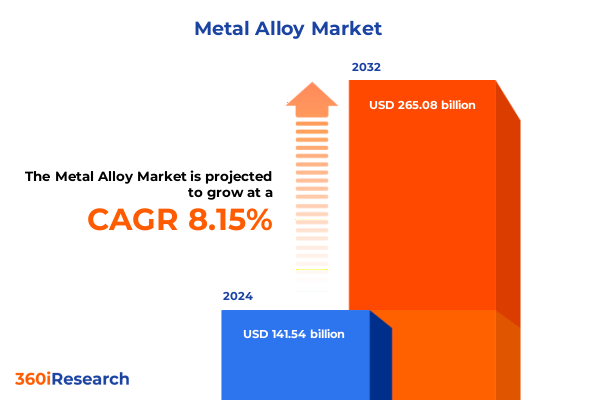

The Metal Alloy Market size was estimated at USD 152.38 billion in 2025 and expected to reach USD 164.06 billion in 2026, at a CAGR of 8.23% to reach USD 265.08 billion by 2032.

Unveiling the Critical Role and Evolving Dynamics of Metal Alloy Materials in Modern Industrial Applications

Metal alloys form the backbone of countless industries, spanning from aerospace to consumer electronics. These engineered materials combine multiple metallic elements to achieve tailored properties such as enhanced strength, corrosion resistance, conductivity, and weight reduction. As global manufacturing and technological demands evolve, so too do the expectations placed on alloy performance and sustainability. In recent years, rising environmental regulations, electrification of transportation, and digital transformation have reshaped both supply chains and application requirements. Against this backdrop, understanding the intricate dynamics of alloy composition, manufacturing techniques, and end-user adoption becomes critical for decision makers seeking a competitive edge.

The modern portfolio of metal alloys encompasses an extensive range of chemistries and forms, including aluminum, copper, nickel, steel, and titanium variants. Each segment brings unique advantages: aluminum alloys drive lightweight vehicle structures, copper alloys support high-performance electrical systems, nickel alloys enable high-temperature applications, steel alloys offer unmatched strength and affordability, and titanium alloys deliver superior strength-to-weight ratios in demanding settings. However, achieving optimal material selection demands a nuanced view of each alloy’s processing methods, cost drivers, and performance trade-offs. This executive summary distills the latest transformational shifts, tariff implications, segment insights, regional distinctions, and strategic imperatives essential for industry stakeholders to thrive.

Tracing the Shifting Currents That Are Redefining Metal Alloy Production, Innovation, and Demand Patterns

Over the past decade, the metal alloy landscape has undergone transformative shifts driven by technological innovation and changing end-user priorities. Digitization of manufacturing processes-through automation, real-time analytics, and additive manufacturing-has revolutionized alloy development and production. Manufacturers can now rapidly prototype and qualify novel compositions, enabling a faster cycle from material discovery to commercial deployment. In parallel, heightened environmental scrutiny has accelerated the adoption of greener processes, including low-carbon smelting, closed-loop recycling, and hydrogen-based reduction techniques that minimize greenhouse gas emissions. These sustainable practices not only mitigate regulatory risk but also resonate with customers demanding eco-friendly supply chains.

Demand patterns are also being reshaped by the global energy transition and advancements in mobility. The shift toward electric vehicles has driven a surge in demand for high-conductivity copper alloys for battery systems and lightweight aluminum and magnesium alloys for vehicle bodies. In aerospace, lightweighting initiatives and the push toward supersonic and hypersonic platforms have spurred demand for high-temperature nickel and titanium alloys. Meanwhile, defense requirements for resilient and high-strength materials continue to uphold robust demand in military aviation and naval sectors. Taken together, these transformative forces underscore the need for alloy producers and end users to collaborate on innovation roadmaps, ensuring that material performance aligns with emerging technological and environmental imperatives.

