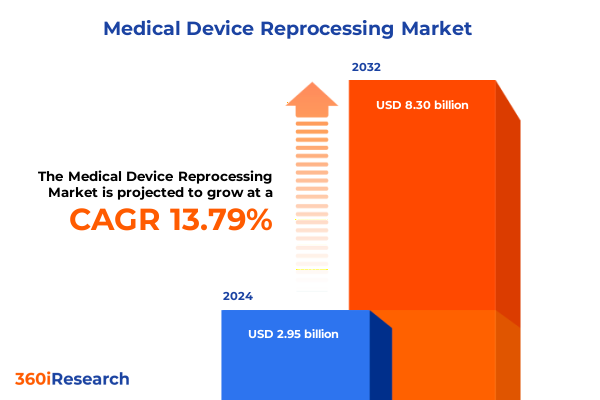

The Medical Device Reprocessing Market size was estimated at USD 3.32 billion in 2025 and expected to reach USD 3.73 billion in 2026, at a CAGR of 13.99% to reach USD 8.30 billion by 2032.

Pioneering Sustained Sterility: Exploring the Strategic Imperatives and Evolutionary Drivers Shaping Modern Medical Device Reprocessing Ecosystems

The evolution of medical device reprocessing has transcended basic sterilization practices to become a cornerstone of modern healthcare quality and patient safety. As healthcare delivery models expand globally and procedural volumes rise, the demand for reliable, repeatable, and efficient reprocessing protocols has never been more urgent. In this context, organizations are confronting a convergence of clinical, regulatory, and environmental pressures that are reshaping the entire reprocessing continuum from cleaning and disinfection to sterilization.

Against a backdrop of escalating scrutiny from regulatory authorities and heightened public expectations, institutions are investing in innovative technologies and standardized workflows to drive consistency, traceability, and compliance. This shift is fostering collaboration between clinical teams, biomedical engineers, and supply chain managers, uniting them around a shared imperative to minimize infection risk and operational waste. Ultimately, this introduction frames the critical importance of a holistic understanding of the market dynamics and key forces steering the advancement of medical device reprocessing.

Unprecedented Technological and Regulatory Transformations Driving the Next Frontier in Medical Device Reprocessing Efficiency and Safety

Over the past decade, transformative shifts have accelerated in the medical device reprocessing landscape, fueled by breakthroughs in automation, digitalization, and regulatory harmonization. Facility managers are increasingly incorporating Internet of Things–enabled washers and IoT-integrated sterilizers that provide real-time process validation and predictive maintenance alerts, thus minimizing downtime. In parallel, software platforms featuring machine learning algorithms are enabling dynamic cycle optimization, adapting parameters such as temperature and humidity to the specific bioburden profile of each load.

Moreover, regulatory bodies across North America, Europe, and Asia have intensified their mandates around sterility assurance levels and environmental safety. These new requirements have spurred the adoption of low-temperature sterilization modalities such as hydrogen peroxide plasma and ethylene oxide alternatives, which offer both material compatibility and reduced ecological impact. Consequently, the industry is witnessing a paradigm shift from manual, labor-intensive workflows toward integrated, closed-loop systems that deliver reproducibility, auditability, and enhanced patient safety.

Navigating the Ripple Effects of the 2025 United States Tariffs on Medical Device Reprocessing Supply Chains and Operational Costs

The introduction of targeted tariffs by the United States in mid-2025 has introduced a new layer of complexity to global medical device reprocessing supply chains. By imposing additional duties on imported sterilization equipment, consumables, and critical components, these measures have heightened procurement costs and triggered a strategic reevaluation of sourcing strategies. Healthcare providers and third-party reprocessors have responded by diversifying supplier portfolios, accelerating qualification of domestic vendors, and leveraging group purchasing organizations to mitigate unit cost increases.

Furthermore, the cumulative impact of these tariffs has extended to consumables such as sterilization wraps and indicator systems, prompting organizations to explore alternative materials and streamline inventory management. In some cases, facilities are recalibrating cycle frequencies and batch sizes to preserve consumable stockpiles, while also seeking long-term contracts to secure favorable pricing. As a result, the reprocessing ecosystem is on the cusp of a reshoring trend that balances cost pressures with the imperative to maintain uninterrupted procedural throughput.

Deciphering the Intricate Segmentation Landscape Unlocking Tailored Value Propositions across Process Types, Service Providers and End Users

A nuanced examination of market segmentation reveals distinct growth trajectories and investment priorities across process type, service provider, end user, equipment category, and automation level. Cleaning protocols remain foundational, yet disinfection applications-particularly high-level disinfection for heat-sensitive devices-are commanding increased attention due to expanded indications for reusable endoscopes. Meanwhile, steam sterilization continues to dominate in high-volume settings, but the shift toward dry heat and advanced chemical modalities underscores the desire for broadened material compatibility.

