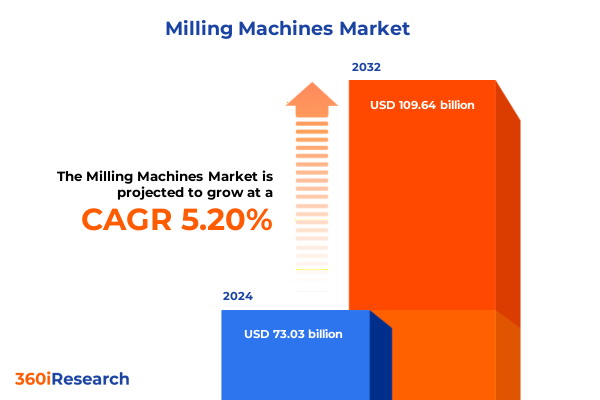

The Milling Machines Market size was estimated at USD 76.81 billion in 2025 and expected to reach USD 80.79 billion in 2026, at a CAGR of 5.21% to reach USD 109.64 billion by 2032.

Understanding the current state and critical drivers of the milling machine market in an era defined by precision, automation, and strategic trade policies

The milling machine market is undergoing a profound transition as manufacturers and end users alike seek to harmonize precision, efficiency, and resilience. This introduction outlines the market’s present contours, tracing how advancements in digital control systems, global trade dynamics, and evolving end-user requirements have collectively reshaped industry priorities. By situating our analysis within the current confluence of technological breakthroughs and policy shifts, we set the stage for a nuanced exploration of both opportunities and challenges that define today’s milling landscape.

As global supply chains face increasing complexity, stakeholders are prioritizing equipment that delivers not only accuracy but also adaptability. From aerospace and automotive to medical device production, the demand for versatile milling solutions has never been higher. Against this backdrop, decision-makers are evaluating how next-generation machine tools can enable rapid changeovers, tighter tolerances, and integrated data feedback loops. Understanding these critical drivers is essential to navigating the strategic imperatives that will shape investment and innovation trajectories in the near future.

Uncover the transformative shifts redefining milling machines—from AI-driven automation to hybrid manufacturing—pushing precision engineering into new realms

Milling machines have evolved from manual, standalone devices into smart, interconnected assets that power Industry 4.0 operations. Artificial intelligence and machine learning have become cornerstones of this evolution, enabling predictive maintenance and real-time process optimization. According to a U.S. National Institute of Standards and Technology report, AI adoption in CNC machining processes grew by 45% between 2022 and 2023, underscoring the rapid integration of intelligent algorithms for toolpath optimization and quality assurance. Concurrently, Internet of Things connectivity is transforming shop floors into data-driven environments, with manufacturers reporting an 18% uptick in overall equipment effectiveness when leveraging IoT-enabled CNC systems.

Beyond digitalization, the rise of hybrid manufacturing systems represents a seismic shift in operational capabilities. Leading OEMs are unveiling multi-axis machines that fuse subtractive milling with additive deposition, granting unprecedented flexibility in complex part fabrication. For instance, DMG MORI’s LASERTEC 125 3D hybrid platform integrates 5-axis machining with directed energy deposition, illustrating the sector’s push toward fully unified production workflows. Simultaneously, the proliferation of digital twins is enabling virtual machine simulation before a single chip is cut, reducing setup times and error rates while bolstering throughput in high-precision applications.

Assessing the cumulative effects of 2025 United States tariffs on milling machines and machinery imports and their ripple effects across manufacturing supply chains

In response to persistent trade frictions, the U.S. has maintained a 25% tariff on Chinese-origin milling machines under Section 301, driving up landed costs and causing many importers to reassess sourcing strategies. Factories that once relied heavily on competitively priced equipment from China are now incurring significant premium charges, disrupting procurement cycles and delaying capital upgrades. While an exclusion process is open through March 31, 2025, to request relief from these duties, the administrative burden and uncertainty have prompted many manufacturers to stockpile legacy inventory or shift orders to tariff-free regions.

Meanwhile, Section 232 tariffs have doubled steel and aluminum duties to 50%, compounding cost pressures for milling machine producers that depend on these metals for critical components. A BCG analysis projects that the expanded steel and aluminum tariffs could add up to $51.4 billion in additional import costs for the U.S. economy annually, with the machinery and mechanical equipment sectors bearing a disproportionate share. These higher input prices are being passed through to end users, ultimately slowing capital expenditure cycles and prompting OEMs to explore alternative materials and nearshoring strategies to mitigate margin erosion.

