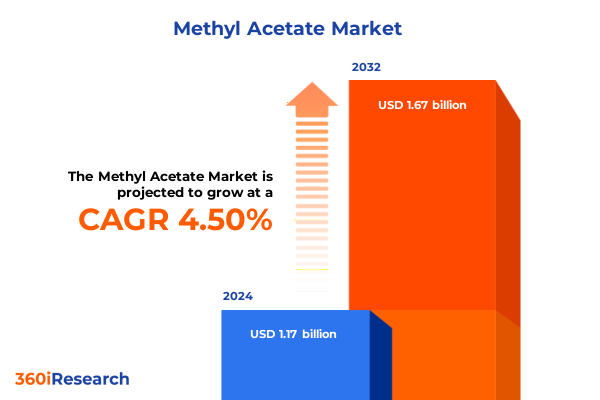

The Methyl Acetate Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.27 billion in 2026, at a CAGR of 4.50% to reach USD 1.67 billion by 2032.

Methyl Acetate’s Integral Role as a Versatile, Eco-Conscious Solvent Enabling Industrial Efficiency and Sustainability Across Key Sectors Globally

Methyl acetate has emerged as a pivotal industrial solvent renowned for its exceptional balance of performance, safety, and environmental compatibility. In an era where regulatory bodies are tightening restrictions around volatile organic compounds and industries are seeking greener alternatives, methyl acetate stands out for its low toxicity and biodegradability. As a cleaner substitute for traditional solvents such as toluene and xylene, it addresses stringent emissions standards in applications ranging from paints and coatings to cleaning and degreasing processes.

Beyond regulatory compliance, methyl acetate’s physicochemical properties-such as rapid evaporation rate, high solvency power, and good miscibility-facilitate efficient process performance. These characteristics make it a reliable choice across adhesives and sealants, chemical intermediates, and pharmaceutical formulations. Moreover, its compatibility with both fossil-derived and bio-based feedstocks enables manufacturers to align with sustainability objectives by shifting toward renewable resource utilization.

With evolving customer expectations prioritizing environmentally responsible solutions, the introduction of bio-based methyl acetate production pathways underscores its role in circular economy initiatives. Producers are actively exploring catalytic processes that leverage bioethanol feedstock, aiming to reduce carbon footprint and enhance supply chain resilience. Consequently, methyl acetate is at the forefront of solvent innovation, bridging performance demands with ecological stewardship.

How Shifts Toward Sustainable Chemistry, Digital Transformation, and Supply Chain Resilience Are Reshaping the Methyl Acetate Market Landscape

The methyl acetate market is undergoing transformative shifts driven by a confluence of sustainability mandates, technological innovations, and supply chain reconfiguration. Heightened focus on green chemistry has catalyzed investment in novel production routes, including enzymatic and catalytic processes that leverage renewable feedstocks and minimize byproducts. These developments enable manufacturers to reduce lifecycle emissions and meet increasingly rigorous environmental standards without sacrificing process efficiency.

Simultaneously, digitalization is reshaping operational models across the chemicals value chain. Advanced analytics and process automation allow for precise control over reaction conditions, yielding higher product consistency and energy savings. By integrating real-time monitoring systems with predictive maintenance, facilities can mitigate downtime risks and optimize resource utilization. This shift toward data-driven manufacturing enhances overall competitiveness and supports rapid scaling of methyl acetate output to meet shifting customer demands.

In parallel, companies are prioritizing supply chain resilience in response to geopolitical volatility and trade policy uncertainties. Strategic partnerships with diversified raw material suppliers, coupled with localized production hubs, are enabling stakeholders to buffer against disruptions. Emphasis on circular economy principles-such as solvent recovery, recycling, and waste valorization-further bolsters resource efficiency. Together, these transformative shifts are redefining market dynamics, unlocking new growth avenues while reinforcing long-term sustainability objectives.

Assessing the Cumulative Consequences of Recent United States Section 301 Tariffs and Extended Exclusions on the Methyl Acetate Supply Chain

The introduction and evolution of United States Section 301 tariffs have imparted significant financial pressures and strategic considerations throughout the methyl acetate supply chain. Initially implemented to address broader trade imbalances, these tariffs imposed additional duties on chemical imports from certain regions, influencing raw material costs and procurement strategies. In response, the U.S. Trade Representative extended specific exclusions on targeted products-covering essential manufacturing equipment and selected chemical intermediates-through August 31, 2025, thereby alleviating short-term cost burdens for importers.

Prior to the extension, the four-year review concluded with increased duty rates ranging from 25 to 50 percent on key intermediate goods, including polysilicon, wafers, and certain specialty chemicals, effective January 1, 2025. These measures aimed to fortify domestic supply chains and incentivize onshore production, but they also escalated the landed cost of several feedstocks used in methyl acetate synthesis.

Despite partial reprieves through exclusion extensions, the cumulative impact has compelled industry participants to reassess procurement frameworks and explore alternative sourcing corridors. Companies are negotiating long-term contracts with non-tariffed suppliers, leveraging free trade agreements, and expanding domestic production capacity. While the tariff landscape introduces complexity, it simultaneously catalyzes investment in local infrastructure, enhancing overall supply chain resilience for methyl acetate producers and end users alike.

