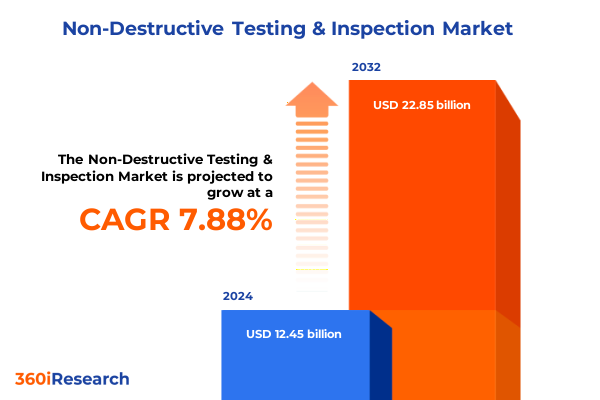

The Non-Destructive Testing & Inspection Market size was estimated at USD 13.45 billion in 2025 and expected to reach USD 14.41 billion in 2026, at a CAGR of 7.85% to reach USD 22.85 billion by 2032.

Setting the Stage for Non-Destructive Testing and Inspection: Defining Its Strategic Importance for Safety, Compliance, and Performance Excellence

Non-destructive testing and inspection have emerged as essential pillars for maintaining safety, compliance, and operational integrity in high-stakes industries. By enabling the evaluation of material properties, structural conditions, and potential defects without impairing functionality, these methodologies safeguard assets while minimizing production downtime. Organizations rely on non-destructive testing to detect anomalies early, avert catastrophic failures, and uphold stringent regulatory requirements. As global supply chains grow ever more complex, the assurance of quality and reliability through non-destructive inspection becomes indispensable in preserving brand reputation and protecting end-users.

The evolution of inspection practices has transitioned from manual, visual assessments to sophisticated, data-driven approaches that leverage advanced sensors, robotics, and digital analytics. This shift reflects a broader industry imperative to move from reactive maintenance paradigms to predictive and condition-based strategies. Across aerospace, automotive, oil and gas, and power generation sectors, decision-makers recognize that investment in cutting-edge inspection technologies yields long-term cost efficiencies by extending asset lifecycles and optimizing maintenance schedules. Moreover, heightened regulatory scrutiny and the proliferation of international standards underscore the necessity of a comprehensive testing framework.

This executive summary provides a concise yet thorough introduction to the non-destructive testing and inspection landscape. It outlines transformative technological trends, evaluates the cumulative impact of U.S. tariffs through 2025, presents segmentation insights by technique, method, service, and industry vertical, and highlights regional dynamics, competitor strategies, and actionable recommendations. Fueled by rigorous research and expert validation, the analysis that follows equips stakeholders with the intelligence required to navigate market complexities and seize emerging opportunities.

Charting the Revolution in Non-Destructive Testing Through Advanced Technologies, Automation, and Data-Driven Insights

Recent years have witnessed transformative shifts in non-destructive testing and inspection, driven by rapid advancements in sensor technology, automation, and digital integration. Traditional ultrasonic scans and magnetic particle methods have given way to phased array ultrasonic testing that generates precise, real-time imagery of internal structures. At the same time, acoustic emission testing now captures continuous data on crack propagation, enabling predictive maintenance frameworks. These innovations reduce manual intervention and enhance detection accuracy, ultimately improving operational efficiencies and reducing lifecycle costs.

Parallel to hardware improvements, the integration of artificial intelligence and machine learning algorithms has revolutionized data interpretation. Automated defect classification minimizes subjectivity and expedites decision-making by identifying patterns across high-volume datasets. Inspection drones equipped with visual and volumetric inspection capabilities now access confined or hazardous environments, broadening the scope of inspectable assets. Furthermore, cloud-based platforms facilitate seamless data sharing, enabling multidisciplinary teams to collaborate on analysis and remotely validate findings in real time.