Gleaning insights from market segmentation across control types, axis configurations, end-use industries, applications, and distribution channels for milling machines

Analysis of the milling machine market unveils distinct patterns across various control modalities and configurations. Conventional mills continue to serve niche applications where simplicity and low capital outlay are prioritized, yet the dominant trajectory is toward CNC systems, particularly those offering three- to five-axis interpolation for intricate geometry and multi-surface machining. Demand for five-axis platforms is surging where complex aerospace and medical components require simultaneous multi-plane access.

End-use segmentation reveals divergent growth accelerators: the aerospace sector’s emphasis on lightweight alloys and tight tolerances is driving investment in high-rigidity, multi-axis centers, whereas the automotive industry balances throughput with cost efficiency, favoring four-axis mills that optimize cycle times. Electronics and energy applications are pushing suppliers to refine micro-boring and fine-slotting capabilities, while industrial machinery and medical device markets underscore the necessity for repeatable accuracy and stringent validation protocols.

Application-level insights highlight that milling remains the cornerstone for component shaping, but drilling operations-whether in composites, metals, or plastics-are increasingly integrated into multi-function machines. Facing and boring functions are being streamlined through modular tooling systems, and gear cutting is benefiting from hardened-surface milling capabilities. Distribution channels also exhibit strategic bifurcation: direct OEM sales are favored for complex, high-value deployments that require turnkey integration, while distributors continue to serve smaller shops and rapid-replacement needs with standardized configurations.

This comprehensive research report categorizes the Milling Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Control Type

- Axis Type

- End User Industry

- Application

- Distribution Channel

Examining key regional perspectives revealing how Americas, EMEA, and Asia-Pacific dynamics shape demand, innovation, and growth trajectories in milling equipment markets

Regional analyses uncover that the Americas remain a stronghold for innovation adoption and aftermarket services. The U.S. market leads in integration of advanced CNC capabilities due to robust R&D investments and established aerospace and defense manufacturing clusters. Latin American manufacturing hubs are leveraging tariff-free components to enhance local value chains, particularly in automotive assembly and agricultural machinery.

Europe, the Middle East, and Africa present a diverse mosaic of requirements: Western European firms are at the forefront of digital twin and green-energy machining solutions, while Eastern European markets emphasize cost-competitive medium-complexity mills. In the Middle East, industrial diversification initiatives are accelerating demand for turnkey, heavy-duty machining centers in oil and gas infrastructure. Across Africa, rising infrastructure spending is creating nascent opportunities for entry-level CNC machines.

Asia-Pacific continues to lead in unit volumes, with China and India driving consumption for both conventional and CNC mills. Japan and South Korea maintain their strong position in high-precision, multi-axis markets, leveraging local OEM ecosystems. Southeast Asian manufacturers are rapidly adopting Industry 4.0 principles to support burgeoning electronics and semiconductor fabrication industries, fueling demand for micro-milling and high-speed drilling capabilities.

This comprehensive research report examines key regions that drive the evolution of the Milling Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading milling machine manufacturers and their strategic maneuvers in technology, partnerships, and market expansion fueling competitive advantage

Competition among milling machine OEMs is intensifying along dual vectors: technological leadership and strategic consolidation. Industry leaders such as DMG MORI have bolstered their portfolios through acquisitions like the integration of Kuraki’s horizontal machining expertise, enabling a broader range of large-format boring and milling solutions under a unified digitalization strategy. Okuma continues to differentiate through control-platform innovation; its OSP-P500 system incorporates digital-twin capabilities and enhanced processing power to support real-time simulation and adaptive machining.

Yamazaki Mazak and Makino are pushing the envelope in hybrid manufacturing and micro-machining, targeting aerospace and semiconductor markets with specialized five-axis platforms and high-speed aluminum cutting centers. Haas Automation maintains dominance in cost-sensitive segments by offering modular, user-friendly mills with rapid delivery times, serving educational and small-job shops. Meanwhile, strategic alliances-such as Fanuc’s robot-integration partnerships-underscore a shift toward comprehensive, automated cell solutions that pair milling with upstream and downstream processes. This confluence of R&D intensity and collaborative ventures is elevating the threshold for competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Milling Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CHIRON Werke GmbH & Co. KG

- DMG MORI CO., LTD.