Unlocking Growth Potential Through Application, End-Use, Grade, and Distribution Channel Segmentation Insights into the Methyl Acetate Market

The methyl acetate market exhibits nuanced behavior when evaluated through the prism of application, end-use industry, grade, and distribution channel segmentation. In terms of application, adhesives and sealants pioneers are harnessing its solvency to formulate epoxy, pressure sensitive, and silicone products, while chemical intermediate producers utilize it for acetic acid and methyl methacrylate pathways. The cleaning and degreasing sector relies on methyl acetate’s volatility profile for both electronic and industrial cleaning operations, whereas paints and coatings formulators integrate it across automotive electrodeposition and powder coatings, marine coatings, industrial coatings, and wood furniture finishes. Within the pharmaceutical realm, active pharmaceutical ingredients and downstream formulations leverage its compatibility to achieve high-purity processes.

Examining end-use industries reveals automotive manufacturers valuing methyl acetate for precision coatings and solvent-based adhesives, electronics producers emphasizing its efficacy in circuit board cleaning, pharmaceutical entities prioritizing reagent-grade purity, and printing houses utilizing industrial-grade variants for inks. Grade differentiation further refines market allocation: electronic-grade product meets stringent purity thresholds, industrial-grade accommodates broad performance requirements, and reagent-grade responds to high-specification laboratory and pharmaceutical demands. Distribution dynamics encompass direct sales arrangements that foster strategic partnerships, distributor networks that emphasize reach and technical support, and online sales channels catering to agile procurement needs. Together, these segmentation insights illuminate the diverse end-use imperatives and distribution strategies shaping methyl acetate demand.

This comprehensive research report categorizes the Methyl Acetate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Application

- Distribution Channel

- End Use Industry

Comparative Regional Dynamics Driving Methyl Acetate Demand and Innovation Across the Americas, EMEA, and Asia-Pacific Markets

Regional markets for methyl acetate demonstrate distinct growth drivers and innovation pathways. In the Americas, regulatory frameworks like the U.S. Environmental Protection Agency’s VOC standards have accelerated adoption in coatings and cleaning applications. North American producers are investing in bio-based feedstock projects and advanced recovery technologies, supported by infrastructure incentives and tax credits aimed at promoting domestic chemical manufacturing. Latin American markets are characterized by gradual implementation of environmental regulations, creating emerging opportunities for eco-friendly solvent entrants.

Europe, Middle East, and Africa (EMEA) present a mosaic of regulatory regimes underpinned by REACH directives and national VOC emission targets. Western Europe leads with stringent environmental policies and strong R&D ecosystems, fostering rapid integration of methyl acetate in sustainable coatings and printing inks. The Middle East is advancing petrochemical diversification strategies, with investments in local derivatives capacity and solvent recovery units. Meanwhile, African markets are nascent but show promise as infrastructure development and environmental awareness gain momentum, particularly in pharmaceuticals and industrial cleaning segments.

Asia-Pacific remains the most dynamic region, propelled by rapid industrialization, rising automotive production, and intensifying environmental regulations in China, India, Japan, and South Korea. Government initiatives targeting air quality improvements and circular economy adoption have prompted manufacturers to transition to green solvents. In parallel, Asia-Pacific hosts a burgeoning startup ecosystem focused on bio-based chemical synthesis, which is poised to further elevate the regional methyl acetate landscape.

This comprehensive research report examines key regions that drive the evolution of the Methyl Acetate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Harnessing Technological Advances and Strategic Partnerships to Lead the Evolving Methyl Acetate Market

A core cohort of global chemical companies has solidified its leadership in the methyl acetate arena through strategic investments, technological innovation, and collaborative partnerships. Industry frontrunners such as Celanese and Eastman Chemical Company leverage their integrated production platforms to deliver high-purity grades while optimizing feedstock flexibility. LyondellBasell and SABIC have advanced catalyst and reactor design enhancements, enabling greater throughput and lower energy consumption. European giants BASF and INEOS apply continuous process intensification methods to reduce emissions and achieve tighter reaction control.

Furthermore, specialty producers like Sekisui Chemical and South Korea’s LG Chem have differentiated through customized formulations tailored to electronics and pharmaceutical applications, ensuring exacting compliance with purity specifications. Innovation hubs in Japan and Germany are driving membrane-based solvent recovery technologies that improve circularity and minimize waste streams. Collectively, these leading organizations are shaping the competitive landscape by scaling sustainable production processes, forging joint ventures to access emerging markets, and integrating digital tools to enhance operational transparency and product quality.

This comprehensive research report delivers an in-depth overview of the principal market players in the Methyl Acetate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Wanwei Group Co., Ltd

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Chang Chun Group

- Changzhi Huojia Industrial Co., Ltd

- Daicel Corporation

- Dow Inc.

- Eastman Chemical Company

- Hunan Xiangwei Group Co., Ltd

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Mitsubishi Gas Chemical Company, Inc.

