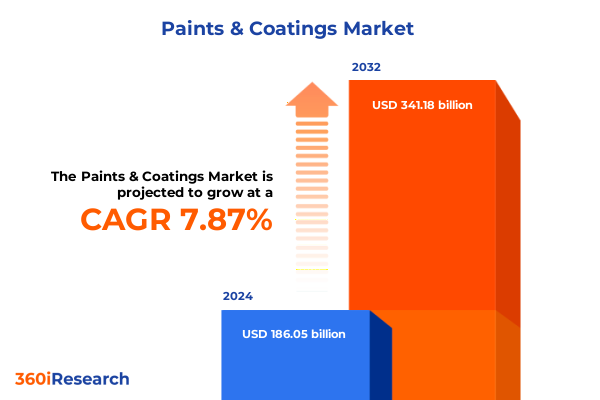

The Paints & Coatings Market size was estimated at USD 199.86 billion in 2025 and expected to reach USD 214.91 billion in 2026, at a CAGR of 7.93% to reach USD 341.18 billion by 2032.

Unveiling The Dynamic Forces Reshaping The Global Paints And Coatings Arena In The Wake Of Innovation And Evolving Market Demands

Across industrial and architectural applications alike, the paints and coatings sector remains a cornerstone of global economic activity, underpinning the performance, durability, and aesthetic appeal of products in construction, transportation, packaging, and consumer goods. In recent years, innovation has accelerated at every level of the value chain, from advanced resin chemistries that enhance corrosion resistance and weatherability to digital color-matching platforms that elevate customer experience. Faced with mounting regulatory requirements, raw material constraints, and shifting end-user demands, manufacturers and suppliers are compelled to rethink traditional approaches, embrace sustainability mandates, and leverage new technologies to safeguard competitive positioning.

Transitioning beyond legacy formulations, industry participants are integrating high-performance additives and exploring next-generation application methods to deliver multifunctional coatings with self-cleaning, anti-microbial, and thermal management properties. This paradigm shift is driven not only by end users’ desire for differentiated value but also by heightened environmental scrutiny that penalizes volatile organic compound emissions and incentivizes waterborne and powder-based solutions. Simultaneously, supply chain vulnerabilities and geopolitically driven tariff regimes have placed a premium on strategic sourcing, cost transparency, and regional manufacturing footprints.

As market participants navigate this complex landscape, a comprehensive understanding of emerging trends, segmentation dynamics, and competitive responses becomes indispensable. This executive summary distills the forces reshaping the paints and coatings arena, highlights the cumulative effect of United States tariff actions slated for 2025, and presents strategic recommendations designed to inform investment decisions and operational enhancements.

Exploring The Major Technological Breakthroughs And Sustainability Drivers Reshaping Coatings Performance And Market Dynamics Globally

The paints and coatings industry is experiencing transformative shifts catalyzed by a confluence of technological breakthroughs, regulatory reforms, and evolving end-use imperatives. Foremost among these is the rapid advancement of sustainable formulation technologies that reduce volatile organic compound emissions while enhancing performance. Waterborne systems have surged ahead as manufacturers seek to replace solventborne alternatives, and UV-curable coatings are gaining traction in high-throughput industrial applications where rapid curing and energy efficiency translate to lower operational costs and reduced carbon footprints.

Regulatory drivers also play a pivotal role in guiding product development trajectories. Stricter environmental standards have prompted a departure from traditional alkyd and solventborne chemistries in favor of polyurethane and epoxy systems, which offer superior chemical resistance and longevity with fewer environmental trade-offs. Concurrently, the advent of smart and functional coatings-ranging from anti-corrosive layers embedded with nano-materials to self-healing polymers-reflects a rising demand for multi-property solutions that address challenges from surface protection to energy management.

Digital transformation is further redefining stakeholder interactions, as integrated color-matching software, cloud-based order management, and predictive maintenance platforms empower applicators and end users to optimize supply chains, minimize waste, and accelerate time-to-market. These cumulative shifts underscore an era of dynamic reinvention for industry players willing to embrace innovation, collaborate across the value chain, and align product portfolios with the escalating demands of sustainability and performance excellence.

