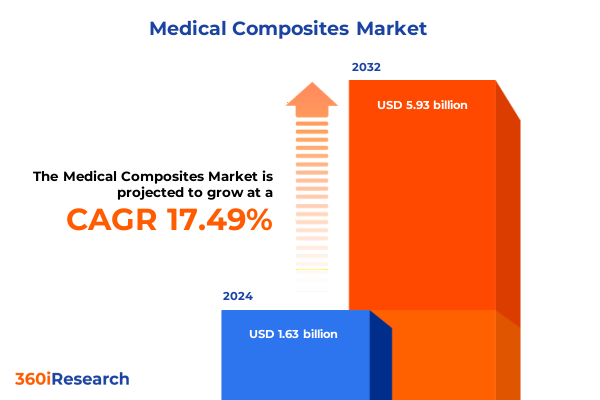

The Medical Composites Market size was estimated at USD 1.91 billion in 2025 and expected to reach USD 2.25 billion in 2026, at a CAGR of 17.51% to reach USD 5.93 billion by 2032.

Shaping the future of healthcare through high-performance medical composites that deliver unparalleled strength, lightweight design, and imaging compatibility

Medical composites have emerged as essential enablers in modern healthcare, offering an exceptional balance of mechanical strength and lightweight design that traditional materials cannot match. These advanced materials enable the fabrication of medical devices that improve patient outcomes by reducing device mass while maintaining structural integrity and fatigue resistance. Moreover, their inherent radiolucency makes them indispensable in diagnostic imaging environments, where clear, artifact-free images are critical for accurate decision-making.

In parallel with technological progress in polymer chemistry and fiber reinforcement, medical composites now support a broad spectrum of applications ranging from prosthetic limbs to imaging tables. Strategic investments in research and development have bolstered innovations in carbon fiber and high-performance polymer matrices, setting a new standard for medical device engineering. As a result, the medical community is experiencing a paradigm shift in device performance and patient comfort, driven by the unique capabilities of composite materials.

Unveiling transformative shifts where additive manufacturing, bioactive materials, and sustainable composites converge to redefine medical device innovation and patient care

Advanced manufacturing techniques, most notably additive manufacturing, have accelerated the customization of medical implants and prosthetics. By leveraging carbon-fiber reinforced PEEK filaments optimized for precision 3D printing, device makers can now produce patient-specific implants within days rather than weeks, enhancing surgical planning and reducing inventory overhead. This digital transformation in device fabrication marks a significant departure from traditional production methods, enabling rapid iterations and real-time adjustments during treatment preparation.

Concurrently, the integration of bioactive and surface-modified composite systems is set to elevate the efficacy of implantable devices. Tailoring composite matrices with osteoconductive additives and antimicrobial coatings fosters improved tissue integration and minimizes infection risks. The development of customer-specific biomaterials, supported by collaborative R&D platforms, is paving the way for next-generation composites that actively contribute to healing pathways and long-term biocompatibility.

Sustainability is increasingly becoming a core driver in material selection, as leading manufacturers introduce bio-circular carbon fiber and recycled thermoset composite solutions. These innovations reduce environmental impact across the value chain, from precursor production to end-of-life recycling. By adopting closed-loop systems and leveraging renewable feedstocks, stakeholders are aligning composite development with global sustainability goals, creating a competitive edge through eco-friendly credentials.

Moreover, digitalization and AI-driven analytics are streamlining preoperative planning and predictive maintenance of composite-based devices. Through advanced simulation and machine learning algorithms, healthcare providers can forecast material performance under physiological conditions, optimize device designs for specific patient anatomies, and monitor device integrity in real time. This convergence of AI and composites science heralds a more proactive, precision-based approach to medical device lifecycle management.

Assessing the cumulative impact of recent U.S. tariff expansions on carbon fiber and prepreg imports and their long-term effects on medical composite supply chains

In April 2025, the U.S. implemented a universal 10% tariff on all imported goods, extending to raw materials and composite intermediates critical to medical device production. Higher duties of up to 34% have been applied to select trading partners, reflecting targeted measures to protect domestic industry. While pharmaceutical APIs were exempted, essential medical device components and polymer precursors imported from China and India now face elevated costs that are permeating the healthcare supply chain.

Further complicating the landscape, Section 301 tariff expansions have increased duties on specific composite materials. Effective March 2025, tariffs on raw carbon fiber tow were raised from 7.5% to 25%, and prepreg materials saw a jump from 4.2% to 17.5%. These changes have triggered near-term inventory adjustments and prompted a reevaluation of sourcing strategies. As importers navigate compliance and adjust procurement pipelines, manufacturers are experiencing increased cost pressures that are driving a strategic pivot toward domestic production capabilities and alternative supply partnerships.