- Doosan Machine Tools Co., Ltd.

- EMAG GmbH & Co. KG

- Haas Automation, Inc.

- Hardinge Inc.

- Hurco Companies, Inc.

- Makino Milling Machine Co., Ltd.

- Okuma Corporation

- The Yamazaki Mazak Corporation

Actionable strategic recommendations for industry leaders to navigate technological evolution, trade policies, and operational efficiencies in precision machining

Industry leaders should accelerate investment in multi-axis and hybrid machining capabilities, ensuring that CNC portfolios incorporate additive functions to support complex part geometries and rapid design iterations. Embracing digital twin frameworks and IoT-enabled monitoring will yield measurable gains in uptime and cost control, and organizations must develop cross-functional teams to harness data insights for continuous improvement.

To navigate tariff headwinds, executives should proactively engage with the USTR exclusion process for Section 301 duties while diversifying supply chains across tariff-advantaged regions. Nearshoring metal inputs and forging strategic alliances with steel and aluminum producers can mitigate the volatility of Section 232 levies. Strengthening aftermarket services and subscription-based maintenance models will foster customer loyalty and generate recurring revenue streams, offsetting capital-goods cycle fluctuations.

Finally, workforce development initiatives-centering on upskilling technicians in digitalization tools and advanced machining techniques-will be essential to operationalizing next-generation milling suites. By prioritizing agile innovation, cost resilience, and talent cultivation, industry players can capitalize on the evolving landscape to outpace competitors.

Transparent research methodology detailing primary and secondary approaches, expert interviews, data triangulation, and analytical frameworks underpinning the study

This study is underpinned by a rigorous blend of primary and secondary research methodologies. Primary insights were gathered through in-depth interviews with senior executives and engineers at leading OEMs and end-user facilities, supplemented by on-site observations at key manufacturing centers. Secondary data sources include government trade filings, USTR notices, industry association publications, and peer-reviewed journals to ensure factual accuracy and contextual relevance.

Quantitative analysis involved triangulating shipment data, customs statistics, and financial reports to validate emerging trends and tariff impacts. Segmentation analyses were performed by mapping equipment characteristics across control types, axis configurations, and application requirements to identify demand pockets. Regional dynamics were assessed through market-level data, infrastructure spending trends, and policy reviews. All findings were subjected to stringent quality checks and peer reviews to uphold analytical rigor and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Milling Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Milling Machines Market, by Control Type

- Milling Machines Market, by Axis Type

- Milling Machines Market, by End User Industry

- Milling Machines Market, by Application

- Milling Machines Market, by Distribution Channel

- Milling Machines Market, by Region

- Milling Machines Market, by Group

- Milling Machines Market, by Country

- United States Milling Machines Market

- China Milling Machines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concise conclusion synthesizing critical insights and strategic takeaways guiding stakeholders through the evolving milling machine market landscape

This executive summary has highlighted the convergence of digital innovation, trade policy pressures, and regional dynamics that define the modern milling machine market. From AI-driven CNC systems and hybrid manufacturing breakthroughs to the cumulative impacts of U.S. tariffs, stakeholders face a multifaceted landscape demanding proactive strategy and operational adaptability.

As the market continues to evolve, those organizations that integrate advanced technologies, navigate trade complexities, and foster robust talent pipelines will secure sustainable growth and market leadership. The insights presented herein provide a comprehensive roadmap for informed decision-making, equipping executives with the strategic foresight required to thrive in precision machining’s next chapter.

Engage with Ketan Rohom, Associate Director at 360iResearch, to access comprehensive milling machine market research and capitalize on strategic insights

To secure your organization’s competitive edge and access the full spectrum of strategic insights, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will provide you with comprehensive details on the milling machine market research report, including in-depth analyses on technological trends, tariff impacts, regional dynamics, and segmentation intelligence. Engage directly with him to discuss tailored solutions that align with your strategic objectives and investment priorities. Reach out today to explore pricing options, delivery schedules, and customizable research deliverables that will inform your decision-making and drive sustained growth in the precision machining arena.

- How big is the Milling Machines Market?

- What is the Milling Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?