Assessing The Far-Reaching Consequences Of New United States Tariff Measures On Raw Materials Cost Structures And Supply Chain Resilience

In response to trade policy adjustments announced for 2025, United States tariff measures on critical raw materials such as titanium dioxide, specialty resins, and performance additives have exerted a cumulative impact on cost structures and supply chain resilience. These levies have translated into higher landed costs for imported feedstocks, necessitating a reevaluation of procurement strategies and prompting manufacturers to explore alternative sourcing avenues. As a result, many producers are pursuing nearshoring initiatives, forging partnerships with domestic resin producers, and diversifying their supplier base across emerging markets to hedge against tariff-induced price volatility.

The ripple effects of these tariffs extend beyond direct material costs, influencing inventory policies and working capital requirements. Elevated duty liabilities have encouraged just-in-time delivery models and intensified collaboration between suppliers and end users to synchronize production schedules and buffer against price spikes. On the downstream side, formulators have incrementally adjusted pricing models, balancing pass-through increases with value-added service offerings to maintain margins while preserving customer loyalty.

Looking ahead, proactive engagement with trade policy developments will be essential. Industry stakeholders are investing in predictive analytics tools to simulate tariff scenarios, assess supplier risk profiles, and quantify the trade-offs between cost containment and supply continuity. By integrating these insights into strategic planning processes, organizations can mitigate exposure to future trade disruptions and sustain competitive cost positions in a tariff-sensitive environment.

Decoding The Diverse Segmentation Framework Highlighting Resin Varieties Technologies Products Substrates End Uses And Channels

A nuanced appreciation of segmentation dynamics forms the backbone of any strategic growth initiative within the paints and coatings domain. Resin diversity encompasses acrylic, alkyd, epoxy, polyester, polyurethane, and vinyl variants, each distinguished by its mechanical strength, chemical resistance, and aesthetic flexibility. These resin platforms serve as foundational building blocks upon which formulators tailor performance attributes to meet stringent application criteria across diverse end uses.

Equally transformative is the shift in technology formats, where high-solids coatings and powder systems reduce volatile organic compound profiles, while UV-curable and waterborne technologies optimize curing speed and environmental compliance. Solventborne formulations, although facing headwinds from regulatory constraints, continue to hold relevance in specialized industrial contexts where solvent-borne chemistries deliver unmatched substrate adhesion and surface finish qualities.

Product offerings further bifurcate into architectural coatings and industrial coatings, with architectural solutions subdividing into exterior paints, interior paints, primers, and sealers that cater to aesthetic trends and protective requirements of the built environment. Industrial coatings, by contrast, emphasize corrosion resistance and chemical durability for heavy machinery and transportation equipment. Underlying these product categories is the substrate dimension, encompassing composites, concrete, glass, metals, paper and paperboard, plastics, textiles, and wood surfaces, each necessitating tailored adhesion and flexibility considerations to ensure longevity and performance.

The end-use industry framework extends through automotive and transportation sectors, where both OEM and refinish applications demand precise color consistency and durability; building and construction segments that distinguish between exterior and interior specifications; marine and protective coatings venues including marine coatings for hull applications and protective coatings for infrastructure; packaging initiatives that prioritize barrier properties; and wood and furniture domains that balance aesthetic finish with substrate preservation. Finally, distribution channels bifurcate into offline networks that leverage established dealer and distributor relationships, and online platforms that cater to a growing cohort of end users seeking digital convenience and rapid fulfillment.

This comprehensive research report categorizes the Paints & Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Product Type

- Substrate

- End Use Industry

- Distribution Channel

Revealing Distinct Regional Market Dynamics Through Focus On Americas EMEA And Asia Pacific Growth Catalysts And Challenges

Regional market dynamics reveal distinct growth catalysts and operational considerations across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, emphasis on sustainable infrastructure investment and green building certifications has buttressed demand for low-VOC architectural coatings, while the robust automotive manufacturing corridor in North America continues to drive industrial coatings consumption, especially in OEM and refinish applications.

Within Europe, Middle East and Africa, regulatory rigor-particularly around chemical safety and emissions-has accelerated the transition toward waterborne and powder coatings. The EMEA region benefits from proximity to advanced research clusters, enabling rapid commercialization of functional coatings, yet is also navigating geopolitical trade flows that influence raw material availability and cost. In emerging Middle Eastern markets, infrastructure expansion and oil and gas maintenance projects sustain demand for protective coatings with high corrosion resistance and extended service life.