The convergence of robotics, IoT connectivity, and digital twins has catalyzed a shift from isolated testing events to continuous, condition-based monitoring. Industry stakeholders increasingly prioritize end-to-end transparency, ensuring that every inspection cycle feeds into a centralized maintenance ecosystem. As a result, non-destructive testing and inspection are transforming from discrete, manual processes into interconnected, proactive systems that anticipate failures, extend asset life, and support data-driven strategic planning.

Assessing the Cumulative Impact of United States Tariffs Through 2025 on Equipment Costs, Supply Chains, and Service Delivery Dynamics

The landscape of non-destructive testing and inspection in the United States has been materially influenced by cumulative tariff policies enacted through 2025. Early in the decade, safeguard measures under Section 232 imposed a 25% levy on imported steel and a 10% duty on aluminum, significantly affecting the cost structure for manufacturers and service providers reliant on metallic testing components. Subsequent actions under Section 301 expanded tariffs to include certain categories of imported machinery and parts, elevating expenses on specialized instruments such as phased array ultrasonic equipment and advanced radiographic scanners.

These tariff regimes have disrupted traditional supply chains, compelling companies to reassess sourcing strategies and localize production where feasible. Domestic equipment suppliers have experienced a relative advantage, which has spurred increased investment in local manufacturing capabilities and maintenance infrastructures. Conversely, smaller service providers have faced margin pressures as the cost of calibration and consumable components has escalated. This dynamic has prompted a broader industry reconfiguration, with alliances forming between inspection firms and domestic fabricators to secure more resilient procurement channels.

As tariffs continue to influence pricing and service delivery models, market participants are adopting strategic hedging approaches. Long-term procurement contracts, vertical integration via rental services, and selective investment in multi-functional inspection equipment are among the tactics being deployed. Ultimately, the cumulative impact of U.S. tariffs has accelerated market consolidation and stimulated innovation in cost-effective inspection solutions, reshaping competitive dynamics and encouraging a renewed focus on supply chain agility.

Uncovering Key Market Segmentation Insights by Technique, Methodology, Service Offerings, and Industry Application Profiles

A nuanced understanding of market segmentation illuminates the diverse requirements and adoption patterns that define the non-destructive testing and inspection universe. Techniques range from Acoustic Emission Testing to Eddy Current Testing, Radiographic Testing, Magnetic Flux Leakage, Liquid Penetrant Testing, Magnetic Particle Testing, Ultrasonic Testing, and Visual Inspection Testing, each delivering distinct detection capabilities. While volumetric methods penetrate underlying structures for internal defect analysis, surface inspection techniques reveal surface-level discontinuities without depth insight, and visual inspection methods provide rapid, real-time assessment at lower complexity.

Service portfolios further cater to varied customer needs, encompassing consulting services that guide asset integrity programs, calibration services that ensure instrument accuracy, equipment rental services that lower capital barriers, inspection services delivered on-site or remotely, and specialized training services designed to upskill technician workforces. These layers of segmentation intersect across sector verticals, with aerospace and defense demanding the highest sensitivity levels, automotive focusing on speed and repeatability, medical and healthcare emphasizing compliance and traceability, manufacturing prioritizing cost efficiency, oil and gas stressing robustness in challenging environments, power generation requiring precision in high-temperature contexts, and public infrastructure seeking scalable inspection frameworks for bridges, pipelines, and transit networks.

Together, this multidimensional segmentation reveals the complexity of market requirements and underscores the importance of tailored solutions. Service providers that align their offerings with specific technique capabilities, methodological depth, and industry vertical demands are best positioned to deliver differentiated value and nurture long-term client relationships.

This comprehensive research report categorizes the Non-Destructive Testing & Inspection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Method

- Service

- Industry Vertical

Analyzing Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets for NDT Solutions

Regional variation in non-destructive testing and inspection adoption reflects divergent regulatory environments, infrastructure maturity, and investment priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, stringent safety regulations and robust energy and aerospace sectors drive demand for advanced inspection solutions. The integration of digital inspection platforms has gained momentum here as end users seek to consolidate data streams and standardize maintenance processes across vast geographies.

