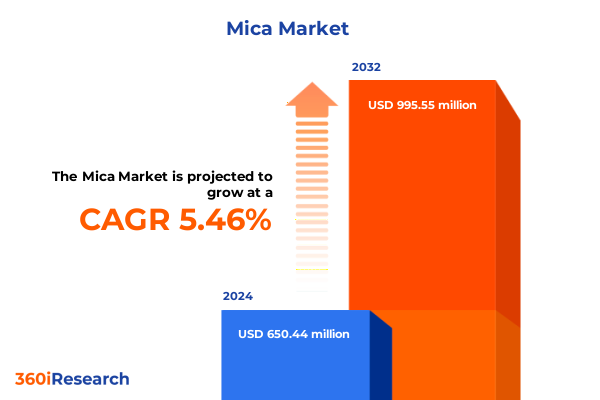

The Mica Market size was estimated at USD 684.44 million in 2025 and expected to reach USD 724.31 million in 2026, at a CAGR of 5.49% to reach USD 995.55 million by 2032.

Unveiling the Mica Market’s Foundational Dynamics and Strategic Imperatives Shaping Industry Evolution in a Transforming Global Landscape

Mica stands out as a versatile phyllosilicate mineral distinguished by its ability to be cleaved into ultra-thin sheets while preserving exceptional electrical insulation, thermal resistance, and chemical stability. Its innate characteristics-ranging from high dielectric strength to reflection and resilience under extreme environmental conditions-have solidified mica’s role as a critical enabler in industries characterized by rigorous performance requirements. As global supply chains adapt to heightened regulatory scrutiny, mica’s cost-effective durability positions it as a preferred material for a variety of applications.

From a technological standpoint, rapid advancements in electronics and renewable energy systems have amplified the demand for mica in capacitors, high-frequency insulators, and semiconductor substrates. The proliferation of 5G infrastructure, electric vehicles, and sophisticated industrial components has underscored mica’s irreplaceable contribution to maintaining operational safety and efficiency, while simultaneously driving research into enhanced synthetic analogues to meet stringent purity specifications.

Additionally, end-use industries such as construction, cosmetics, and coatings have embraced mica’s unique functional and aesthetic properties. In coatings, mica-infused formulations deliver superior adhesion and weather resilience, whereas in personal care, mica’s natural shimmer elevates product appeal. The construction sector leverages mica’s reinforcing and insulating qualities in joint compounds and roofing materials, and in plastics and rubber, it enhances mechanical strength and heat tolerance.

Given this multifaceted growth landscape, it is essential for industry stakeholders to engage with a structured analysis that transcends traditional market sizing, focusing instead on real-world applications, supply chain integrity, and evolving regulatory frameworks to enable informed strategic decisions.

Identifying the Pivotal Industry Disruptors and Technological Advances Redefining Mica Applications Across Multifaceted End-Use Sectors

The mica industry is at an inflection point, driven by a series of transformative shifts that are redefining its competitive landscape. Foremost among these trends is the intensifying focus on ethical and sustainable sourcing. Collaborative initiatives with non-profit organizations and the adoption of transparent supply chain protocols are gaining momentum, as suppliers seek to address consumer and regulatory demands for conflict-free minerals. Such measures not only bolster corporate reputations but also secure reliable access to high-quality raw materials.

Simultaneously, the electronics sector continues to underpin substantial growth, with mica’s superior dielectric and thermal stability becoming indispensable in applications ranging from capacitors to advanced insulators in electric vehicles and renewable energy systems. The miniaturization of electronic components has further elevated the requirement for ultrafine mica grades, prompting investments in novel processing technologies that yield consistent particle size distributions and minimal impurity profiles.

In parallel, the cosmetics and personal care segment is experiencing a resurgence in demand for naturally derived, non-toxic pigments. Brands are increasingly formulating products with ethical sources of mica, driven by consumer preferences for clean beauty solutions and heightened awareness of environmental stewardship. This paradigm shift is complemented by significant advancements in synthetic mica manufacturing, where fluorophlogopite variants deliver impurity-free performance tailored to high-end applications in electronics, cosmetics, and specialty composites.

