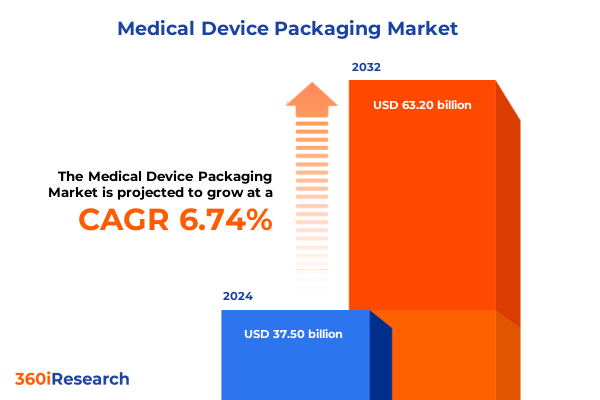

The Medical Device Packaging Market size was estimated at USD 39.76 billion in 2025 and expected to reach USD 42.16 billion in 2026, at a CAGR of 6.84% to reach USD 63.20 billion by 2032.

Setting the Stage for Medical Device Packaging Excellence by Exploring Key Drivers, Industry Challenges, and Strategic Imperatives to Ensure Device Integrity

The introduction offers a panoramic view of the medical device packaging arena, underscoring the critical role that packaging plays in safeguarding product integrity, ensuring regulatory compliance, and supporting patient safety. In today’s healthcare ecosystem, packaging transcends its traditional function as a mere barrier; it is an integral component of a product’s life cycle management strategy, influencing everything from supply chain visibility to end-user usability. The discussion begins by examining the foundational drivers shaping demand, such as evolving clinical delivery models, heightened quality assurance protocols, and intensified regulatory scrutiny. It then navigates through prevailing challenges, ranging from material selection complexities to stringent sterilization compatibility requirements. Furthermore, there is an emphasis on how emerging trends in digitization and sustainability are reshaping stakeholder expectations across manufacturers, distributors, and healthcare providers.

Moreover, this opening section highlights the strategic imperatives that industry leaders must embrace to maintain competitive advantage. A forward-looking perspective is provided on the interplay between technological advancement and market growth, suggesting that proactive investment in innovation and cross-functional collaboration will be critical to unlocking new opportunities. By framing the scope of analysis around patient safety, supply chain resilience, and regulatory alignment, the stage is set for a comprehensive exploration of transformative shifts, tariff implications, segmentation nuances, and regional dynamics that will define the trajectory of medical device packaging in the years ahead.

Revolutionizing Medical Device Packaging Through Sustainability, Digital Innovations, and Regulatory Modernization to Drive Efficiency and Patient Trust

The medical device packaging landscape has undergone transformative shifts driven by the confluence of sustainability imperatives, technological innovation, and evolving regulatory frameworks. Initially, sustainability emerged not as an optional enhancement but as a core strategic priority, prompting manufacturers to explore circular material flows and closed-loop reuse initiatives. In parallel, advancements in digital printing and smart packaging technologies have introduced real-time track and trace capabilities, enabling stakeholders to monitor device integrity across the distribution continuum and enhance patient safety.

In addition, the shift toward patient-centric care models has necessitated packaging designs that prioritize ease of use, ergonomic handling, and accessibility, particularly for at-home healthcare settings. This movement has further accelerated the adoption of flexible packaging formats that facilitate unit-dose administration and mitigate user errors. At the regulatory level, recent harmonization efforts have aligned sterilization validation protocols and labeling requirements across major markets, reducing time to market while elevating compliance thresholds. Consequently, manufacturers are now engaging in more robust cross-functional collaboration, combining material scientists, regulatory specialists, and supply chain experts to co-create packaging solutions that deliver on environmental goals, operational efficiency, and patient trust.

Ultimately, these transformative shifts are redefining how value is created within the medical device packaging ecosystem. As stakeholders embrace digital transformation and sustainability hand in hand, they cultivate a more adaptive, transparent, and resilient framework that is positioned to respond to future disruptions and to drive incremental improvements in both performance and patient outcomes.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Medical Device Packaging Supply Chains, Cost Structures, and Market Adaptation Strategies

The implementation of new United States tariffs in 2025 has ushered in a period of recalibration across the medical device packaging supply chain. Manufacturers reliant on imported plastics, aluminum foils, and specialized polymers from key markets have experienced upward pressure on input costs, necessitating a reassessment of sourcing strategies. In response, several leading packaging firms have diversified their supplier bases, securing alternate channels in regions less impacted by trade measures and establishing buffer inventories to maintain uninterrupted production.