In contrast, Europe, the Middle East & Africa exhibit diverse growth trajectories influenced by public infrastructure modernization initiatives and the renewal of aging asset bases in transportation and utilities. Investments in turnkey inspection services and turnkey training programs have surged, with local providers collaborating with multinational equipment manufacturers to meet evolving compliance standards. The Middle East’s focus on petrochemical resilience and Africa’s infrastructure expansion both contribute to steady uptake of volumetric and surface inspection methods.

Asia-Pacific stands out for its rapid industrialization and manufacturing excellence, punctuated by heightened activity in automotive and medical device production. A proliferation of small- and medium-sized enterprises has driven equipment rental models and remote inspection services, reducing entry barriers and bolstering service provider penetration. Governments across the region have also prioritized infrastructure safety, catalyzing demand for high-precision techniques such as radiographic and ultrasonic testing. Collectively, these regional insights highlight the importance of localized service delivery models and adaptive technology roadmaps to capture latent demand.

This comprehensive research report examines key regions that drive the evolution of the Non-Destructive Testing & Inspection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Non-Destructive Testing and Inspection Providers Reveals Strategic Moves, Innovation Focus, and Competitive Landscape

Leading service providers and equipment manufacturers are actively reshaping the competitive landscape through strategic partnerships, technology alliances, and targeted acquisitions. Major players have accelerated digital transformation programs, integrating cloud-based analytics and remote operation tools to broaden service portfolios. Collaborative initiatives with robotics firms have yielded autonomous inspection drones capable of performing volumetric and visual inspections in confined spaces, reducing risk exposure and enhancing data fidelity.

Market frontrunners have also invested in advanced training platforms that combine virtual reality simulations with hands-on modules, strengthening the capabilities of inspection technicians and supporting consistent service delivery across global sites. Key providers have expanded calibration and consulting networks to offer end-to-end lifecycle management, bundling preventive maintenance solutions with standard inspection services. Meanwhile, several firms have established centers of excellence that serve as incubators for research into next-generation sensors and AI-driven defect detection algorithms.

Competitive differentiation increasingly hinges on the ability to deliver integrated solutions that align with client digital transformation objectives. Organizations that can couple technical expertise with accessible, pay-per-use business models-such as equipment on demand-enjoy heightened market traction. As the competitive environment intensifies, sustained investment in R&D, talent development, and strategic alliances will define leadership in the evolving non-destructive testing and inspection sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Non-Destructive Testing & Inspection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashtead Technology Ltd.

- Baker Hughes Company

- Bureau Veritas SA

- Carestream Health, Inc.

- Cygnus Instruments Ltd.

- Danatronics Corporation

- Eddyfi Technologies

- Fischer Technology Inc.

- Fujifilm Holdings Corporation

- General Electric Company

- Hitachi, Ltd.

- Intertek Group plc

- Magnetic Analysis Corporation

- MISTRAS Group, Inc.

- Nikon Metrology NV

- Olympus Corporation

- SGS SA

- Siemens Energy AG

- Sonatest Ltd.

- T.D. Williamson, Inc.

- UniWest

- Zetec Inc.

Actionable Strategies and Best Practices for Industry Leaders to Capitalize on Emerging Trends and Enhance Testing Efficiency and Quality

Industry leaders seeking to capitalize on emerging trends must adopt a proactive stance that blends strategic foresight with operational rigor. First, organizations should integrate condition-based monitoring systems that leverage the full spectrum of inspection techniques, from surface testing to advanced ultrasonic modalities. By synthesizing data across Acoustic Emission Testing, Magnetic Flux Leakage, and Radiographic Testing platforms, decision-makers can transition toward predictive maintenance models that preempt failures and optimize asset uptime.

Additionally, forging partnerships with digital solution providers will be critical in deploying AI-enabled defect detection and remote inspection services at scale. Collaborative ecosystems enable rapid prototyping of custom inspection drones and robotic crawlers, reducing human exposure to hazardous environments while accelerating inspection cycles. To navigate the ongoing impact of tariff policies, companies should evaluate vertical integration opportunities-such as equipment rental services and localized instrument calibration-to insulate margins against import cost fluctuations.

