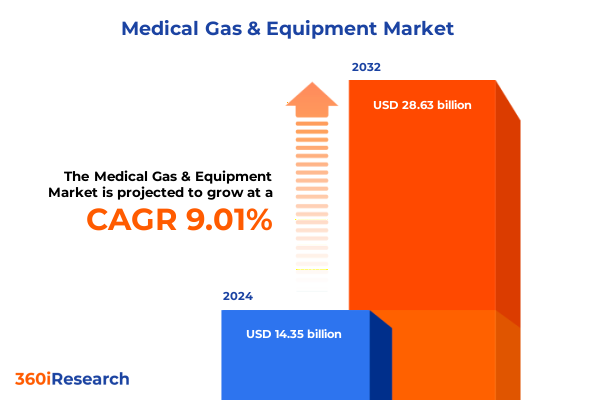

The Medical Gas & Equipment Market size was estimated at USD 15.54 billion in 2025 and expected to reach USD 16.84 billion in 2026, at a CAGR of 9.11% to reach USD 28.63 billion by 2032.

Pioneering the Medical Gas and Equipment Frontier with Patient-Centric Innovations and Operational Excellence Driving Healthcare Transformation

The medical gas and equipment landscape underpins critical therapeutic and diagnostic interventions that define modern healthcare delivery. From the consistent provision of high-purity oxygen in intensive care units to the precise administration of anesthetic gases in surgical suites, these solutions ensure patient safety and clinical effectiveness. Growing surgical volumes, spurred by advances in minimally invasive techniques and an expanding range of interventional procedures, have heightened demand for reliable gas delivery infrastructures that seamlessly integrate with hospital information systems and facility management platforms.

Demographic shifts further intensify this demand. Aging populations experience higher incidences of chronic respiratory diseases such as chronic obstructive pulmonary disease and sleep apnea, driving the adoption of long-term oxygen therapy both in institutional and home care environments. Concurrently, hospitals seek to optimize operational efficiency through redundant supply strategies and robust maintenance protocols, mitigating risks of supply interruption. These dynamics converge in an environment where regulatory compliance, cost containment, and patient outcomes align as the primary forces guiding procurement and technology deployment decisions.

Embracing Digital Intelligence Sustainable Practices and Advanced Technologies to Revolutionize Medical Gas Delivery and Management Systems

The onset of digital intelligence and automation is revolutionizing how healthcare facilities monitor and manage their medical gas systems. Embedded sensors and IoT connectivity now offer real-time insights into flow rates, pressure variances, and consumption patterns, enabling predictive maintenance that anticipates system failures before they occur. By leveraging AI-driven analytics platforms, facility engineers receive automated alerts when anomalies in gas supply threaten clinical operations, reducing unplanned downtime and enhancing patient safety through uninterrupted delivery of critical gases such as oxygen and nitrous oxide.

Alongside intelligent monitoring, the industry is witnessing a marked shift toward on-site gas generation solutions. Hospitals and clinics are increasingly installing membrane separation and pressure swing adsorption units that produce oxygen and nitrogen locally, diminishing reliance on external cylinder deliveries. This transition not only insulates providers from global supply chain disruptions but also streamlines logistics and lowers transportation-related emissions, fostering greater operational resilience in the face of geopolitical uncertainty and material shortages.

Sustainability has emerged as a central pillar of strategic planning, inspiring the adoption of low-carbon solutions across the gas supply chain. Innovations such as carbon capture in nitrous oxide processing and renewable energy–powered electrolysis for oxygen and hydrogen generation are redefining environmental stewardship within healthcare. Suppliers now offer certified green gas portfolios that help providers achieve ambitious carbon reduction targets without compromising on purity or reliability.

Driven by these technological and environmental imperatives, medical gas infrastructures are evolving into smart, connected ecosystems. Centralized control platforms integrate automated alarms, compliance reporting, and energy management dashboards, empowering clinicians and facility managers with cohesive oversight. Through these transformative shifts, the industry is not only enhancing patient care but also paving the way for more agile, sustainable, and cost-effective operations that will define the next era of medical gas service delivery.

Assessing the Far Reaching Consequences of United States Trade Measures on Medical Gas Imports Equipment Availability and Healthcare Costs in Twenty Twenty Five

Tariff measures enacted by the United States in early 2025 have introduced significant complexities to the medical gas and equipment supply chain. Import restrictions and elevated duties on equipment and components sourced from major manufacturing hubs have extended lead times for critical items such as anesthesia machines, vacuum pumps, and specialized cylinders. Healthcare supply chain professionals report delays in shipment scheduling and the need for contingency sourcing to maintain uninterrupted gas delivery for clinical procedures and respiratory therapies.

These heightened import costs have reverberated through procurement budgets, prompting hospitals and group purchasing organizations to renegotiate long-term contracts and adjust inventory strategies. Survey data indicates that the majority of providers anticipate passing through higher expenses to payers and patients, amplifying affordability concerns at a time when operational margins remain under pressure. Executives underscore the urgency of engaging with policymakers to secure exemptions for essential healthcare goods and to establish longer implementation timelines that allow for strategic planning within finance and supply chain teams.