Assessing How Recent United States Tariff Policies in 2025 Are Reshaping Metal Alloy Supply Chains and Trade Dynamics

In 2025, a series of tariff adjustments by the United States government have cumulatively reshaped global metal alloy trade flows, impacting both importers and domestic producers. New levies on certain aluminum and steel alloy categories have increased landed costs for foreign-sourced materials, prompting many downstream manufacturers to reconsider their supply origins. These tariffs, ranging from protective import duties to specific product-based surcharges, have created an environment of heightened price volatility, as buyers grapple with fluctuating input costs and seek to secure long-term supply contracts at predictable terms.

The cumulative effect of these measures has spurred several strategic responses. Domestic producers have capitalized on reduced competition from imports to expand their milling and casting capacities, investing in modernized facilities to capture incremental market share. Conversely, global alloy suppliers have explored rerouting trade flows through allied nations or entering into tolling arrangements, wherein raw metal is shipped for processing abroad before final delivery to the U.S. Some manufacturers have accelerated regionalization strategies, establishing production hubs in North America to insulate operations from tariff risk. These shifts underscore the interconnected nature of policy actions and supply-chain resilience, illustrating how tariff policy can serve as both a catalyst for domestic investment and a driver of new cross-border partnerships.

Revealing Key Market Segmentation Narratives Across Alloy Types, Applications, Forms, and Manufacturing Processes

A nuanced view of the market reveals distinct patterns when analyzed through various segmentation lenses. Based on alloy type, the landscape encompasses aluminum, copper, nickel, steel, and titanium variants. Within copper alloys, subdivisions such as brass deliver cost-effective electrical conductivity, while bronze offers superior wear resistance, and copper-nickel combinations excel in marine environments. Nickel-based alloys, including high-performance grades such as Hastelloy, Inconel, and Monel, dominate sectors requiring exceptional corrosion and temperature resilience. Steel alloys range from versatile carbon grades to specialized tool steels and an array of stainless families-Austenitic for general corrosion resistance, Duplex for strength and toughness balance, Ferritic for magnetic applications, and Martensitic where high hardness is paramount.

Application segments drive demand patterns in critical sectors such as aerospace, automotive, construction, defense, electronics, energy, and industrial machinery. Aerospace usage spans from engine components fabricated with nickel superalloys to fuselage and wing structures leveraging advanced aluminum compositions. In automotive, structural body panels and crash management systems utilize tailored steel and aluminum grades, while electrical systems rely on high-conductivity copper alloys. Construction infrastructure employs corrosion-resistant alloys for both commercial and institutional projects, and the burgeoning renewable energy market taps specialized steels and titanium alloys for turbines and frames.

Form factor further influences material selection. Bars and rods facilitate precision machining for industrial machinery, while sheets-whether cold-rolled full-hard or quarter-hard, hot-rolled, or galvanized-meet diverse structural requirements. Pipes and tubes are essential in oil and gas transport, and foils serve microelectronic and heat-exchanger applications. Manufacturing processes shape final properties: continuous and die casting produce complex geometries, investment casting delivers fine detail in aerospace parts, and powder metallurgy enables near-net shapes with exceptional microstructural control. From resin-bonded sand casting to extrusion and forging, each process choice affects alloy microstructure and application suitability.

This comprehensive research report categorizes the Metal Alloy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Alloy Type

- Form

- Manufacturing Process

- Application

Demystifying Regional Growth Drivers and Challenges Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics vary considerably across the Americas, Europe Middle East & Africa, and Asia-Pacific, each exhibiting unique drivers and challenges. The Americas region has benefited from near-shoring trends and supportive trade policies that have encouraged domestic investment in steel and aluminum capacity. Energy infrastructure projects and the automotive sector’s pivot to electric vehicles have underpinned strong demand for high-conductivity and lightweight alloys. Meanwhile, resilient construction activity across North and South America continues to fuel demand for corrosion-resistant stainless steel and brass products.