Furthermore, downstream device producers have explored material substitution initiatives, evaluating alternative substrates such as glass and tyvek that offer comparable barrier performance with different tariff classifications. While these adaptations often require extensive validation to meet stringent sterilization compatibility and regulatory approval, they illustrate the agility demanded in today’s tariff-constrained environment. Simultaneously, some organizations have accelerated investments in domestic manufacturing capacity, aiming to circumvent trade barriers and enhance supply chain transparency. This localized approach not only mitigates cost fluctuations but also strengthens traceability and compliance with U.S. Food and Drug Administration mandates.

In concert with these tactical shifts, collaboration between procurement, quality assurance, and regulatory affairs teams has intensified, fostering a more integrated framework for risk management. By proactively mapping tariff exposure against critical product lines and evaluating the total landed cost implications, companies are better positioned to develop pricing strategies that preserve competitiveness while safeguarding profit margins. The cumulative impact of the 2025 U.S. tariffs thus extends beyond cost considerations, compelling the industry to embrace resilient, diversified, and innovation-driven supply chain models.

Unveiling Critical Market Segmentation Dynamics Shaping Medical Device Packaging Decisions Across Types, Materials, Sterilization, Formats, and End Users

A nuanced understanding of market segmentation is crucial for tailor-making packaging solutions that align with device requirements, regulatory constraints, and user expectations. The varied landscape of packaging types, including ampoules, vials, bags, pouches, boxes, clamshells, blister packs, containers, labels, cards, trays, tubes, and wraps, demands that manufacturers adopt specialized design and material approaches. Material selection further complicates the equation, as aluminum foil, glass, paperboard, plastics, silicone, and Tyvek each offer distinct barrier properties, cost profiles, and production challenges. Within plastics, the choice among polycarbonate, polyethylene, PET, polypropylene, polystyrene, or PVC can have implications for sterilization compatibility and disposability.

Speaking of sterilization, compatibility across methods such as dry heat, E-beam, EtO, gamma radiation, and steam is imperative to maintaining sterility assurance levels while preserving material integrity. Packaging levels spanning primary containment to secondary grouping and tertiary shipping solutions add layers of complexity, requiring harmonized design criteria that address both operational efficiency and regulatory compliance. The decision between flexible and rigid formats further shapes manufacturing processes and user interaction; flexible film pouches and sachets cater to unit-dose needs, whereas rigid PTP blister packs and strip cards drive high-throughput diagnostics and device protection.

Different device types, from dental and surgical instruments to implants, IV equipment, and home healthcare devices, have unique packaging imperatives, as do considerations of sterile versus non-sterile applications. Distribution channels, whether offline or online, influence packaging robustness and labeling standards, while end users-ranging from ambulatory surgical centers and hospitals to clinics and pharmaceutical companies-introduce varying preferences for form factor, handling, and environmental impact. Recognizing these segmentation insights enables stakeholders to develop targeted strategies that optimize performance, cost, and patient safety across the medical device packaging spectrum.

This comprehensive research report categorizes the Medical Device Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Sterilization Method Compatibility

- Packaging Level

- Packaging Formats

- Device Type

- Packaging Type

- Application

- Distribution Channel

- End User

Comparative Regional Analysis Reveals Distinct Growth Drivers and Regulatory Nuances Impacting Medical Device Packaging Across Americas, EMEA, and Asia-Pacific

Regional dynamics exert a profound influence on medical device packaging strategies as companies navigate diverse regulatory regimes, environmental mandates, and market maturity levels. In the Americas, the emphasis is on leveraging a robust domestic supply base, with manufacturers focusing on scaling up local production to reduce lead times and foster closer alignment with U.S. FDA requirements. Sustainability initiatives are also gaining momentum, driven by state-level policies that encourage recyclable and reusable packaging materials. This region’s mature healthcare ecosystem affords opportunities for pilot programs involving smart packaging and IoT-enabled traceability solutions.

Contrastingly, Europe, the Middle East, and Africa present a mosaic of regulatory frameworks-from the Medical Device Regulation in the European Union to emerging compliance structures in the Gulf Cooperation Council. Here, stakeholders prioritize harmonization of labeling and sterilization standards, often participating in cross-border coalitions to streamline approvals. Sustainability remains top of mind, with stringent directives catalyzing the adoption of biodegradable materials and carbon footprint reporting. Additionally, the region’s diversified market profiles, spanning high-income Western Europe and cost-sensitive Eastern markets, necessitate versatile packaging platforms that can be adapted to local affordability and infrastructure conditions.

