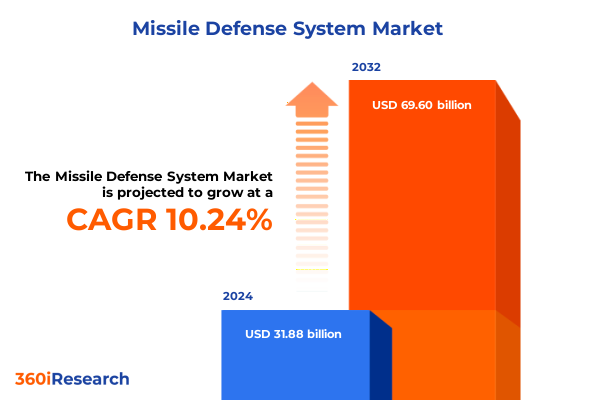

The Missile Defense System Market size was estimated at USD 35.10 billion in 2025 and expected to reach USD 38.64 billion in 2026, at a CAGR of 10.27% to reach USD 69.60 billion by 2032.

Navigating the New Era of Missile Defense with Advanced Technologies and Strategic Imperatives to Strengthen National Security Resilience

The modern security environment demands a robust and agile missile defense posture that can adapt to rapidly evolving threats and harness the power of emerging technologies. Rising tensions among strategic competitors have underscored the critical need for integrated solutions that protect national assets, civilian populations, and deployed forces across land, air, sea, and space domains. In this context, defense planners and system integrators are compelled to rethink traditional architectures in favor of more dynamic, multi-layered approaches capable of delivering early warning, real-time command and control, and rapid interception.

Furthermore, the relentless pace of innovation-from artificial intelligence–enabled decision support systems to novel directed energy weapons-has created opportunities and challenges in equal measure. Organizations must navigate complex supply chains, evolving regulatory environments, and interoperability demands to field next-generation capabilities on schedule and within budget. This executive summary synthesizes the most pertinent insights, drawing on an extensive analysis of system types, deployment platforms, threat profiles, regional dynamics, and leading industry players to inform strategic priorities and investment decisions.

Unveiling Disruptive Shifts Reshaping Missile Defense Industry Dynamics in Response to Emerging Threats and Technological Breakthroughs

Missile defense is undergoing a paradigm shift driven by both technological breakthroughs and changes in threat trajectories. Hypersonic glide vehicles capable of maneuvering at extreme speeds and altitudes have disrupted longstanding intercept doctrines, prompting a reevaluation of detection sensors, interceptor lethality, and engagement timelines. At the same time, directed energy weapons have advanced from laboratory prototypes to fielded demonstrators, offering the promise of speed-of-light defense against certain classes of incoming threats.

Simultaneously, command and control architectures are becoming more distributed and resilient through the integration of artificial intelligence and machine learning. These innovations facilitate rapid data fusion from space-based sensors, ground radars, and airborne platforms, enabling operators to generate more accurate firing solutions under compressed timelines. Meanwhile, software-defined networking and secure satellite links have enhanced the redundancy and cyber-resilience of critical communications pathways.

On the geopolitical front, non-traditional actors and regional instabilities have expanded the operational threat spectrum, compelling system developers to address a broader array of scenarios. From cruise missile attacks in littoral regions to strategic ballistic threats in high-altitude environments, defense stakeholders now require highly adaptable frameworks. Moreover, interdisciplinary collaboration between defense primes, academia, and specialized technology firms has accelerated the pace of innovation, fostering an ecosystem where rapid prototyping, digital twinning, and live experimentation have become the norm.

Assessing the Far-Reaching Effects of Recent United States Trade Measures on Missile Defense Supply Chains and Innovation Ecosystems

In 2025, new tariffs and trade measures introduced by the United States government have exerted pronounced effects on the missile defense supply ecosystem and innovation pathways. By imposing levies on key electronics components, semiconductor wafers, and certain advanced materials, these measures have created both challenges and opportunities for defense contractors and subsystem suppliers. Procurement schedules have been reexamined to account for increased unit costs and potential bottlenecks, prompting organizations to diversify their vendor base and explore domestic manufacturing options.

Moreover, the tariffs have driven strategic reassessment of R&D investments in critical enabling technologies. Companies have accelerated partnerships with allied suppliers in Europe and Asia-Pacific to mitigate exposure and maintain continuous development cycles for next-generation sensors and interceptors. Concurrently, government agencies have incentivized onshore production of rare earth elements and specialized alloys, underpinning efforts to secure supply chains for essential missile defense components.

While cost pressures have surfaced in short-term budgets, the ripple effects have stimulated innovation in alternative materials, additive manufacturing techniques, and resilient logistics frameworks. Defense stakeholders have responded by forging public-private partnerships that underwrite test facilities and qualification programs domestically. As a result, the ecosystem is adapting to align strategic autonomy goals with the imperative of sustaining cutting-edge capability development under evolving trade constraints.