Building organizational capability through targeted training services-spanning foundational Visual Inspection Testing to complex phased array ultrasonic analysis-will ensure that technical personnel sustain proficiency in evolving methodologies. Finally, aligning service portfolios with industry-specific compliance frameworks and public infrastructure mandates will unlock blue-chip contracts and foster long-term partnerships. By executing these recommendations, industry leaders can not only mitigate risk but also harness the full potential of tomorrow’s inspection technologies.

Detailing the Rigorous Research Methodology Incorporating Primary Interviews, Data Triangulation, and Quantitative and Qualitative Analysis

This analysis is grounded in a rigorous, multi-phase research methodology that blends comprehensive primary and secondary research to deliver robust insights. In the primary phase, over 40 in-depth interviews were conducted with senior executives, technical directors, and field inspection specialists across aerospace, energy, and infrastructure sectors. These discussions provided qualitative perspectives on strategic priorities, technology adoption drivers, and service model preferences.

Secondary research sources included industry standards documentation, regulatory filings, and publicly available patent databases. Data triangulation techniques were employed to validate findings, ensuring consistency across diverse data points and minimizing bias. Quantitative analysis comprised a detailed review of trade statistics, import and export duty histories, and service utilization patterns, which informed the evaluation of tariff impacts and regional demand dynamics.

Throughout the process, the research team maintained transparency by documenting assumptions, methodological constraints, and data validation steps. This systematic approach underpins the credibility of the insights presented, offering stakeholders a clear line of sight into the analytical rigor that shaped the executive summary recommendations and regional, segmentation, and competitive analyses.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Non-Destructive Testing & Inspection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Non-Destructive Testing & Inspection Market, by Technique

- Non-Destructive Testing & Inspection Market, by Method

- Non-Destructive Testing & Inspection Market, by Service

- Non-Destructive Testing & Inspection Market, by Industry Vertical

- Non-Destructive Testing & Inspection Market, by Region

- Non-Destructive Testing & Inspection Market, by Group

- Non-Destructive Testing & Inspection Market, by Country

- United States Non-Destructive Testing & Inspection Market

- China Non-Destructive Testing & Inspection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Insights Emphasize the Critical Role of Evolving Technologies, Policy Shifts, and Strategic Stakeholder Collaboration

In conclusion, the non-destructive testing and inspection landscape stands at the intersection of technological innovation, regulatory evolution, and shifting economic policies. The rapid adoption of AI, digital twins, and autonomous inspection platforms is redefining how organizations monitor asset health, while tariff-induced supply chain recalibrations are reshaping procurement and service delivery models. Segmentation insights reveal the nuanced interplay between technique capabilities, methodological depth, service offerings, and industry vertical requirements, underscoring the necessity of tailored, integrated solutions.

Regional analyses highlight the distinct drivers in the Americas, Europe, Middle East & Africa, and Asia-Pacific markets, emphasizing the critical role of localized strategies and collaborative ecosystems. Competitive profiles demonstrate that sustained investment in R&D, digital transformation, and workforce development will separate market leaders from followers. The recommendations provided offer a clear blueprint for transitioning from reactive inspection regimes to proactive, data-driven maintenance frameworks.

As organizations navigate the complexity of evolving inspection standards and geo-political headwinds, the insights contained within this executive summary serve as a strategic compass, guiding decision-makers toward initiatives that enhance safety, compliance, and operational resilience in the years ahead.

Drive Business Growth and Operational Excellence: Connect with Ketan Rohom to Unlock Comprehensive Non-Destructive Testing Market Intelligence

Ready to elevate your operational reliability and safety standards with comprehensive non-destructive testing insights? Take the next step by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this in-depth market research can inform your strategic planning, optimize your inspection processes, and position your organization at the forefront of innovation. Engage today to secure access to critical data, expert analysis, and tailored recommendations that will empower your team to make confident decisions and drive measurable results.

- How big is the Non-Destructive Testing & Inspection Market?

- What is the Non-Destructive Testing & Inspection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?