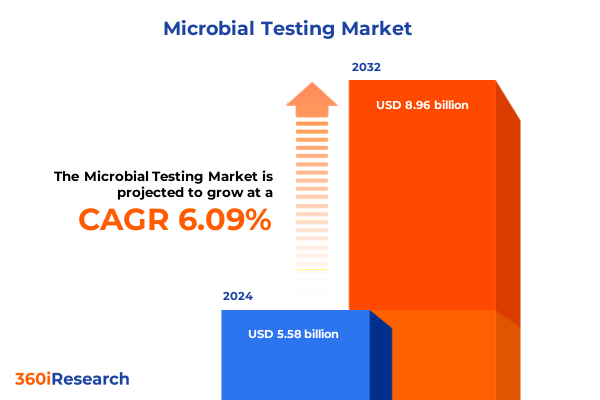

The Microbial Testing Market size was estimated at USD 5.90 billion in 2025 and expected to reach USD 6.24 billion in 2026, at a CAGR of 6.14% to reach USD 8.96 billion by 2032.

Innovative microbial testing paradigms redefine detection accuracy and accelerate quality assurance across clinical, food, and environmental sectors

Microbial testing stands at the heart of quality assurance across a wide array of sectors, from clinical diagnostics and pharmaceutical development to food safety and environmental monitoring. As pathogens evolve and regulatory expectations intensify, laboratories and manufacturers must deploy robust, accurate detection mechanisms to safeguard public health and maintain consumer trust. In recent years, the convergence of digital technologies, novel assay chemistries, and heightened global collaboration has accelerated the pace of innovation, reshaping how microbial threats are identified and managed.

This executive summary explores the key drivers redefining microbial testing, tracing the evolution from manual culture-based workflows to integrated, automated platforms. It outlines the transformative shifts that are enabling faster turnaround times and deeper insights while reducing operational costs. By examining the impact of United States tariffs enacted in 2025, identifying critical segmentation patterns, and spotlighting regional dynamics, this summary delivers a strategic roadmap for decision-makers. Ultimately, the goal is to equip stakeholders with the knowledge needed to navigate an increasingly complex marketplace and to capitalize on emerging growth opportunities.

Automation, AI-driven diagnostics, and high-throughput sequencing are driving paradigm-shifting technological transformations in microbial testing workflows

The landscape of microbial testing is undergoing a profound technological metamorphosis, driven by the integration of automation, artificial intelligence, and advanced molecular tools. Laboratories that once relied on manual plate counts and time-intensive biochemical assays are now embracing high-throughput sequencing and AI-powered image analysis to achieve unparalleled sensitivity and specificity. Beyond throughput gains, these innovations help standardize workflows, minimizing human error and ensuring reproducible results across geographically dispersed testing facilities.

Transitioning from traditional culture-based methods to real-time molecular diagnostics has also empowered clinicians and manufacturers with actionable insights at the point of need. AI-driven pattern recognition algorithms refine pathogen identification, while digital connectivity enables remote monitoring of critical parameters. As next-generation sequencing platforms become more accessible, they unlock the potential for metagenomic surveillance, delivering holistic profiles of microbial communities. In parallel, bio-sensor technologies are finding new applications in inline process monitoring, ushering in an era of continuous quality management that aligns with the ambitions of Industry 4.0.

These technological waves are not merely incremental improvements; they represent a paradigmatic shift in how microbial testing is conceived, executed, and integrated into broader quality ecosystems. Organizations that embrace these capabilities today will set the standard for efficiency and reliability in the microbial testing workflows of tomorrow.

United States tariffs imposed in 2025 have triggered supply chain realignments, cost pressures, and sourcing diversification across microbial testing

In 2025, the United States introduced new tariff measures targeting laboratory instrumentation and consumables imported from select regions, reshaping cost structures across the microbial testing value chain. Suppliers faced elevated duties on critical equipment-such as mass spectrometers and PCR instruments-prompting end users to reassess procurement strategies. Many laboratories responded by diversifying their vendor base, fostering relationships with domestic manufacturers to mitigate exposure to unpredictable trade policy shifts.

The ripple effects extended to reagent and consumables pricing, where general-purpose reagents and pathogen-specific kits experienced incremental cost increases. To preserve testing volumes and maintain budgetary discipline, some organizations adopted longer reagent lead times and implemented inventory buffering strategies. Others negotiated volume discounts or reevaluated service agreements to offset tariff-driven expenses.

Despite these headwinds, the tariffs also catalyzed innovation in localized supply chain development. New entrants in North America expanded production capacity for high-quality reagents and automated identification systems, leveling the playing field for domestic producers. As a result, the microbial testing ecosystem is evolving toward a more resilient and geographically diversified configuration, better equipped to absorb future policy fluctuations and ensure uninterrupted access to critical testing operations.