- RuiFeng Polymer Materials Co., Ltd

- Shanxi Sanwei Group Co., Ltd

- Sichuan Chuanwei Group Co., Ltd

- Sinochem Plastic Co., Ltd

- Sinochem Qingdao Co., Ltd

- Wacker Chemie AG

- Zhangzhou Oushuo Chemical Co., Ltd

Actionable Strategies for Industry Leaders to Capitalize on Sustainability Trends, Supply Chain Agility, and Market Diversification

Industry leaders seeking to capitalize on the evolving methyl acetate landscape should prioritize actions that reinforce sustainability, operational agility, and market diversification. First, expanding bio-based feedstock initiatives by collaborating with agricultural and bio-refinery partners can reduce dependency on fossil inputs and align with circular economy imperatives. Investing in process intensification and advanced catalysis will mitigate energy consumption and waste generation, enhancing both cost competitiveness and environmental performance.

Second, strengthening supply chain resilience through geographic diversification of raw material sources and establishing regional production hubs will buffer against tariff volatility and geopolitical disruptions. Companies should leverage digital procurement platforms and scenario planning tools to anticipate market fluctuations and adjust sourcing strategies preemptively.

Third, fostering deeper customer engagement via tailored technical support and co-development projects can differentiate offerings across key segments. For example, co-innovating with automotive and electronics OEMs to optimize solvent blends for next-generation coatings and cleaning processes will drive incremental value and long-term partnerships.

Finally, continuing to explore membrane separation and solvent recovery solutions will enhance circularity and reduce net operating costs. By embedding these recommendations into strategic roadmaps, industry participants can secure competitive advantage while advancing collective sustainability goals.

Comprehensive Research Methodology Integrating Primary Interviews and Secondary Data to Deliver Rigorous Market Analysis

This research integrates a rigorous methodology combining primary and secondary sources to ensure robust and unbiased market analysis. Primary inputs were collected through in-depth interviews with key executives, technical specialists, and procurement managers across leading methyl acetate producers and end-user industries. These engagements provided firsthand insight into emerging trends, technology adoption drives, and strategic priorities.

Secondary research encompassed a comprehensive review of publicly available literature, including regulatory filings, trade association publications, academic journals, and industry white papers. Data triangulation techniques were employed to validate qualitative findings and reconcile any discrepancies. Specialty chemical databases and patent repositories were analyzed to assess technological developments and innovation trajectories.

Quantitative analysis involved mapping supply-demand dynamics, evaluating raw material cost structures, and examining distribution channel performance through proprietary market intelligence systems. Scenario modeling and sensitivity analyses were conducted to evaluate the impact of tariffs, feedstock price variability, and regional regulatory changes. This multi-pronged approach ensures a transparent, data-driven foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Methyl Acetate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Methyl Acetate Market, by Grade

- Methyl Acetate Market, by Application

- Methyl Acetate Market, by Distribution Channel

- Methyl Acetate Market, by End Use Industry

- Methyl Acetate Market, by Region

- Methyl Acetate Market, by Group

- Methyl Acetate Market, by Country

- United States Methyl Acetate Market

- China Methyl Acetate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Conclusion Emphasizing the Strategic Imperatives of Sustainability, Innovation, and Resilience in the Methyl Acetate Industry

The methyl acetate market stands at a strategic inflection point where sustainability, innovation, and supply chain resilience converge. Regulatory mandates and evolving customer preferences are driving adoption of green solvent solutions that balance performance with environmental stewardship. Technological advances in bio-based production, process intensification, and digital manufacturing are unlocking new efficiencies while reducing ecological footprints.

Simultaneously, the reshaping of trade policies-exemplified by U.S. Section 301 tariffs and evolving exclusion frameworks-underscores the importance of flexible sourcing strategies and localized production. Companies that proactively diversify supply chains and integrate circular economy models will be best positioned to navigate policy shifts and capitalize on emerging regional opportunities.

Segmentation insights reveal a heterogeneous market serving adhesives and sealants, pharmaceuticals, coatings, cleaning, and more, each with distinct performance and regulatory requirements. Regional dynamics in the Americas, EMEA, and Asia-Pacific further highlight the importance of tailored market approaches. Key players setting new benchmarks in catalyst innovation, solvent recovery, and collaborative partnerships are driving the industry forward.

As the industry transitions toward greener, more resilient paradigms, stakeholders who align strategic investments with sustainability objectives and operational agility will secure lasting competitive advantage.

Secure Your Competitive Advantage with Customized Methyl Acetate Market Insights—Contact Ketan Rohom to Access the Full Report

Don’t miss the opportunity to gain unparalleled strategic insights into the methyl acetate market landscape. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this in-depth analysis can empower your business decisions. Secure access to detailed segmentation breakdowns, tariff impact assessments, and forward-looking recommendations that will sharpen your competitive edge. Partner with our expert team to tailor the findings to your unique objectives-and elevate your market strategy today.

- How big is the Methyl Acetate Market?

- What is the Methyl Acetate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?