Asia-Pacific represents the largest and most varied landscape, with mature markets in Japan and South Korea leading in automotive and electronics coatings innovation, while China and India display a voracious appetite for construction coatings fueled by urbanization and infrastructure development. Southeast Asian countries are likewise emerging as competitive manufacturing hubs, catalyzing growth in both industrial and architectural segments. Across the region, digitalizing distribution and e-commerce penetration are reshaping customer engagement, enabling formulators to offer tailored product bundles and value-added technical support directly to end users.

This comprehensive research report examines key regions that drive the evolution of the Paints & Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Approaches And Innovation Initiatives Among Leading Paints And Coatings Corporations Driving Competitive Advantage

Leading corporations within the paints and coatings sphere are leveraging a combination of strategic acquisitions, sustained R&D investments, and concerted sustainability initiatives to fortify competitive advantage. Through targeted partnerships with specialty chemical innovators and material science institutes, major players are accelerating the rollout of next-generation resin systems and high-performance additives, thereby expanding their solution portfolios to address corrosion resistance, UV stability, and antimicrobial functionality.

Digitalization efforts have become a critical differentiator, as organizations develop cloud-based color-matching platforms, digital ordering portals, and predictive maintenance applications designed to streamline customer workflows and foster deeper brand loyalty. Supply chain resilience programs are concurrently emphasizing vendor risk management and vertical integration, with several market leaders investing in backward integration of raw material manufacturing to mitigate exposure to cyclical price fluctuations and geopolitical tariff pressures.

Sustainability frameworks are being operationalized through carbon footprint reduction targets, increased utilization of bio-based feedstocks, and end-of-life recyclability initiatives. By collaborating across industry consortia and certification bodies, these companies are establishing metrics to benchmark progress and ensure transparency for end users. The confluence of these strategic approaches underscores a sector-wide commitment to innovation, risk mitigation, and sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Paints & Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Atlas Paints (PTY) LTD

- BASF SE

- DAW SE

- Dekro Paints

- DuPont de Nemours, Inc.

- Duram (Pty) Ltd

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Indigo Paints Ltd.

- Kansai Paint Co.,Ltd

- Masco Corporation

- Medal Paints Pty LTD

- Midas Paints

- Natal Associated Chemicals (Pty) Ltd

- Nippon Paint Holdings Co., Ltd.

- Paintcor

- Pro-Paint Manufacturing (Pty) Ltd.

- Prolux Paints & Coatings

- Prominent Paints by PPG Industries, Inc.

- RPM International Inc.

- Sparcolux Paints

- Specialized Coating Systems (Pty) Ltd.

- The Sherwin-Williams Company

- Top Paints (Pty) Ltd.

Formulating Strategic Actions For Executives To Navigate Rising Regulatory Complexities Supply Chain Pressures And Innovation Imperatives

Industry leaders seeking to navigate an increasingly complex and competitive landscape must prioritize investment in sustainable formulation technologies that meet stringent environmental standards without sacrificing performance. By allocating R&D resources toward bio-based resins, low-VOC solvents, and energy-efficient curing processes, organizations can not only comply with emerging regulations but also tap into premium pricing segments driven by sustainability-conscious customers.

Optimizing supply chain resilience entails developing dual-sourcing strategies that balance cost competitiveness with security of supply. This involves forging relationships with alternative resin and pigment suppliers in diverse geographic locations, implementing real-time materials tracking systems, and conducting regular risk assessments to anticipate disruptions. Such a proactive stance reduces vulnerability to tariff escalations and raw material shortages.

To fully leverage digital capabilities, companies should deploy cloud-enabled color management and order fulfillment platforms that facilitate seamless collaboration with distributors and end users. This digital backbone can be complemented by data analytics tools that analyze customer usage patterns, enabling predictive maintenance and personalized product recommendations. Finally, executive teams should foster cross-functional innovation hubs that bring together R&D chemists, application engineers, and customer insights teams to co-create solutions tailored to high-value end-use requirements. This integrated approach ensures that new product development aligns with market demand and operational feasibility.

