeholder needs. When examining registry type, the spectrum spans disease registries, health service registries, and product registries. Disease registries encompass specialized modules for cancer, cardiovascular conditions, chronic kidney diseases, diabetes, orthopedic disorders, and rare diseases, each addressing unique clinical pathways and data requirements. Health service registries cover broad public health initiatives such as immunization tracking, maternal and child health monitoring, and screening programs, emphasizing population outreach and preventive care metrics. Product registries focus on post‐market surveillance for drugs and medical devices, enabling manufacturers and regulators to monitor safety signals and real‐world performance.

In terms of platform format, solutions are categorized as integrated platforms or standalone applications. Integrated platforms typically interface directly with electronic health records and enterprise resource planning systems, delivering consolidated workflows, while standalone applications offer targeted functionality with faster deployment cycles. Assessing core functionality further delineates market preferences, whether for data collection and reporting, medical research and clinical study support, outcome tracking and analysis, patient care management, or population health management. Each functional focus carries implications for software architecture, user interface design, and analytic capabilities.

Pricing models range from freemium and pay‐per‐use to perpetual license and subscription structures, reflecting diverse buyer budgets and procurement strategies. Meanwhile, database preferences differentiate between commercial databases optimized for large‐scale analytics and public databases that ensure wider access. Deployment modes in this context traverse cloud‐based services and on‐premise installations, each offering trade‐offs in scalability, security, and governance. Finally, end users span government and public health agencies, hospitals and clinics, pharmaceutical and biotech companies, and research organizations and contract research organizations, underscoring a varied stakeholder ecosystem. By synthesizing these segmentation layers, stakeholders can pinpoint high‐value opportunities and tailor offerings to specific market demands.

This comprehensive research report categorizes the Patient Registry Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Registry Type

- Product Type

- Functionality

- Pricing Model

- Database Type

- Deployment Mode

- End-User

Exploring Regional Dynamics and Adoption Trends of Patient Registry Software Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

A regional examination of patient registry software adoption uncovers distinctive drivers and constraints that reflect local healthcare infrastructures and regulatory landscapes. In the Americas, mature health systems in the United States and Canada leverage robust digital health frameworks and value-based care initiatives to accelerate registry integration. High levels of healthcare expenditure and established interoperability standards foster adoption of advanced analytics and cloud migration, while Latin American nations demonstrate growing interest in disease‐specific registries to support emerging public health challenges.

Across Europe, the Middle East, and Africa, diverse regulatory environments shape registry strategies. In Europe, stringent data protection regulations such as the General Data Protection Regulation compel software providers to implement rigorous privacy controls and data residency solutions. Government‐driven public health campaigns in the Middle East and Africa often rely on registries to track immunization coverage and maternal health outcomes, emphasizing scalability and mobile accessibility in areas with limited infrastructure. Collaborative efforts between regional health authorities and international partners further drive deployment of standardized registry platforms that align with global health objectives.

In the Asia Pacific region, rapid digital transformation and significant investments in healthcare technology are expanding registry capabilities. Countries such as China, Japan, and Australia emphasize integration of registry platforms with national health information exchanges, while emerging markets like India and Southeast Asian nations adopt cost‐effective, cloud‐based solutions to address chronic disease burdens. Telehealth integration and mobile data collection tools enhance registry reach in rural areas, creating opportunities for stakeholders to tailor offerings to local needs. By understanding these regional nuances, organizations can optimize strategies and resource allocation to maximize impact in each market.

This comprehensive research report examines key regions that drive the evolution of the Patient Registry Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations from Leading Patient Registry Software Companies Driving Market Differentiation and Technological Leadership

Key companies operating in the patient registry software market demonstrate a range of strategic approaches that influence their competitive position. Large enterprise electronic health record vendors often extend their core platforms with registry modules, leveraging existing customer relationships and deep integration capabilities to streamline adoption. These incumbents typically emphasize comprehensive service portfolios, combining registry functions with revenue cycle management, population health analytics, and patient engagement tools.