Meanwhile, Asia-Pacific stands out for its rapid growth and rising manufacturing prowess. Countries like China, India, and Vietnam have expanded their capacity to produce both basic and advanced packaging substrates, often under government-backed initiatives aimed at export promotion. These markets are witnessing a dual trend: cost-competitive solutions tailored for high-volume device lines, alongside premium, innovation-led offerings targeting specialized segments such as implants and advanced diagnostics. The region’s burgeoning e-commerce penetration also accelerates demand for packaging solutions designed to withstand complex logistics while ensuring tamper evidence and brand authenticity.

This comprehensive research report examines key regions that drive the evolution of the Medical Device Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships in Medical Device Packaging to Highlight Competitive Strengths and Emerging Collaborative Models

Leading players in the medical device packaging arena are charting distinct paths to strengthen market positioning and drive innovation. Global packaging conglomerates are investing in next-generation materials research, forging partnerships with polymer specialists to develop enhanced barrier coatings and lightweight composites. Such collaborations enable rapid prototyping and accelerated time to market, particularly for devices requiring stringent sterility assurance and tamper-evident features. Innovation-driven companies are also integrating digital printing technologies to enable on-demand customization, reducing inventory carrying costs while catering to personalized medicine applications.

At the same time, regional specialists are differentiating through agile service models and deep regulatory expertise. By offering turnkey solutions that encompass design, validation, and supply chain management, these firms address the growing complexity of global compliance. Strategic alliances between device OEMs and packaging providers have become more prevalent, facilitating co-development projects that tightly align product functionality with packaging performance criteria. In addition, several key players are exploring joint ventures in emerging markets, establishing local manufacturing hubs that capitalize on cost advantages and align with evolving trade policies.

Financial investment trends further underscore the competitive landscape, with sustained capital flows into startups focused on biodegradable materials and blockchain-enabled serialization platforms. As the industry consolidates around a core set of capabilities-sustainability, digitalization, and regulatory acumen-market leaders are differentiating through integrated service offerings and collaborative ecosystems. This strategic convergence highlights the critical role of partnerships in advancing the next frontier of medical device packaging solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Device Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Amcor Limited

- AptarGroup Inc.

- Berry Global Inc.

- Coveris Management GmbH

- DuPont de Nemours, Inc.

- EPL Limited

- Huhtamäki Oyj

- Johnson & Johnson Services, Inc.

- Mitsubishi Chemical Holdings Corporation

- Oliver Healthcare Packaging

- Ostium Group

- Placon Corporation

- Riverside Medical Packaging Company Limited

- STERIS Group

- Toppan Printing Co., Ltd.

- West Pharmaceutical Services, Inc.

- WestRock Company

- Wipak Group

Actionable Strategic Imperatives for Medical Device Packaging Leaders to Advance Sustainability, Enhance Supply Chain Resilience, and Embrace Technological Integration

Industry leaders must adopt a suite of strategic imperatives to navigate ongoing disruptions and position for long-term growth. First, embedding sustainability at the core of packaging design will not only address regulatory pressures but also resonate with increasingly eco-aware healthcare stakeholders. This entails rigorous assessment of material life cycles, investment in recyclable and compostable substrates, and pursuit of closed-loop recovery programs that drive circular economy outcomes. In parallel, strengthening supply chain resilience through supplier diversification and nearshoring strategies will mitigate risks associated with trade volatility and capacity bottlenecks.

Moreover, accelerating digital integration is essential for operational visibility and regulatory compliance. Implementing end-to-end track and trace systems, underpinned by serialized labeling and IoT sensor networks, will enhance real-time monitoring of environmental conditions and enable rapid response to quality deviations. Cross-functional collaboration between R&D, regulatory, and procurement teams will facilitate agile decision-making, ensuring that packaging solutions remain compliant with evolving standards and aligned with user needs. Additionally, embracing modular packaging platforms can reduce complexity and drive economies of scale, allowing organizations to adapt swiftly to changing device formats and market demands.

Finally, cultivating strategic partnerships across the ecosystem will accelerate innovation and market penetration. Engaging in co-development projects with material scientists, digital technology providers, and distribution specialists can unlock new functionalities, such as antimicrobial surface coatings and automated packaging line capabilities. By combining core competencies and sharing risk, companies can expedite development timelines and lower the barrier to commercialization for advanced packaging solutions. These actionable recommendations provide a roadmap for industry leaders to enhance performance, reduce costs, and elevate patient outcomes in an increasingly competitive and regulated environment.