Segmentation analysis uncovers the influence of product categories, organism types, technologies, applications, and end users on microbial testing dynamics

An examination of market segmentation reveals multifaceted drivers shaping microbial testing dynamics around product, organism type, technology, application, and end user. In terms of product offerings, the industry spans a spectrum from complex instruments-including automated microbial identification systems, incubators, mass spectrometers, microscopes, and PCR instruments-to consumable categories comprising both general reagents and specialized pathogen-specific kits, alongside software platforms and services that unify data handling and workflow management. The organism type dimension covers the full gamut of bacterial, fungal, parasitic, and viral threats, each demanding tailored detection strategies and methodological rigor.

Technological segmentation further illuminates how bio-sensors, culture-based assays, immunological techniques, mass spectrometry, and molecular diagnostics collectively advance diagnostic precision. Where traditional plate-based cultures remain indispensable for certain regulatory and compliance applications, molecular approaches are rapidly gaining ground for their speed and multiplexing capabilities. At the same time, immunoassays continue to offer cost-effective screening for high-volume testing scenarios, while mass spectrometry has carved out a niche in clinical laboratories, delivering rapid species-level identification from complex samples.

The application segment underscores the breadth of microbial testing across chemical and material manufacturing, clinical diagnostics, environmental monitoring, food safety, and pharmaceutical quality control. Within clinical contexts, emphasis spans bloodstream infections, gastrointestinal diseases, periodontal conditions, respiratory disorders, sexually transmitted infections, and urinary tract analyses. Environmental testing protocols evaluate soil contamination and water quality, while food testing protocols safeguard against spoilage and pathogenic outbreaks. Lastly, the end user category captures the diverse customer base, from academic and research institutions pioneering novel methodologies to pharmaceutical and biotechnology companies driving therapeutic development, with hospitals and diagnostic centers on the front lines of patient care and food and beverage enterprises ensuring product integrity.

This comprehensive research report categorizes the Microbial Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Organism Type

- Technology

- Application

- End User

Regional breakdown highlights the Americas, EMEA, and Asia-Pacific as pivotal zones for microbial testing growth, innovation, and regulatory adaptation

Regional dynamics in microbial testing reflect divergent growth trajectories, regulatory regimes, and innovation ecosystems across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States and Canada lead in advanced molecular diagnostics adoption, fuelled by substantial R&D investment and proactive regulatory frameworks. Latin American markets are poised for growth as infrastructure investments expand testing capacity and public health initiatives intensify efforts against endemic pathogens.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and market maturity. Western Europe boasts rigorous compliance standards, driving demand for high-throughput sequencing and automation, while emerging economies in Eastern Europe and the Gulf Cooperation Council are increasingly investing in laboratory modernization. Africa’s testing landscape remains fragmented, though public-private partnerships and philanthropic funding are accelerating capabilities in environmental surveillance and infectious disease monitoring.

Asia-Pacific emerges as a powerhouse of manufacturing and innovation. Japan and South Korea continue to push the envelope in bio-sensor technology and mass spectrometry, while Southeast Asian nations are rapidly building testing infrastructure to support burgeoning pharmaceutical industries. Meanwhile, China’s focus on self-reliance in critical instruments and reagents has spurred local investment, leading to competitive domestic players that are increasingly challenging established global suppliers.

This comprehensive research report examines key regions that drive the evolution of the Microbial Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading companies differentiate through strategic partnerships, portfolio diversification, and investments in next-generation microbial testing

Leading corporations are distinguishing themselves through targeted investments in next-generation technologies and strategic alliances that extend capabilities across the testing continuum. Companies specializing in life science instrumentation are forging partnerships with software developers to deliver integrated solutions, while reagent manufacturers are collaborating with molecular diagnostics firms to co-develop kits that accelerate time to result and broaden pathogen detection panels.

In response to tariff-induced supply chain shifts, several key players have expanded their North American manufacturing footprint, reducing lead times and insulating customers from cost volatility. Concurrently, forward-thinking companies are investing heavily in AI and machine learning to enhance predictive analytics in microbial identification, enabling proactive risk mitigation. Some have also established innovation centers and academic collaborations to drive continuous pipeline development, ensuring that emerging needs-from antibiotic resistance surveillance to environmental monitoring-are met with robust, field-proven solutions.

This competitive dynamic underscores the importance of agility, where the ability to rapidly integrate novel assay chemistries, scale automated platforms, and adapt service models will define market leaders in the coming decade. The interplay between global supply capabilities and local production agility is shaping a new generation of microbial testing enterprises that prioritize resilience and customer-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbial Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Accepta Ltd.

- AEMTEK Laboratories

- Agilent Technologies, Inc.

- ALS Limited

- ARL Bio Pharma, Inc.

- Beckman Coulter Inc. by Danaher Corporation

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- bioMérieux SA

- Biosan Laboratories, Inc.