Illuminating Key Insights Across Diverse Missile Defense Segments Spanning System Types Platforms Threat Categories and Critical Components

A closer examination of system types reveals a diverse array of technologies driving defense postures. Command and control systems, anchored by battle management platforms and communication networks, leverage both satellite links and terrestrial links to ensure robust connectivity. Directed energy weapons, comprising laser systems and microwave systems, are progressing from experimental test beds toward operational deployment. Ground based radar arrays encompass early warning radar installations and phased array radar sites, with phased arrays differentiated across active electronically scanned arrays and passive electronically scanned arrays. Interceptor missiles operate in both endo-atmospheric and exo-atmospheric regimes, each domain offering variants equipped with hit-to-kill warheads or proximity warheads.

In terms of deployment platforms, solutions extend across air based assets-including fixed wing aircraft and rotary wing aircraft-with specialized payloads for airborne early warning and laser integration. Land based sites manifest in both fixed site installations and mobile site configurations to support forward presence. Sea based defenses capitalize on surface combatants, notably cruisers and destroyers, with Arleigh Burke class and Ticonderoga class vessels outfitted for layered point and area defense missions.

Threat type analysis underscores the necessity of phase-specific countermeasures. Ballistic missile defense solutions address boost phase defense using directed energy weapons and missile interceptors, midcourse phase defense with ground based interceptors and space based interceptors, and terminal phase defense through land based interceptors and ship based interceptors. Cruise missile threats are countered via directed energy weapons and advanced radar systems, while hypersonic missiles require tailored responses for hypersonic cruise defense as well as hypersonic glide defense.

Component segmentation further refines capability priorities, highlighting the role of communication systems via satellite communication and terrestrial networks, the critical function of kill vehicles across endo-atmospheric and exo-atmospheric engagements, ergonomic and resilient launchers employing canister launch and vertical launch methods, and multi-modal sensors spanning electro optical systems, infrared sensors, over-the-horizon radars, phased array radars, and traditional radar suites. This multi-dimensional breakdown illuminates investment focal points and underscores how integrated architectures depend on the seamless partnership of diverse sub-systems.

This comprehensive research report categorizes the Missile Defense System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Threat Type

- Engagement Phase

- Range Class

- Technology

- Platform

Uncovering Regional Dynamics Driving Missile Defense Adoption in the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping defense strategies and procurement priorities. In the Americas, defense modernization programs in the United States drive adoption of advanced interceptors, directed energy demonstrators, and networked sensor arrays. Collaborative engagements with Canada and select partners in Latin America have fostered a focus on homeland defense, maritime security, and joint training exercises that validate multi-national interoperability.

Across Europe, the Middle East, and Africa, alliances such as NATO underpin cooperative procurement and standardization efforts. European nations are upgrading phased array radars and integrating new command and control frameworks, while partners in the Middle East emphasize layered defenses against cruise and ballistic missile threats. Meanwhile, select African states have begun investing in coastal surveillance radars and collaborative frameworks to deter emerging regional threats.

In the Asia-Pacific region, strategic competition and evolving security postures have elevated missile defense to top priority status. Nations such as Japan and South Korea continue to refine their endo-atmospheric defenses and explore space based sensor networks, while India accelerates programs across boost phase and terminal phase interceptors. Concurrently, several regional actors are evaluating directed energy prototypes and expanding sensor grids to address the full spectrum of missile threats emanating from neighboring states.

These regional insights highlight the interplay between threat perceptions and defense investments, underscoring the importance of adaptable architectures that align with each region’s strategic imperatives and sovereign industrial capabilities.

This comprehensive research report examines key regions that drive the evolution of the Missile Defense System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Partnerships and Innovations Among Leading Missile Defense System Providers and Technology Developers

Leading aerospace and defense contractors have pursued an array of strategic initiatives to maintain technology leadership and accelerate capability maturation. Several primes have established dedicated directed energy divisions to fast-track laser and microwave systems, complementing their traditional interceptor portfolios. Joint ventures between established defense firms and niche technology specialists have yielded advanced sensor suites integrating electro optical, infrared, and over-the-horizon capabilities.

Partnerships with academic institutions and national laboratories have also become more prevalent, particularly in the development of artificial intelligence algorithms for target discrimination and adaptive threat assessment. Some companies have secured landmark agreements to co-develop modular mission packages, enabling rapid reconfiguration of platforms across air, land, and sea domains. In parallel, major industrial players have restructured supply chains to include small business innovators, accelerating the qualification of novel materials and subsystems while mitigating risk.

Furthermore, recent mergers and acquisitions have created scale that empowers sustained investment in dual-use technologies, bridging the gap between defense and commercial applications. These corporate maneuvers, combined with heightened emphasis on cybersecurity for systems engineering, illustrate a trend toward holistic, resilient solutions capable of countering sophisticated, multi-vector missile threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Missile Defense System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Israel Aerospace Industries Ltd.

- Kongsberg Defence & Aerospace AS

- Kremin Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA Holding SAS

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Taylor Devices, Inc.

- Thales S.A.