Collectively, these dynamics underscore a market in transition-one where sustainability, technological innovation, and stringent quality mandates converge to create new competitive fronts and strategic pathways for industry participants.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Global Mica Supply Chains and Manufacturing Costs

In 2025, the United States embarked on one of the most extensive tariff realignments in recent memory, with implications that have reverberated across the global mica supply chain. The average effective duty on Chinese imports escalated to over 50 percent, significantly elevating landed costs for companies reliant on natural mica sourced from key production hubs. Layered upon existing Section 301 duties and targeted IEEPA “fentanyl-related” tariffs, the cumulative rate structure placed unprecedented pressure on procurement budgets and spurred executives to reassess sourcing strategies.

The mid-year announcement of a 90-day tariff truce with China, effective May 14, 2025, temporarily reduced reciprocal duties from 34 percent to 10 percent, offering reprieve to importers navigating the complex duty matrix. Nevertheless, the persistence of the 20 percent fentanyl-related levy illustrated the enduring nature of political risk and underscored the need for agile supply chain frameworks capable of absorbing abrupt policy shifts.

As firms contended with surging import expenses, domestic processing capacity and investments in synthetic mica production gained new strategic importance. Corporations accelerated capital deployments aimed at expanding local manufacturing footprints and forging alliances with downstream processors to mitigate tariff exposure and secure uninterrupted access to premium-quality materials. Additionally, some market participants explored alternative mineral sources, such as phlogopite derivatives from non-traditional geographies, to diffuse supply concentration risks.

Through this lens, the 2025 U.S. tariff realignment catalyzed a broader industry response-characterized by supply base diversification, vertical integration, and increased emphasis on regulatory hedging-to ensure resilience against future trade policy volatility.

Deriving Strategic Insights from End-Use, Product-Type, Form, and Flake-Size Segmentation to Inform Market Positioning and Innovation

The intricate segmentation of the mica market reveals crucial insights into how product characteristics align with end-use requirements and commercialization pathways. Based on end-use industry, the coatings sector manifests robust demand for both powder and water-based mica variants, optimizing formulations for enhanced film strength and gloss retention, whereas the construction segment leverages mica’s insulating and reinforcing attributes in asphalt fillers, joint compounds, plaster formulations, and roofing materials. In parallel, the cosmetics and personal care industry prioritizes fine mica grades for hair care, makeup pigments, and skincare formulations to achieve consistent luster and safety profiles. From an electronics perspective, capacitors, insulators, and semiconductor substrates require ultra-pure mica forms that exhibit low dielectric loss and thermal stability. Meanwhile, the plastics and rubber industry integrates epoxy resin, polypropylene, and PVC composites with mica to bolster dimensional stability and thermal resistance.

Furthermore, the bifurcation between natural and synthetic product types underscores a trade-off between cost efficiency and material consistency. Natural mica sources such as lepidolite, muscovite, and phlogopite continue to serve cost-sensitive applications, while synthetic variants like fluorophlogopite and titania-coated mica command premiums in high-performance settings. Across material presentation, flakes, powder, and sheets each fulfill distinct processing and application needs; flakes are most prevalent in coatings and fillers, powders gain traction in cosmetics and specialty composites, and rigid sheets are preferred for electrical insulation in transformers and motors. Finally, the spectrum of flake sizes-from fine to micro-enables formulators to tailor rheology and optical effects, with fine grades delivering smooth finishes and micro grades imparting ultrafine shimmer. This multi-layered segmentation framework not only clarifies demand drivers but also guides product development and strategic positioning for manufacturers and end users alike.

This comprehensive research report categorizes the Mica market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Flake Size

- End Use Industry

Examining Distinct Regional Drivers and Demand Patterns Across the Americas, Europe-Middle East-Africa, and Asia-Pacific Mica Markets

Geographic analysis of mica demand highlights divergent growth trajectories shaped by regional industrial policies and consumer behaviors. In the Americas, the United States stands at the forefront of technological application, driven by aerospace, renewable energy, and advanced electronics sectors that rely heavily on mica’s insulating and heat-resistant properties. Concurrent infrastructure investments under U.S. stimulus measures further underpin demand in construction and coatings, facilitating a dynamic domestic market environment.