- Bruker Corporation

- Charles River Laboratories by Bausch & Lomb

- Döhler GmbH

- Ecolyse, Inc.

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd.

- Intertek Group PLC

- LuminUltra Technologies Ltd.

- Medicinal Genomics Corp.

- Merck KGaA

- Microbac Laboratories Inc.

- Nelson Laboratories, LLC by Sotera Health

- NEOGEN Corporation

- QIAGEN N.V.

- Sartorius AG

- SGS S.A.

- Shimazdu Corporation

- Thermo Fisher Scientific Inc.

- TÜV SÜD

Industry leaders must embrace digital integration, streamline regulatory compliance, and pursue collaborative innovation to secure competitive advantage

To capitalize on evolving market dynamics, industry leaders should prioritize the seamless integration of digital tools across the testing workflow. By implementing laboratory information management systems that interface directly with instrument control software and cloud-based analytics platforms, organizations can achieve real-time visibility into assay performance and resource utilization. This digital backbone not only optimizes operational efficiency but also enhances traceability and regulatory compliance.

In parallel, establishing a proactive regulatory intelligence function can help organizations anticipate shifting standards and align product development efforts accordingly. By engaging early with regulatory bodies and participating in standards-setting consortia, companies can expedite approvals and reduce time to market. Equally important is investing in collaborative innovation models-whether through co-development agreements with academic institutions or consortium-driven pilots-that accelerate the validation of breakthrough technologies in real-world settings.

Finally, leaders should develop a diversified supplier network to mitigate the impact of future trade policy changes. Strategic sourcing agreements with multiple manufacturers, combined with dynamic inventory management, will safeguard against supply disruptions. Collectively, these recommendations form an actionable blueprint for securing a sustainable competitive advantage in an industry defined by rapid technological change and evolving regulatory landscapes.

Research methodology combines primary interviews, secondary research, and quantitative validation to ensure comprehensive insights into microbial testing

The foundation of this market analysis rests on a rigorous research methodology designed to capture the full spectrum of microbial testing dynamics. Primary research involved extensive one-on-one interviews with laboratory directors, quality assurance managers, and procurement specialists across clinical, industrial, and academic settings. These discussions elicited detailed insights into purchasing criteria, workflow challenges, and emerging technology adoption patterns.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory publications, and patent filings, providing context on methodological advancements and policy changes. Trade association reports and white papers were scrutinized to track industry standards evolution and supplier initiatives. Quantitative validation was achieved by cross-referencing interview data with publicly available financial disclosures and corporate press releases, ensuring that strategic conclusions are grounded in verifiable evidence.

This triangulation of primary insights, secondary context, and quantitative confirmation underpins the credibility of the findings, offering stakeholders a transparent view of methodology and enabling reproducibility in future market assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbial Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbial Testing Market, by Product

- Microbial Testing Market, by Organism Type

- Microbial Testing Market, by Technology

- Microbial Testing Market, by Application

- Microbial Testing Market, by End User

- Microbial Testing Market, by Region

- Microbial Testing Market, by Group

- Microbial Testing Market, by Country

- United States Microbial Testing Market

- China Microbial Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Holistic conclusion underscores the strategic imperatives for stakeholders to navigate evolving technologies and regulatory landscapes in microbial testing

In summary, the microbial testing landscape is being reshaped by an interplay of advanced diagnostics, trade policy influences, and evolving customer expectations. Organizations that harness automation, AI, and molecular methods will lead the charge toward faster, more accurate testing paradigms, while diversified supply networks and active regulatory engagement will bolster resilience against external shocks.

Segmentation and regional analyses further emphasize the need for tailored strategies across product categories, technology platforms, and geographic markets. By aligning R&D investments with end-user requirements and local regulatory frameworks, stakeholders can unlock new growth avenues and enhance operational agility. The overarching imperative is clear: a holistic, data-driven approach that integrates technological foresight with strategic planning will define success in the dynamic world of microbial testing.

Connect with Associate Director Ketan Rohom to purchase the definitive microbial testing market research report and empower data-driven decisions

For enterprises seeking to elevate their microbial testing strategies and gain a competitive edge, reaching out to Associate Director Ketan Rohom represents the most direct path to unlocking rigorous, tailored market research insights. Ketan’s deep understanding of industry nuances, combined with a consultative approach, ensures that purchasing decisions align precisely with organizational objectives and operational realities.

Engaging with Ketan opens the door to a comprehensive market research report that empowers stakeholders with granular data, actionable trends analysis, and expert commentary. Whether the goal is to optimize product development roadmaps, refine go-to-market strategies, or strengthen regulatory compliance frameworks, this report serves as a vital resource. Connect today to secure a resource that will drive data-informed decisions and solidify your position at the forefront of microbial testing innovation

- How big is the Microbial Testing Market?

- What is the Microbial Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?