Manufacturers and distributors have responded by diversifying their supplier base, increasing domestic production capacity, and investing in local assembly facilities. Nonetheless, specialized equipment-particularly advanced imaging-compatible gas systems-relies on complex global value chains that are not easily replicated onshore. Industry leaders warn that protracted tariff uncertainty could impede procurement cycles, delay critical upgrades, and challenge the delivery of life-saving services, reinforcing calls for a balanced trade policy that safeguards patient access to cutting-edge medical technologies.

Unlocking Market Potential through Strategic Product Equipment Source End User Distribution and Application Perspectives Driving Insightful Segmentation Analysis

The medical gas and equipment market reflects a tapestry of specialized offerings and end-use scenarios that demand nuanced strategic planning. Product lines encompass pure gases such as carbon dioxide, helium, and medical air as well as nitrous oxide and oxygen, each fulfilling distinct clinical functions from imaging contrast to respiratory support. Equipment portfolios feature anesthesia machines, gas cylinders, gas generators, incubators, regulator systems, and vacuum pumps, enabling providers to tailor solutions to the acuity level and service mix of their care environments.

Source infrastructure remains a critical decision variable. Providers may opt for cylinder-based supply for its flexibility, pipeline networks for centralized distribution efficiency, or onsite generation via membrane separation and pressure swing adsorption to achieve cost and environmental objectives. Each choice carries implications for installation complexity, regulatory adherence, and lifecycle maintenance protocols. End users span ambulatory surgery centers where space and capital constraints prevail to dental clinics requiring reliable nitrous oxide delivery and high-volume hospitals operating expansive pipeline grids with built-in redundancy.

Distribution channels drive market accessibility and service quality. Direct sales relationships facilitate bespoke engineering and responsive technical support while distributor partnerships extend geographic reach and volume management. Online retail offers convenient sourcing of non-critical components, and retail pharmacies play a role in home healthcare by providing portable oxygen systems and consumables. Application contexts-from anesthesia in surgical theaters to sterilization of instruments-further differentiate demand characteristics, influencing procurement cycles and aftermarket service requirements. Through this segmentation lens, stakeholders can align product development, marketing, and service delivery with the precise needs of each clinical and operational constituency.

This comprehensive research report categorizes the Medical Gas & Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Equipment Type

- Source

- Application

- End User

- Distribution Channel

Navigating Regional Dynamics across the Americas Europe Middle East Africa and Asia Pacific to Identify Strategic Growth and Operational Imperatives

In the Americas, mature healthcare systems and well-established regulatory frameworks underpin a robust demand for advanced gas delivery infrastructures and digital monitoring solutions. Hospitals leverage long-term supply contracts with domestic and regional providers to hedge against global disruptions, while home healthcare adoption continues to expand portable oxygen and helium concentrator usage. Investment in pipeline upgrades and microbulk delivery systems remains strong, supported by a competitive supplier landscape that emphasizes service reliability and customer support.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and market maturity. European Union regulations on environmental emissions drive the procurement of low-carbon gas portfolios and the decommissioning of high-global-warming-potential anesthetic gases. In the Middle East and Africa, expanding tertiary care networks and harmonization of medical device standards are fueling opportunities for pipeline installation and cylinder supply in emerging hubs, though economic volatility requires agile financing structures and localized support capabilities.

Asia-Pacific stands out as a dynamic growth frontier, propelled by rapid hospital construction, government-led healthcare modernization, and rising prevalence of chronic respiratory illnesses. Policy incentives for domestic gas generation infrastructure have accelerated the deployment of membrane and PSA units in urban centers, while rural outreach programs rely on portable systems to bridge care gaps. Strategic partnerships between global suppliers and local equipment integrators are critical to navigating diverse regulatory landscapes and meeting the nuanced needs of high-volume imaging and surgical services across the region.

This comprehensive research report examines key regions that drive the evolution of the Medical Gas & Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Leadership Strategies and Innovations of Key Industry Players Transforming the Medical Gas and Equipment Landscape Worldwide

Air Liquide has taken a leadership stance in decarbonizing medical gas supplies through its ECO ORIGIN™ program, securing low-carbon oxygen and nitrogen contracts with hospitals across Europe and Brazil. By ensuring traceability of energy sources from renewable electricity and optimizing transport emissions, the initiative reduces the carbon footprint of medical gas deliveries by over seventy percent compared to standard supply chains. This strategic focus aligns with rising demand for sustainable healthcare operations and supports long-term partnerships built on environmental stewardship.

Linde plc continues to leverage its diversified global footprint to mitigate macroeconomic and currency headwinds, reporting a year-over-year adjusted earnings per share increase driven in part by its healthcare and electronics gas divisions. The company’s investments in localized production facilities and microbulk supply systems strengthen supply security for critical care environments, while ongoing R&D in high-purity gas purification technologies underpins its competitive differentiation in advanced clinical applications.