Rigorous Research Methodology Combining Primary Expert Engagement, Secondary Data Triangulation, and Analytical Rigor to Validate Medical Device Packaging Insights

The research methodology deployed for this study combines robust primary research engagements, comprehensive secondary data analysis, and rigorous analytical validation. Primary research involved in-depth interviews with senior executives, quality assurance managers, and regulatory specialists across device manufacturers, packaging suppliers, and healthcare end users. These conversations yielded granular perspectives on material performance, sterilization compatibility, and emerging innovation priorities.

Secondary research encompassed an exhaustive review of public filings, regulatory documents, and scientific publications to contextualize market dynamics within the framework of global compliance regimes and sustainability mandates. Proprietary whitepapers, industry consortium reports, and patent analyses were also synthesized to uncover technological trajectories and identify potential disruption vectors. Data triangulation techniques were employed to reconcile insights across sources, ensuring reliability and reducing bias. Advanced analytical tools, including scenario modeling and sensitivity analysis, were used to assess supply chain disruptions, tariff impacts, and segmentation opportunities.

Quality assurance protocols were implemented at each stage of the research lifecycle, with cross-functional peer reviews and validation workshops conducted to vet assumptions and refine conclusions. This rigorous methodological approach underpins the credibility of the study’s findings and equips stakeholders with confidence in the accuracy and relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Device Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Device Packaging Market, by Type

- Medical Device Packaging Market, by Material Type

- Medical Device Packaging Market, by Sterilization Method Compatibility

- Medical Device Packaging Market, by Packaging Level

- Medical Device Packaging Market, by Packaging Formats

- Medical Device Packaging Market, by Device Type

- Medical Device Packaging Market, by Packaging Type

- Medical Device Packaging Market, by Application

- Medical Device Packaging Market, by Distribution Channel

- Medical Device Packaging Market, by End User

- Medical Device Packaging Market, by Region

- Medical Device Packaging Market, by Group

- Medical Device Packaging Market, by Country

- United States Medical Device Packaging Market

- China Medical Device Packaging Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2862 ]

Concluding Insights Highlighting the Convergence of Innovation, Regulatory Alignment, and Market Forces Shaping the Future of Medical Device Packaging

In conclusion, the medical device packaging sector stands at an inflection point where innovation, regulation, and market forces converge to reshape value creation. Stakeholders must embrace sustainability not merely as compliance but as a catalyst for differentiation, while leveraging digital technologies to achieve end-to-end visibility and quality assurance. The 2025 tariff landscape underscores the importance of diversified supply chains and domestic capacity, compelling organizations to adopt agile sourcing and material substitution strategies.

Moreover, segmentation insights highlight the necessity of highly tailored packaging solutions that address the unique demands of device type, sterilization method, and end-user environment. Regional variances further dictate that market entry and expansion plans must be calibrated to local regulatory frameworks and consumer preferences. Leading companies are already setting the pace through strategic partnerships and advanced materials research, signaling a broader industry shift toward integrated, innovation-driven ecosystems.

As the sector progresses, those who translate strategic recommendations into operational execution-prioritizing cross-functional collaboration and modular design-will unlock sustainable growth and reinforce patient safety. Ultimately, a holistic approach that aligns environmental stewardship, technological adoption, and regulatory compliance will define the next chapter of medical device packaging excellence.

Secure In-Depth Market Intelligence and Strategic Guidance for Medical Device Packaging with Customized Solutions from Ketan Rohom Associate Director Sales & Marketing

For decision-makers seeking to gain a comprehensive understanding of the medical device packaging landscape and to secure a competitive edge, engaging directly with Ketan Rohom will deliver unparalleled value. As Associate Director of Sales & Marketing with deep expertise and a proven track record facilitating actionable insights, Ketan stands ready to customize how the report’s findings align with your strategic priorities. Whether your focus is sustainability, cost optimization, regulatory compliance, or digital innovation, this tailored conversation will translate high-level analysis into tangible next steps. Reach out today to initiate a collaborative dialogue that will equip your organization with the market intelligence and strategic guidance needed to navigate emerging challenges, capitalize on new growth vectors, and confidently drive product integrity and patient safety.

- How big is the Medical Device Packaging Market?

- What is the Medical Device Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?