In-house reprocessing capabilities retain prominence within large hospital networks, leveraging existing infrastructure and trained personnel to maximize asset utilization. At the same time, third-party providers are capitalizing on capacity constraints and stringent accreditation standards by offering scalable, outsourced solutions that appeal to ambulatory surgical centers and diagnostic laboratories. End users are increasingly differentiated by procedural complexity; hospitals and specialty clinics demand turnkey automation, whereas smaller facilities prioritize manual or semi-automated platforms that balance cost with performance.

From an equipment standpoint, endoscopes-both flexible and rigid-have emerged as critical drivers of innovation because of their intricate design and high throughput requirements. Dental and orthopedic implants also necessitate specialized sterilization workflows that integrate residual detection and aeration protocols. Across all categories, fully automated reprocessing cycles are gaining traction, delivering traceable digital records and reducing human error, while semi-automated and manual systems continue to serve niche and cost-sensitive environments.

This comprehensive research report categorizes the Medical Device Reprocessing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Process Type

- Automation Level

- Material Composition

- End User

Illuminating Regional Dynamics Shaping Medical Device Reprocessing Adoption Trends across Americas, EMEA and Asia-Pacific Markets

Regional dynamics exert a profound influence on the adoption and evolution of medical device reprocessing practices, with each geography characterized by its unique interplay of regulatory frameworks, infrastructure maturity, and economic considerations. In the Americas, robust regulatory oversight by the FDA and Environment Protection Agency has driven facilities toward meticulous cycle validation and compliance-driven investments. This region benefits from high procedural volumes and established distribution networks, supporting rapid deployment of automation and advanced sterilization modalities.

Transitioning to Europe, Middle East & Africa, diverse regulatory regimes ranging from the European Union Medical Device Regulation to national health authority guidelines have fostered a culture of harmonized standards. Facilities are prioritizing sustainable sterilization approaches, reflecting EU directives on waste reduction and chemical emissions. At the same time, emerging markets within the region are increasingly outsourcing reprocessing tasks to accredited third parties to address workforce constraints and cost volatility.

Meanwhile, the Asia-Pacific arena is witnessing explosive growth fueled by rising healthcare investment, expanded hospital capacity, and government initiatives to bolster patient safety. While major urban centers deploy cutting-edge automated washers and low-temperature sterilizers, rural and semi-urban hospitals still rely on proven steam and chemical disinfection processes. Collaboration between international technology vendors and local distributors is key to bridging these disparities and ensuring scalable, cost-effective solutions across the region.

This comprehensive research report examines key regions that drive the evolution of the Medical Device Reprocessing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Profiles of Leading Medical Device Reprocessing Innovators Transforming Standards of Sterility Assurance and Productivity

Leading entities in the medical device reprocessing sphere have distinguished themselves through targeted investments in product innovation, compliance solutions, and integrated service models. A select group of global providers has prioritized research and development to enhance cycle efficiency, reduce turnaround times, and minimize environmental impact. These companies are forging partnerships with academic institutions and regulatory bodies to validate novel sterilization chemistries and digital traceability platforms that meet evolving industry standards.

Concurrently, established reprocessor equipment manufacturers are extending their portfolios to encompass comprehensive service offerings, including remote monitoring, preventive maintenance, and operator training programs. By delivering end-to-end solutions, they aim to cultivate long-term customer loyalty and address site-specific challenges such as throughput optimization and staff turnover. Smaller niche players are also carving out specialized roles by catering to the unique reprocessing demands of dental, orthopedic, and ophthalmic devices, leveraging deep domain expertise and flexible deployment models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Device Reprocessing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Sterilization Products

- Avante Health Solutions

- Belimed AG

- Cardinal Health, Inc.

- Ecolab USA Inc.

- Fujifilm Holdings Corporation

- GE Healthcare Technologies Inc.

- Getinge AB

- Innovative Health LLC

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Medifix Solutions Pty Ltd.

- Medline Industries, Inc.

- NEScientific, Inc.

- Olympus Corporation

- Pioneer Medical Devices AG

- ReNu Medical, Inc.

- Richard Wolf GmbH

- Ruhof Corporation

- Smith & Nephew PLC

- Sotera Health Company

- SteriPro Canada, Inc.

- Steris PLC

- Stryker Corporation

- SureTek Medical Inc.

- Teleflex Incorporated

- UVC Solutions d.o.o.