- The Boeing Company

Delivering Actionable Strategies for Industry Stakeholders to Enhance Missile Defense Capabilities and Streamline Operational Effectiveness

Industry stakeholders should prioritize diversifying supplier networks to reduce dependencies on constrained or single-source components, especially for critical electronics and specialized materials. By establishing dual-tracked procurement strategies that involve allies and domestic suppliers, organizations can safeguard production timelines and enhance resilience under evolving trade policies.

Simultaneously, allocating resources to artificial intelligence and machine learning integration within command and control frameworks can dramatically improve situational awareness and decision cycle times. Emphasizing open architecture standards will facilitate seamless integration of new sensors, interceptors, and communication nodes while preserving system interoperability across joint and coalition environments.

A sustained focus on directed energy weapon development offers a cost-per-engagement advantage for certain threat sets and can complement kinetic interceptors to provide layered defense. Organizations should invest in live-fire demonstrations and digital simulation environments to validate performance under realistic conditions and accelerate transition to operational status.

Finally, fostering collaborative exercises and joint test programs with allied nations will help refine engagement doctrines and ensure compatibility of systems in multi-national operations. Embedding cybersecurity requirements into every stage of design and procurement will protect critical networks and data integrity, enabling continuous operation in contested domains.

Outlining Rigorous Research Methodology Employed to Secure Reliable Data Sources Expert Insights and Comprehensive Industry Analysis

This research draws on a rigorous methodology that integrates both primary and secondary sources to underpin its findings. Primary research included structured interviews with senior defense officials, system integrators, and technology suppliers to capture firsthand perspectives on capability gaps, procurement drivers, and innovation roadmaps. Secondary research leveraged open-source defense budgets, procurement announcements, technical white papers, and government test reports to validate and contextualize key trends.

Data points were systematically triangulated to ensure reliability, with quantitative inputs from procurement records and program budgets cross-referenced against qualitative insights from subject matter experts. Detailed workshops and roundtables facilitated in-depth discussions around phase-specific defense requirements, spanning boost, midcourse, and terminal engagement considerations. Conceptual frameworks were stress-tested through scenario analysis to assess resilience under potential threat trajectories.

Segmentation matrices were developed through iterative analysis, classifying system types, platforms, threat categories, and components to reveal interdependencies and investment focal areas. Regional profiles were constructed by synthesizing geopolitical risk assessments, alliance structures, and sovereign industrial capabilities. Company profiles were vetted through supply chain mapping exercises and an examination of strategic alliances, ensuring a holistic view of the competitive landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Missile Defense System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Missile Defense System Market, by Component

- Missile Defense System Market, by Threat Type

- Missile Defense System Market, by Engagement Phase

- Missile Defense System Market, by Range Class

- Missile Defense System Market, by Technology

- Missile Defense System Market, by Platform

- Missile Defense System Market, by Region

- Missile Defense System Market, by Group

- Missile Defense System Market, by Country

- United States Missile Defense System Market

- China Missile Defense System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Summarizing Critical Findings and Charting Future Directions for Resilient and Adaptive Missile Defense Frameworks in Complex Security Environments

The insights presented herein underscore the necessity of a multi-layered defense posture that seamlessly integrates advanced sensors, rapid interceptors, and resilient command networks. Emerging threats such as hypersonic glide vehicles and low-observable cruise missiles demand adaptive strategies that combine both kinetic and non-kinetic countermeasures. The interplay of regional drivers, trade policies, and technological maturation continues to shape procurement and development pathways.

Key strategic imperatives include the acceleration of directed energy weapon programs, expansion of AI-enabled decision support, and standardization of open architectures to foster multi-domain interoperability. Suppliers and end-users alike must navigate evolving regulatory and trade environments, balancing cost pressures against the imperative of maintaining technological edge.

Ultimately, the complex security environment requires continuous collaboration among governments, industry stakeholders, and research institutions. By leveraging rigorous analysis, stakeholder engagement, and robust methodology, leaders can make informed decisions that fortify defense capabilities and anticipate future challenges. This executive summary serves as a blueprint for shaping procurement priorities, guiding R&D investments, and reinforcing alliances that underpin effective missile defense frameworks.

Engage With Our Specialist to Secure Exclusive Insights and Seamlessly Acquire the Definitive Missile Defense System Market Research Report Today

I would be delighted to help you secure the definitive analysis you need to drive informed strategies in this critical domain. Ketan Rohom, Associate Director, Sales & Marketing, is ready to guide you through the report’s extensive findings and specialized insights. Connect directly to unlock comprehensive intelligence covering evolving threat dynamics, cutting-edge technologies, and strategic imperatives that can fortify your program planning, procurement decisions, and partnership strategies. Accessing this research will equip your organization with the actionable intelligence required to anticipate next-generation threats, optimize capabilities across system types and regions, and collaborate effectively with global partners. Engage now to ensure your team has timely, tailored expertise that empowers confident decision-making and accelerates capability development in an increasingly contested environment

- How big is the Missile Defense System Market?

- What is the Missile Defense System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?