Unlocking nuanced market dynamics by examining diverse segmentation across end-use industries, resin chemistries, fiber types, and manufacturing processes shaping composite applications

Analyzing the market through multiple segmentation lenses reveals how composite adoption is tailored to the nuanced requirements of each application. In end-use industries, aerospace and defense leverage fuselage, interior, and wing components for high-strength, lightweight structures, while automotive OEMs incorporate composites into body panels, chassis components, and interior assemblies to reduce vehicle mass and improve fuel efficiency. Healthcare applications range from diagnostic imaging tables to orthopedic implants and custom prosthetics that demand biocompatibility and radiolucency. Marine vessels deploy composites in deck structures and hulls for corrosion resistance, and recreational equipment uses them in bicycles, golf clubs, and rackets for performance gains. Wind energy platforms rely on composites for blades, hubs, and nacelles to withstand dynamic loads and environmental exposure.

From a materials perspective, resin chemistries span thermoplastics and thermosets. Thermoplastic matrices include PEEK, polypropylene, and PPS grades that vary from carbon fiber–reinforced to unfilled and glass-filled to support diverse processing and performance requirements. Thermoset systems encompass epoxy, polyester, and vinyl ester formulations, each further broken down into subfamilies such as bisphenol-A and novolac epoxies, DCPD polyesters, and Atlac vinyl esters, catering to specialized performance and processing profiles. Fiber selection extends across aramid, carbon, and glass fibers, with subtypes like meta-aramid, PAN-based carbon fiber, and E-glass providing tailored strength, stiffness, and cost balances.

Production methods such as autoclave molding, compression molding, filament winding, hand lay-up, pultrusion, and resin transfer molding define the manufacturing process landscape, dictating throughput, part complexity, and quality consistency. Form factors including pipes and tubes, fabrics and nonwoven mats, rods and bars, and sheets and plates further differentiate composite offerings, while product portfolios span bulk molding compounds, pultruded profiles, prepregs, and sheet molding compounds optimized for electrical conductivity, structural performance, or premium surface aesthetics.

This comprehensive research report categorizes the Medical Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Fiber Type

- Manufacturing Process

- Product Type

- End Use Industry

Exploring regional disparities in medical composite adoption as North America leads innovation, Europe champions sustainability, and Asia-Pacific accelerates growth momentum

In the Americas, the convergence of advanced healthcare infrastructure and progressive reimbursement models has positioned the region at the forefront of medical composite utilization. Leading medical centers in the United States and Canada have standardized composite-based device trays and imaging tables, leveraging high-strength, lightweight materials to enhance procedural efficiency and patient throughput. This early technology adoption is underpinned by substantial R&D investments and regulatory support mechanisms that facilitate rapid qualification of composite medical devices.

Europe’s emphasis on regulatory compliance, patient safety, and sustainability has driven the integration of composite materials in precision diagnostics and minimally invasive surgical instruments. Industry leaders in Germany, France, and the United Kingdom are collaborating on bio-circular carbon fiber initiatives and recycled thermoset composite research, aligning manufacturing processes with stringent EU environmental mandates. These efforts reflect a broader commitment to lifecycle stewardship and closed-loop material management in healthcare applications.

Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market for medical composites, fueled by rapidly aging populations, expanding healthcare access, and strategic government incentives aimed at bolstering domestic composite production. Countries such as China and India are scaling precursor and fiber manufacturing capabilities, while import substitution policies encourage local development of advanced resins and prepreg systems. This dynamic environment is creating new opportunities for regional supply chain diversification and cost optimization in medical device manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Medical Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the strategic moves of leading composite material innovators driving breakthroughs in medical applications through collaboration and R&D prowess

Toray Industries has reinforced its leadership by showcasing next-generation composite technologies at major industry events, emphasizing vertically integrated operations that span carbon fiber, advanced towpregs, and high-performance thermoset and thermoplastic composites. With a focus on sustainability, the company is introducing bio-circular carbon fiber solutions and recycled composite materials that maintain performance while reducing environmental impact. Toray’s strategic participation at international forums highlights its commitment to collaborative development and cross-border innovation in the medical composites domain.