Across Europe, the Middle East, and Africa, regulatory emphasis on sustainability and energy efficiency-driven by frameworks such as the European Green Deal and regional building codes-has stimulated the adoption of mica-infused products in construction materials, including energy-efficient plasters and thermal insulation boards. Meanwhile, the cosmetics industry in Western Europe and the GCC prioritizes ethically sourced mica to comply with stringent consumer safety and environmental standards. Simultaneously, emerging markets in Africa are exploring local mica reserves to foster downstream processing capabilities and capture added value within regional value chains.

In the Asia-Pacific region, robust industrialization and infrastructure expansion in China, India, and Southeast Asia underpin a diverse range of mica applications. Packaging, plastics, and rubber sectors integrate mica to bolster product durability, while coatings and paints segments leverage it for weather resistance and aesthetic enhancement. The Asia-Pacific’s dual role as a leading producer and consumer underscores its strategic importance for global supply dynamics, as domestic producers invest in upgrading processing facilities to meet rising quality benchmarks and international regulatory requirements.

These regional insights collectively illuminate the nuanced interplay between policy drivers, end-use demands, and supply chain configurations that characterize the global mica marketplace.

This comprehensive research report examines key regions that drive the evolution of the Mica market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Market Leadership Strategies and Competitive Dynamics Among Major Natural and Synthetic Mica Producers Globally

Major mica producers have adapted their strategies to capture evolving market opportunities across natural and synthetic segments. Franklin Industrial Minerals, a leading U.S.-based supplier, has expanded its phlogopite processing capabilities to serve high-temperature applications, capitalizing on growth in the aerospace and industrial heating sectors. Pacer Corporation has differentiated through value-added services, offering customized mica plate and strip solutions for electrical insulation and precision component manufacturing.

In the European and global synthetic mica arena, BASF Catalysts has invested in fluorophlogopite production to deliver high-purity mica analogues for electronics and cosmetics applications, distinguishing itself through rigorous quality control and proprietary coating techniques. Cogebi N.V. has pursued strategic partnerships to enhance its distribution network and accelerate displacement of lower-grade natural mica in specialty paint and coating formulations. Meanwhile, Asheville-Schoonmaker Mica Company maintains a leadership position in dielectric mica sheet manufacturing, targeting legacy electrical equipment and emerging transformer technologies with ultra-flat, high-dielectric-strength laminates.

Premier Mica Company and Mica Manufacturing Co. have each forged alliances with end users in construction and cosmetics sectors to co-develop bespoke mica blends, ensuring alignment with client-specific performance and aesthetic requirements. Concurrently, Daruka Minerals and Gunpatroy Private Limited have invested in vertical integration, acquiring downstream processing assets to mitigate raw supply volatility and introduce value-added ground mica products tailored to domestic markets.

These competitive dynamics reflect a collective industry emphasis on technological innovation, supply chain integration, and collaborative partnerships aimed at sustaining market leadership amid shifting customer expectations and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mica market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Elcora Advanced Materials Corp.

- Guangdong Beacon Mica Co., Ltd.

- Imerys SA

- JSK Minerals Pvt. Ltd.

- Mica Distribution, Inc.

- Rio Tinto Group Limited

- Shandong Jinhe Industrial Group Co., Ltd.

- Sibelco Group NV

- Supriya Mica Private Limited

- Tewari Exports Private Limited

Recommending Actionable Strategic Pathways for Industry Leaders to Strengthen Supply Resilience and Drive Sustainable Growth in Mica Markets

Industry leaders should prioritize the diversification of supply chains by establishing dual sourcing arrangements across both traditional mining regions and emerging non-conventional deposits, thereby mitigating geopolitical and tariff risks. Progressive companies can invest in expanding synthetic mica production capacity to secure consistent high-purity inputs for critical electronics and cosmetics applications, while also addressing ethical sourcing concerns through in-house manufacturing.

Furthermore, deploying advanced analytics and blockchain-enabled traceability systems will enhance transparency and compliance, enabling real-time monitoring of material provenance and quality attributes. By integrating digital tools into procurement workflows, organizations can preemptively identify supply chain bottlenecks and dynamically reallocate resources to maintain production continuity under fluctuating trade policies.