Across Europe, stringent environmental regulations are spurring rapid adoption of low-carbon alloy production methods, with several EU member states investing in hydrogen-based smelting demonstration plants. Middle East markets leverage abundant energy resources to produce competitively priced aluminum and steel, supplying both regional customers and global export markets. Africa’s growing infrastructure and mining operations are driving demand for abrasion-resistant tool steels and marine-grade copper-nickel alloys, though logistical challenges and currency fluctuations remain headwinds.

In the Asia-Pacific, established production hubs in China, Japan, South Korea, and India continue to dominate global alloy output. Ongoing enhancements in automation and digitalization are raising productivity levels, while domestic end-user industries-from electronics manufacturing in Southeast Asia to aerospace in Japan-are pushing for high-performance materials. Regional free trade agreements and targeted investments in inland processing facilities are helping to diversify supply sources and mitigate exposure to external trade tensions.

This comprehensive research report examines key regions that drive the evolution of the Metal Alloy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Materials Producers and Specialty Alloy Innovators Driving Technological and Sustainable Advances

Leading companies in the metal alloy arena are leveraging technological prowess, strategic partnerships, and sustainability commitments to fortify their competitive positions. Major integrated producers are investing heavily in next-generation furnace and casting technologies that reduce carbon footprints and improve yield. Several specialty alloy manufacturers have established collaborative innovation centers with end-users to co-develop application-specific grades and accelerate time-to-market. Meanwhile, diversified materials groups are pursuing bolt-on acquisitions of niche powder metallurgy and additive manufacturing specialists, enabling them to offer comprehensive value-added services from alloy design through finished component.

These firms are also differentiating through digital solutions. Real-time melt and process monitoring platforms, advanced predictive maintenance analytics, and customer portals for order tracking and quality documentation are becoming standard offerings. At the same time, investment in circularity initiatives such as closed-loop recycling partnerships and remelt programs is helping to secure premium feedstock sources and lower operating costs. Collectively, these strategic endeavors underscore the imperative for alloy producers to not only master metallurgical science but also to cultivate integrated ecosystems that deliver sustainable, data-driven value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Alloy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allegheny Technologies Inc.

- Alloys Unlimited & Processing, LLC

- Arnold Magnetic Technologies Corporation

- ATI Inc.

- Avion Alloys, Inc.

- Carpenter Technology Corporation

- Doncasters Group Ltd

- Fushun Special Steel Co., Ltd.

- Haynes International, Inc.

- ICAST Alloys LLP

- Loos & Co., Inc.

- MetalTek International, Inc.

- Nippon Yakin Kōgyō Co., Ltd.

- Phoenix Industries Limited

- Plansee SE

- Poongsan Corporation

- Shandong Innovation Group Co., Ltd.

- Shanghai HY Industry Co., Ltd.

- Skyland Metal & Alloys Inc.

- Special Metals Corporation

- Telex Metals, Inc.

- United Performance Metals Inc.

- VDM Metals GmbH

- Virgamet SA

Charting Strategic Imperatives to Strengthen Resilience, Drive Innovation, and Accelerate Sustainable Growth

Industry leaders should prioritize several strategic initiatives to navigate the evolving metal alloy landscape. First, enhancing supply-chain resilience through diversified sourcing and regional production hubs can mitigate tariff and logistical risks. Establishing long-term tolling and joint-processing agreements with key suppliers will help stabilize input costs and secure critical feedstock volumes. Second, investing in advanced digital manufacturing capabilities-such as real-time process monitoring, predictive analytics, and additive manufacturing platforms-will drive operational efficiency and enable rapid customization of alloy compositions.