Evonik has distinguished itself through the development of VESTAKEEP® carbon-fiber reinforced PEEK filaments designed specifically for long-term 3D printed medical implants. These filaments feature controlled fiber alignment and bio-compatible formulations that enable rapid, patient-specific implant fabrication using standard extrusion-based 3D printing technologies. Evonik’s robust product portfolio and ongoing investments in customer-specific medical biomaterials underscore its role as a materials innovator in the additive manufacturing space.

Hexcel Corporation has advanced its presence in surgical instrument and diagnostic equipment applications through proprietary thermoplastic composite solutions. Its HexPEKK® materials offer corrosion resistance and sterilization durability for robotic surgical arms and portable imaging devices. By partnering with leading OEMs, Hexcel has accelerated the deployment of lightweight, high-strength components that meet stringent medical performance standards and support next-generation healthcare workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Medical Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACP Composites, Inc.

- Arkema S.A.

- Avient Corporation

- Celanese Corporation

- Composiflex Corporation

- Dentsply Sirona Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Koninklijke DSM N.V.

- Mitsubishi Chemical Corporation

- Royal DSM N.V.

- Saudi Basic Industries Corporation

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Victrex plc

Strategic recommendations for industry leaders aiming to fortify supply chains, embrace sustainable materials, and leverage advanced manufacturing for competitive advantage

To mitigate supply chain disruptions and escalating import costs, industry leaders should diversify procurement strategies by establishing strategic partnerships with regional composite manufacturers and investing in domestic production capabilities. Strengthening local capacity for carbon fiber tow and prepreg materials can reduce exposure to adverse trade policies and enable more agile responses to regulatory changes. Continuous monitoring of tariff schedules and leveraging trade compliance expertise will be essential for maintaining cost-effective sourcing in 2025 and beyond.

Leaders should also accelerate investments in sustainable composite technologies and bioactive formulations that resonate with evolving healthcare and environmental regulations. Collaborations between material suppliers, medical device OEMs, and research institutions can drive co-development of next-generation composites optimized for biodegradability, recyclability, and enhanced biological performance. Embracing digital manufacturing workflows, including AI-driven design and additive fabrication, will unlock new opportunities for patient-specific solutions and operational efficiencies in healthcare delivery.

Detailing the comprehensive research methodology integrating multi-source data analysis, expert interviews, and rigorous validation to ensure actionable market insights

This research synthesizes insights drawn from extensive secondary data sources, including technical literature, regulatory filings, and proprietary industry databases. Rigorous analysis of peer-reviewed publications and technology roadmaps informed our evaluation of emerging material systems and manufacturing techniques. Key market trends were validated through discussions with subject-matter experts, encompassing composite material scientists, medical device engineers, and trade policy analysts.

Primary research encompassed structured interviews with senior executives at composite material producers, healthcare technology companies, and manufacturing service providers. Quantitative data was triangulated with qualitative insights to ensure the robustness of conclusions. Continuous methodological checks and cross-referencing against publicly available data maintained the integrity and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Medical Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Medical Composites Market, by Resin Type

- Medical Composites Market, by Fiber Type

- Medical Composites Market, by Manufacturing Process

- Medical Composites Market, by Product Type

- Medical Composites Market, by End Use Industry

- Medical Composites Market, by Region

- Medical Composites Market, by Group

- Medical Composites Market, by Country

- United States Medical Composites Market

- China Medical Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4452 ]

Synthesizing critical insights on market drivers, structural shifts, and strategic opportunities to navigate the evolving landscape of medical composites

The medical composites landscape is defined by the convergence of advanced polymer science, sophisticated fiber technologies, and digital manufacturing paradigms. The unique combination of strength-to-weight performance, radiolucency, and customization drives applications across diagnostic imaging, orthopedic implants, and minimally invasive instruments. Competitive dynamics are shaped by an intricate overlay of technological innovation and evolving trade policies.

As regional markets continue to diverge, with North America maintaining a leadership position, Europe advancing sustainability mandates, and Asia-Pacific accelerating production capacity, stakeholders must navigate complex segmentation and regulatory frameworks. Strategic investments in domestic capacity, bioactive composite systems, and AI-enabled manufacturing will determine market leaders in the healthcare composites sector. By aligning innovation with operational resilience, organizations can capitalize on the transformative potential of medical composites to deliver improved patient outcomes and sustainable growth.

Engage Associate Director Ketan Rohom to access in-depth market intelligence and empower your strategic decisions with the full executive research report today

To explore comprehensive insights and strategic guidance that translate the nuances of the medical composites landscape into actionable business intelligence, reach out to Ketan Rohom (Associate Director, Sales & Marketing) for a personalized discussion and secure your access to the full market research report today

- How big is the Medical Composites Market?

- What is the Medical Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?