Detailing A Robust Research Methodology Integrating Primary Expert Interviews Secondary Data Analysis And Rigorous Validation Processes

This analysis integrates a rigorous blend of primary and secondary research methodologies to ensure comprehensive and reliable findings. Secondary data collection involved systematic reviews of industry publications, regulatory filings, financial reports, and patent databases to map current trends and benchmark performance metrics. These insights established the macroeconomic, technological, and regulatory context needed to frame primary investigations.

Primary research was conducted through structured interviews with C-level executives, product development leaders, procurement specialists, and technical experts across major paints and coatings producers, end-user groups, and distribution partners. These conversations provided qualitative depth on strategic priorities, technology roadmaps, and risk management practices. In parallel, targeted surveys captured quantitative perceptions on emerging market drivers, adoption timelines for innovative formulations, and the impact of tariff structures on procurement decisions.

Data triangulation combined both qualitative and quantitative inputs, leveraging cross-validation techniques to reconcile discrepancies and enhance data integrity. Statistical analyses and scenario modelling were applied to interpret complex interactions between regulatory changes, supply chain dynamics, and product innovation cycles. The resulting methodology ensures that insights presented in this report are robust, actionable, and reflective of stakeholder perspectives across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Paints & Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Paints & Coatings Market, by Resin Type

- Paints & Coatings Market, by Technology

- Paints & Coatings Market, by Product Type

- Paints & Coatings Market, by Substrate

- Paints & Coatings Market, by End Use Industry

- Paints & Coatings Market, by Distribution Channel

- Paints & Coatings Market, by Region

- Paints & Coatings Market, by Group

- Paints & Coatings Market, by Country

- United States Paints & Coatings Market

- China Paints & Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing The Critical Need For Adaptability Innovation And Sustainability In Crafting Future Growth Trajectories For Coatings Industry

As the paints and coatings industry continues its evolution toward higher performance, sustainability, and digital integration, agility emerges as a cornerstone of success. Stakeholders must cultivate an organizational culture that embraces continuous innovation, adapts swiftly to regulatory shifts, and anticipates end-user preferences. This requires not only investing in next-generation chemistries but also harnessing data-driven decision-making to refine product portfolios and optimize operational efficiencies.

Collaboration across the value chain-from raw material suppliers to applicators-will be pivotal in addressing shared challenges such as environmental compliance, carbon footprint reduction, and supply chain resilience. By fostering cooperative R&D initiatives and sharing best practices, industry participants can accelerate the commercialization of multifunctional coatings while mitigating risks associated with material scarcity and trade policy fluctuations.

Ultimately, the ability to balance performance demands with sustainability imperatives and cost pressures will define market leaders. Organizations that integrate strategic foresight, leverage digital platforms, and maintain a relentless focus on customer-centric innovation will be well-positioned to capture emerging opportunities and sustain growth in a rapidly transforming paints and coatings landscape.

Engage With Associate Director Ketan Rohom To Unlock Comprehensive Insights And Secure Your Definitive Paints And Coatings Report Today

For organizations seeking to deepen their understanding of the evolving paints and coatings ecosystem, engaging directly with a dedicated sales and marketing specialist offers a streamlined path to tailored intelligence. By connecting with Ketan Rohom, Associate Director, Sales & Marketing, stakeholders can clarify specific research requirements, explore customization options, and gain clarity on utilization of insights to inform strategic planning. This personalized dialogue ensures that decision-makers access the precise data and analysis needed to support critical investments, risk mitigation strategies, and product development roadmaps.

Securing the full market research report unlocks comprehensive coverage of industry drivers, segment-level evaluation, regional nuances, and competitive landscape analyses. The report’s granular breakdown by resin type, technology, product category, substrate applications, end-use industries, and distribution channels empowers leaders with actionable insights to refine go-to-market strategies and identify greenfield opportunities. In addition, the detailed assessment of United States tariff impacts equips procurement and supply chain executives to model cost pressures and optimize sourcing frameworks.

To initiate the process of report acquisition and discuss bespoke research enhancements, please reach out to Ketan Rohom. This engagement will pave the way for organizations to harness robust market intelligence, forge resilient strategies, and position themselves for sustainable growth in an increasingly dynamic paints and coatings industry.

- How big is the Paints & Coatings Market?

- What is the Paints & Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?