- Vanguard AG

- Zimmer Biomet Holdings, Inc.

Charting Proactive Strategies Empowering Industry Leaders to Capitalize on Disruption and Guarantee Sustainable Competitive Advantages

Industry leaders seeking to thrive amid dynamic market forces must adopt a multifaceted strategy that balances technological innovation with operational resilience. First, allocating resources to scalable automation solutions will drive consistency and efficiency, particularly for high-volume device classes like endoscopes and surgical instruments. Concurrently, organizations should diversify their supply chain by qualifying multiple vendors and exploring regional manufacturing partnerships to mitigate tariff-driven cost uncertainties.

Furthermore, integrating digital validation and traceability tools into existing workflows will empower real-time analytics, enabling continuous process improvement and proactive compliance readiness. Establishing collaborative frameworks with third-party reprocessors can alleviate capacity constraints while preserving in-house expertise for critical or complex procedures. Lastly, investing in workforce development through certification programs and cross-functional training will ensure that personnel remain adept at operating advanced reprocessing platforms and interpreting digital performance data.

Unveiling Rigorous Multi-Source Research Methodology Ensuring Unparalleled Accuracy, Credibility and Actionability of Market Insights

This research utilized a rigorous, multi-tiered methodology to ensure the accuracy, credibility, and actionability of the insights presented. Secondary data sources included regulatory guidelines from authorities such as the FDA, EU MDR documentation, peer-reviewed journals, and industry white papers to establish a foundational understanding of reprocessing standards and emerging technologies. Proprietary databases were also examined to track historical adoption rates and technology diffusion curves.

Complementing the secondary research, primary interviews were conducted with a cross-section of stakeholders, including hospital sterile processing managers, biomedical engineers, third-party service executives, and leading equipment vendors. These conversations provided qualitative depth and real-world validation of market drivers, operational challenges, and investment priorities. Data triangulation techniques were applied to reconcile findings across sources, enabling robust corroboration of trends and forward-looking insights. Finally, the entire analysis underwent a multi-level peer review process by subject matter experts to uphold methodological integrity and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Device Reprocessing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Device Reprocessing Market, by Equipment Type

- Medical Device Reprocessing Market, by Process Type

- Medical Device Reprocessing Market, by Automation Level

- Medical Device Reprocessing Market, by Material Composition

- Medical Device Reprocessing Market, by End User

- Medical Device Reprocessing Market, by Region

- Medical Device Reprocessing Market, by Group

- Medical Device Reprocessing Market, by Country

- United States Medical Device Reprocessing Market

- China Medical Device Reprocessing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Consolidating Critical Learnings to Chart the Future Trajectory of Medical Device Reprocessing Amidst Dynamic Global Healthcare Challenges

The convergence of advanced technologies, evolving regulatory landscapes, and supply chain realignments is reshaping the medical device reprocessing sector at an unprecedented pace. Key themes include the migration toward automated and IoT-enabled systems, heightened emphasis on sustainable sterilization chemistries, and strategic responses to tariff-induced procurement challenges. Market segmentation clarity reveals differentiated value propositions across process types, service models, end-user groups, equipment categories, and automation profiles.

Regional insights underscore the variable rate of adoption driven by local regulations, infrastructure maturity, and economic parameters. Within this dynamic environment, leading organizations are distinguishing themselves through collaborative R&D initiatives, integrated service offerings, and targeted workforce development programs. Finally, the actionable strategies outlined in this report provide a roadmap for optimizing reprocessing efficiency, mitigating cost pressures, and future-proofing operational resilience. As the field continues to evolve, maintaining a holistic, data-driven perspective will be essential for guiding strategic decision-making and safeguarding patient outcomes.

Secure Definitive Market Intelligence with Dedicated Expert Guidance to Elevate Your Medical Device Reprocessing Strategy

Engaging with this comprehensive market research report will provide you with the insights and strategic latitude to navigate the complex ecosystem of medical device reprocessing with confidence. You can reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to explore bespoke licensing options, secure enterprise access, or discuss volume discounts tailored to your organization’s needs. His deep understanding of the reprocessing landscape and commitment to client success will ensure that you extract maximum value from the findings.

By collaborating with Ketan Rohom, you will gain personalized guidance on optimizing your procurement timeline, accelerating decision-making, and unlocking competitive advantages. Don’t miss the opportunity to transform your strategic planning with data-driven clarity-contact Ketan Rohom today to secure your copy of the report and embark on an evidence-based journey toward operational excellence.

- How big is the Medical Device Reprocessing Market?

- What is the Medical Device Reprocessing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?