Chart Industries and Flowserve are poised to reshape the equipment landscape through their announced merger, creating a comprehensive platform that integrates cryogenic and flow management solutions. The combined entity will offer an expanded range of process technologies, aftermarket services, and digital monitoring capabilities, capitalizing on synergies to enhance cost efficiencies and deliver tailored solutions for hospitals, laboratories, and surgical centers worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Gas & Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Airgas, Inc.

- Gulf Cryo Holding K.S.C.P.

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer Group GmbH

- Norco Inc.

- Ohio Medical Corporation

- SIAD S.p.A.

- Taiyo Nippon Sanso Corporation

- Westfalen AG

Implementing Proactive Supply Chain Digitalization Sustainability and Advocacy Strategies to Enhance Resilience and Competitive Advantage in the Medical Gas Sector

Industry leaders should prioritize diversification of their supply networks to hedge against geopolitical and tariff-driven disruptions. Establishing strategic partnerships with both global and domestic suppliers, while developing in-house inventory buffering strategies, will ensure continuity of care during periods of elevated import duties or logistical constraints. Concurrently, investing in on-site generation technologies can reduce reliance on vulnerable supply chains and yield operational savings over the asset lifecycle.

Advancing digital transformation initiatives is critical to capturing real-time insights, optimizing maintenance schedules, and automating compliance reporting. Facilities should adopt AI-powered monitoring platforms that integrate seamlessly with building management systems, delivering predictive alerts and facilitating data-driven decision making. These tools not only enhance safety and uptime but also support capital planning and resource allocation for maximum return on investment.

Given the continued impact of tariffs, stakeholders must engage proactively with policymakers and industry associations to advocate for exemptions on essential healthcare products and enforce phased implementation timelines. By articulating the critical role of medical gas technologies in patient care, industry consortia can influence trade negotiations and safeguard access to life-saving equipment. Simultaneously, aligning sustainability and decarbonization efforts with corporate social responsibility objectives will resonate with healthcare providers and payers seeking to meet stringent environmental standards.

Detailing a Robust and Transparent Research Framework Combining Primary Engagement Secondary Analysis and Data Triangulation for Comprehensive Market Insights

This research synthesizes insights derived from a structured combination of primary and secondary data sources. Primary engagement encompassed in-depth interviews with hospital procurement directors facility engineers and clinical leaders, capturing frontline perspectives on gas supply challenges and technological requirements. Secondary analysis involved a comprehensive review of industry publications trade press regulatory filings and supplier disclosures to establish context and benchmark best practices.

Data triangulation reinforced the validity of findings through cross-reference of stakeholder input with publicly available performance metrics and press reports. This multi-vector approach enabled a robust segmentation analysis across product types equipment configurations source modalities end-user categories distribution channels and application domains. Methodological rigor was maintained through iterative validation sessions with domain experts, ensuring that the final insights and recommendations reflect both strategic relevance and operational feasibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Gas & Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Gas & Equipment Market, by Product Type

- Medical Gas & Equipment Market, by Equipment Type

- Medical Gas & Equipment Market, by Source

- Medical Gas & Equipment Market, by Application

- Medical Gas & Equipment Market, by End User

- Medical Gas & Equipment Market, by Distribution Channel

- Medical Gas & Equipment Market, by Region

- Medical Gas & Equipment Market, by Group

- Medical Gas & Equipment Market, by Country

- United States Medical Gas & Equipment Market

- China Medical Gas & Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Critical Learnings and Emphasizing Strategic Priorities to Foster Innovation Stability and Sustainable Growth in Medical Gas and Equipment Markets

As healthcare systems traverse an era marked by rapid technological advancement complex regulatory landscapes and evolving patient demographics, the medical gas and equipment sector stands at a pivotal juncture. Providers and suppliers must align strategic investments in automation sustainability and supply chain resilience with clinical imperatives that prioritize safety and reliability. By integrating smart monitoring capabilities and sustainable gas solutions, stakeholders can enhance operational efficiency while advancing environmental objectives.

The confluence of tariff pressures and supply chain vulnerabilities underscores the importance of proactive advocacy and localization strategies. Market participants capable of balancing global innovation with robust domestic infrastructure will be best positioned to deliver uninterrupted care and capture new opportunities across diverse regions. Ultimately, the capacity to adapt to transformative shifts-whether through digital intelligence adoption or on-site generation expansion-will define the leadership landscape for medical gas and equipment providers in the years ahead.

Elevating Decision Maker Engagement Contact Ketan Rohom Associate Director Sales Marketing to Secure In Depth Medical Gas Equipment Market Research Insights Today

To delve deeper into these findings and access comprehensive analysis of the medical gas and equipment landscape with strategic guidance tailored to your organization’s needs, please reach out to Ketan Rohom Associate Director, Sales & Marketing for a personalized discussion on how this research can empower your decision making and drive impactful results.

- How big is the Medical Gas & Equipment Market?

- What is the Medical Gas & Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?