Third, embedding sustainability at the core of R&D and production strategies is essential. Leaders should accelerate adoption of low-carbon smelting, hydrogen reduction, and recycled content programs to address regulatory and customer demands. Fourth, cultivating collaborative partnerships with end-users in aerospace, automotive, and energy sectors can uncover unmet performance requirements and unlock new high-value applications. Lastly, developing talent pipelines focused on metallurgy, data science, and supply-chain management will ensure the workforce is equipped to support emerging technologies and sustainability goals. By aligning these priorities with clear investment roadmaps, organizations can secure leadership positions in both traditional and transformative alloy markets.

Detailing a Robust Dual-Track Research Methodology Integrating Secondary Data Analysis with Expert Primary Insights

The research underlying this report was built on a dual-track methodology combining comprehensive secondary research with targeted primary investigations. In the secondary phase, industry publications, peer-reviewed journals, public filings, and trade association records were analyzed to collate historical trends, regulatory developments, and technological breakthroughs. Key data points were cross-validated using multiple reputable sources to ensure accuracy and consistency. Concurrently, proprietary databases were leveraged to map global production capacities, trade flows, and patent landscapes.

In parallel, extensive primary research was conducted through in-depth interviews with senior executives at major alloy producers, contract manufacturers, original equipment manufacturers, and industry experts. Their insights provided real-world perspectives on tariff impacts, evolving end-user requirements, and innovation trajectories. The research team also engaged with supply-chain specialists and sustainability officers to assess the implementation of low-carbon initiatives. Quantitative data were triangulated against qualitative inputs to capture both the numerical and contextual dimensions of market dynamics. Finally, rigorous data cleaning, validation checks, and peer reviews were applied to ensure the findings presented herein accurately reflect the complex, rapidly changing world of metal alloy production and consumption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Alloy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Alloy Market, by Alloy Type

- Metal Alloy Market, by Form

- Metal Alloy Market, by Manufacturing Process

- Metal Alloy Market, by Application

- Metal Alloy Market, by Region

- Metal Alloy Market, by Group

- Metal Alloy Market, by Country

- United States Metal Alloy Market

- China Metal Alloy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Reinforcing the Strategic Nexus Between Technological, Environmental, and Trade Forces Shaping the Metal Alloy Sector

This executive summary offers a panoramic view of the metal alloy domain, uniting insights on transformative technological shifts, tariff-driven supply-chain realignments, segmentation nuances, regional market variations, and competitive strategies. As environmental imperatives and geopolitical forces continue to evolve, stakeholders must adopt agile, data-driven approaches to material selection, production planning, and customer collaboration. The landscape is marked by both challenges-such as tariff volatility and sustainability mandates-and opportunities, including digital manufacturing innovations and circular economy initiatives.

Ultimately, success in the metal alloy market hinges on the ability to anticipate end-user requirements, foster strategic partnerships, and invest in both technological and human capital. By synthesizing the in-depth research findings outlined in this summary, companies can position themselves to capture emerging high-value niches, optimize operational efficiencies, and build resilient supply chains. As the world accelerates toward electrification, advanced aerospace platforms, and green infrastructure, the strategic application of metal alloys will remain a cornerstone of industrial progress and competitive differentiation.

Seize Actionable Intelligence and Partner with an Industry Expert to Acquire the Full Metal Alloy Market Research Report Today

Unlock unparalleled insights and take decisive steps toward strengthening your strategic positioning in the metal alloy domain by securing this in-depth market research report today. Engage directly with Associate Director of Sales & Marketing at 360iResearch, Ketan Rohom, to explore customized solutions and gain instant access to the full report. His expertise and tailored advisory will ensure you harness the latest intelligence on supply chain dynamics, tariff impacts, regional growth hotspots, and innovation trends. Reach out now to elevate your competitive advantage, align your business strategy with emerging market realities, and accelerate revenue growth through informed decision-making. Don’t miss this opportunity to partner with a seasoned industry authority who can guide you through data-driven strategies and deliver the clarity needed to navigate a rapidly evolving landscape.

- How big is the Metal Alloy Market?

- What is the Metal Alloy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?