Meanwhile, specialized registry software providers differentiate through focused innovations in areas such as real‐time analytics, modular architecture, and user experience design. By incorporating advanced predictive models and customizable dashboards, these companies cater to research institutions and clinical trial sponsors seeking agile study management. Partnerships with contract research organizations and academic medical centers enable rapid validation of analytic algorithms and the incorporation of longitudinal data sources.

Emerging technology firms introduce cloud-native registry solutions with flexible pricing models, appealing to small and mid‐sized healthcare providers and public health agencies. Their emphasis on subscription‐based offerings and freemium tiers lowers entry barriers for markets with constrained budgets. Additionally, collaborations between software vendors and hardware manufacturers are becoming more common, as the integration of connected medical devices and remote monitoring systems expands registry data streams.

Cross‐sector alliances further illustrate competitive dynamics, with pharmaceutical and biotech companies investing in registry platforms to support post‐market surveillance and real‐world evidence generation. These strategic moves underscore a trend toward convergence between clinical research applications and broader healthcare delivery systems. Understanding these diverse company insights equips stakeholders to identify potential partners, benchmark innovations, and anticipate shifts in the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Patient Registry Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- ArborMetrix, Inc.

- Cedaron Medical, Inc.

- Common Management Solutions, S.L.

- Deutsche Telekom AG

- Elekta AB

- Epic Systems Corporation

- EVADO Pty. Ltd.

- EvidentIQ Group GmbH

- Fivos, Inc.

- Global Vision Technologies, Inc.

- Google LLC by Alphabet Inc.

- Health Catalyst, Inc.

- Healthmonix

- Hewlett Packard Enterprise Development LP

- Ifa systems AG

- ImageTrend, Inc.

- Intelerad Medical Systems Incorporated

- International Business Machines Corporation

- IQVIA Holdings Inc.

- McKesson Corporation

- Microsoft Corporation

- Milliman, Inc.

- MRO Corporation

- OpenText Corporation

- Optum, Inc.

- Oracle Corporation

- Ordinal Data, Inc.

- RAYLYTIC GmbH

- Seqster PDM, Inc.

- Syneos Health, Inc.

- Veradigm LLC

- Vitro Software Holdings DAC

- WIRB-Copernicus Group

Driving Future Success through Strategic Initiatives to Enhance Adoption, Compliance, Interoperability, and Innovation in Patient Registry Software Solutions

Industry leaders can capitalize on the evolving patient registry software market by implementing a series of targeted strategies. First, it is essential to prioritize interoperability by adopting open standards and application programming interfaces that facilitate seamless data exchange with electronic health record systems, laboratory platforms, and third‐party analytic tools. Such technical integration not only enhances data fluidity but also promotes user satisfaction and reduces administrative inefficiencies.

Second, embracing cloud‐native deployment models can offer significant advantages in scalability, cost management, and rapid feature delivery. Cloud solutions empower organizations to scale data storage dynamically and access advanced analytics without requiring substantial upfront investments in on‐premise infrastructure. Consequently, decision-makers should evaluate hybrid deployment frameworks to balance control and flexibility.

Third, the implementation of flexible pricing strategies-such as pay-per-use and subscription tiers-can align software solutions with diverse budgetary constraints and encourage incremental adoption. Introducing pilot programs or freemium models may also attract early adopters and demonstrate proof of value, fostering long-term commitment.

Fourth, strengthening cybersecurity measures and compliance protocols is vital to address heightened privacy expectations and regulatory mandates. Investing in encryption, multi-factor authentication, and continuous monitoring will not only mitigate risk but also build stakeholder trust.

Finally, leveraging artificial intelligence and machine learning capabilities to deliver predictive insights and personalized patient management tools can differentiate registry offerings. By combining these technical enhancements with stakeholder engagement initiatives-such as training programs and collaborative feedback loops-organizations can ensure that solutions remain aligned with evolving clinical and research priorities.