Optimization of product portfolios through tailored segment-specific applications-for example, developing nano-enhanced mica composites for fire-retardant coatings or ultrafine pigments for premium beauty lines-can unlock new revenue streams and differentiate offerings in crowded markets. Collaborating with academic and research institutions to co-innovate lightweight, multifunctional composites will further strengthen competitive positioning.

Finally, forging strategic alliances with downstream consumers and regulatory bodies will facilitate joint development of industry standards around quality, sustainability, and ethical mining practices. By adopting a collaborative approach to standard setting and certification, firms can collectively elevate the perceived value of mica-based solutions and secure long-term market resilience.

Outlining Rigorous Research Methodologies Employed to Ensure Data Integrity, Comprehensive Coverage, and Robust Market Analysis

Our comprehensive market research employs a dual-track methodology, integrating extensive primary interviews with industry stakeholders-ranging from mica miners and processing specialists to end-use formulators and regulatory advisors-with rigorous secondary research across academic journals, trade publications, and government databases. This hybrid approach ensures both depth of insight and cross-validation of data points across diverse sources.

Quantitative data aggregation follows a bottom-up framework, wherein production capacities, processing yields, and utilization metrics are synthesized to map material flows across end-use segments. Concurrently, a top-down analytical layer leverages macroeconomic indicators and industrial output statistics to contextualize demand drivers, enabling robust triangulation of market dynamics.

Qualitative thematic analysis is conducted through structured interviews and focus groups to capture nuanced perspectives on emerging technologies, regulatory shifts, and corporate strategic initiatives. All findings undergo multiple stages of peer review and editorial scrutiny to ensure factual accuracy, relevance, and coherence.

Illustrative case studies spotlight best practices in supply chain optimization, synthetic mica innovation, and sustainable sourcing, while sensitivity analyses assess the potential impact of trade policy scenarios and technological breakthroughs. The result is a meticulously curated research framework that delivers actionable insights and reliable intelligence for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mica market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mica Market, by Product Type

- Mica Market, by Form

- Mica Market, by Flake Size

- Mica Market, by End Use Industry

- Mica Market, by Region

- Mica Market, by Group

- Mica Market, by Country

- United States Mica Market

- China Mica Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Strategic Imperatives to Conclude on the Mica Market’s Evolutionary Trajectory and Future Opportunities

Our analysis demonstrates that mica’s intrinsic value-as an electrical insulator, thermal barrier, and aesthetic enhancer-remains undiminished amid shifting trade policies and evolving end-use demands. The convergence of sustainability imperatives, technological innovation in synthetic mica production, and geopolitical volatility will continue to reshape supply chain configurations and competitive strategies.

Segment-specific differentiation-rooted in flake size control, product form customization, and targeted material treatments-emerges as a central driver of value creation. Companies capable of swiftly aligning their portfolios with high-growth applications in electronics, cosmetics, and green building materials will capture disproportionate benefits.

Regional market disparities underscore the importance of localized approaches: capitalizing on the Americas’ technological leadership, leveraging sustainability mandates in Europe-Middle East-Africa, and harnessing Asia-Pacific’s scale and processing expertise. Heightened tariff exposure in 2025 has catalyzed investments in domestic processing and synthetic production, accelerating a structural shift toward vertically integrated business models.

Ultimately, the mica market presents a dynamic mosaic of opportunity and risk, where strategic foresight, operational agility, and collaborative innovation will define industry leaders and set the stage for long-term growth.

Engaging Industry Stakeholders with a Direct Invitation to Collaborate on Advancing Market Insights by Securing Comprehensive Mica Research Intelligence

If you are ready to gain actionable insights and leverage our in-depth analysis of the global mica market, we encourage you to connect with Ketan Rohom, Associate Director, Sales & Marketing. By securing the full research report, your organization will benefit from comprehensive segmentation deep dives, regional performance analysis, and strategic recommendations tailored to the rapidly evolving regulatory, technological, and supply chain dynamics. Empower your team with the rigorous data and expert commentary necessary for informed decision-making and competitive differentiation. Contact Ketan Rohom today to arrange your personalized consultation and acquire the definitive platform for navigating the complexities of the mica industry.

- How big is the Mica Market?

- What is the Mica Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?