Unveiling the Rigorous Research Methodology for Analyzing Patient Registry Software Markets Using Data Collection, Validation, and Expert Insights

The research methodology underpinning this market study combines systematic data collection, rigorous analysis, and expert validation to ensure comprehensive and reliable insights. Initially, secondary research encompassed an extensive review of publicly available literature, including peer-reviewed journals, regulatory guidelines, industry whitepapers, and technology standards. This foundational data provided context on clinical use cases, interoperability requirements, and global regulatory frameworks relevant to patient registry software.

Subsequently, primary research involved structured interviews and surveys with key stakeholders such as healthcare providers, software vendors, public health officials, and clinical researchers. These engagements yielded qualitative insights into deployment experiences, vendor selection criteria, and emerging technology trends. Data triangulation techniques were applied to cross-verify findings from multiple sources, enhancing the robustness of the analysis.

Quantitative data on adoption patterns, functionality preferences, and regional deployment choices were synthesized through segmentation modeling, enabling granular evaluation by registry type, platform format, functionality, pricing model, database preference, deployment mode, and end-user category. The impact of policy measures-particularly the 2025 United States tariffs-was assessed through scenario analysis and cost-impact frameworks.

Finally, expert workshops and panel reviews were conducted to validate assumptions, challenge preliminary conclusions, and refine strategic recommendations. This multi‐stage approach ensures that the study’s conclusions reflect the latest market dynamics and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Patient Registry Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Patient Registry Software Market, by Registry Type

- Patient Registry Software Market, by Product Type

- Patient Registry Software Market, by Functionality

- Patient Registry Software Market, by Pricing Model

- Patient Registry Software Market, by Database Type

- Patient Registry Software Market, by Deployment Mode

- Patient Registry Software Market, by End-User

- Patient Registry Software Market, by Region

- Patient Registry Software Market, by Group

- Patient Registry Software Market, by Country

- United States Patient Registry Software Market

- China Patient Registry Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing the Strategic Imperatives and Future Outlook for Patient Registry Software Adoption to Empower Stakeholders with Data-Driven Healthcare Solutions

The trajectory of patient registry software underscores its pivotal role in enabling data-driven healthcare and research initiatives. As digital transformation and interoperability imperatives continue to reshape the landscape, organizations must navigate evolving regulatory demands, technological innovations, and trade policy impacts such as the 2025 United States tariffs. By applying a nuanced segmentation lens, stakeholders can identify high-impact opportunities across registry types, platform architectures, functional domains, pricing strategies, database preferences, deployment modes, and end-user segments.

Regional dynamics further influence adoption pathways, with mature markets in the Americas prioritizing advanced analytics and value-based care, EMEA emphasizing data privacy and public health programs, and Asia Pacific embracing cloud-based solutions to address emerging healthcare challenges. Within this complex ecosystem, differentiated strategies employed by leading software vendors-from integrated EHR platforms to agile cloud-native providers-highlight pathways for competitive advantage and innovation.

Ultimately, converting these insights into actionable strategies involves prioritizing interoperability, adopting flexible pricing models, fortifying cybersecurity, and leveraging predictive analytics. Healthcare providers, public health agencies, pharmaceutical companies, and research organizations can harness registry platforms to accelerate clinical studies, track outcomes, and realize population health objectives. This comprehensive understanding sets the stage for informed decision making and strategic investment in patient registry software solutions.

Engage with Ketan Rohom to Secure the Comprehensive Patient Registry Software Market Research Report and Drive Informed Decision Making for Your Organization

Ketan Rohom, Associate Director of Sales and Marketing, invites you to explore the full breadth of insights and strategic guidance contained within this market research report. By securing access, you will gain a holistic view of market drivers, segmentation nuances, regional dynamics, and competitive strategies that can inform critical business decisions. Engage with Ketan to discuss how these findings align with your organizational objectives and to tailor a solution that addresses your specific requirements.

For personalized consultation and to acquire the comprehensive patient registry software market study, please contact Ketan through our official channels. His expertise will ensure you receive targeted recommendations and the data-driven intelligence necessary to capitalize on emerging opportunities and navigate regulatory and economic challenges with confidence.

- How big is the Patient Registry Software Market?

- What is the Patient Registry Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?